The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

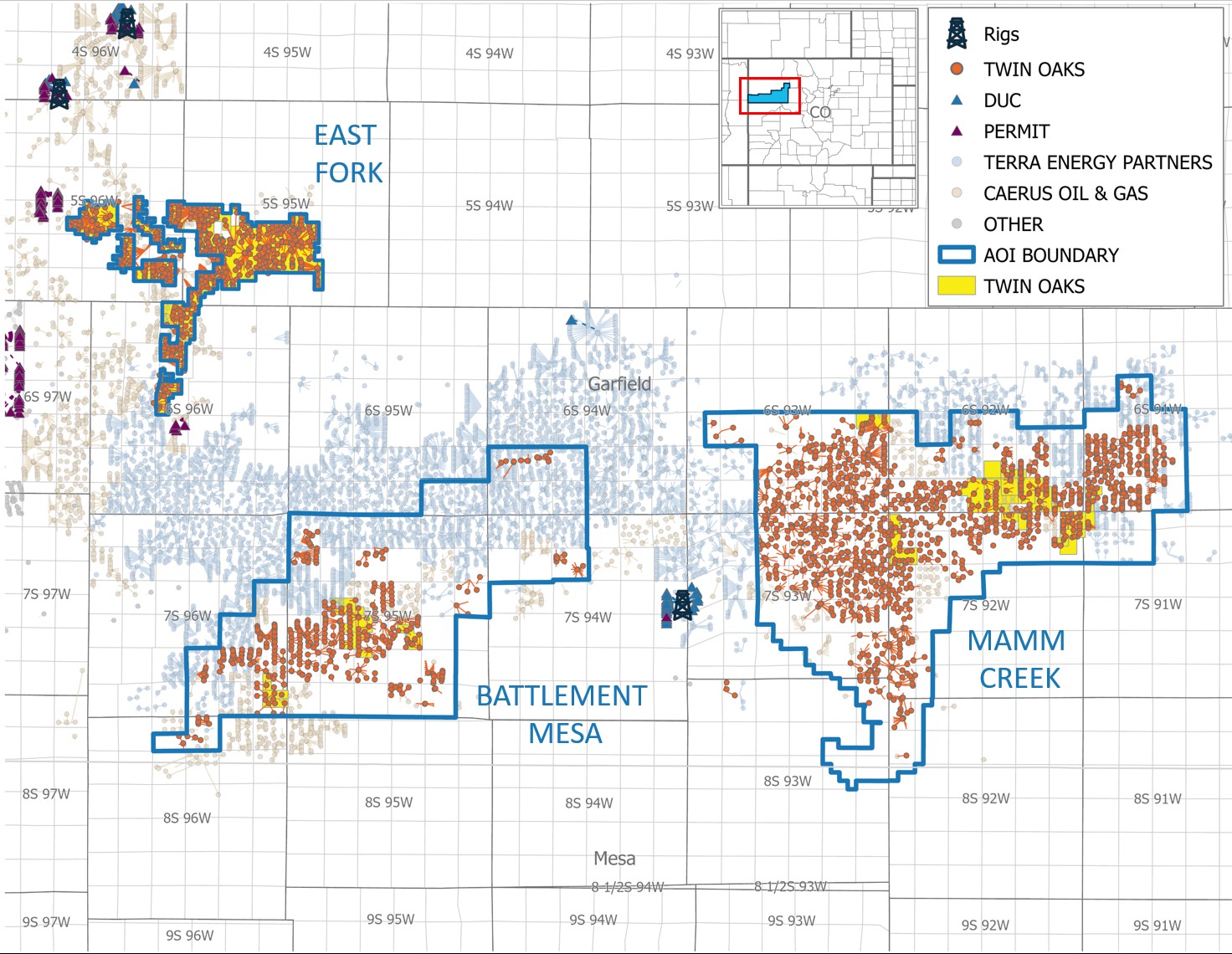

Twin Oaks Production Partners has retained EnergyNet for the sale of a Piceance Basin Opportunity in Garfield County, Colorado. The Lot #110924 package includes an average royalty ownership of 2.9% in 2,790 wells.

Opportunity highlights:

- Large Contiguous Garfield County, Colorado Position

-

- Greater than 6,100 developed mineral acres in the Piceance Basin in Garfield County, Colorado

- 85% of value is in strategic producing area operated by Caerus Oil & Gas (successor to EnCana/Ovintiv)

- Operator owned production infrastructure contributes to decades of economic life remaining:

-

-

- Parachute Ranch - 619 wells with average well life remaining of ~32.9 years

- Other Assets - 1,936 wells with average well life remaining of ~30.0 years

-

- Unique, Large Royalty Ownership

-

- Average royalty ownership of 2.9% in 2,790 wells

-

-

- 500 wells (72% of total PV10 value) have royalty ownership in excess of 10% NRI

- 432 wells have royalty ownership greater than 1% and less than 10%

-

- Predictable Production and Cash Flow

-

- Low-decline, predictable production profile from established Piceance tight gas sands wells

- PDP net production of ~4,500 Mfce/d (95% gas) 1H 2023 average from LOS

- Next twelve-month production decline is ~6.1%

- NTM PDP Cash Flow of ~ $5.7 MM

-

-

- Next 36-month PDP Cash Flow of ~$5.9 MM/yr without Capex or further development

-

-

- All assets are fully held-by-production (HBP)

- High Profit Potential

-

- 95% gross margins

- Very low administration (4 checks per month account for all asset revenue)

Bids are due Dec. 14 at 4:00 p.m. CST. For complete due diligence, please visit indigo.energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

Recommended Reading

Scout Taps Trades, Farm-Outs, M&A for Uinta Basin Growth

2024-11-29 - With M&A activity all around its Utah asset, private producer Scout Energy Partners aims to grow larger in the emerging Uinta horizontal play.

Ovintiv Swaps the Uinta for Montney in Multiple M&A Moves

2024-11-15 - Ovintiv is expanding greatly in the Canadian Montney Shale play through a US$2.38 billion deal with Paramount Resources and exiting the newly booming Uinta Basin in Utah with a $2 billion sale to FourPoint Resources.

As Permian Targets Grow Scarce, 3Q M&A Drops to $12B—Enverus

2024-10-16 - Upstream M&A activity fell sharply in the third quarter as public consolidation slowed and Permian Basin targets dwindled, according to Enverus Intelligence Research.

Oxy CEO Sheds Light on Powder River Basin Sale to Anschutz

2024-11-14 - Occidental is selling non-core assets in the Lower 48 as it works to reduce debt from a $12 billion Permian Basin acquisition.

Crescent to Double, Largely Through M&A, in the Next Five Years, CEO Says

2024-10-23 - Crescent Energy CEO David Rockecharlie said that after closing the SilverBow acquisition, the company is continuing to hunt for new assets, although few make it past the company’s screening process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.