The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

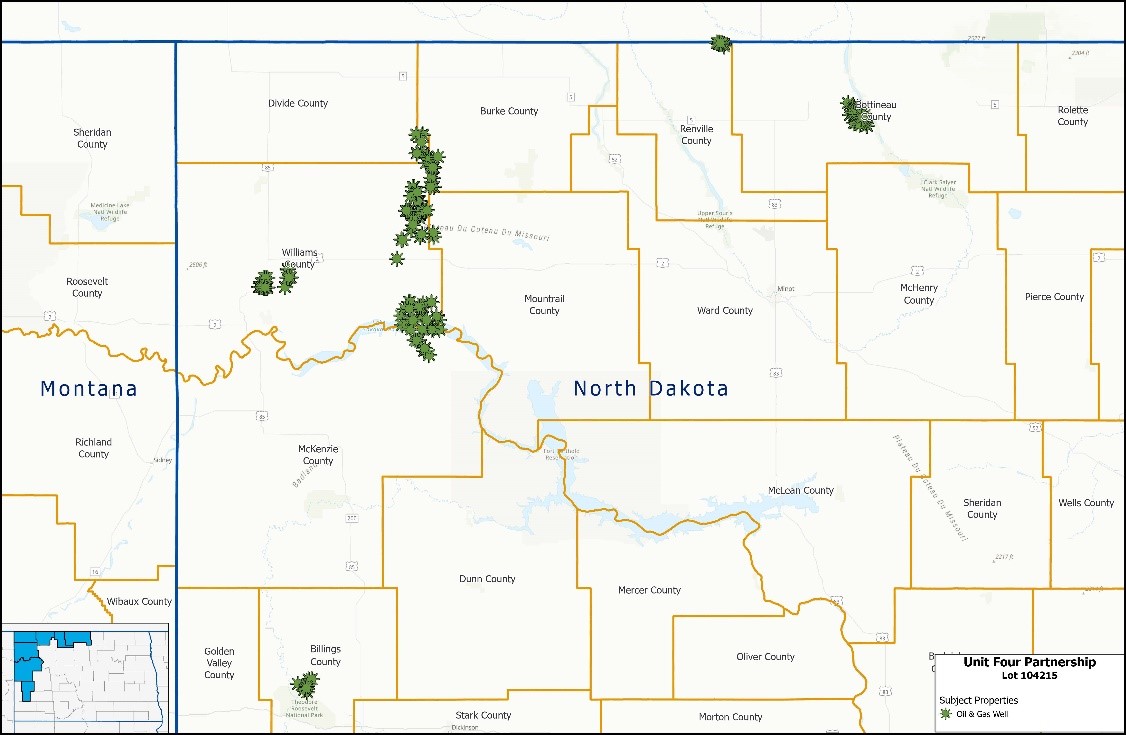

Unit Four Partnership ("Unit Four") retained EnergyNet for the sale of a 139 property package in Billings, Bottineau, Burke, Divide, McKenzie, Renville, Stark, and Williams Counties, North Dakota. Lot# 104215 offers 11 APO only properties, 10 DUC properties, with a 12-month average net income of $89,070/month and a current average 8/8ths production of 5,468 barrels per day (bbl/d) and 11,861 MCFPD. Unit Four has retained EnergyNet as its exclusive advisor relating to the transaction.

Asset Highlights:

- Non-Operated Working Interest in 139 Properties:

- 11 APO Only Properties

- 10 DUC Properties

- 12-Month Average Net Income: $89,070/Month

- Current Average 8/8ths Production: 5,468 bbl/d and 11,861 MCFPD (includes

unit production) - Select Operators:

- Continental Resources, Inc.

- Hess Bakken Investments II, LLC

- Petro-Hunt, LLC

- XTO Energy Inc.

Bids are due on May 17 at 1:30 p.m. CDT. For complete due diligence information, please visit http://www.energynet.com or email Zachary Muroff, Managing

Director, at Zachary.Muroff@energynet.com.

Recommended Reading

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Matador Resources Credit Facility Upped by 30% to $3.25B

2024-12-04 - Matador Resources’ 19 lenders unanimously approved a 30% increase to the E&Ps borrowing base to $3.25 billion.

EON Enters Funding Arrangement for Permian Well Completions

2024-12-02 - EON Resources, formerly HNR Acquisition, is securing funds to develop 45 wells on its 13,700 leasehold acres in Eddy County, New Mexico.

Marathon Oil Expects ‘Mass Layoff’ After ConocoPhillips Deal Closes

2024-10-31 - Marathon Oil’s merger with ConocoPhillips, which is to close by year-end, will trigger a layoff of more than 500 Houston employees, according to a state regulatory filing.

Lion Equity Partners Buys Global Compression from Warren Equipment

2025-01-09 - Private equity firm Lion Equity Partners has acquired Warren Equipment Co.’s Global Compression Services business.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.