The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

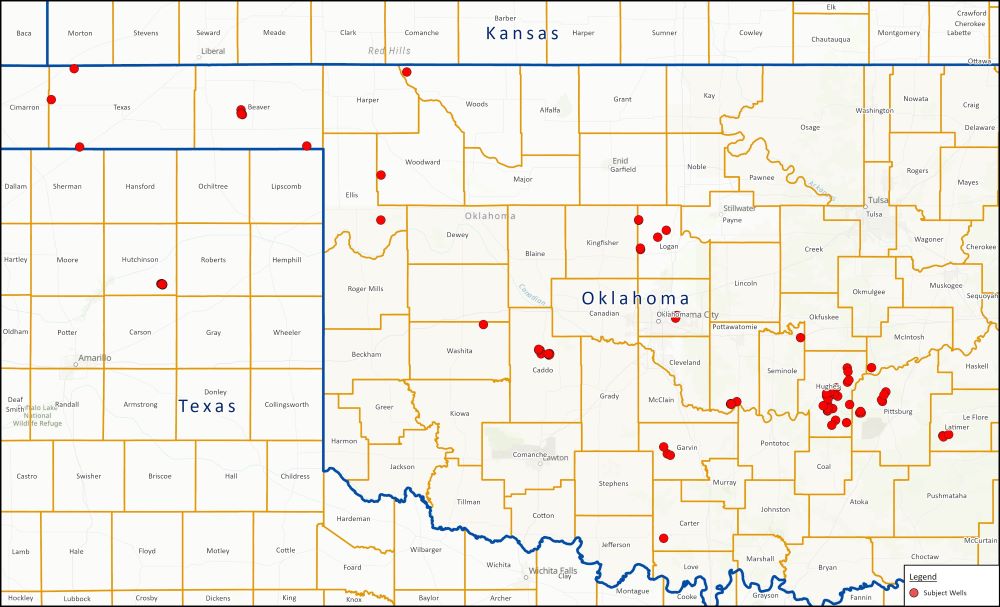

Wagner Oil Co. has retained EnergyNet for the sale of a 90-property package in various counties in Oklahoma and Texas. The Lot # 119913 package includes operated working interest in 14 properties.

Opportunity highlights:

- Operated WI in 14 Properties:

- Avg WI ~74.88% / Avg NRI ~59.97%

- Additional Avg ORRI ~1.95% in 8 of these properties

- Royalty and Overriding Royalty Interest in 50 Properties:

- Avg RI/ORRI ~1.22%

- Non-Operated WI in 25 Wells:

- Avg WI ~20.95% / Avg NRI ~13.67%

- Additional Avg ORRI ~1.72% in 3 of these wells

- 12-Month Average Net Income: $19,879/Month

- 6-Month Average 8/8ths Production: 144 BOPD and 8,395 MCFPD

- Select Operators:

- Blackbeard Operating LLC

- BP America Production Company

- Foundation Energy Management LLC

- XTO Energy Inc.

- Oklahoma interests are further subject to Oklahoma State Sales Tax.

- Operator Bond Required.

Bids are due Sept. 11 at 1:50 p.m. CDT. For complete due diligence, please visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.