The following information is provided by LandGate Corp. All inquiries on the following listings should be directed to LandGate. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

LandGate has been exclusively retained to market for sale a large overriding royalty interest (ORRI) package located in Colorado’s Weld County.

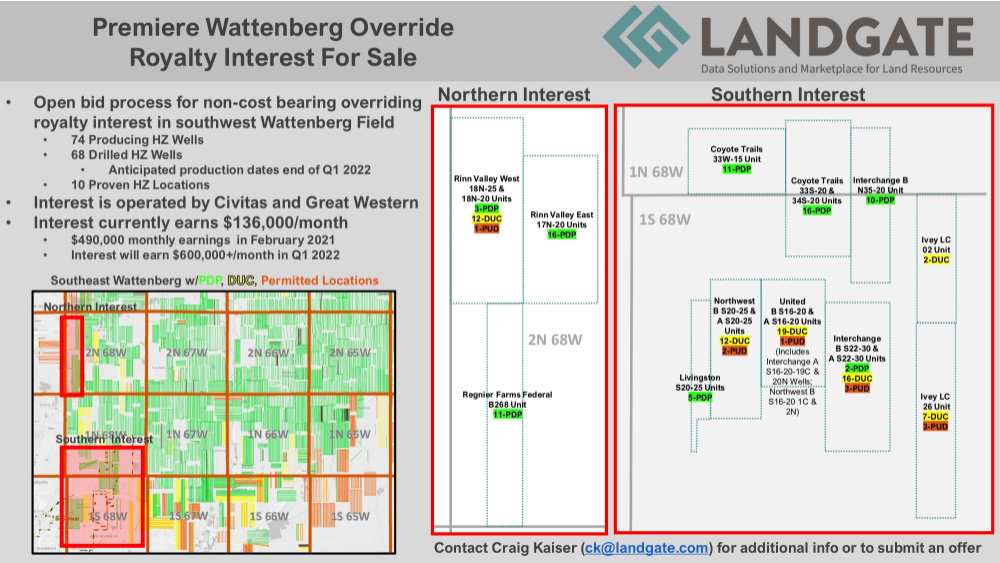

The firm described the sale as an incredibly rare opportunity to acquire ORRI (non-cost bearing) in 152 horizontal Niobrara and Codell wells in the heart of the Wattenberg Field. The package includes 74 wells fully producing with production start dates beginning in early 2020 and 68 wells are drilled and actively being completed. Additionally, 98.6% of well locations will be fully producing by the end of first-quarter 2022.

Civitas Resources Inc., a new energy company forming through the pending merger of Bonanza Creek Energy Inc., Extraction Oil & Gas Inc. and, most recently, Crestone Peak Resources, operates the majority of the position. Great Western operates a fully drilled, uncompleted DSU as well. Civitas has released a public notice (in downloads) for flow line installation on multiple drilled uncompleted wellpads, further solidifying their production scheduling of the DUC inventory for the asset.

Most recent monthly cash flow was approximately $136,000. The interest earned $490,000 in February and is anticipated to earn $600,000-plus by the end first-quarter 2022. Well interests have been confirmed via AFE, division order or pay stub, with remaining well interests calculated by the seller, based on DSU size and royalty percentage. A full economic report along with well schedules can be found online at LandGate’s website.

For more information, please contact Craig Kaiser at ck@landgate.com or 833-782-5837 x 701. Additional listings available at LandGate.com/map.

Recommended Reading

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

New Jersey’s HYLAN Premiers Gas, Pipeline Division

2025-03-05 - HYLAN’s gas and pipeline division will offer services such as maintenance, construction, horizontal drilling and hydrostatic testing for operations across the Lower 48

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.