Oil has played havoc with E&Ps and may delay transactions. “A lot of these deals won’t get done, or will get done in some other form and fashion,” said Bill Marko, managing director of Jefferies, at the A&D Strategies & Opportunities conference. (Source: Hart Energy)

DALLAS—Bill Marko, managing director of Jefferies LLC, minced no words about the uninviting landscape of 2015 A&D.

“It’s brutal,” he said.

A flurry of deals in May and June, prompted by briefly rising oil prices, was short-lived and collapsed, Marko said at Hart Energy’s A&D Strategies & Opportunities conference on Sept. 10.

With the more severe downturn in crude market value, deals may be even less common in an already drab year.

For the rest of 2015 and into 2016, A&D deal flow is expected to go quiet in the unstable oil price environment, though there could be bright spots ahead for quality natural gas assets.

“I don’t see a lot of oily deals,” he said. “No one is going to sell at $45 oil unless they have to.”

Marko said that 2015 is a year of change, which he dubbed “the understatement of the year.” Deal activity and values have fallen off a cliff and into a ravine.

In a typical year, deal volume through three quarters ranges from $50 billion to $75 billion, Marko said.

Year-to-date, the market has produced roughly 50 deals worth $20 billion. In 2014, by contrast, nearly 250 transactions generated $98 billion in deals.

While demand remains good for quality assets, uncertainty due to the recent price downturn could stall many deals that came to market in the late second quarter of 2015 and early third quarter. Still, the U.S. has persevered in the recently dubbed “low-for-long” era.

“I think we surprised Saudi and OPEC and others with what we were able to do,” Marko said, referring to E&Ps rapidly de-escalation from mass production to far more efficient production.

While U.S. oil volumes are down about 50,000 barrels per day (bbl/d), rig counts have fallen far more substantially from roughly 1,900 to 871 as of the week of Aug. 31.

“A year ago it was about fast. This year it’s about efficient,” Marko said, adding that estimated ultimate recoveries (EUR) in some plays have doubled, quadrupled or more.

E&Ps have also survived the low oil price environment due to large cuts in service costs.

“I don’t know that service companies can sustain it forever,” he said.

All About The Permian

Despite the glut of oil and drop in prices, oil assets have held their traditional market share. Oil has accounted for roughly 75% of deals by volume in the past two years.

Overall, unconventional deals still rule in the U.S. In 2015, unconventional accounted for 80% of transactions. Fewer and fewer operators are drilling vertical wells, Marko said.

The leader of the pack for transactions, far and away, is West Texas.

“It’s all about the Permian,” Marko said, noting that the basin has had 25 sales and joint ventures (JVs) in 2015. The next closest play is the Eagle Ford, with seven transactions.

However, Marko said that oil has played havoc with E&Ps and that transactions across the U.S. may be delayed. “A lot of these deals won’t get done, or will get done in some other form and fashion,” he said.

While corporate M&A is gaining momentum, asset deals continue to be the chief driver of transactions, he said. Such deals are “cleaner” than deals involving merging with or absorbing another company.

Marko said that assets present a less complicated transaction. “Assets are generally cleaner,” he said. “You know what liabilities there are.”

However, he said many international investors tell Jefferies they want to buy assets with a team. The key will be buying assets and providing incentives to keep a team in place.

Among potential overseas investors, “Asian sovereign wealth has done more looking at the U.S. so far. We keep wanting and waiting for Middle Eastern sovereign wealth,” he said.

Equity Offerings Make Some Noise

At the beginning of 2015, E&Ps generated record activity with equity offerings.

In the first quarter, equity offerings totaled $13.6 billion—more than all of 2014.

Marko said companies were smart to grab liquidity.

Now, E&Ps are staring down serious leverage concerns. Companies are becoming increasingly concerned with the impact to liquidity from reduced cash flow and borrowing base re-determinations in October.

“Hedging is helping a lot of people, but hedging is rolling off,” Marko said.

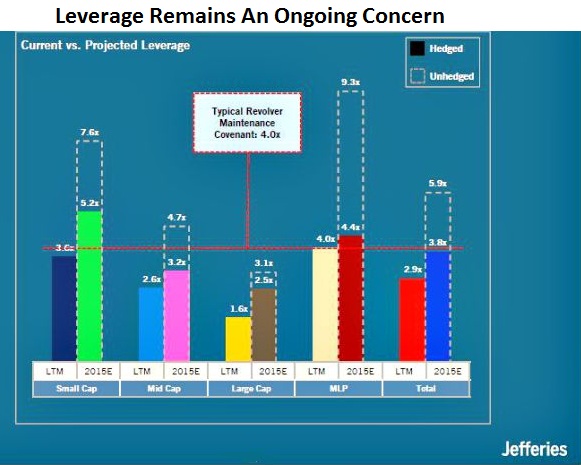

Typically, a borrower’s revolver maintenance has a leverage covenant of 4x.

In 2015, Marko estimates that leverage for small caps will increase from an average 5.2x to 7.6x. Mid caps will also rise to 4.7x. MLP leverage is expected to increase to an average 9.3x.

Under pressure, deals will have few bright spots. Nevertheless, natural gas may be a one of them. Quality resources should attract attention from investors to meet the needs of LNG suppliers.

The Haynesville, for instance, has greatly improved its EURs and led to a major natural gas deal in August.

Jefferies advised GeoSouthern Energy Corp. on the purchase of Encana Corp.’s (ECA) assets in North Louisiana for $850 million. GeoSouthern purchased 112,000 net acres of leasehold and 49,000 acres with mineral rights. As part of the deal, Encana will also reduce its gathering and midstream commitments by $480 million.

Marko said that Encana developed the assets for a decade. Now, GeoSouthern will bring focus to updating techniques and further developing the play.

“Encana knocks down $850 million,” Marko said. “I think there are other things like that out there.”

For now, oil price outlook is expected to continue to sputter due to weak worldwide demand and strong output. Still, if the U.S. could sustain a decline in production by cutting the rig count further, price dynamics could change.

Production declines of 1 MMbbl/d could change prices “If we wake up one day and we lay down rigs,” he said.

More realistically, Marko said the lower-for-longer crowd is likely to see the prolonged pain it envisions.

Contact the author, Darren Barbee, at dbarbee@hartenergy.com.

Recommended Reading

Energy Transition in Motion (Week of Jan. 17, 2025)

2025-01-17 - Here is a look at some of this week’s renewable energy news, including more than $8 billion more in loans closed by the Department of Energy’s Loan Programs Office.

Air Liquide, TotalEnergies Partner to Produce Hydrogen

2024-11-25 - The hydrogen will be produced and used at Air Liquide and TotalEnergies' La Mède biorefinery in France to produce biodiesel and sustainable aviation fuel.

Treasury’s New Hydrogen Tax Credit Regs Open Door to NatGas Producers

2025-01-05 - The U.S. Treasury Department’s long awaited 45V hydrogen tax credit will enable “pathways for hydrogen produced using both electricity and methane” as well as nuclear, the department said Jan. 3.

US Hydrogen Concerns Linger as Next Administration Nears White House

2024-12-11 - BP, EDP Renewables, Inpex and Plug Power executives discuss the state of hydrogen and the hydrogen production tax credit.

Trial and Error: CCS Tries Out Multiple Approaches to Get Ball Rolling

2024-10-30 - Is carbon capture and sequestration about to turn the corner? Some obstacles may stand in the way.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.