(Source: Shutterstock)

Editor's note: This article was updated with analyst comments and a map.

Matador (MTDR) plans to contribute its Pronto Midstream subsidiary with San Mateo Midstream, a joint venture the company owns with Five Point Energy, Matador announced Dec. 5.

The move gives MTDR a chance to showcase the firm’s transport and processing assets, which an analytical firm said were undervalued by the market.

“A pillar of (Matador’s) bull case is underappreciated midstream assets not reflected in MTDR's equity,” said TD Cowen, in a quick analysis released after the announcement.

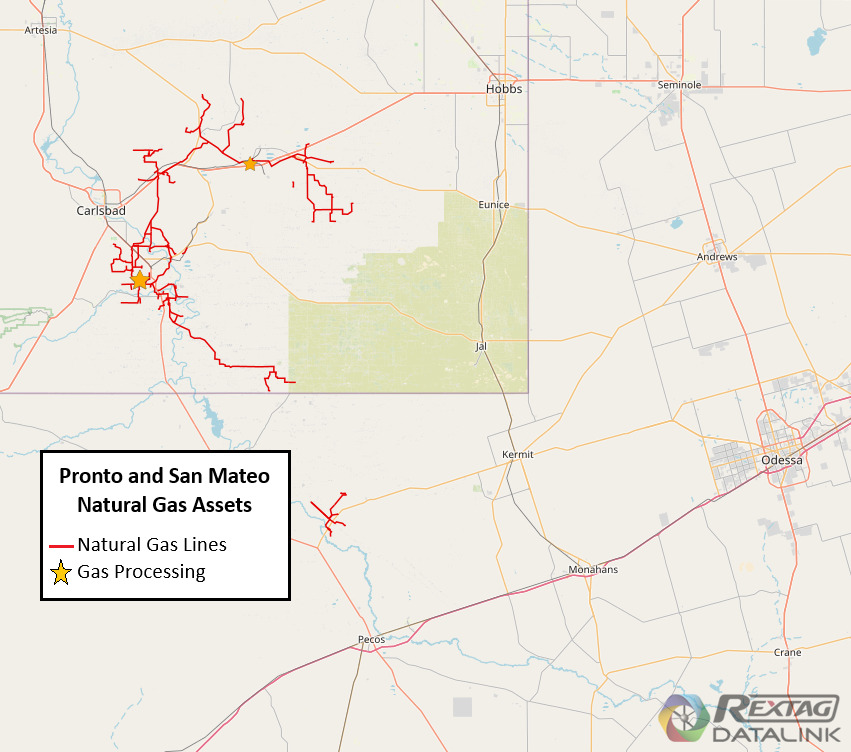

Pronto Midstream is a 45-mile, natural-gas gathering network in New Mexico’s Eddy and Lea counties. San Mateo Midstream has 140 miles in natural gas gathering and processing assets in Eddy and Loving counties, Texas.

The implied valuation of the deal is $600 million, according to Matador’s announcement.

“To recognize part of (the midstream assets’) value, MTDR announced it will drop-down its 100% owned midstream sub Pronto to its midstream JV (51% ownership) for an implied valuation of about $600 million,” TD Cowen said. “This implies about 2.4x ROIC & an estimated 9x EBITDA multiple based on our estimates—attractive indeed.”

At closing, Matador will receive about $220 million in cash from Five Point, according to the announcement. As part of the transaction, Matador will enter into agreements for sour gas treatment in Lea County. Pronto also plans to deliver sour gas to Northwind Midstream, a Five Point affiliate.

Matador plans to use the $220 million to pay down debt. The transaction is expected before the end of the year.

Pronto and San Mateo are already connected. In the first quarter of 2024, Matador joined the two networks.

“This combination will provide San Mateo with additional scale and expansion of its operations into Lea County, New Mexico, where Matador and third-party customers are increasing their focus and production,” said Joseph Foran, Matador's founder, chairman and CEO, in the announcement.

Pronto’s assets also include the Marlan processing plant, which has 60 MMcf/d of natural gas capacity. Matador is currently expanding the plant to 200 MMcf/d capacity.

Several Delaware-based natural gas processing facilities are expanding their ability to handle sour gas, as the basin produces less sweet gas as it matures.

"This transaction also provides Matador with a long-term sour gas solution in northern Lea County,” Foran said. “Northwind has been one of our service providers that has gathered and treated sour gas in other areas of the Delaware Basin, and we are pleased with this opportunity to expand our working relationship with Northwind.”

Analytical firm TPH rated the transaction as positive and recommended Matador as a buy.

“[It’s] definitely good to see the company bring forward value for the deal to accelerate the paydown of debt, which should also allow for the lessening of some of the capex intensity associated with the midstream vs. the prior full ownership of Pronto,” TPH wrote.

Recommended Reading

TotalEnergies, Skyborn Commission Yunlin Wind Farm Offshore Taiwan

2025-03-04 - Located about 15 km off Taiwan’s west coast, Yunlin consists of 80 wind turbines.

Norges Bank Acquires $1.5B Stake in North Sea Wind Projects

2025-03-31 - Norges Bank’s deal with RWE includes the Nordseecluster wind farm in the German North Sea and the Thor wind farm in the Danish North Sea.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

Costs for Dominion’s 2.6-GW Offshore Wind Project Swell to $10.7B

2025-02-03 - With 176 turbines, Dominion Energy’s Coastal Virginia Offshore Wind has seen costs rise by about $900 million, or 9%, the company said.

Energy Transition in Motion (Week of April 11, 2025)

2025-04-11 - Here is a look at some of this week’s renewable energy news.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.