Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities. (Source: Shutterstock.com)

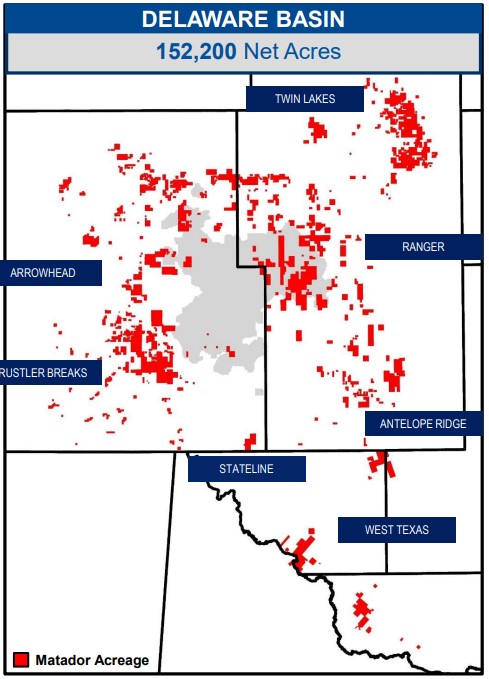

Matador Resources continues to get deeper in the heart of the Delaware Basin through ground game acquisitions.

But with at least $1.5 billion in dry powder liquidity, Matador is also open to growing through large-scale M&A—like the company’s acquisition of Advance Energy Partners last year.

The Dallas-based producer has had boots on the ground acquiring producing oil and gas properties, undeveloped acreage and royalty interests in the Delaware Basin since the beginning of December.

The aggregate purchase price for the bolt-on acquisitions was approximately $281 million, Founder, Chairman and CEO Joe Foran said during Matador’s first-quarter earnings call.

The deals added about 1,350 boe/d (82% oil) to the company’s total first-quarter production. The acquisitions also included additional undeveloped drilling locations in Lea and Eddy counties, New Mexico, and Ward County, Texas.

“These transactions reflect Matador’s ‘brick-by-brick’ acquisition approach that has served us well in building our acreage position from only 7,500 net acres in the Delaware Basin when we became a public company in 2012 to over 150,000 net acres in the Delaware Basin today,” Foran said in a news release.

The incremental acquisitions were funded using borrowings under Matador’s credit facility and the company’s free cash flow.

Matador’s healthy balance sheet should enable the company to ink more acquisitions in the future, should it choose to do so, Foran said.

The company exited the first quarter with a net debt-to-EBITDA ratio of 0.75x, and Matador anticipates maintaining a leverage ratio below 1.0x throughout this year, Siebert Williams Shank & Co. Managing Director Gabriele Sorbara wrote in an April 24 report.

Matador had a total debt of around $1.95 billion as of April 23, on a consolidated basis.

A wave of massive upstream M&A swept over the Permian Basin in the past year—with deal volume heavily weighted toward the Midland Basin—but Matador isn’t in a rush to make another acquisition.

The company also plans to organically boost its Delaware Basin oil and gas production this year.

“We can afford to be patient,” Foran said on Matador’s April 24 earnings call, “but we’re actively looking to grow either [organically or inorganically]—or a third way with midstream.”

After a strong start to the year, including better-than-expected results from new wells drilled on its Stateline assets, Matador anticipates total average 2024 production to come in at between 153,000 boe/d and 159,000 boe/d—at the high end of its guidance.

First quarter production averaged 149,760 boe/d; Oil volumes averaged 84,777 bbl/d.

Major acquisitions steal headlines, but there’s also some financial bumpiness associated with inking big deals, Foran acknowledged.

Matador’s stock price “took a big hit” when it acquired the approximately 2,800 net acres comprising its Stateline area through a 2018 Bureau of Land Management (BLM) oil and gas lease sale in New Mexico, Foran said.

The full deal included 8,400 net acres for about $387 million—approximately $46,000 per net acre—in Lea and Eddy counties.

“When we bought that, our stock took a big hit because people couldn’t believe we paid that much for it,” he said.

But today, the results from Matador’s new Stateline wells outperform expectations.

“That’s kind of the disadvantage of an acquisition. You pay the upfront money and people can think you’ve overpaid,” Foran said. “It takes a matter of months or years to prove it out, just as we did in Stateline.”

Matador is also coming off a $1.6 billion acquisition of EnCap-backed Advance Energy Partners, the company’s largest transaction to date.

The company plans to turn 21 gross (18.9 net) 1.5-mile lateral Dagger Lake South wells on the Advance acreage during the second quarter.

RELATED

Enverus: 1Q Upstream Deals Hit $51B, but Consolidation is Slowing

Midstream moves

Matador has also invested heavily in midstream capacity for its oil and gas volumes in the Delaware Basin, a rural region where operators face a litany of infrastructure constraints.

During the first quarter, Matador completed natural gas pipeline connections between midstream systems. One connection linked Matador’s Pronto Midstream LLC subsidiary to San Mateo Midstream LLC, a joint venture between Matador and Five Point Energy. The second connected the Pronto system to the recently acquired Advance Energy Partners acreage.

Following the deals, Matador has a combined 595 miles of three-stream pipeline capacity to support its Delaware production.

The midstream projects will aid Matador in gathering and processing natural gas from its new Dagger Lake South wells coming online this quarter, Foran said.

Matador is also investing to expand gas processing capacity on the Pronto system with a larger cryogenic gas processing plant.

Foundation work for the expansion is underway; Matador expects to begin installing structural steel and pipe racks this quarter.

The expansion will add another 200 MMcf/d of processing capacity to the Pronto system.

“What you need in the Delaware is flow assurance, and there’s a capacity limitation,” Foran said during the call. “Unless you have flow assurance and work with the other pipelines, you’re going to have some difficulties getting your product to market.”

RELATED

Matador Bolts On Additional Interest from Advance Energy Partners

Recommended Reading

Haslam Family Office: ‘We Need Hydrocarbons’

2025-01-29 - The managing director of HF Capital—the office for Tennessee's Haslam family—says that as long as oil, gas and other energy sources are lacking capital, there’s an investment opportunity.

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Pearl Energy Investments Closes Fund IV with $999.9MM

2025-02-04 - Pearl Energy Investments’ Fund IV met its hard cap within four months of launching and closed on Jan. 31.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.