Matador Resources is expanding its Delaware Basin footprint in West Texas and New Mexico with the acquisition of EnCap-backed operator Ameredev II. (Source: Shutterstock.com)

Matador Resources is expanding its Delaware Basin footprint with a $1.9 billion acquisition.

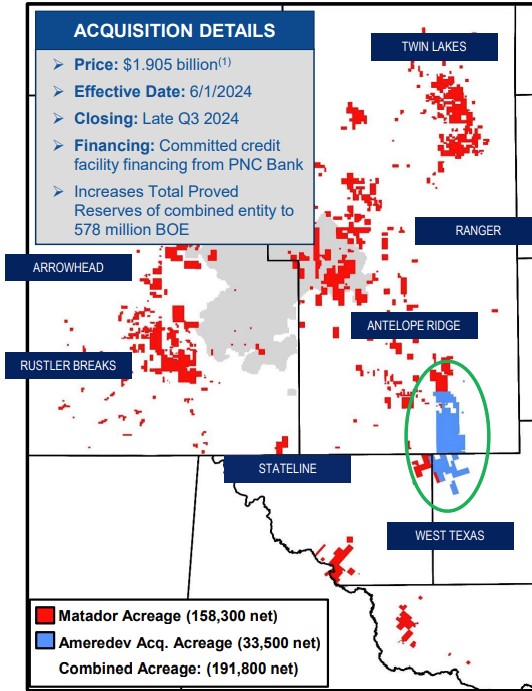

Dallas-based Matador will acquire a subsidiary of Ameredev II Parent LLC and certain oil and gas properties in West Texas and New Mexico, the company announced June 12.

The deal with Ameredev II, a portfolio company of private equity firm EnCap Investments LP, includes producing assets and undeveloped acreage in Lea County, New Mexico, and Loving and Winkler counties, Texas.

The acquired portfolio includes about 33,500 contiguous net acres in the northern Delaware Basin—adjacent to some of Matador’s core operating areas.

Estimated production from the acquired assets is expected to average 25,000 boe/d to 26,000 boe/d (65% oil) during third-quarter 2024.

The deal also includes 431 gross (371 net) undeveloped locations for future drilling operations across the Wolfcamp and Bone Spring intervals.

Consideration for the Ameredev acquisition will consist of a $1.905 billion cash payment.

On closing, Matador will hold more than 190,000 net acres in the Delaware Basin, production of more than 180,000 boe/d and about 2,000 net undrilled locations.

The Ameredev II deal marks Matador’s second large-scale acquisition from EnCap; Matador acquired EnCap-backed Advance Energy Partners last year.

"Matador is very excited to work with EnCap again on this strategic bolt-on opportunity,” said Joseph Wm. Foran, founder, chairman and CEO of Matador Resources. “As with the successful Advance Energy deal we completed in April of 2023, we view the Ameredev transaction as another unique opportunity to work with EnCap and another value-creating opportunity for Matador and its shareholders.”

The acquisition also includes midstream interests: an approximate 19% stake in Piñon Midstream, which has assets in southern Lea County, New Mexico.

RELATED

Matador CEO: Portfolio ‘Rationalization’ to Yield Permian M&A Opportunities

Recommended Reading

Chevron, Brightmark Mark Milestone with First Gas at 10 RNG Plants

2025-01-16 - Chevron and Brightmark Fund Holdings' facilities in Iowa, Michigan, Ohio, South Dakota and Wisconsin are producing RNG using biogas from dairy livestock.

CarbonQuest Lands $20MM Funding for Carbon Capture Projects

2025-02-27 - The new funding is aimed at helping CarbonQuest achieve the lowest cost per ton in the carbon capture industry and improve system efficiency for North American customers.

BKV Reaches FID, Forms Midstream Partnership for Eagle Ford CCS Project

2025-02-13 - If all required permits are secured, BKV’s CCS project in the Eagle Ford Shale will begin full operations in first-quarter 2026, the Barnett natural gas producer says.

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.