Matador Resources is expanding its Delaware Basin footprint in West Texas and New Mexico with the acquisition of EnCap-backed operator Ameredev II. (Source: Shutterstock.com)

Matador Resources is expanding its Delaware Basin footprint with a $1.9 billion acquisition.

Dallas-based Matador will acquire a subsidiary of Ameredev II Parent LLC and certain oil and gas properties in West Texas and New Mexico, the company announced June 12.

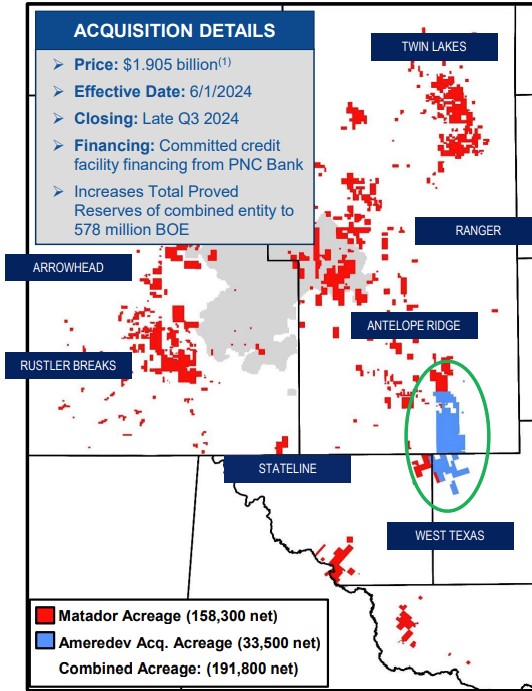

The deal with Ameredev II, a portfolio company of private equity firm EnCap Investments LP, includes producing assets and undeveloped acreage in Lea County, New Mexico, and Loving and Winkler counties, Texas.

The acquired portfolio includes about 33,500 contiguous net acres in the northern Delaware Basin—adjacent to some of Matador’s core operating areas.

Estimated production from the acquired assets is expected to average 25,000 boe/d to 26,000 boe/d (65% oil) during third-quarter 2024.

The deal also includes 431 gross (371 net) undeveloped locations for future drilling operations across the Wolfcamp and Bone Spring intervals.

Consideration for the Ameredev acquisition will consist of a $1.905 billion cash payment.

On closing, Matador will hold more than 190,000 net acres in the Delaware Basin, production of more than 180,000 boe/d and about 2,000 net undrilled locations.

The Ameredev II deal marks Matador’s second large-scale acquisition from EnCap; Matador acquired EnCap-backed Advance Energy Partners last year.

"Matador is very excited to work with EnCap again on this strategic bolt-on opportunity,” said Joseph Wm. Foran, founder, chairman and CEO of Matador Resources. “As with the successful Advance Energy deal we completed in April of 2023, we view the Ameredev transaction as another unique opportunity to work with EnCap and another value-creating opportunity for Matador and its shareholders.”

The acquisition also includes midstream interests: an approximate 19% stake in Piñon Midstream, which has assets in southern Lea County, New Mexico.

RELATED

Matador CEO: Portfolio ‘Rationalization’ to Yield Permian M&A Opportunities

Recommended Reading

TGS Starts Up Multiclient Wind, Metaocean North Sea Campaign

2024-05-07 - TGS is utilizing two laser imaging and ranging buoys to receive detailed wind measurements and metaocean data, with the goal of supporting decision-making in wind lease rounds in the German Bright.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

Enverus Names Manuj Nikhanj as New CEO

2024-05-29 - Enverus President Manuj Nikhanj will take over as CEO of the top energy analytics firm on July 1, succeeding Jeff Hughes, who will continue as executive chairman.

PGS Gets Greenlight to Begin Surveying for Petrobras 4D Contract

2024-05-30 - After a long permitting process, PGS has secured the last permit needed to begin its large 4D survey contract with Petrobras at the Barracuda-Caratinga field offshore Brazil.