Permian-heavy producer Matador Resources touted its vast untapped gas reserves in Louisiana’s Cotton Valley play. (Source: Shutterstock.com/ Matador Resources Co.)

Matador Resources again touted its Cotton Valley “gas bank,” where the Permian-heavy E&P might look to drill as natural gas prices improve.

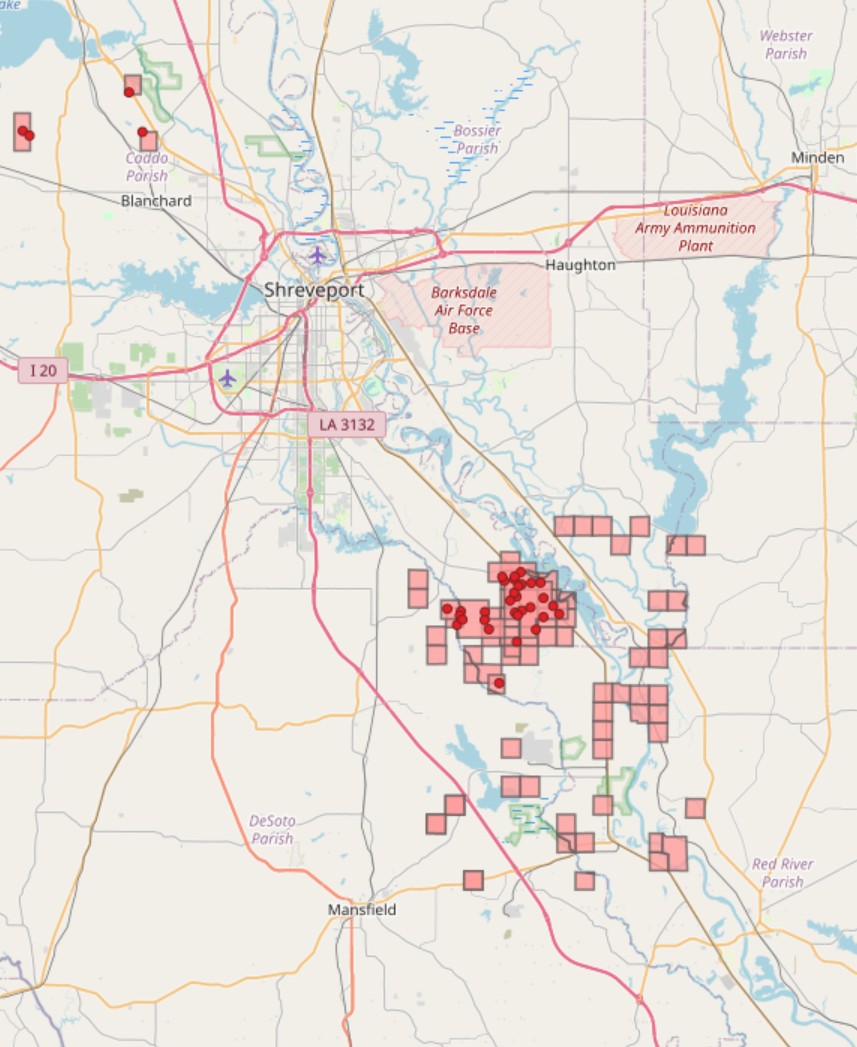

Matador held 14,800 net Cotton Valley acres and 8,900 net Haynesville acres in northwestern Louisiana as of year-end 2023, according to regulatory filings.

The Cotton Valley assets—which Matador refers to as its “gas bank”—are 100% held-by-production (HBP), said Matador Founder, Chairman and CEO Joe Foran in the company’s fourth-quarter earnings.

The Cotton Valley and Haynesville have been part of Matador’s portfolio for a long time, Foran said. In 2008, Matador sold Haynesville rights across approximately 9,000 net acres to Chesapeake Energy for around $180 million.

“We solely sold them the Haynesville formation down there,” Foran said during Matador’s Feb. 19 earnings call, “and we reserved all the up-hole rights with these properties.”

The Cotton Valley assets also have a “very high net revenue interest” as Matador retained the overrides that had been earned or acquired, Foran said.

Matador estimates that it has 37 net horizontal locations in the Cotton Valley. Reservoir engineers estimate the asset could produce between 200 Bcf and 300 Bcf of natural gas.

The last well Matador drilled on the asset came online in January 2011 in De Soto Parish, according to Louisiana state records.

The 1-mile horizontal well has produced an estimated ultimate recovery (EUR) of 6 Bcf, said Tom Elsener, executive vice president for reservoir engineering.

“I know today our operations team would go in there and be capable of drilling a 2-mile well, or [2.5 miles] or even further, perhaps,” Elsener said.

RELATED

Matador’s U-lateral Delaware Tests Outproduce 2-mile Straight Holes

‘Rallying’ commodity prices

Natural gas, after languishing in the doldrums of low prices for essentially two years, is now having a moment in the spotlight.

U.S. natural gas prices are increasing on winter heating demand and growing demand to feed new LNG export capacity on the Gulf Coast.

Gas producers are also foaming at the mouth to feed gas into power-hungry AI data centers.

Exxon Mobil, Chevron and Expand Energy are in conversations with technology customers to supply behind-the-meter, gas-fired power generation capacity for data center projects.

“Gas seems to be rallying,” Foran commented. “You have these data centers. You have the liquids [NGL] that can be taken out. It’s starting to be more attractive.”

He emphasized that Matador is “not in any way trying to sell” its Cotton Valley assets.

“It just shows you we have another card to play at the appropriate time,” he told analysts.

New U.S. LNG export capacity is already influencing natural gas futures pricing.

Venture Global’s Plaquemines plant—on the Mississippi River south of New Orleans—is currently pulling around 1.5 Bcf/d after exporting its first cargo in late December.

The quicker-than-anticipated ramp up of Plaquemines has already pushed up summer 2025 futures prices near the Gulf Coast, executives for Appalachia gas producer Antero Resources noted in an earnings call last week.

Cheniere Energy’s expansion at Corpus Christi, Texas, began liquefaction in December. Full capacity from the seven-train expansion will be 1.3 Bcf/d, bringing the plant’s total output to more than 3.3 Bcf/d.

And Exxon Mobil’s long-awaited Golden Pass LNG plant is also expected to come online within the next 12 months. Golden Pass LNG has FERC approval for 2.6 Bcf/d.

Expand Energy—the rebranded company after Chesapeake Energy and Southwestern Energy merged last year—expects to see 5.6 Bcf/d of incremental demand coming online over the next year from those LNG projects.

Strip prices are currently above $4/MMBtu, compared with roughly $3/MMBtu a year ago, according to CME Group data.

Matador’s Cotton Valley gas bank is well positioned to take advantage of growing LNG exports on the Gulf Coast, the company said in investor materials.

Additional demand is expected from AI data center projects in the future. However, projections swing wildly from producer to producer and analyst to analyst.

Expand Energy has heard forecasts ranging from 2 Bcf/d all the way to 20 Bcf/d of incremental gas demand from data centers, CFO Mohit Singh said at the 2025 NAPE Conference earlier in February.

“I think we’ll land around an incremental 5 Bcf/d of natural gas demand from data centers,” he said.

RELATED

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

Ameredev and U-turn wells

With its Cotton Valley gas bank lying in wait for the future, Matador continues to focus its efforts on the Permian Basin.

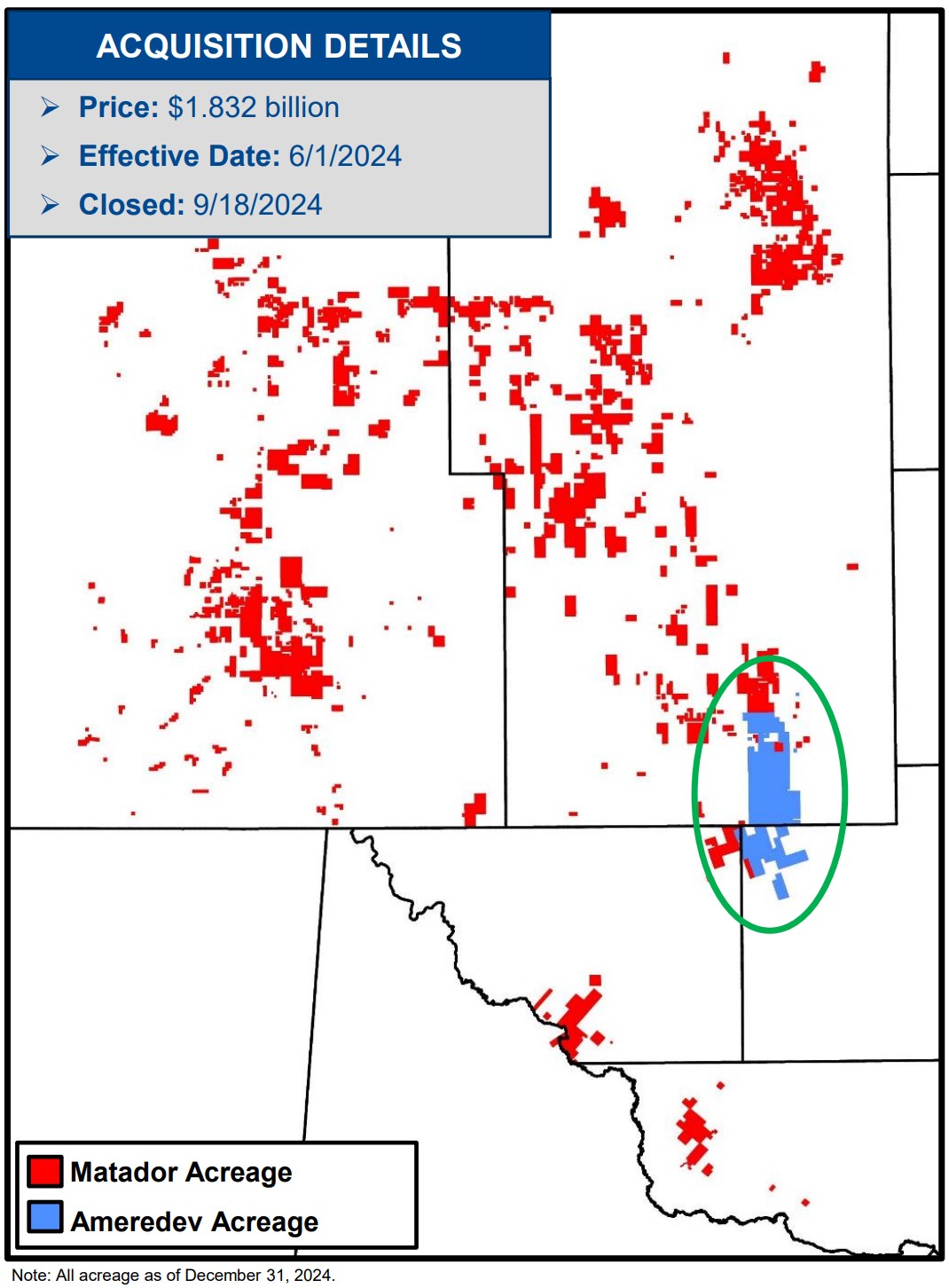

The company got even deeper in the Permian’s Delaware Basin with the closing of a $1.8 billion acquisition of private E&P Ameredev II last year.

The Ameredev deal added 33,500 net acres, 371 net locations and over 25,000 boe/d in production.

Matador estimates that it has seen at least $4 million in D&C cost synergies after closing the Ameredev deal, Foran said. Over the next five years, the company expects to see about $150 million in synergistic cost savings from the transaction.

Lease operating expenses on the Ameredev acreage have also fallen by 35%, or more than $2 million per month, since Matador took over as operator.

The Ameredev deal represented the largest transaction in Matador’s long corporate history: Foran originally launched the Matador brand in 1983 with just $270,000 raised from friends and family.

Matador currently has a market value of approximately $7 billion—and many of those friends and family investors remain shareholders today.

RELATED

By the Horns: Matador Wrangles Ameredev Deal for Delaware Scale

Matador is also lowering its D&C spending by drilling more U-turn-lateral wells and using more simul- and trimul-frac completions.

The company turned a record five new U-turn wells to sales during the fourth quarter.

Matador estimates that it saved drilling time and $15 million—around $3 million per well—for each new U-turn well, compared to drilling 10 vertical wellbores and 10, 1-mile laterals, Foran said.

“Initial results from the five U-Turn wells indicate that these U-Turn wells are performing as good or better than traditional two-mile straight lateral wells in the same area,” he said.

In certain areas, cost savings from drilling U-turn wells can reduce oil breakeven prices by as much as 20%.

RELATED

Matador’s U-lateral Delaware Tests Outproduce 2-mile Straight Holes

Recommended Reading

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

CNOOC Starts Production at Two Offshore Projects

2025-03-17 - The Caofeidian 6-4 Oilfield and Wenchang 19-1 Oilfield Phase II projects by CNOOC Ltd. are expected to produce more than 20,000 bbl/d of crude combined.

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Chevron Delivers First Oil from Kazakhstan Project

2025-01-24 - Chevron Corp.’s newest plant at Kazakhstan’s Tengiz Field is expected to ramp up output to 1 MMboe/d.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.