Mexico Pacific’s 30 million tonnes per annum (mtpa) Saguaro Energía LNG project will connect low-cost Permian Basin gas with high-demand markets in Asia. The project on Mexico’s Pacific Coast will provide an outlet for stranded, and in some cases, flared gas associated with oil production in the Permian, an ongoing challenge for producers there.

Saguaro is the largest proposed liquefaction facility on Mexico’s Pacific Coast, which is set to emerge as a new and potentially massive North American supply point targeting Asia. Mexico Pacific intends to make a final investment decision on the anchor project in early 2025.

Saguaro LNG’s location on Mexico’s Pacific Coast gives it a competitive advantage over U.S. Gulf Coast LNG projects because tankers will not have to pass through the Panama Canal to reach Asia. The voyage from Saguaro is 11 days shorter than from the Gulf Coast, which also translates into reduced CO2 emissions en route to key Asian markets.

Avoiding the highly congested Panama Canal isn’t a novel idea, and it is a key driver behind interest in projects on Mexico’s West Coast. But it joins Russia’s invasion of Ukraine in early 2022 and other geopolitical issues as factors bolstering the project, Mexico Pacific CEO Sarah Bairstow told Oil and Gas Investor (OGI).

“Asia, in particular [is] a region that has such great need for international imports for energy security,” said Bairstow, who took over as Mexico Pacific’s CEO in April following the resignation of Ivan Van der Walt. “That’s nothing new; that’s always been the case. They’ve got depleting reserves and a high reliance on, particularly, allied nations [for] support with energy imports. For them, it’s always been about diversification, which is why you’ve seen Asian buyers take offtake from the Middle East, Australia, Indonesia, Malaysia, the U.S., et cetera. For us, it was an absolute diversification play that was coupled with the cheapest landed LNG into Asia, which helps.”

Saguaro LNG will be built in two phases. Phase 1 will include three trains with a processing capacity of 5 mtpa each (15 mtpa combined). Phase 2 will also have three trains with a processing capacity of 5 mtpa each (15 mtpa combined), according to Mexico Pacific.

Saguaro LNG’s location in Puerto Libertad in Sonora, Mexico, will offer a 55% shorter shipping route to Asia, which translates into savings of at least $1/MMBtu and a 60% lower carbon emissions profile compared to Gulf Coast peers, according to Mexico Pacific.

It’s not just the shorter shipping distance, but the combined emissions reductions from tapping Permian gas, shipping it along pipeline crossing the U.S.-Mexican border and then liquefying it at the facility before sailing it off to Asia, said Bairstow, a native of Australia.

“The Permian is about 99% less CO2 than Haynesville and Eagle Ford. That gives you a big starting advantage in terms of CO2 content. You’ve then got a pipeline. Newer pipelines have newer technologies, so methane leakage is far lower. On the LNG production side, it’s a very proven out technology and equally contained. And then, of course, you halve the emissions shipped to market,” she said. “When you aggregate that value chain, you start to see that it’s not just about low-cost LNG. It’s done in a way that has a much lower emissions profile that then is supplemented.”

But is it Texas LNG or Mexican LNG? Or Tex-Mex?

“It’s not up to us to determine what this LNG is classified as,” Bairstow said. “It’s actually determined by every importing country. They have their own importing regulations that determine whether the product is U.S. or Mexican or otherwise. And frankly it differs. Some of [the Asian markets] deem it as Mexican LNG. Others deem it as U.S. LNG. But we don’t really have too much influence in that. We’ve really got to work with our customers and how they view that in terms of their own existing regulations.”

Saguaro LNG and Mexico LNG potential

Companies looking to build LNG export facilities in Mexico confront their own unique set of challenges, according to an analyst at Poten & Partners.

“Headwinds include regulatory hurdles, a high-skilled labor shortage, limited natural gas pipeline capacity and in some cases, disinformation on social media,” Sergio Chapa, a U.S. LNG analyst at Poten, wrote in a September report. “U.S. regulators with the DOE (Department of Energy) also appear to be becoming wary of re-export projects in Mexico that do not provide domestic jobs or boost energy infrastructure.”

Saguaro LNG is among five liquefaction export projects planned on Mexico’s Pacific Coast. The projects present a vast opportunity for Mexico, as well as potential for Permian and other shale producers to boost gas exports to Asia.

The five projects—Saguaro LNG, 30 mtpa; Energía Costa Azul, 15.3 mtpa; Amigo LNG, 7.8 mtpa; Vista Pacifico LNG, 3 mtpa; and Salina Cruz LNG, 3 mtpa—could add around 59.1 mtpa (7.8 Bcf/d) of processing capacity to the global market, according to data compiled by OGI. Such a figure could convert Mexico into the third-largest LNG exporter in the Americas, trailing only the U.S. and Canada, according to Rystad Energy.

However, Bairstow pegged the Mexico LNG potential at a higher 70 mtpa.

“Whether that 70 million tons is incremental growth from us as well beyond our initial growth plans or other projects, we’ll see, but there’s a lot of room for a lot of projects here,” Bairstow said, referring to Mexico’s Pacific Coast.

In January, the administration of President Joe Biden announced a temporary pause on pending LNG exports permits until the DOE completed an analysis of greenhouse gas emission impacts when making the authorizations. And, discussion around the pause remains topical due to its impacts—from delays and subsequent higher costs—on U.S. LNG developers.

“Macro-wise, it’s obviously an unfortunate thing to happen here in the U.S. from an investment certainty perspective. We, like many others in the industry, know it will be resolved, it’s just a matter of time. But the bigger challenge is how long will it delay all of those other projects,” Bairstow said.

She said the pause had been a bit of a tailwind for Mexico Pacific as no other U.S. LNG projects are currently moving through financing.

“As we talk with lenders [and] equity providers, all of them are looking to further invest in North American energy,” Bairstow said. “It’s seen as a very safe, very reliable and a very important investment over the coming decades, particularly around the energy transition and energy security. But there aren’t a lot of places for people to put that capital these days.”

Under Mexico’s former President Andrés Manuel López Obrador, the private sector was mostly sidelined. President Claudia Sheinbaum Pardo officially took office on Oct. 1. Sheinbaum is from the same Morena Party as Obrador and isn’t expected to drastically change course. However, a recent judicial reform passed during Obrador’s last days as president has raised a red flag for many watching the Mexican political and energy spaces.

Mexico Pacific has been working closely with the Mexican federal government under Obrador and now Sheinbaum and the Sonoran state government under its Gov. Alfonso Durazo Montaño. The federal and state governments continue to support Saguaro LNG, Bairstow said. In terms of the recently passed judicial reform, she said her team hasn’t seen any impact, and didn’t expect to be impacted either.

Saguaro LNG: The initial phase

In Puerto Libertad, Mexico Pacific—which boasts Houston-based Quantum Capital Group as its controlling owner and lead sponsor—owns 1,500 acres of land. The anchor Saguaro LNG facility will have two 180,000 cubic-meter tanks. The facility will use ConocoPhillips’ proprietary Optimized Cascade Process to liquefy the gas, which will save money and maximize efficiency of the overall facility, according to Mexico Pacific and ConocoPhillips’ websites.

At 15 mtpa, Phase 1 of Saguaro LNG will be on par with Freeport LNG’s three-train, 15 mtpa liquefaction facility on Quintana Island on Texas’ Gulf Coast. Freeport LNG is the seventh-largest liquefaction facility in the world and second-largest in the U.S. Its daily capacity is enough to power and light a metropolitan area about the size of San Antonio for a full day, according to the company.

Bairstow said FID on Phase 1 would be made in early 2025 and will move forward as a modularized project. The decision was made based on expected growth, as well as a way to keep the project on time and on budget.

“We would much prefer to pivot and take the time if we think it will reduce our execution risk than to simply rush through to an FID,” Bairstow said. “And modularization was a big part of that. When you look at the project now, there’s no offshore element. All of it is onshore. We’ll naturally have a significant amount of labor on site, but we will complement that with a number of the components being modularized offshore in Asia and brought to site just to further de-risk the project. It took longer, but it’s been the right decision for the project, and I think our stakeholders are all happy with the decision.”

Bairstow and her team—many of whom labored with her on the Gladstone LNG project in Australia—have worked on around 15 trains with Bechtel and ConocoPhillips. Bairstow said the traditional modularized scale hasn’t been employed much in the U.S. Gulf Coast due to the risk involved in transporting the modules through the Panama Canal and to site. She said Saguaro LNG doesn’t have that issue.

Train 1, Train 2 and Train 3 are ready in terms of permits and offtake contracts, Bairstow said.

Saguaro LNG boasts offtake agreements with Exxon Mobil, ConocoPhillips, Shell and Woodside Energy, and others from Asia like Posco International, Zhejiang Energy Group and Guangzhou Gas Group. The agreements are indexed to the Waha Hub and/or Henry Hub and are said to include combined liquefaction and pipeline fees ranging from $2.50/MMBtu to $3.77/MMBtu, according to Poten.

In February, Mexico Pacific issued a six-month limited notice to proceed (LNTP) to Bechtel, the liquefaction facility’s EPC contractor. The LNTP called for ground-clearing work and other preliminary works that were completed in early August, according to Poten.

“We have been moving through capital markets, both debt and equity. That’s the primary focus now, and rounding that out,” Bairstow said. “We will seek to maintain that flexibility as to whether we do a two train with a subsequent third or whether we close as one phase. We’ll really work with the market to figure out what’s the best fit and the best outcome for the project.”

1,052-km pipeline needed

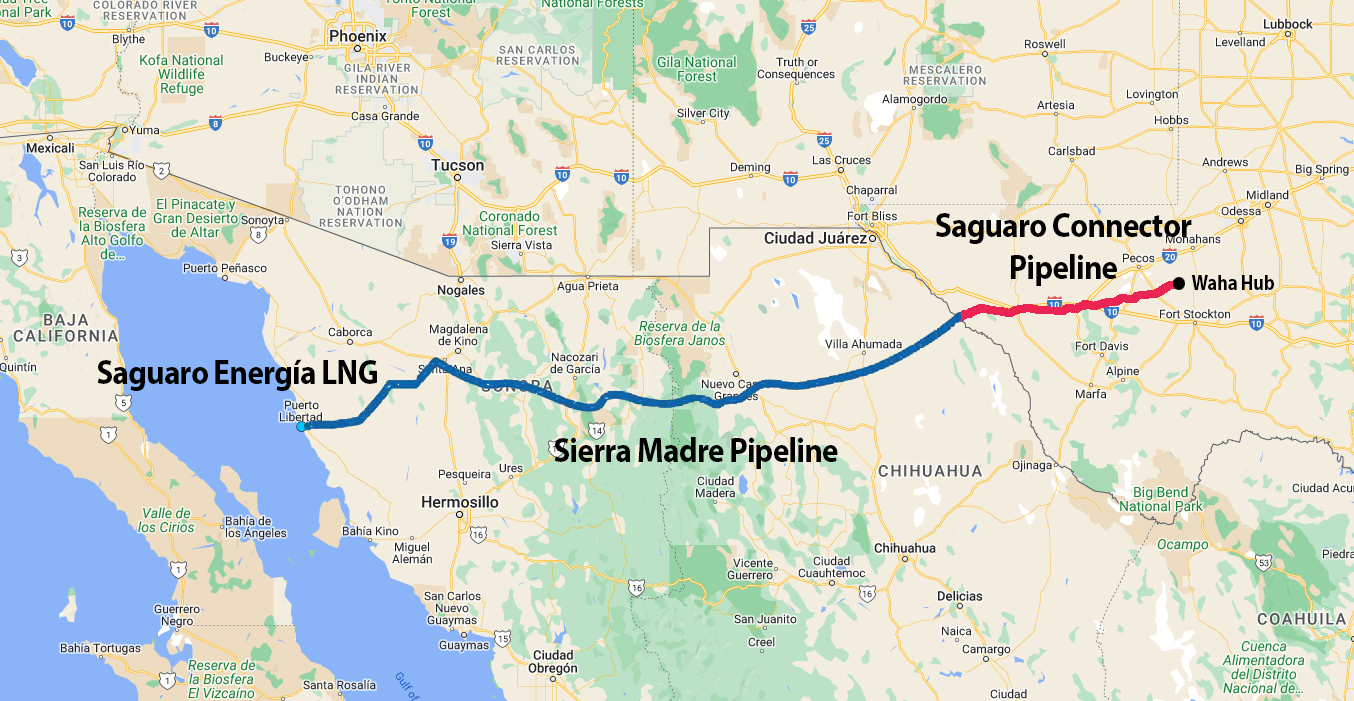

In the U.S., Permian feed gas will be shipped along the 252-km Saguaro Connector Pipeline to the Texas border with Mexico. From there, it will be shipped along the 800-km, 48-inch Sierra Madre Pipeline on the Mexican side of the border to the Saguaro LNG facility. Both segments have the capacity to handle 2.8 Bcf/d, according to Mexico Pacific.

The engineering, procurement and construction (EPC) contract for the Sierra Madre Pipeline will be executed under a lump-sum-turnkey arrangement and will be undertaken by a joint venture of Bonatti and GDI Sicim Pipelines. The two companies are leading pipeline EPC contractors with substantial experience in Mexico, according to Mexico Pacific. And, Bonatti’s scope of work will extend to the required compressor stations.

(Source: Shutterstock, Mexico Pacific)

In late August, Mexico’s Energy Regulatory Commission (CRE) granted Mexico Pacific permission to hold an open season on the pipeline. Now Mexico Pacific can book capacity on the pipeline and a related storage project, Chapa said.

But energy analysts from Mexico City to Chicago who cover the Mexican energy space are somewhat divided on the outlook for the Sierra Madre Pipeline, owing to the region of Mexico where it is located and potential issues with drug cartels and/or communities in its vicinity.

“When you look at LNG on a global basis, projects always have pipelines. So, this is not different in terms of risk profile when you look at other LNG projects and historically how things have been developed. It’s just simply different to the U.S. Gulf Coast,” Bairstow said. “We now have the right of way and, equally, the pipeline EPCs completed to a point that we can finance the project.… We feel very confident about that pipeline, particularly on the back of the routing and all the support that we’ve got from the [Sonora] government.”

Mexico Pacific was announced as the cornerstone of Plan Sonora, which promotes clean energy development, investment and economic prosperity for the region. The plan has been endorsed by both the U.S. and Canada and “is this tripartite effort where everybody sees the ability to grow out and create a hub off the West Coast of Sonora,” Bairstow said.

Mexico Pacific studied taking the initial portion of the pipeline across the U.S. and then down the West Coast of Sonora. That plan encountered bio reserves and key environmental areas, among other issues. The current route “avoids every environmentally sensitive area, every indigenous community and every community,” Bairstow said.

A total of three FEEDs were carried out by Mexico Pacific on the pipeline to identify the best route to “naturally [try to] balance the scale that you need, but equally the execution path itself,” Bairstow said. She said the final pipeline path “wasn’t the cheaper decision, it’s more expensive to do it that way, but we think it’s the right way to do it.”

On the U.S. side, Mexico Pacific will utilize an interstate pipeline running from Waha to the border. That one is not a Federal Energy Regulatory Commission (FERC) regulated pipeline, according to Bairstow. The two key permits Mexico Pacific needs in the U.S. include the non-free trade agreement (non-FTA) export permit from the DOE and the presidential permit for the cross-border infrastructure. The latter is comparatively very small and covers just that cross-border footprint.

“We have both of those for all of the offtake on the anchor project. But we’ve really experienced a lot of demand here, and again it all ties back to the Permian,” Bairstow said.

While Saguaro LNG is now 94% sold out, Chapa said Mexico Pacific still needs to seek an extension to its non-FTA export permit.

Saguaro LNG: growth potential

While Mexico Pacific has yet to take FID for Phase 1 of Saguaro LNG, it is already looking to the future. Phase 2 would likewise consist of three trains (4, 5 and 6) with a combined capacity of 15 mtpa, according to Mexico Pacific. The baseline infrastructure from Phase 1 will be leveraged for growth with some compression in the second phase, Bairstow said.

Bairstow said an FID on Train 4 could be taken within 12 months of the anchor project. After that, Bairstow said Mexico Pacific would explore how to manage growth in terms of its execution approach and equally incremental permitting. And part of that revolves around an ability to create an LNG and broader industrial export hub in Sonora, she said.

“Train 4 is a pretty simple expansion effort. [Regarding] Train 5 and Train 6 and what we choose to do beyond that, we’re in the process now of looking at existing right of way paths, et cetera, to identify, do we want to replicate what we have and leverage that or do we want to go in a different direction, and we’ll take that decision pretty near-term.”

“It’s a great place for the project to be in right now. But we’ll immediately move into growth and starting to execute off the back of that, which will mean cycling through the permitting process again,” Bairstow said. “This is a bigger project, and we’ve got phasing and a lot of demand across all of that. We’ve been able to show that we’ve got the anchor project fully committed, and a great evacuation route to monetize into Asia. We’ve equally already optioned out over half of Train 4, Train 5 and Train 6, and we have over 18 million tons of incremental offtake negotiations beyond that.”

Bairstow added that the Permian needed about another 100 million tons of LNG offtake to evacuate the gas to accommodate growth and access to the liquids.

“People are starting to recognize that the next big wave of lower-cost LNG that has higher reliability that the market really needs now will be the West Coast of Mexico,” Bairstow said. “And so, while we’re very proud that people are understanding and supporting our project, it represents so much more than just our project. It represents a whole new supply point.”

Recommended Reading

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

Pioneer Energy’s Tech Offers More Pad Throughput, Fewer Emissions

2025-01-14 - Pioneer Energy’s Emission Control Treater technology reduces emissions and can boost a well’s crude yield by 5% to10%, executives say.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.