Mexico’s domestic midstream sector strains to reorganize and serve an evolving economy as border connections with its northern neighbor increase.

Mexico is a big market for U.S. natural gas, gas liquids and petroleum products—and getting bigger. To date, the midstream appears the winner from Mexico’s constitutional reforms as weak crude oil prices have dampened interest by privately held E&P companies.

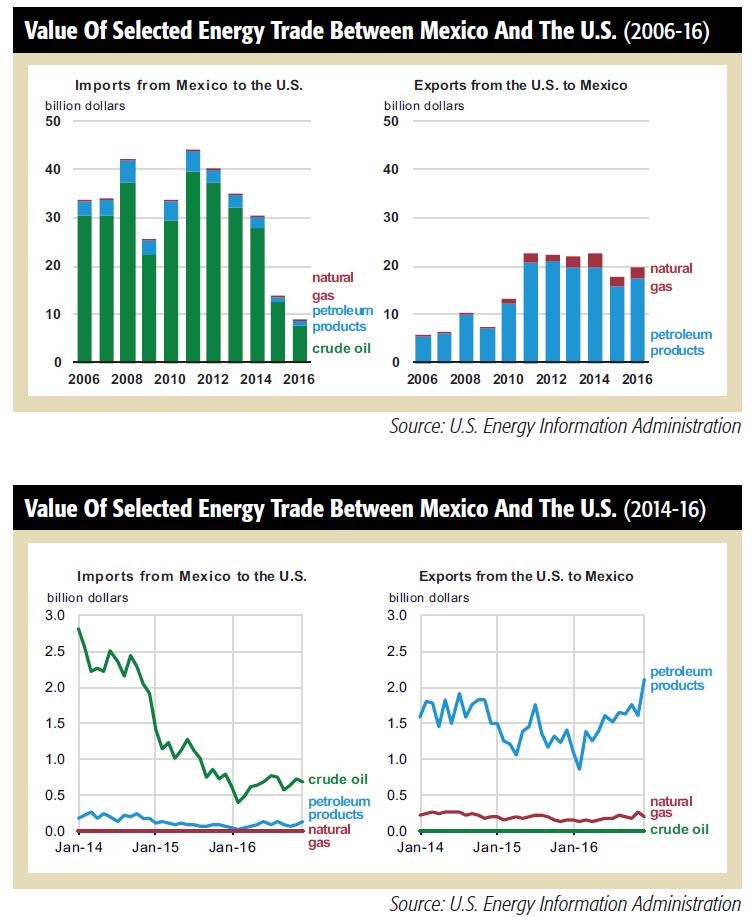

Mexico is second only to Canada in energy trade with the U.S. Based on data from the U.S. Census Bureau, energy accounted for about 9% of all U.S. exports to Mexico and 3% of all U.S. imports from Mexico in 2016. Crude comprises most of the energy imports from Mexico, averaging 688,000 barrels per day (Mbbl/d) in 2015 and 588 Mbbl/d in the first 11 months of 2016. In 2015, Mexico was the source of 9% of crude imported by the U.S., providing the fourth-largest share behind Canada, Saudi Arabia and Venezuela.

The bilateral energy trade situation with Mexico has changed significantly in recent years, according to the U.S. Energy Information Administration (EIA). In 2015 and 2016, the value of U.S. energy exports to Mexico, including rapidly growing volumes of both petroleum products and natural gas, exceeded the value of U.S. energy imports from Mexico as volumes of Mexican crude oil sold in the U.S. continued to decline. For 2016, the value of U.S. energy exports to Mexico was $20.2 billion, while the value of U.S. energy imports from that country was $8.7 billion.

Exports up, imports down

Import and export values each reflect commodity volumes and their prices. Monthly trends in volumes through 2016 showed increasing U.S. petroleum product and natural gas exports to Mexico, with a generally declining trend in U.S. crude oil imports from Mexico.

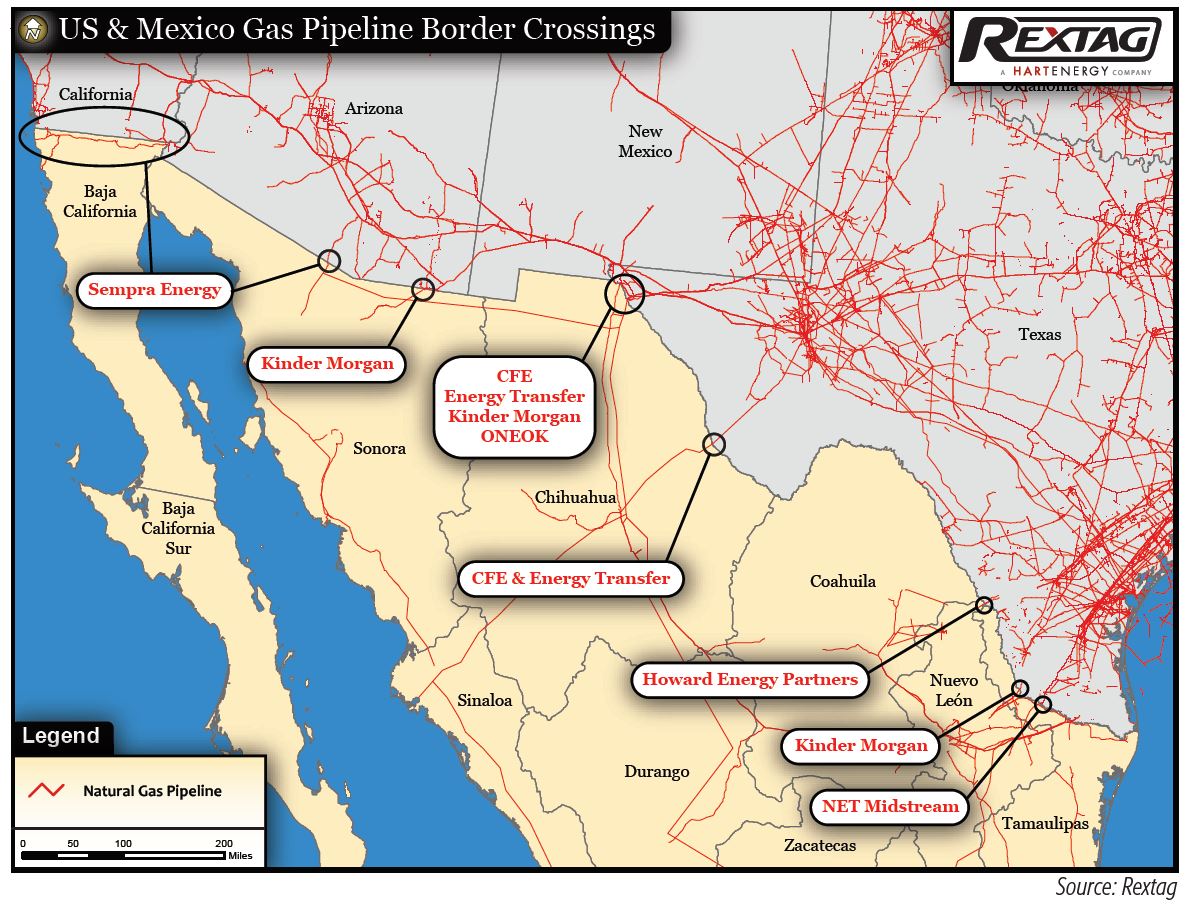

The notable caveat for exports of gas to Mexico is pipeline limitations in that country. “By the time all the pipelines are built to export gas to Mexico, we are going to have 15 Bcf/d [billion cubic feet per day] of capacity,” said Ira B. Joseph, head of gas and power analytics at S&P Global Platts. “When we talk to the industrial users in Mexico they say that they are going to fill the whole 15. But there are so many constraints on the Mexican midstream once you get past [the major industrial hub of] Monterrey [in Nuevo León].”

There is “lots of potential upside for gas in Mexico,” he added. “But there are major questions about the role of [national power commission] CFE, and the ability to build out midstream,” both transmission and distribution.

“There are four main drivers affecting the growth of gas supply to Mexico,” Matthew S. Ramsey, president and chief operating officer of Energy Transfer Partners LP (ETP), told Midstream Business. “There is the abundant supply in the U.S. [notably in basins close to the border], and at the same time, declining supply within Mexico from domestic wells. Then there is the rising demand within Mexico for natural gas for industrial use and power generation. And finally, there is the expansion of pipelines within Mexico and to the border.”

Total gas exports to Mexico from the U.S. were about 1 Bcf/d in 2010, Ramsey suggested. That grew to 4.3 Bcf/d by the middle of this year, mostly crossing the border from Texas but also moving south from California and Arizona.

The bottleneck

“The real bottleneck is not supply capacity in the U.S. to the border, it is transportation within Mexico,” Ramsey said. “There is a great deal of construction on the Mexican side of the border. When ETP made its decision to proceed with our plans to build to Mexico, we did that based on demand fees from our customers taking that gas.”

Together, the Trans Pecos and Comanche Trail lines have a capacity of 2.5 Bcf/d, and ETP has other lines to Mexico. But all of its lines together have been moving just about 1 Bcf/d. Of that, Comanche Trail was running, on average, about 125 million British thermal units per day (MMBtu/d) in October and Trans Pecos, zero.

“As you can tell, the flows are just not there yet,” Ramsey said. “That is because the Mexican side is just not ready to accept the gas.” ETP’s customer in Mexico is CFE, which is taking the hit for the lack of carry-on pipe south of the border.

“We have demand fees with CFE,” Ramsey explained. “CFE is paying the demand fee regardless of whether gas flows or not.” Ramsey estimated that “there are approximately 800 miles of pipeline under construction in Mexico, and another 2,500 miles of pipeline line approved but not yet under construction. Some of that is going to come into service this year, but most of it is not expected until 2018 or beyond. There is a lot of construction; it is just difficult to track its progress.”

ETP built its first line connecting to Mexico around 2014, so the company has experience in collaborating with carriers on the other side.

“With FERC [the Federal Energy Regulatory Commission] in the U.S., it is relatively easy to track the progress on the public docket,” Ramsey said. “But with the Mexican authorities there is not quite the same clarity. It is difficult from this side of the border to predict what is taking place on the other side. We put Trans Pecos and Comanche Trail into service knowing that.”

Under the liberalized hydrocarbon laws, ETP or any midstream operator is able to invest in and operate lines that cross the border and operate within Mexico. Few have chosen to do so, however.

“We have made the strategic decision to stay in the U.S.,” Ramsey said. “We bring gas into our new Waha Header, which has 6 Bcf/d of capacity and connects to multiple lines, so we can go in lots of directions. Over time, the situation in Mexico will right itself, and we feel that Mexico will be a strong market. There are good people doing good work there.”

Keeping things in perspective, Ramsey added, “They have certainly had delays down there, but we have had delays here on projects. That is normal on both sides of the border. For the present, we have no further plans to expand, because we already have more capacity on our own to meet the demand.”

He is also confident the strong market will continue for a long time.

“In Mexico, they have found it easier to buy U.S. gas at the border than to develop the domestic upstream sector. It provides a shorter time frame and less of a capital and technological challenge,” he said.

All projects have delays

“There is generally sufficient capacity to carry Permian gas production growth,” Rick Margolin, senior analyst for natural gas at Genscape Inc., told Midstream Business. “It is possible that the Permian could become constrained, but we are just not there yet, especially for gas. In particular, there is plenty of capacity to get gas to Mexico. There is total capacity to export 10.5 Bcf/d of gas from the entire U.S. to Mexico, but only 4.1 Bcf/d is actually being exported. With regards to the Permian specifically, there is the capacity to export just about 4 Bcf/d, of which less than 0.5 Bcf/d is actually flowing.”

Some of that stark difference can be explained by the fact that connections’ carry-on capacity is not yet sufficient—or even existent.

“The market has been disappointed,” Margolin acknowledged, “but there has been a lack of appreciation of the challenges to build capacity within Mexico. All projects have delays. Everyone knows that projects in the U.S. have had significant delays.”

There are several important lines that Genscape expects to be completed in 2018, which will make next year, not this year, a better indication of the potential for the market.

The biggest demand center is the industrial complex of steel mills, chemical plants and other heavy manufacturing in and around Monterrey, Nuevo León, only 300 miles southwest of Corpus Christi, Texas. Genscape estimates gas demand from the Monterrey region at 3 Bcf/d. There are further industrial hubs at Puebla, Bajio and Guadalajara.

Gas growth factors

Broadly, the demand for gas in Mexico was driven by three factors, Margolin said. “First is the higher demand from the power sector as gas replaces fuel oil. But not to be overlooked is the general growth of the economy in Mexico. GDP growth has been about 3% for the past several years. And, as has been widely reported, there is rapidly declining domestic gas production. Looking forward, we forecast lower demand growth because most of the fuel oil-switching is done, and GDP growth has slowed.”

There are several parties working to put steel in the ground and get molecules to those markets. Industrial and utility companies in Mexico are prominent, but international companies are active, including TransCanada Corp., Sempra Energy through its in-country affiliate IEnova, Canadian energy and utility group Atco, and Fermaca.

Pemex, the national energy company that lost its monopoly through Mexico’s 2014 constitutional changes, cannot be counted out either. Margolin noted that Pemex was involved in the large Los Ramones line that was completed in 2014, bringing 2.1 Bcf/d of gas into the country. Notably, Sempra was also involved in that project, and the line was divested by Pemex and is now owned by IEnova and a portfolio company of the large private-equity manager Blackrock.

“It does not appear that the regulatory or official situation in Mexico has been prohibitive to pipeline construction,” Margolin said. “Mexico does have stringent environmental, safety, and social restrictions. In particular, indigenous groups have a lot to say about rights of way. But again, that has been the case in Canada, but also to some degree in the U.S. In Mexico, indigenous issues have led to some delays.”

Overall, Margolin reiterated, “greenfield pipelines are difficult no matter where you are trying to build them. They are challenging in Mexico, but it does not seem any more so than in the U.S. or Canada.”

Building out

As the connections come into service, trading grows in importance.

“We are definitely looking for opportunities in Mexico,” Mark Davis, midstream manager for commodity trading and risk management at Allegro Development, told Midstream Business.

“One of the biggest challenges in past years has been changing the direction of flows. During my 25 years as an operational and commercial gas guy, most gas was going to the Northeast from the Gulf Coast. Now we are seeing Marcellus and Utica gas coming south and west. We are also seeing more gas being moved from the Permian to the south and more gas coming into the Waha Hub [in West Texas] and being moved to Agua Dulce [Hub, outside Corpus Christi].”

Just as there is willingness for U.S. companies to invest in transporting gas to Mexico, Davis said there is also plenty of investment on the other side of the border.

“There is already a lot of infrastructure to transport gas into the state of Nuevo León [where there is abundant manufacturing], especially the industrial center of Monterrey. There is also LNG, with two receiving terminals on the west coast and ideas for a new one on the Gulf coast.”

There is also a line, TDF, bringing LPG into Monterrey at the Nuevo León delivery point.

While there are numerous major capital projects, Davis stressed that there is opportunity to expand existing pipeline capacity.

“Current operators are looking into increasing horsepower to add a bit of capacity to the established lines,” he said. Davis and several others have noted that there is a first-mover advantage for the midstream in Mexico. There is so much need for infrastructure—including pipelines, terminals, roads, railways and processing facilities—that anything in the ground soon is likely to become established quickly. Unlike in the U.S. or Canada where there can be infrastructure competition, in Mexico the next capital peso is more likely to flow to an unserved market rather than compete with steel already in the ground.

“Beyond pure capacity, there is a lot of struggle associated with shifting from a nationalized industry to a free market. It’s a huge transition from central planning to the competitive commercial market with four cycles in the gas day, open seasons and contracts, which greatly impacts both operational and commercial dynamics,” he added.

The expropriation

For three-quarters of a century, hydrocarbons were state-controlled due to Mexican President Lazaro Cardenas signing an order in 1938 that expropriated the assets of almost all foreign oil companies. It has only been since the constitutional change signed into law in August 2014 by President Enrique Peña Nieto that Mexican companies have had to deal with heating- or cooling-degree days, load factors, energy factors and mark-to-market accounting.

“I have more day-to-day business activity supporting customers in their commercial dealings into, and in, Mexico, than dealing with any physical capacity issues,” Davis said. “People in Mexico definitely want to do business, and people in the U.S. and elsewhere definitely want to conduct business in Mexico.

“According to some of the largest gas marketers I have spoken with, there is less concern about how to get molecules across the border than there is about what happens after that,” he added.

Looking ahead, Davis sees further questions about how Pemex is going to unwind its control of the midstream.

“How is capacity going to be allocated? And are we going to have truly open seasons?” he asked. “I don’t see a lot of resistance to this, just some confusion. We spend a lot of time walking our customers through these challenges, which will continue until things are settled and there is more transparency.”

Davis differentiates selling gas elsewhere in North America from selling gas in Mexico. “In Mexico, part of the selling is actually going down there and helping. People are eager and open to learning; they want to get it right. Selling gas in Mexico is more than just software and technology. It’s very personal,” he added.

Product demand

Gas isn’t Mexico’s only midstream question right now. All of Latin America has been a strong export market for U.S. refined products for more than a decade, Ashley Petersen, lead oil analyst at Stratas Advisors, told Midstream Business.

“That is because, in general, their refineries are older and have not been well maintained. Mexico is a prime example of that. There are six refineries, the largest of which was out of operation from June to September because of a fire. It has a nameplate crude throughput of 340 Mbbl/d but had not been operating at more than 200 Mbbl/d.”

It could be said that, given limited capital availability over the past few years, authorities in Mexico City went upstream with their make-or-buy decision for fuels.

“It is relatively easy and inexpensive to put fuels on a ship,” Petersen said. “The refining clusters at Corpus Christi and even Houston are within barge distance, but for the most part the volumes move by larger oceangoing vessels because they make multiple stops along the coast.”

Revamping its existing refineries or building a new one is on Pemex’s list of things to do. But it is not high on that list.

“The need to import fuels is an issue for the Mexican government,” Petersen said. “But there is a debate between Pemex and the government over funding.”

How long that Mexican TV telenovela will play out remains anyone’s guess. Tune in tomorrow, but by all accounts, U.S. exports of all liquids are expected to be a strong and lasting business. That is taken to include not just fuels but also NGL and LPG.

“There is not a pipeline issue,” Petersen added. “There are no capacity constraints, and there has not been any major problem.”

But there are procedural and accounting snags related to free trade, as noted above. One U.S.-based energy trader told Midstream Business that letters of credit have delayed one Mexican firm’s imports of 100-car trains of propane. In the old days, everything came from Pemex and the state energy firm didn’t demand credit letters. It’s a new way of thinking for Mexican business.

An EPIC deal

Early in October, midstream operator EPIC struck a deal with BP Energy as the anchor shipper on a new 650-mile pipeline to carry NGL from the Permian Basin to Corpus Christi and then to Gulf Coast refiners, petrochemical companies and export markets—especially Mexico. The new NGL line is planned to begin operations in early 2018 and will run parallel to a previously announced crude line. EPIC has secured a capital commitment from Ares Management LP for the projects. BP is a major marketer of natural gas and liquids.

Also, EPIC is courting possible anchor shippers for a natural gas pipeline that would likely run parallel to the other two.

The NGL line will have capacity of at least 220 Mbbl/d with multiple origin points in the Delaware and Midland basins. Destinations will include interconnects near Orla, Benedum and Corpus Christi, Texas, where an affiliate plans to build a fractionation complex. Before the end of the year, EPIC will conduct a FERC open season. The company is already acquiring rights of way.

“BP is looking at Corpus as a hub for LPG because it has an advantage into Mexico and the Caribbean,” Phil Mezey, CEO of Epic Midstream Holdings, told Midstream Business. “There is definitely the possibility to lay lines into Nuevo León down the road, but for the time being there is rail loading for propane and butane into Mexico. That is very competitive vs. marine shipments out of [Mont Belvieu, Texas] because of the congestion around Houston for marine, rail, and truck. Corpus has the logistical advantage. And even if it were a tie, everyone is already long Houston. There is a growing awareness of the need to diversify assets away from Houston for supply-chain integrity.”

South Texas and more

EPIC is an acronym for Eagle Ford-Permian-Ingleside-Corpus. Its predecessors, TexStar Midstream Logistics and TexStar Midstream Services, owned and operated oil and gas midstream infrastructure throughout South Texas including crude- and gas-gathering systems, trunk lines and treating and processing plants including a fractionator near Corpus Christi.

Ares Management is a publicly traded global alternative-asset manager with about $104 billion of assets under management as of June 2017.

“We definitely see an export market for condensate into Mexico,” Mezey said. In some ways the liquids balance is the opposite of natural gas. For gas, there is capacity to get volumes to the border, and demand within the country, but not yet the infrastructure to take gas at the border and get it to demand centers. For liquids there is demand and distribution within Mexico, but not yet capacity to get volumes to Mexico.

There are also ample markets for liquids worldwide.

“You would be surprised how many Asian companies participated in our open season on the oil line,” Mezey noted. “With the larger Panama Canal, Corpus is becoming a hub for Asian shipments of condensate and crude.”

Recommended Reading

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

Chevron Completes Farm-In Offshore Namibia

2025-02-11 - Chevron now has operatorship and 80% participating interest in Petroleum Exploration License 82 offshore Namibia.

Oklo Signs MOU with RPower for Phased Power to Data Centers

2025-01-20 - Oklo and power generation company RPower will work together to provide a phased natural gas-to-emissions free approach to power data centers

TGS Launches Advanced Imaging Centers for Petrobras

2025-01-21 - TGS' 4D technologies will provide enhanced subsurface clarity in basins offshore Brazil for Petrobras.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.