— Rodrigo Rosas, senior Analyst, Americas Gas Research, Wood Mackenzie. (Source: WoodMac)

According to Wood Mackenzie’s Rodrigo Rosas, senior analyst of Americas gas research, “LNG is emerging as the key driver for new demand in Mexico. [New Fortress Energy’s] Altamira project has started commercial operation, followed by Costa Azul, set to start in late 2025. Together, these projects will add 0.5 Bcf/d to feedgas requirements.”

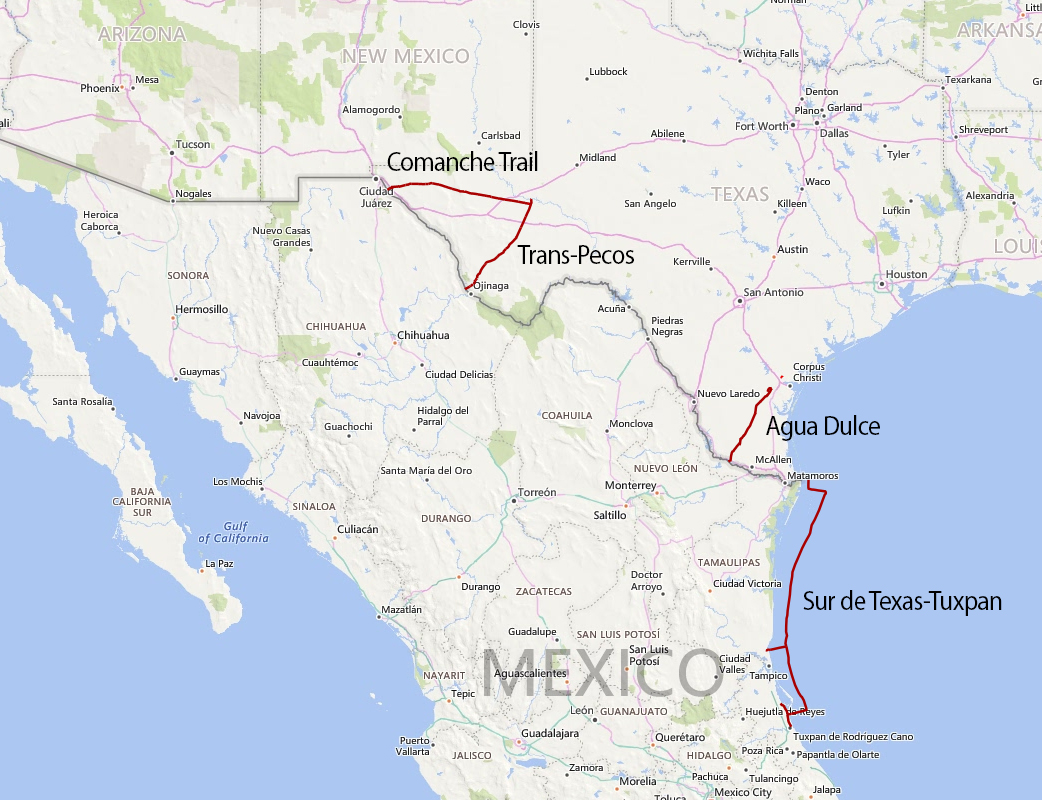

Rosas stressed that growth in Mexico’s liquefaction capacity is “contingent on future pipeline network improvements.”

The initial five liquefaction plants planned on Mexico’s Pacific Coast are being led by Sempra Infrastructure, which is eying three projects (Energia Costa Azul or ECA, Vista Pacific LNG and Salina Cruz LNG), Mexico Pacific (Saguaro Energía LNG) and LNG Alliance (Amigo LNG, also known as Epcilon LNG).

Sempra Infrastructure has plans for 2 Bcf/d of capacity at its ECA project located in Ensenada in Baja California, Mexico. The project is being developed in two phases: ECA LNG Phase 1 will consist of one train with a capacity of 0.4 Bcf/d, and ECA LNG Phase 2 will consist of two trains and one LNG storage tank and for a combined capacity of 1.6 Bcf/d.

ECA Phase I is the only project of the five planned on Mexico’s Pacific Coast to have a final investment decision (FID) under its belt. Consequently, it is the only project under construction and will be the first to use and export Permian feedgas from a liquefaction plant on Mexico’s Pacific Coast.

Sempra is targeting late-2024 for completion of the 188-mile Gasoducto Rosarito or GRO pipeline expansion project in Baja California. The GRO pipeline will have three sections, a compression station with 30,000 horsepower and capacity to transport 0.5 Bcf/d, according to Sempra Infrastructure. ECA Phase 1’s commercial operation date is slated for the spring of 2026.

Sempra’s other two planned liquefaction projects are further down the development phase worksheet. Vista Pacifico LNG in Topolobampo in Sinaloa, Mexico, will have one train with 0.4 Bcf/d of capacity, while Salina Cruz LNG in Salina Cruz in Oaxaca, Mexico, a development with Mexico’s CFE, will have one train with 0.4 Bcf/d of capacity.

The first phase of Saguaro is the next project to watch after ECA Phase 1, analysts tell MB.

Mexico Pacific, which lists Quantum Capital Group as its controlling owner and lead sponsor, is somewhat overdue to take an estimated $15 billion FID on Saguaro Phase 1, considering promises company executives made to the market in late 2023 related to “imminent” FID announcements.

Mexico Pacific has plans for 4 Bcf/d capacity at its Saguaro project in Puerto Libertad in Sonora, Mexico. Saguaro Phase I will include three trains with a combined capacity of 2 Bcf/d. Similarly, Saguaro Phase II, also comprising three trains, will have 2 Bcf/d of capacity.

Saguaro will source gas from Waha that will be shipped along the 157-mile Saguaro Connector pipeline on the U.S. side of the border and then the 498-mile Sierra Madre pipeline on the Mexican side of the border. Both segments have the capacity to handle 2.8 Bcf/d of gas, according to Mexico Pacific.

In late 2023, Mexico Pacific, GDI Sicim Pipelines and Bonatti executed an engineering, procurement and construction (EPC) contract for the Sierra Madre pipeline project. Under the lump sum, turnkey EPC contract, the GDI Sicim Pipelines and Bonatti joint venture are responsible for the Sierra Madre pipeline, with Bonatti’s scope extending to the required compressor stations.

“The main constraint we see [for the U.S.] in increasing exports to Mexico is pipeline capacity and the lack of additional sanctioned pipes coming online by 2030,” Enverus Intelligence Research senior associate Josephine Mills told MB. With no financial announcements yet from Mexico Pacific, the Saguaro Connector and the Sierra Madre pipelines, “projects are waiting for the Saguaro LNG I facility to reach FID,” Mills said.

Wood Mackenzie’s Rosas expects Mexico Pacific to announce FID for Saguaro in the second half of 2024 or early 2025.

The lone Asian company in the group, LNG Alliance, has plans for 1 Bcf/d of capacity at its Amigo LNG (Epcilon LNG) project in Guaymas in Sonora, Mexico. The project will be developed in two phases: Amigo LNG 1 will include one train with 0.6 Bcf/d of capacity, while Amigo LNG 2 will have one train with 0.5 Bcf/d of capacity. LNG Alliance has not had much to talk about, but it expects to see movement on the project by year-end 2024.

When it is all said and done, much of Mexico’s current nearshoring success and future success in the LNG space will be linked to Texas.

“In addition to the existing infrastructure and production levels, the main advantage of Texas to continue being Mexico’s top natural gas supplier is geographical proximity,” Baker Institute’s Duhalt said. “Given the circumstances, nothing can beat that.”

RELATED

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

EIA: Tariff Chaos, OPEC Output Increases Spell $57/bbl WTI in 2026

2025-04-10 - Energy Information Administration price estimates for 2025 and 2026 are bad news for producers—if they come to pass—as breakeven prices for operators, even in the Permian Basin, require between $61/bbl and $62/bbl to remain profitable.

Analysts: How Trump's Tariffs Might Affect Commodity, Energy Sectors

2025-02-03 - Trump's move has sparked volatility in the commodities market. Oil prices rose, with WTI up 2.4% at $74.27 a barrel and Brent crude futures adding 1% to $76.40 a barrel.

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

Oil Prices Ease as US Tariffs On Mexico Paused for a Month

2025-02-03 - WTI crude futures were down $0.04, or 0.01%, at $72.49 after climbing as much as 3.7% earlier in the session to reach their highest since Jan. 24 at $75.18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.