The Zama Field was discovered by Talos Energy and its partners in the Gulf of Mexico in 2017. (Source: Talos Energy, Hart Energy archives)

MEXICO CITY—In shallow waters offshore Mexico, the Zama field development in Block 7 has been granted “strategic project” status by both the country’s federal government and its state-owned Petróleos Mexicanos (Pemex), according to the project’s former operator Talos Energy.

But despite the importance placed on Zama to up Mexican oil production and secure energy security for the country, the consortium developing the field continues to run into headwinds.

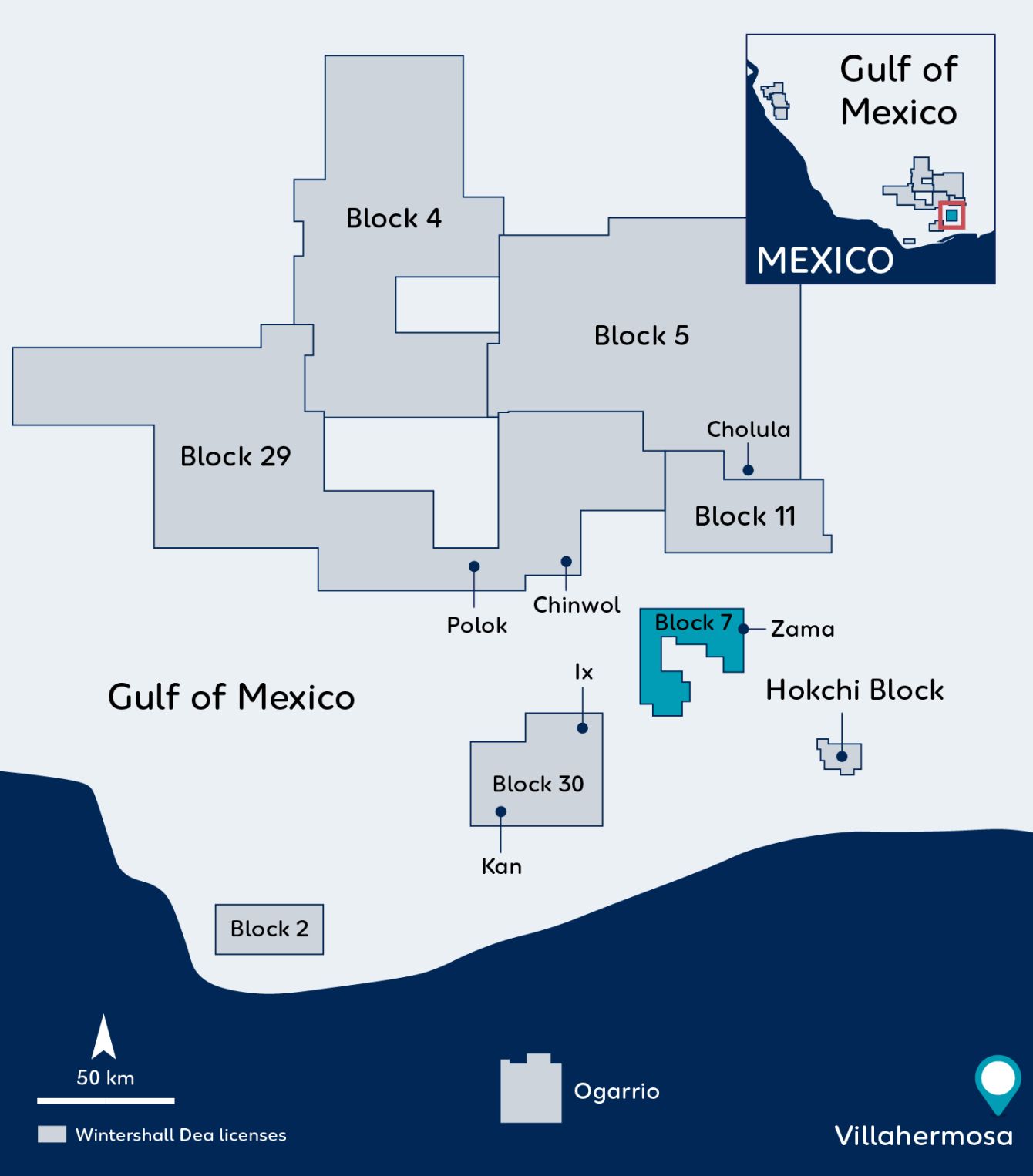

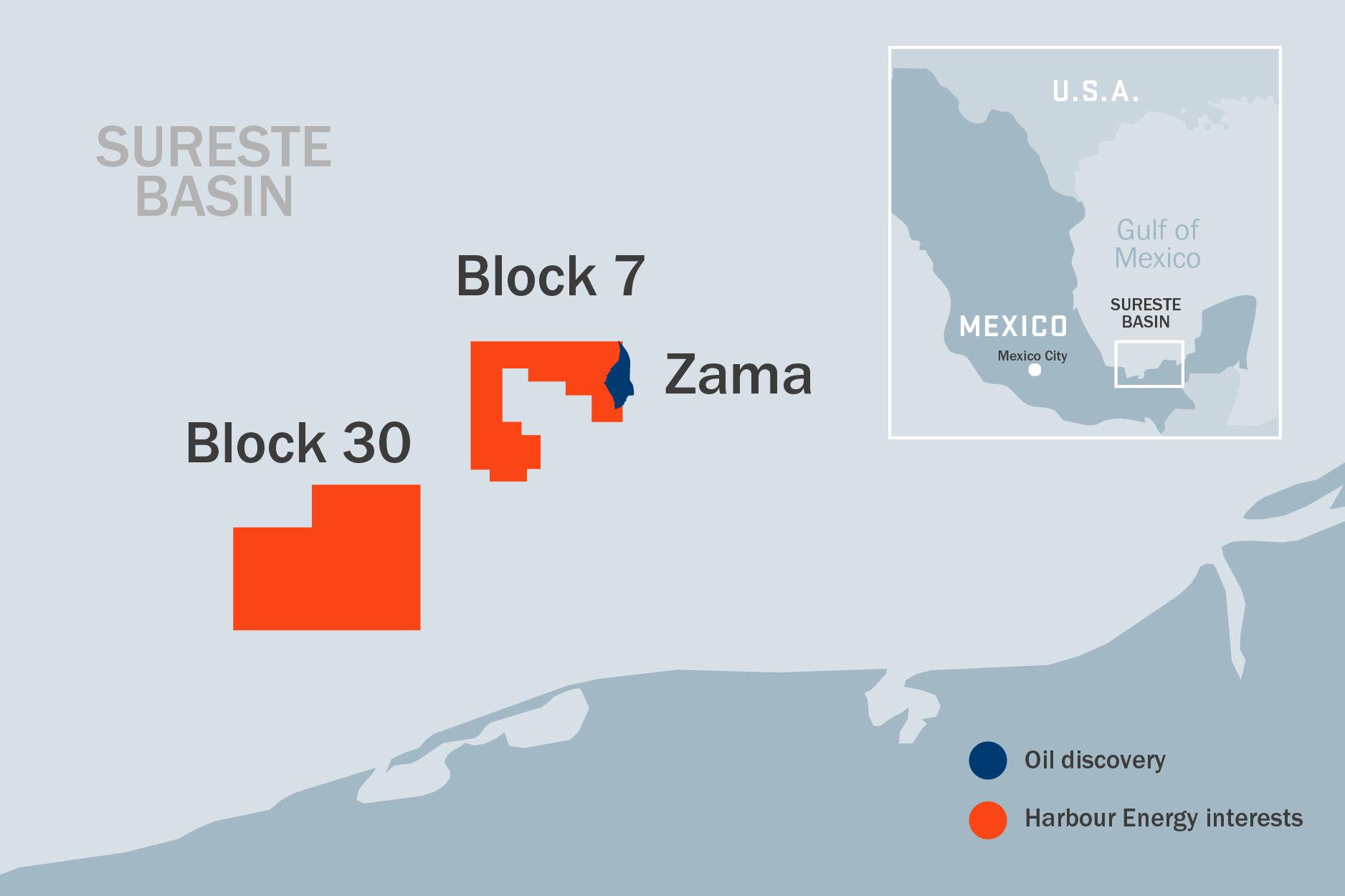

The Zama field is located within Mexico’s Sureste Basin, a prolific proven hydrocarbon province off the coast of Tabasco state. Identified in 2017, the Zama field discovery was the first find in Mexico made by an international consortium. At the time, Talos was the project’s operator, along with partners Sierra Oil and Gas and Premier Oil Plc.

Less than a decade later, Talos remains a mainstay within the Block 7 consortium, in addition to new names: Pemex, the U.K.’s Harbour Energy, Germany’s Wintershall Dea and most recently, Mexico’s Grupo Carso.

And Pemex is now at the helm of the project after being designated as operator by Mexico’s Energy Secretariat (Sener).

The Block 7 consortium could take final investment decision (FID) for Zama in late 2024 or sometime in 2025, according to consensus estimates from analysts with U.S.-based consultancies Welligence Energy Analytics, Enverus Intelligence Research and Pickering Energy Partners. Recent estimates from the Paris-based International Energy Agency (IEA) concur with the latter date.

“The new [Claudia Sheinbaum Pardo] administration will have to get her team going, and that could entail more time on the runway before the first steel is cut for [the Zama] development,” Josephine Mills, Enverus senior associate, told Hart Energy.

Zama ranks as one of the world’s largest shallow water discoveries in the past 20 years, and could produce up to 180,000 bbl/d, according to independent estimates published by the Block 7 consortium participants. Such production would represent 7% of Mexico’s equivalent production in 2023, which was 2.67 MMboe/d (1.85 MMbbl/d of oil and 4.9 Bcf/d of gas), according to Pemex data. From an oil production standpoint, Zama’s production would represent 10% of Mexico’s 2023 oil production.

Projects such as Zama are expected to aid the long-term production decline that confronts Mexico, Andres Armijos, Welligence’s vice president and head of Latin America research told Hart Energy. But realistically, that Zama production figure could be lower.

The IEA has pegged Zama’s peak production at 150,000 bbl/d. Pickering Director Kevin MacCurdy told Hart Energy that initial production could be closer to 100,000 bbl/d.

Zama’s production start date could be 2030 or before, based on consensus analysts’ estimates. Its production is expected to be 94% oil of excellent quality, with API gravities between 26° and 29°, according to Talos.

Armijos views Zama as one of the emblematic projects for Mexico’s energy reform. The plans were first announced by the administration of Enrique Pena Nieto, the president that preceded outgoing president Andrés Manuel López Obrador (AMLO).

“It's key to see how it succeeds,” Armijos told Hart Energy. “I think the expectation is that [Zama will] go forward.”

Recent presidential elections in Mexico will see a change in government effective Sep. 1. Political pundits in Mexico do not expect drastic changes to the country’s energy sector.

President-elect Sheinbaum, of the Morena Party, said she would continue with national and sovereign development plans for Pemex and the Federal Electricity Commission (CFE) during her presidential campaign. Her stance follows the same line as AMLO, who founded the Morena Party.

Sheinbaum holds a doctorate in energy engineering from the National Autonomous University of Mexico (UNAM), which could translate into positive things to come for Mexico’s energy sector, especially in the clean energy space.

Sheinbaum’s more technocratic approach to policy making will result in an improvement in the business operating environment, which favors international oil companies (IOCs).

But, bidding rounds aren’t likely to return, Dominika Rzechorzek, senior oil and gas analyst with BMI, a Fitch Solutions company, said in May during a webinar from Mexico City.

BMI expects Sheinbaum, an environmentalist, to pressure Pemex more on themes related to flare reduction and pollution.

The Zama drama

In July 2015, Talos and its Block 7 consortium partners Sierra and Premier executed a production-sharing contract (PSC) with Mexico’s oil and gas regulator, the National Hydrocarbons Commission (CNH). The PSC was awarded during the first tender of Mexico’s oil and gas fields in over 80 years. The PSC’s term was for 30 years starting in September 2015, with the option to extend for two additional five-year periods. Talos originally had a 35% interest in Block 7.

In 2017, the consortium made a significant discovery after drilling the Zama-1 well. At that time, Mexico’s Energy Secretariat estimated that Zama had original oil in place between 1.360 Bbbl to 2 Bbbl. Sener also said it expected the resource base to contribute significantly to Mexico's energy supply over the next 25 years.

Subsequent to the Zama-1 discovery, Talos drilled three additional wells to further appraise the discovery. Upon conclusion of the three-well appraisal program, Talos determined that the Zama field likely extended into a nearby offshore block owned by Pemex.

The Block 7 consortium and Pemex engaged a third-party reservoir engineering firm to evaluate initial tract participation within the Zama reservoir. The evaluation concluded that the consortium held 49.6% of the gross interest in Zama, while Pemex held 50.4%. Sener subsequently designated Pemex as the operator of the Zama unit, in effect replacing Talos.

In terms of Zama’s recoverable resources, an independent third-party reserve auditor estimated them at between 735 MMboe to 950 MMboe, Talos announced in a press release in March 2022.

With the bitter taste of Zama drama arguably still on the tongues of the Block 7 consortium, things seemingly turned for the better in 2023: in June, Mexico's CNH approved the Zama Unit Development Plan (UDP), and in September, a key partner with deep pockets, a critical local presence in Mexico and a global commercial reputation entered into the Block 7 consortium—Grupo Carso.

Grupo Carso, which is controlled by the family of Mexican billionaire Carlos Slim, entered the Block 7 consortium when Talos sold a 49.9% interest in its subsidiary Talos Energy Mexico to Zamajal SA, a wholly-owned subsidiary of Grupo Carso.

The total consideration for the deal was US$124.75 million, which consisted of $74.85 million in cash at closing and an additional $49.90 million due upon first production.

As a result of the deal, Talos Energy Mexico is now 50.1% owned by Talos Energy and 49.9% by Grupo Carso. Talos remains the controlling shareholder of Talos Energy Mexico, which now holds a 17.4% interest in the Zama field.

All summed, Block 7 consortium partners hold 49.6% in the Zama development. Wintershall Dea has a 19.8% interest, Talos Mexico holds a 17.4% interest and Harbour has a 12.4% interest. Pemex has the controlling 50.4% interest.

Impressively, the Block 7 consortium contains four of the top 10 companies in Mexico’s upstream sector—Harbour, Wintershall, Talos and Grupo Carso—ranked by the value of their assets, according to a Welligence analysis.

Grupo Carso is made up of four strategic sectors, including retail, industrial manufacturing, infrastructure and construction and energy. And, the Slim family office is a strategic Talos shareholder, creating the potential for Talos Energy Mexico to participate in different oil and gas opportunities in Mexico, according to Talos.

“Zama breakevens will be paramount to the new Pemex administration. There is also a fair amount of pride of having a Mexican player involved now (Grupo Carso),” Enverus’ Mills said. “Given Zama's material resource and low breakeven cost, we estimate Pemex will likely prioritize Zama over other capital projects.”

The Slim group joining the consortium is “certainly a positive in helping to de-risk the entire project,” Pickering’s MacCurdy said. “Any time you have a large [exploration] success and you're able to develop it and get some cash flow, it confirms the value proposition that you offer as a company.”

Most recently, DORIS Group, a French engineering company, was awarded a FEED contract for Zama. DORIS will collaborate with the two Mexican engineering companies NOMARNA and SUMMUM to carry out the FEED work, Wintershall Dea announced in a press release in June. Once these studies have been finalized, the Zama Unit partnership will proceed with the tendering process of engineering, procurement and construction contracts, followed by FID.

“Zama is currently one of the most important energy projects in Mexico, and we are very pleased to have reached the next milestone,” Martin Jungbluth, managing director of Wintershall Dea in Mexico said in the June press release.

But, all the drama is not over yet for the Block 7 consortium. Pemex, the world’s most indebted oil company with around $101 billion in debt, will be put to the test soon. Heavy financial commitments to the Mexican government continue to restrain Pemex. Its production is way down from the peaks of yesteryear and accidents happen frequently.

“Pemex is naturally in financial problems, which is the main reason for the decrease in investments and the production levels as well,” Holland & Knight Partner Rodolfo Rueda said in May during a webinar in Mexico City.

And, Talos’ drop to non-operator means it will have a limited ability to exercise influence over operations and associated costs, the company said in its 2023 annual report.

“Our dependence on the operator and other working interest owners, and our limited ability to influence operations and associated costs of properties operated by others, could prevent the realization of anticipated results in drilling or acquisition activities,” Talos warned in the report.

None of the companies in the Block 7 consortium immediately responded to emails from Hart Energy requesting comments for this story.

Zama development plan

In March 2023, prior to the entrance of Grupo Carso into the Block 7 consortium, the partners in the Zama development—Wintershall Dea, Pemex, Talos and Harbour—jointly agreed on a Zama unit development plan (UDP), according to documents on Wintershall Dea’s website.

Pemex submitted the UDP to Mexico’s CNH for formal approval in March 2023 and approved in June 2023. Modifications to the development plan were approved by CNH in February 2024 due to a revised timeline for infrastructure development activities, Talos said in its annual report.

As part of the UDP, the Block 7 consortium also agreed on the formation of an integrated project team (IPT) that would allow them to pool the talents and competencies of all companies participating in the development of the Zama oil field.

Wintershall Dea, together with Pemex, Talos and Harbour, will co-lead different work groups within the IPT. The IPT will provide technical, operational and execution expertise by leveraging the talents from each of the Zama partners to report to the Zama Unit Operating Committee, which includes representatives from each of the companies.

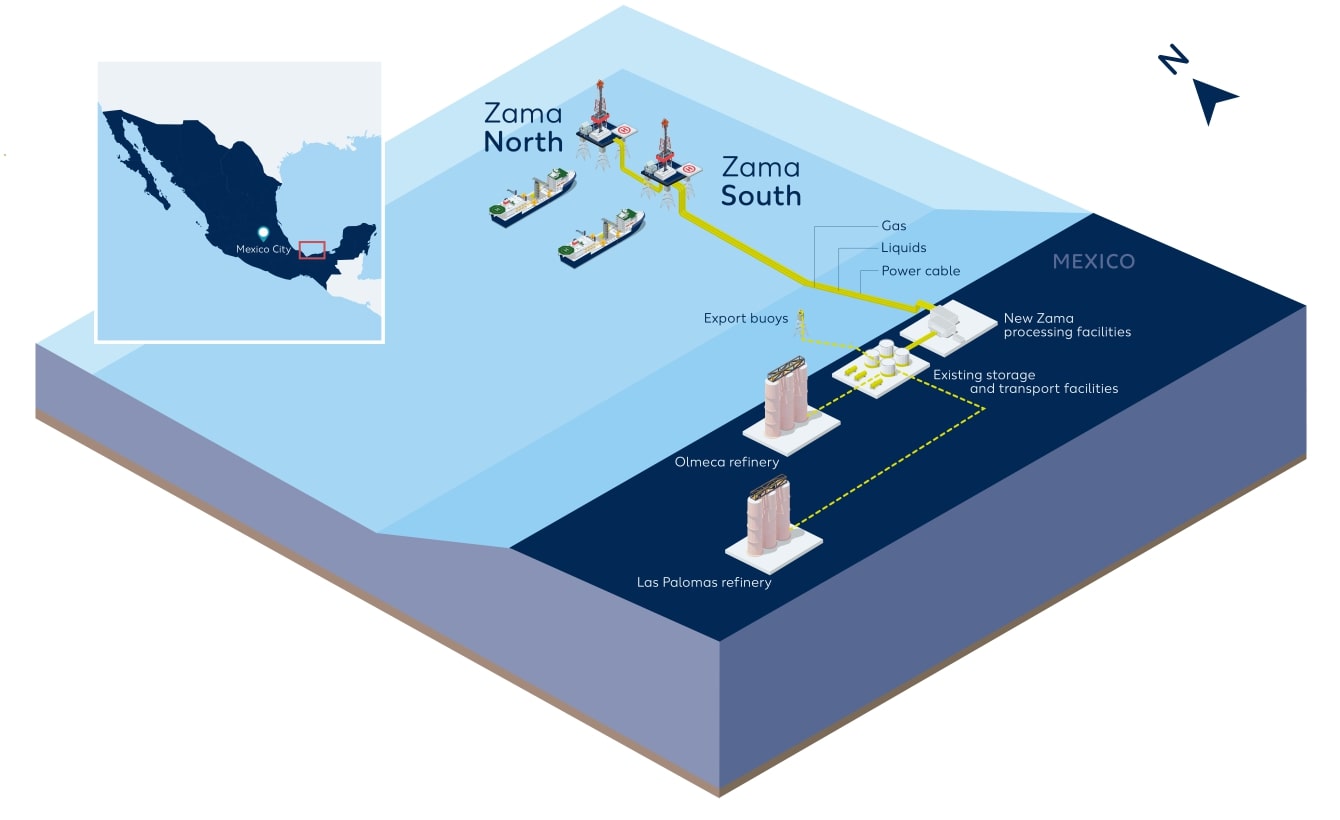

The UDP proposes the installation of two offshore platforms and the drilling of 46 wells. The production from offshore will be shipped onshore via two 68-km pipelines. Once onshore, the oil will be processed in new facilities fully dedicated to the Zama project in the Dos Bocas Maritime Terminal in Paraiso, Tabasco.

According to statements on Wintershall Dea’s website, the “UDP minimizes greenhouse gas intensity by using best available technology, produced gas for onshore power generation, as well as best use of existing storage and transport infrastructure.”

Despite the positive advancements of late, the rhetoric coming out of Mexico hasn’t been all that positive for international investors in the energy space. One saving grace is Mexico has yet to change the terms of contracts, Welligence’s Armijos said, despite problems Pemex has with paying suppliers.

“The reality is that projects [like Zama and Woodside Energy’s Trion] are coming online in this decade, but [Pemex] still has a problem with declining production across the country,” Armijos said. “You have a huge set of assets that you could potentially find players who are better suited to develop them rather than Pemex.”

Whether Sheinbaum agrees or not, only time will tell.

RELATED

Recommended Reading

Pearl Energy Investments Closes Fund IV with $999.9MM

2025-02-04 - Pearl Energy Investments’ Fund IV met its hard cap within four months of launching and closed on Jan. 31.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Activist Elliott Builds Stake in Oil Major BP, Source Says

2025-02-10 - U.S.-based Elliott is seeking to boost shareholder value by urging BP to consider transformative measures, Bloomberg News reported Feb. 8.

EOG’s Donald F. Textor to Retire from Board

2025-02-11 - Textor was first elected a director of EOG Resources in 2001, where his counsel played a key role in EOG’s growth, Chairman and CEO Ezra Y. Yacob said in a press release.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.