Market conditions and the depressed price environment have driven unconventional operators to dramatically improve cost efficiencies since early 2016, which in turn reduced breakeven prices and increased returns. Although a large portion of those capital efficiencies can be attributed to reduced service costs, better use of technology to improve drilling efficiency and optimize completion and treatment designs has made the most significant contribution. Understanding how the reservoir reacts to a particular combination of treatment parameters and optimizing the design based on those observations has been key to the success of the project.

Combining the competitive nature of humans to outperform their peers and the desire to find solutions to technical challenges as geoscientists, operators acquire a plethora of data to understand an asset better, help improve its development and ultimately increase returns. The shale puzzle is a complex one with multiple variables. Success is no longer driven by structure as is the case for conventional reservoirs; it is driven by understanding the variability in geology, reservoir properties, the impact of treatment design parameters and hydrocarbon production as the ultimate expression of all variables.

A technology that lends itself to solving the problem and providing an unbiased observation of how variable geology responds to variable completion and treatment design is microseismic monitoring. Driven by historic acreage multiples, the need to maximize returns led most of the top operators in the Permian Basin to incorporate microseismic as a crucial element of their technology portfolio. As is the case with any type of data, microseismic is one piece of a large puzzle and needs to be integrated with other technologies and data to limit the degrees of freedom in models and arrive at a well-constrained solution.

The industry has long called for integration into reservoir simulation and hydraulic fracture modeling to turn microseismic data from a scientifically interesting observation into something actionable.

Seven out of the top 10 operators in the Midland Basin integrated microseismic monitoring (as delivered by MicroSeismic Inc.) into their exploration and development workflows in 2016. This case study will focus on validating reservoir simulation results from microseismic monitoring to determine vertical wellbore spacing for a large independent operator.

Case study

Using a three-well example from the Permian Basin, MicroSeismic illustrated a workflow that translated data obtained from microseismic monitoring into a production forecast and compared it to a well-calibrated history-matched model using more than two years of production data.

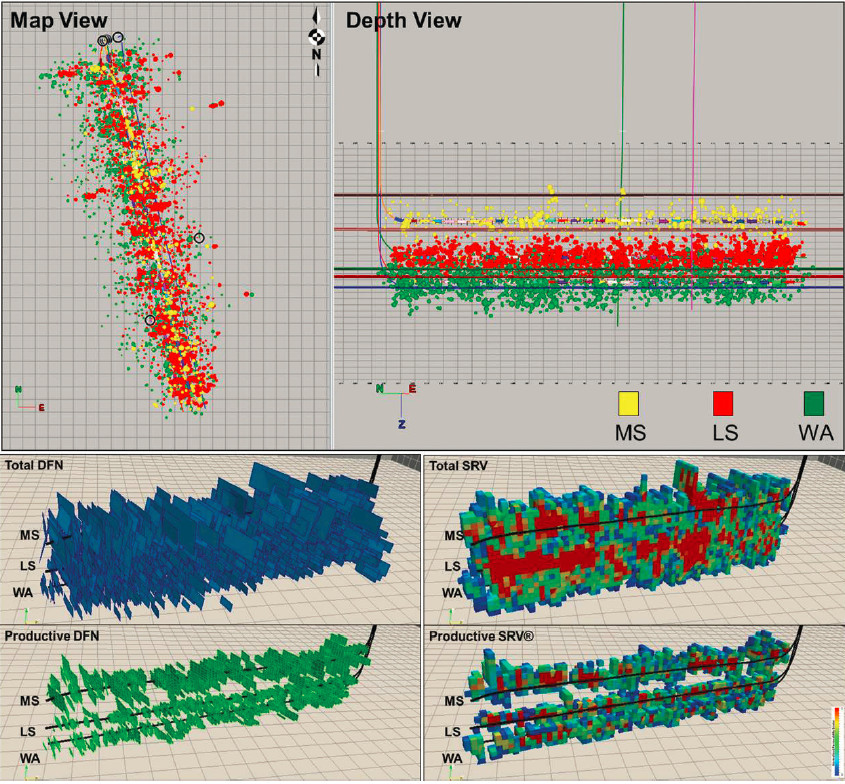

Figure 1 shows the microseismic data obtained for the study wells and the subsequent fracture network that was modeled onto the eventset. Surface acquisition allowed the determination of a unique focal mechanism, magnitude and size for every event from which the orientation of the fracture plane was created.

FIGURE 1. Microseismic events, total discrete fracture network, propped discrete fracture network, and total stimulated reservoir volume and productive stimulated reservoir volume cross-sections at wellbores for Permian Basin study wells are shown. Events for Middle Spraberry (MS) well are shown in yellow, events for Lower Spraberry (LS) well are shown in red and events for Wolfcamp A (WA) wells are shown in green. Events are sized by magnitude. Stimulated reservoir volume cells are colored by fracture permeability ranging from low (blue) to high (red). The grid size for map view and depth view of events is 76 m by 76 m (250 ft by 250 ft). The grid size for oblique views of discrete fracture networks and stimulated reservoir volume is 152 m by 152 m (500 ft by 500 ft). (Source: MicroSeismic Inc.)

The discrete fracture network calculated for the eventset was then filled with proppant according to the actual treatment schedule using a simple mass balance approach that honored the evolution of microseismic events over time. Based on the number of fractures, their geometry and their orientation in space, the permeability enhancement in the reservoir and its distribution in a geocellular model were calculated.

This process produces three different zones within the monitored area that are then imported into a reservoir simulator:

1. The unstimulated background reservoir with matrix permeability;

2. An unpropped portion of the stimulated reservoir volume that will lose most of its initially created conductivity with pressure depletion; and

3. The propped part of the discrete fracture network that follows a different permeability-pressure dependency and will provide substantially better long-term conductivity (productive stimulated reservoir volume).

Using well logs, pressure-volume temperature and core data as well as other available offset well data, a reservoir model was created to forecast production for the study wells. This estimate was made at the time of completion without production data to provide an immediate and robust understanding of wellbore productivity and evaluate the effectiveness of completion and treatment designs.

Figure 2 shows the cumulative production over time obtained from the initial model compared to actual production data. Microseismic-based reservoir simulation correctly predicted the order of producers at any point in time and predicted 30-month cumulative production within 16% to 22%. These results were used for early vertical wellbore spacing considerations since the model will show pressure depletion over time and wellbore interference with reasonable accuracy.

FIGURE 2. A microseismic-based cumulative oil forecast is shown for study wells at the time of completion predicting correct order of producers. Data for the Lower Spraberry well are shown in green, data for the Middle Spraberry well are shown in blue and data for the Wolfcamp A well are shown in orange. Model predictions are shown as solid lines, and actual production data are shown as spheres. (Source: MicroSeismic Inc.)

Figure 3 shows a refined and history- matched model using historic rate and pressure data for a more calibrated model. The initial prediction accuracy was improved by 8% to 10% using 90-day production data, making the model a solid base for refinement of operator-internal reservoir models that test “what if” scenarios for other parts of the asset with different reservoir properties.

FIGURE 3. A microseismic-based cumulative oil forecast is shown for study wells using 90-day rate and pressure data for history match. Data for the Lower Spraberry well are shown in green, data for the Middle Spraberry well are shown in blue and data for the Wolfcamp A well are shown in orange. Model predictions are shown as solid lines, and actual production data are shown as spheres. (Source: MicroSeismic Inc.)

The quality of the prediction illustrates the information contained within the microseismic data that was extracted by integrating it with other available data. Given the nonuniqueness of rate transient analysis and traditional reservoir models that lack microseismic data, it is important to observe how the reservoir actually responds to hydraulic fracturing and the location and nature of rock failure.

The workflow illustrated above shows how this operator used microseismic monitoring to improve its understanding of the subsurface and satisfied both the scientific aspect of its shale development and the need to turn data into actionable results to drive meaningful economic decisions.

In this case it was demonstrated that a reservoir model incorporating microseismic-derived permeability enhancement predicts production and in turn pressure depletion and wellbore interference with reasonable accuracy to inform vertical wellbore spacing and ultimately determine the number of wells that can be drilled per section.

Recommended Reading

Cummins, Liberty Energy to Deploy New Engine for Fracking Platform This Year

2025-01-29 - Liberty Energy Inc. and Cummins Inc. are deploying the natural gas large displacement engine developed in a partnership formed in 2024.

Diversified, Partners to Supply Electricity to Data Centers

2025-03-10 - Diversified Energy Co., FuelCell Energy Inc. and TESIAC will create an acquisition and development company focused on delivering reliable, cost efficient net-zero power from natural gas and captured coal mine methane.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.