Producers in Oklahoma (pictured) and the Rockies need to see higher oil and gas prices to substantially increase drilling activity, the Kansas City Fed reports. (Source: Shutterstock.com)

E&Ps in the Midcontinent and Rockies plays need higher oil and gas prices to substantially increase drilling activity, according to a Federal Reserve Bank of Kansas City survey.

Drilling and business activity continued to decline for producers in the Tenth District, which includes Kansas, Colorado, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri, the Kansas City Fed said in a third-quarter energy survey.

It was the seventh consecutive quarterly decline in Tenth District drilling and business activity.

Revenues and profits are both down year-over-year as oil and gas producers work through a cycle of lower commodity prices.

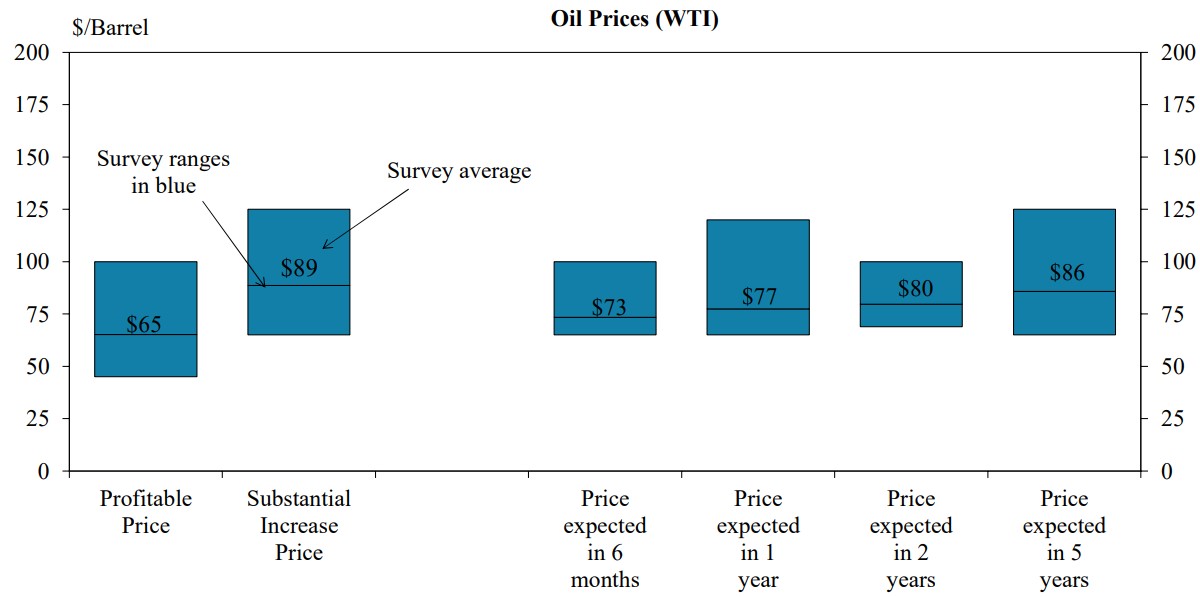

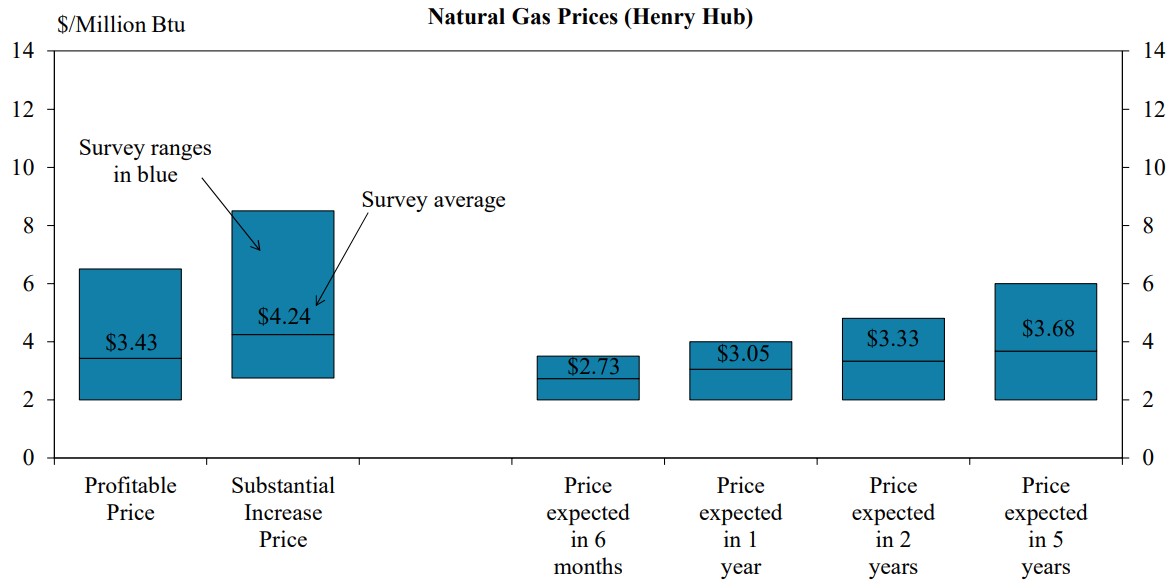

To be profitable, Tenth District producers need an average WTI oil price of $65/bbl and an average natural gas price of $3.43/MMBtu.

And to substantially boost drilling activity in the Midcon and Rockies, producers need an average WTI oil price of $89/bbl and an average gas price of $4.24/MMBtu.

Healthy oil prices have continued to support oil drilling activity in the Midcon and Rockies plays, like Oklahoma’s SCOOP/STACK, Colorado’s Denver-Julesburg (D-J) Basin and Wyoming’s Powder River Basin.

“We will concentrate on oilier plays,” one industry executive wrote in a survey response.

But low natural gas prices haven’t supported gas-drilling activity, and the Midcontinent is relatively gassy for an oil basin. Experts say drilling activity in Oklahoma is more influenced by natural gas prices than other regions.

Producers in the Tenth District don’t expect to see high enough natural gas prices to turn a profit for several years. Henry Hub spot prices averaged $2.28/MMBtu in September—well below the $3.43/MMBtu level needed to make a profit.

RELATED

Midcon Momentum: SCOOP/STACK Plays, New Zones Draw Interest

Gas producers have been hampered by abundant oversupply, elevated storage inventories, mild winter weather and a glut of associated gas coming out of the Permian—where natural gas is a byproduct of drilling oil wells.

“The natural gas side of our business has become very cyclical, and it feels like one year of great pricing and then if we have warm winters, two years of lousy pricing,” another executive said. “The industry has become too good at finding natural gas and with the Permian takeaway increasing, a lot of Permian operators don't care about gas as a revenue stream with the strong oil component.”

Another executive said that Henry Hub “needs to be close to” $4/MMBtu to support profitable development anywhere other than in the Permian Basin.

The Kansas City Fed’s third-quarter energy survey ran from Sept. 16 through Sept. 30 and included 32 responses from firms in the Tenth District.

Oil and gas producers reported volatility and uncertainty across the industry in last month’s Dallas Fed Energy Survey. The Dallas Fed’s survey included responses from 133 oil and gas firms in Texas, southern New Mexico and northern Louisiana.

RELATED

Dallas Fed: Low Natgas Prices Force Permian E&Ps to Curtail Output

Recommended Reading

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

IOG Resources II Buys Non-Op Utica Shale Interests

2025-02-26 - IOG Resources II is expanding in Appalachia with an acquisition of Utica working interests in eastern Ohio.

Matador Exits Eagle Ford Shale, Preps for ‘Turbulent Times’

2025-04-04 - Matador Resources Co. divested its Eagle Ford Shale assets “in preparation for turbulent times” but doesn’t expect tariffs to affect well costs until the second half of 2025.

ConocoPhillips Shopping Marathon’s Anadarko Assets for $1B— Source

2025-04-02 - ConocoPhillips is marketing Anadarko Basin assets it picked up through a $22.5 billion acquisition of Marathon Oil last year, Hart Energy has learned.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.