Scale of development typically varies with a given producer’s size, balance sheet and comfort with at times complex logistics. As experience grows, the Midland Basin’s transformative process continues. (Source: Hart Energy)

A version of this story appears in the December 2017 edition of Oil and Gas Investor. Subscribe to the magazine here.

An evolutionary event sometimes conjures up an image of a slow-moving process rather than one of size and speed. But as the Midland Basin evolves into a massive opportunity to capture multistacked reserves, the march forward is moderated only by E&Ps’ desire to seize growing efficiencies and cost savings made possible by the sheer scale of development.

Of course, each producer’s plan for its Midland Basin development varies, depending on factors such as project rates of return and capital allocation decisions. Takeaway may over time also be a factor. And, ultimately, the pace of technology will be a key consideration, albeit an uncertain one.

As one player said, “We don’t know how many technology breakthroughs are going to come along in the next few years. It’s really hard to gauge. We know that things are changing all the time—maybe not as quickly as they were three years ago, but the technology is continuing to evolve.”

CrownRock LP, jointly owned by CrownQuest Operating LLC and Lime Rock Partners, owns about 94,000 net acres in the Midland Basin, mainly in Howard, Martin and Midland counties, Texas. The history of the joint venture (JV) includes drilling more than 1,000 gross vertical wells over nine years, starting in 2007, the year the JV was formed. CrownRock launched its horizontal drilling program in early 2015.

CrownRock hasn’t looked back. The JV with private-equity sponsor Lime Rock will enter next year with four operated horizontal rigs and plans to add a fifth and sixth rig in 2018, according to CrownQuest CEO Tim Dunn. (It also plans to run two or more vertical rigs to hold acreage.) Capex is projected at $574- to $638 million in 2018, up from an estimated $332- to $370 million this year, he said.

The jump in capex of more than 70%, at the midpoint, is to be financed by internally generated cash flow supplemented by assets sales and debt financing, noted Dunn. In October, CrownRock issued $1 billion in senior notes due 2025, with proceeds set to retire two earlier issues that were callable totaling $755 million. The earlier notes carried interest rates of 7.125% and 7.75% vs. 5.625% for the latest issue.

“We’re very fortunate in being a private company that has access to the institutional bond market,” commented Dunn.

CrownQuest is implementing a number of measures as it ramps up its Midland Basin operations. It has moved to a program comprised primarily of pad drilling after testing its acreage with just 13 “one-off” or “parent” well tests. The program is focused mainly on Howard and Martin counties, since offset operators had already effectively tested much of its Midland County acreage. “They were well ahead of us,” said Dunn. “They’d already shown that pad drilling was prospective there.”

As for an optimal development strategy, Dunn said there were still “conflicting opinions” as to the relative merits of a “bottom-up” development vs. a “tank-style” or “cube” development. He noted CrownQuest is testing both alternatives, each of which brings its own sequence for completing wells on the pad following the drilling phase.

“The question is whether you complete all the wells at once in the multiple benches [tank-style] or whether you complete one bench at a time and come back to do the next bench,” said Dunn. “Our conversations with other operators indicate that there’s a difference of opinion as to which is best at this point.”

To date, CrownQuest has mainly used the bottom-up method, which it also calls a “sequential” style, in developing one bench at a time. Key considerations in any such choice include well costs, recovery factors and ease (or otherwise) of logistics during drilling and completion.

“The advocates of sequential style will say that the tank-style gets inferior reserves and the sequential style is logistically simpler. And the tank-style advocates will say exactly the opposite on reserves,” said Dunn. “I don’t know what they say on logistics. But it’s our belief that the sequential style is easier logistically. There aren’t as many drilled but uncompleted wells.”

Primary targets for CrownQuest have been the Wolfcamp A, Wolfcamp B and lower Spraberry intervals, with the Wolfcamp D also targeted in some instances. A typical development plan calls for an alternating pattern of eight and seven wells per interval. Individual wells are positioned so that they usually lie at a distance of 660 feet laterally from the wells in the immediately upper or lower interval.

While existing targets make up “a pretty big chunk” of what is a 3,000-foot stratigraphic column in the Midland Basin, Dunn is optimistic about further successes in other zones.

“We expect a very substantial portion of the column will be proven to be productive over time, perhaps doubling the existing productive zones; it’s just that the industry hasn’t got to it yet,” he said.

Near-term, for example, CrownQuest holds acreage in the vicinity of Parsley Energy Corp.’s recent success in the Wolfcamp C, he noted. “I don’t think anyone disagrees that the geologic potential looks great there. I don’t think anyone is going to be surprised if their excitement is validated.”

Workhorse Assets

As with CrownQuest, Callon Petroleum Co. (NYSE: CPE) has been running four horizontal rigs in the Midland Basin and is in discussions to add a fifth in the New Year. The additional rig would be assigned to its Spur area in the Delaware Basin, which Callon acquired in early 2017. The latter follows its prior Midland asset acquisitions in operating areas Ranger in 2012, Monarch in 2014 and Wildhorse in 2016.

Callon has a high-quality problem on its hands in allocating capital to the various areas, according to CEO Joe Gatto, since they all compete for capital even in the $45-per-barrel (bbl) price environment.

“I think it speaks broadly to the quality of our acreage position,” said Gatto. “When we were building this footprint, we wanted to focus on the best rock we could. Some areas are a little better than others, but overall, they are all very strong. We have a portfolio of assets that can deliver strong returns in a $45-per-barrel flat world across all of our acreage.”

Gatto noted that each of Callon’s three Midland areas offer drilling opportunities with very attractive payback periods. While stacked pay obviously occur across each area, he highlighted one key productive zone in each: the lower Spraberry in Monarch, which is located mainly in Midland County; the Wolfcamp A in Wildhorse, in Howard County; and the lower Wolfcamp B in Ranger, in Reagan and Upton counties.

In Howard County, Monarch has been “a workhorse asset for us,” according to Gatto. Initially, Callon began developing the Wolfcamp B interval, but shortly thereafter switched to the lower Spraberry, which “turned out to be a phenomenal zone,” he said. During the tough conditions of late 2015 and early 2016, it enabled the company to “deliver sequential growth and be free-cash-flow neutral in a $30-per-barrel environment. It’s been a solid zone that we’ve continued to develop.”

Results from pilot programs have confirmed development of the upper and lower Spraberry zones on 13 wells per section spacing. Initially, Callon had assumed eight-well spacing, but saw an opportunity to drill two separate zones in the lower Spraberry. It eventually resulted in seven wells in the lower-lower Spraberry and six in the upper-lower Spraberry. Testing of the concept took over two years.

“We wanted to see if there were any depletion impacts when you started infilling on that type of spacing,” recalled Gatto. “Generally speaking, we haven’t seen any material degradation by going to 13 well spacing, and we’re going to continue to evaluate the opportunity for 14 or 15 wells, and keep progressing, to make sure we’re recovering the resource. The more recent wells have outperformed the earlier vintage wells, in spite of tighter spacing, although it’s not quite apples-to-apples, as we’ve also refined our completions.”

Callon has also drilled in the Wolfcamp A, Wolfcamp B and middle Spraberry zones in Monarch and will continue to co-develop these benches alongside the lower Spraberry, said Gatto.

At Wildhorse, lower Spraberry wells have exhibited relatively flat production profiles, similar to those at Monarch, but it is the Wolfcamp A development that is in full stride.

“The Wolfcamp A is certainly a big part of the story at Wildhorse,” said Gatto. “The most delineated interval is the Wolfcamp A, which we’ve done across our entire position in northwest and central Howard County. We’ve also selectively started development of the lower Spraberry and the Wolfcamp B to better understand the resource potential there.”

Callon has dedicated two rigs to Wildhorse for the majority of 2017, targeting the three zones noted above. Spacing varies from six to eight wells per section, depending on the specific interval. Callon said results showed Wolfcamp A wells tracking or exceeding a 1-million-barrel type curve on average in Howard County. Peak 24-hour IP rates for five recent Wolfcamp A wells averaged about 1,480 boe/d.

In addition to the legacy Wolfcamp B program in Ranger, Callon is drilling a Wolfcamp C well, which is expected to have results by the first quarter of 2018. The well is located about 9 miles south of Parsley’s first successful Wolfcamp C test. “We see a very similar opportunity in the Wolfcamp C in Ranger,” commented Gatto.

In terms of delineating new zones, “we like to think of ourselves as more of a ‘fast follower,’” said Gatto. For example, Pioneer Natural Resources has drilled wells targeting the Jo Mill zone near Callon’s Monarch acreage, he noted, as well as testing the Cline in Reagan County near Ranger. “We don’t have any tests in Jo Mill or Cline yet, but we’ll continue to monitor offsetting results and drill our own test after reviewing the data, similar to the Wolfcamp C test in Ranger,” he commented.

While infill wells at Monarch have not shown material evidence of depletion from downspacing, should the industry be concerned about the issue?

“It’s going to vary by zone and by area,” said Gatto. “You don’t want to wait for more than a year before getting back to drill that well next to it. We keep an eye on that since you can’t say the phenomenon doesn’t exist in certain areas. But if you’re thoughtful, you can manage it.”

Even in more typical circumstances, infill drilling can have an impact on a parent well’s production.

“Say you have an existing well, that’s been producing for a year, and next door you’re going to drill a three-well pad,” said Gatto. “During that completion operation, you’re pumping water and sand down to complete those wells, and some of that water is going to find its way into the established well next door. During the period when that completion is going on at the three-well pad—let’s call it roughly a month—that existing well is likely to produce mostly water. But once you move off the completion job, that well will de-water and get back to oil production similar to levels it was producing beforehand.”

ROCE

Amid heightened investor pressure to see returns on investment, Callon has been highlighted by research analysts as a company with the potential to earn returns on capital employed (ROCE) that are in excess of many of its peers. Can Callon fulfill those expectations?

Encana Corp. lead operator Austin Lame checks the pressure levels of the 19 operatiing wells at Encana Corp.'s RAB Davidson pad site.

“For a company our size, we’re pretty unique in considering capital efficiency, long-term development and the need to put in infrastructure,” said Gatto. “Overall, we deployed about $1.5 billion of capital we raised from the equity markets to support our acquisitions in 2016. There’s a period of time now when we need to accelerate activity on a measured basis, pull forward future returns—driven by discrete well returns that average 50% or more—and arrive at a point where we’re earning a ROCE that’s in excess of our cost of capital.

“And at that point, likely in 2019, depending on activity levels and oil prices, it’s a sustained business, even in a lower commodity price environment. Day in and day out you’re delivering value.”

While SM Energy Co. (NYSE: SM) has significant acreage in other regions, its operations are focused entirely in Texas, where it is investing capital in just five counties. Seven rigs are running in the Midland Basin and two in the Eagle Ford Shale. Like Callon, SM Energy is active in Howard County, where CEO Jay Ottoson is emphatic on how high oil cuts translate into higher revenues and superior returns.

SM Energy showed an average oil cut of as much as 89% for more than a dozen of its recent Howard County wells with 30-day IP rates, according to a company presentation. In addition, Ottoson pointed to a FBR Capital Markets & Co. report showing SM Energy outpacing the median Midland operator by 65% in terms of revenue per lateral foot for wells on production for at least three months.

The markedly higher revenue per foot is a reflection of the low gas-oil ratio (GOR), or high oil cut, in Howard and Martin counties, where SM Energy made its RockStar acquisition, according to Ottoson.

“Howard County producers have the lowest GORs of any of the operators in the Midland Basin,” he said. “Recent SM Energy wells are highly productive, with a 30-day average rate of roughly 1,450 boe/d, which is significantly higher than we expected these wells to perform when we bought the acreage last year. In addition, a good measure of the outperformance is due to completion performance improvement.”

SM Energy’s acreage position in the Midland Basin stands at about 89,000 net acres, of which almost 66,000 acres is in Howard and Martin counties, with the balance in the Midland-Upton County area of its Sweetie Peck development. “We continue to add economic inventory in both our core areas through completion optimization and delineation,” said Ottoson.

SM Energy is developing its acreage on three fronts around Howard County.

In western Howard County and Martin County, “it’s clearly at least a three-interval development: the lower Spraberry, Wolfcamp A and Wolfcamp B. Our focus this year is getting to spacing testing and an understanding of how to develop this if we’re going to start to ‘mow the grass’ in development in 2018. This is intensive pad development, so the key focus is on what spacing are we going to drill these out.”

An example of the testing conducted by SM Energy is the Iceman pad. The six-well pad comprises three Wolfcamp A wells and three lower Spraberry wells. The wells are in a stack/stagger formation with 420 feet of lateral spacing. Testing is for interaction between the Wolfcamp A and lower Spraberry zones, “which frankly we do not expect,” said Ottoson, as well as between the laterally separated wells.

“Once we get into 2018, we’ll be running largely six-well pads, and we want to drill them at the final spacing that we want the wells to be,” emphasized the SM Energy CEO. “I think everyone understands that the infill in these programs is not very effective. We want to get to the right spacing upfront.”

In central south Howard County, in its Signal Mountain area, SM Energy is continuing a Wolfcamp A program started by a legacy operator. The company has drilled three Wolfcamp A wells at its Griswold pad, for example, with 24-hour IPs averaging 1,524 boe/d. In addition, it has drilled a Wolfcamp B well on the Fletch pad, and it has plans to test a “good-looking” Wolfcamp C interval.

Finally, on its northeast block—the subject of some controversy due to higher carbonate—SM Energy’s Wolfcamp A test, the Viper 14-09 well, has been holding flat at about 1,000 boe/d after more than 130 days. SM Energy bought the block with no Wolfcamp A wells on it, so expectations were not for the well to outperform its western Howard County peers.

“It didn’t have a big peak rate upfront, but it looks terrific, with a very flat decline, a highly economic well,” observed Ottoson. “As we get into next year, there’s going to be a lot of intensive development and continued spacing testing on the northeastern block.”

Optimal Capital Allocation

For RSP Permian Inc. (NYSE: RSPP), with offices in Midland and Dallas, full development is underway across its 46,500 net acres in the Midland Basin, even as the company spurs production from its recently acquired Delaware Basin assets. Of its seven operated rigs, four are working on Midland Basin acreage, located mainly in Midland, Martin and Glasscock counties. Over half of RSP’s 2018 capex is expected to go to the Midland Basin.

RSP characterizes its “platinum inventory” as drilling opportunities that can generate a 50% internal rate of return at $50/bbl. These top-tier assets, projected to make up 60% of next year’s drilling, are said to be widely distributed, but certain areas demand attention. Examples range from a development plan of 14 wells per section in Martin County to new Wolfcamp potential on acreage abutting the Central Basin Platform, where the company has already confirmed lower Spraberry pay.

“The four main zones we’re currently producing from are the middle Spraberry, lower Spraberry, and Wolfcamp A and B, said RSP CEO Steve Gray. “In addition, we’ve tested the Wolfcamp D. We have not drilled a Jo Mill well yet, but expect to test a Jo Mill and possibly, on our Glasscock acreage, a Wolfcamp C well in the next year or so. Those zones are certainly undeveloped on our acreage.”

Gray noted how the industry has come a long way in terms of technology, especially in completions.

“The way we complete wells is an evolution that everybody has focused on over the last two or three years,” observed Gray. “We knew we’d have to drill the wells densely to maximize our recovery of oil. When we first started this play, we thought we were going to recover 7% to 8% of the oil in place (OIP). Now we’ve exceeded that OIP number, and we have new targets that are more in the low teens.”

On the completion side, Gray said, “Our typical practice is to complete the Wolfcamp A and the Wolfcamp ‘B’ simultaneously. There’s very little separation between the two, so we think it’s prudent to treat the A and B like one reservoir and complete them both at the same time.”

As for the shallower Spraberry interval, he noted, “You have a little bit of a separation between the Wolfcamp and Spraberry, so we generally treat the lower Spraberry separately. There’s an upper and lower landing zone in the lower Spraberry, and we’re completing those wells simultaneously.”

One of RSP’s recent well spacing pilots for the lower Spraberry is its Johnson Ranch Section 10 unit in Martin County. Regarding optimum spacing, RSP’s initial thought was that eight or 10 wells per section would be appropriate. The Johnson Ranch pilot includes five wells on the eastern half of the section (base case spacing) and seven wells on the western half (increased density spacing). With seven wells in just half a section, this represents the equivalent of 14 wells per section spacing, a 40% increase, Gray noted. RSP is awaiting additional production data to draw conclusions from this spacing test.

In Glasscock County, on the eastern edge of its acreage, RSP enjoys the benefit of the entire geologic section thickening as it trends east. The thicker pay translates to some of RSP’s most economical wells, which produce both more oil and more gas, at a higher GOR than the company’s other Midland Basin properties. Four recent Wolfcamp A and B wells on its Calverley unit had 30-day IP rates of approximately 1,200 to 1,500 boe/d.

“If you go too much farther east of RSP’s position, the gas-oil ratio gets quite a bit higher,” said Gray. “But the section is thicker. There’s just more pay, more oil in place.”

Conversely, toward the Central Basin Platform on the western edge of RSP’s acreage, the geologic section becomes thinner. Despite the thinness, several recently completed wells showed strong results, including one that came in with a 10-day IP rate of more than 2,000 boe/d from the Wolfcamp A. RSP estimates the results provide the company with “20 to 30 additional highly economic locations.”

How does RSP view the trend of larger pads and the timing of completing parent and child wells?

“It really starts to feel like a manufacturing process if you can park one rig or two rigs on a pad and drill four or six or eight wells at once,” he observed. “Clearly, if you don’t have to move a rig in and out four times to drill four wells, there’s a savings—that’s pretty obvious. And there are lots of little things that can add up when you have a multiwell pad, including shared facilities and other infrastructure.”

On the parent-child well issue, “if you drill an initial well and wait years to offset it, it creates the potential risk of pressure sinks in the reservoir; and when you frack the next well, the frack preferentially wants to go toward the lower pressure,” he said. “We’ve altered our frack design to keep more of the energy near the wellbore, so you’re efficiently stimulating a narrower radius around the wellbore, not generating fractures that go out a thousand feet from the wellbore that will interfere with the next well.”

On the issue of completing multiple intervals—to mitigate the risk of interference between reservoirs—the issue of infrastructure size and the associated capital expenditures, as well as logistical considerations, are factors, according to Gray.

“From a reservoir management standpoint, it probably makes sense,” he said. “What you have to weigh against that is, if you complete a large number of wells and bring them on all at once, you have to have appropriate facilities. You have to have substantial water handling capacity, because you require a lot of water to complete the wells, and you produce a lot of water that needs to be disposed of or recycled. It comes down to an economic decision by each company of what is optimal from a capital allocation and rate of return perspective.”

Cube Development

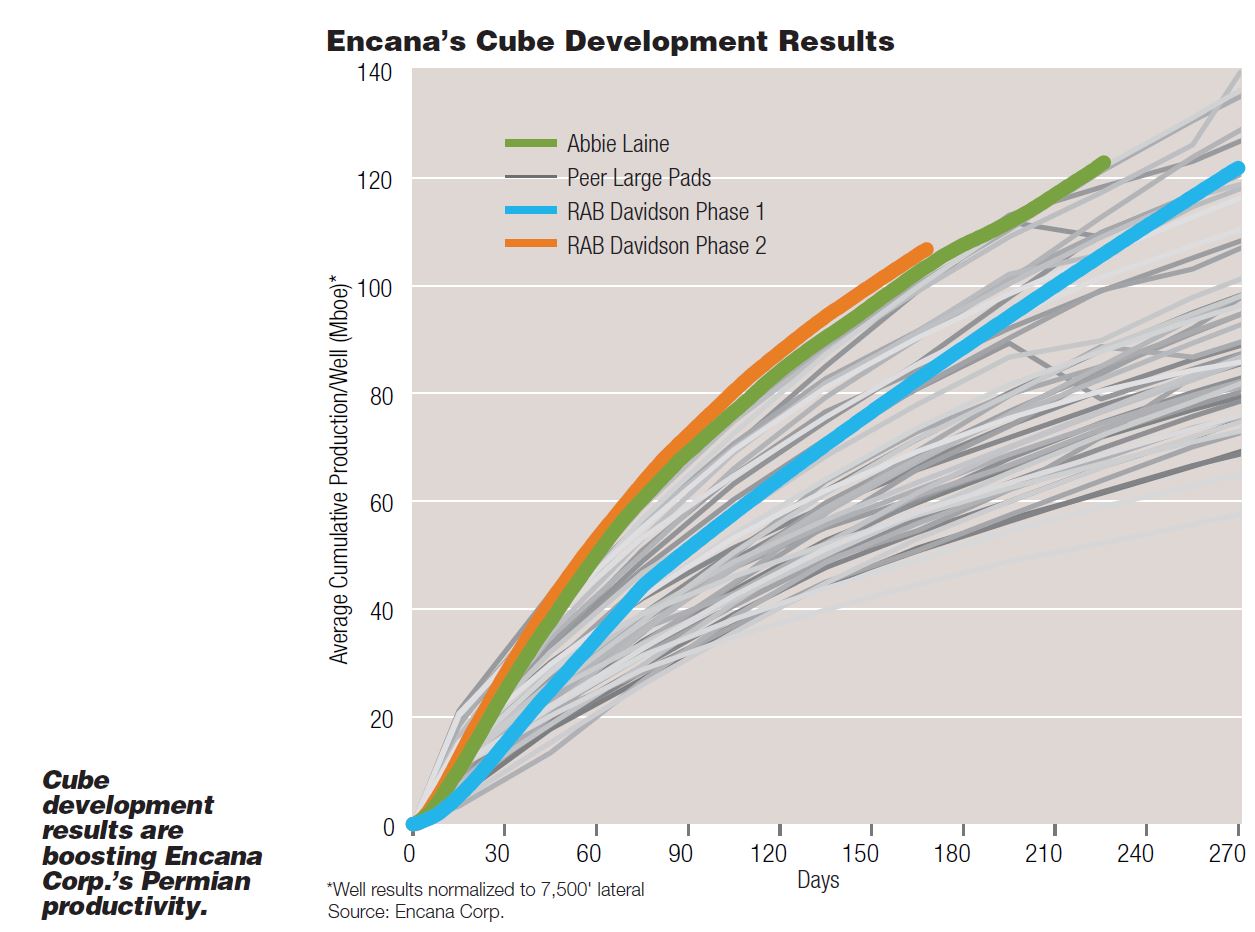

If any producer has prepared itself for such a challenge as best as it can, it is Encana Corp. (NYSE: ECA). In October, the Calgary-based producer had as many as 45 wells on production—and another 20 wells on the way—under its “cube” development at its Davidson pad in Midland County. Moreover, it said the two new pads under the cube development were outperforming its initial well results by 22% and 28%.

Currently, Encana’s cube development comprises two pads. These are: the RAB Davidson pad, Phases 1 and 2, and the Abbie Laine pad. Each of the pads produce from three to five benches, with the primary intervals being the Wolfcamp A, Wolfcamp B and lower Spraberry. Frequently, there is more than one landing zone per bench. Lateral spacing of the wells is typically 450 to 660 feet.

Jeff Balmer, Encana’s vice-president and general manager, Southern Operations, likes to discuss the cube development in terms of “top to bottom and left to right,” emphasizing not just lateral spacing, but also what he calls “vertical optimization.” In 2015, he recalled, the company drilled a vertical optimization well designed to gauge pressure effects between wells drilled in proximity to each other under differing conditions.

“That ‘springboarded’ us into that first RAB Davidson cube, where we put in 14 wells, with multiple targets, top to bottom and left to right,” he said. “What we found was that for the vast majority of the wells in the entire basin, including our own, the overall performance of the average well improves if you can do more of the drilling early on or all at once.”

This led to the use of a “zipper frack,” he said, in which adjacent wells are fracked in an alternating stage sequence.

“As you fracture stimulate with a zipper frack, the pressure pulses of water and sand you’re putting into the reservoir compete for space, so you’re breaking the rock into a more complex fracture geometry,” said Balmer. “You’re actually accessing more of the subsurface rock by doing them simultaneously than if you did one early and then came back and did one a year or two later.”

Through October, Encana has drilled 12 wells on its Abbie Laine pad, followed by 19 wells on Phase 2 of the RAB Davidson pad, also dubbed “Davidson Reoccupation.” The latter reflects the Davidson Phase 2 having reoccupied the same surface location as the Phase 1 pad, but then having drilled the wells in the opposite direction from the Phase 1 wells using the facilities in place from the earlier activity.

“We have tremendous operational savings from equipment logistics,” said Balmer. “We can come in with multiple rigs on the same location, drill all our wells, back them off, then bring in multiple frack crews and have three frack crews working at the same time on the same pad. And when the fracture stimulations are done, there are companies that come in to drill out the plugs. We’ve had up to eight drill-out crews working on the same extended pad simultaneously. Importantly, when you’re able logistically to handle all that, it reduces your cycle times.”

Encana’s September investor presentation cited the company’s use of “sophisticated planning and logistics to execute mega-pad developments” as having contributing cost savings of $1.2 million per well vs. single-well development. Its drilling and completion costs were termed “industry-leading,” with only three other E&Ps in the basin matching Encana’s $5 million per well cost level.

In addition to substantial cost savings, Encana pointed to improved productivity from wells on its cube development pads. Relative to its RAB Davidson Phase I pad, the Abbie Laine wells were outperforming in terms of cumulative production by an average 22% after 180 days, while the RAB Davidson Phase 2 wells were outperforming by an average 28% after 170 days.

“The cube evolution is alive and well. Each of those successive cube developments has gotten better,” observed Balmer.

Is the entire section being developed as intensely as, in theory, it could be? Would it even be possible?

“We haven’t tried to do an entire section, left to right and top to bottom. The capital intensity that would be required to do that is probably not a fit for the portfolio right now,” said Balmer. “We have five active drilling rigs right now; you’d probably need eight to do that effectively, and it would put a lot of eggs in one basket.”

A drone shot shows the scale of development at Encana Corp's RAB Davidson pad.

The fact that the cube development comes with plenty of complexity—just in its current form—likely provides an edge to Encana, as well as ongoing challenges, according to Balmer.

“I think the fact that it’s complicated gives us a tremendous competitive advantage,” he said. “Each of the sequences has its own reservoir characteristics. We have to come up with slightly different recipes on a county-by-county basis or a target-by-target basis. And it’s complicated having to understand and organize the logistics and the supply management.

“The water infrastructure, in particular, is an enormous component that is very critical to the reliability and the profitability of the operations: how you handle water, both coming in for the rigs and fracture stimulations, as well as the produced water that you recycle. We have a tremendous recycling program and expect to average 40% recycled water next year. It’s really low-cost and lowers our lease operating expense significantly, but we had to commit to it early.”

As with other Permian producers, Encana points to the “massive potential” of the Midland Basin’s multistacked pay. Of these, seven specific benches are identified as offering “premium return” drilling locations, which it defines as earning after-tax rates of return exceeding 35%. Encana estimates that its acreage holds 3,450 “premium return” locations containing 3.3 billion boe of reserves.

“The idea is to make every sequential pad better. If the total well cost is $6 million plus, with facilities and water infrastructure, and you have 12 wells per pad, that’s approximately $74 million in one location, so you’re on the hook for a substantial investment,” said Balmer. “We want the subsequent, larger-scale development pads to be as good or better. We’re never satisfied with the status quo.”

Geology Vs. Technology

As development plans unfold in the Permian Basin, a nagging question persists at the back of some industry experts’ minds. Could the Permian follow the pattern of earlier “hot” shale plays, which performed extremely well in the first few years, only to encounter major headwinds thereafter?

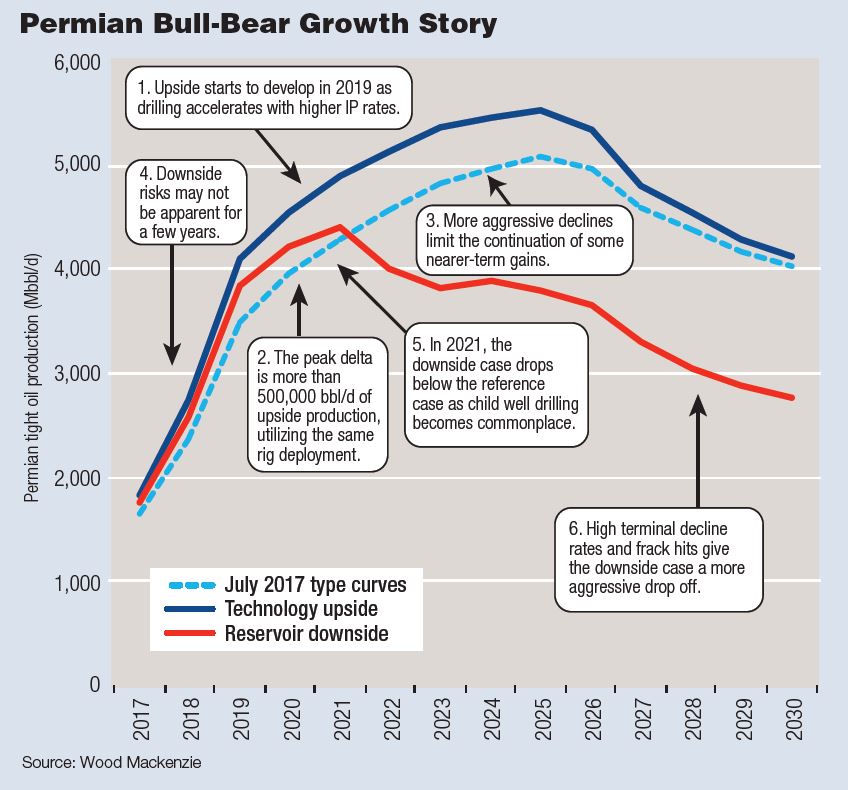

This was a project tackled by Wood Mackenzie in a study titled, “Geology Vs. Technology: How Sustainable is Permian Tight Oil Growth?” The study’s observations include three scenarios in which WoodMac weighs, under varying assumptions, the likelihood of continued technological achievements overcoming geological constraints that may arise as the play is aggressively developed.

A key finding of the study: a potential variance of well over 1 million barrels per day (MMbbl/d) between the upside and downside cases.

In its base case, WoodMac forecast production growing to over 5 MMbbl/d in 2025. In an upside case, incorporating the potential impact of “latest breakthrough technologies,” its model sees “measurable upside” to peak production. And in its downside case, WoodMac predicted Permian production reaching a peak four years earlier than in the upside case.

If the downside case is realized, it would “put more than 1.5 MMbbl/d of future production in question,” according to WoodMac, who attributed the lower forecast output to “downside risks related to tighter well spacing and well-on-well interference.”

The study found that EUR values could be reduced by 30% due to “high-intensity, long-lateral, close proximity drilling and fracking.” Specifically, on the parent-child well issue, the risk of child wells drilling into “pressure sinks” could mean 20% to 40% smaller EURs vs. parent wells, and in turn “massively impact production growth” and limit cash flow available for reinvestment.

Bottom line: Reservoir issues could begin to emerge “as sweet spots become exhausted,” according to WoodMac. And if ongoing technology evolution cannot offset the impact of less productive reservoir rock, the “Permian may peak in 2021.”

“We wanted to get ahead of the conversation and highlight the delta between the upside and downside cases, because the range of uncertainty is massive,” said Robert Clarke, research director for Lower 48 Upstream at WoodMac. “If you believe there’s still a lot more technology to come, and you’re going to see rapid implementation of everything in the pipeline, then the Permian could peak at closer to 6 million barrels per day,” he said. “If you think technology has run its course, and we’ve already drilled the best rocks, then it potentially peaks in 2021.”

“The companies that have drilled the largest number of wells are without a doubt being proactive,” he continued. “Since we released the study, lots of operators have wanted to help us understand what it is they’re doing in an effort to minimize the risk. They’re saying, ‘If you don’t have a lot of Permian subsurface experience already, that red line could become reality for you.’

Chris Sheehan can be reached at csheehan@hartenergy.com.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.