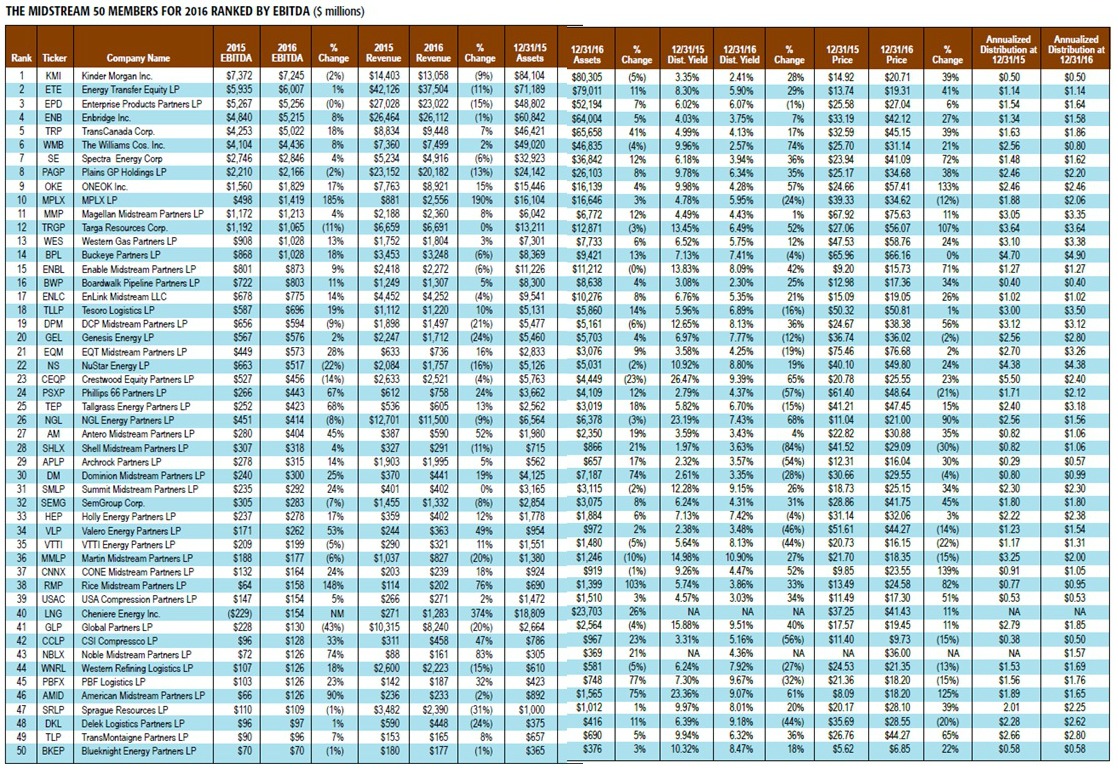

Among the 50 largest midstream companies in the U.S., the biggest move for 2016 was at No. 10 rather than No. 1. The top nine places in this magazine’s 2nd annual Midstream 50 were little changed but for MPLX LP, the MLP affiliated with Marathon Petroleum Corp., which vaulted 13 spots from 23rd place in the 2015 table to 10th in 2016 with its acquisition of MarkWest and dropdowns from its parent.

The top three were unchanged: Kinder Morgan Inc., Energy Transfer Equity LP and Enterprise Products Partners LP held steady. Enbridge made a jump of two places to 4th with TransCanada Corp. and Williams both slipping a single spot to 5th and 6th, respectively. Spectra Energy, Plains All American and ONEOK all held steady at 7th through 9th.

A better year

With help once again from Barclays Capital Inc., Midstream Business benchmarked the sector for last year, based on Form 10-K annual reports filed with the U.S. Securities and Exchange Commission. The complete master ranking can be found on pages 30 and 31.

What we found was this vital energy sector improved from the doldrums of the prior year. Major changes in the rankings depended on M&A activity for the most part. Rankings are by EBITDA.

What makes the MPLX quantum leap all the more remarkable is that steady on, or a move up or down of one or two, was the rule for the top half of the table. Of the top 23 companies, eight held steady, one—EQT Midstream Partners LP—moved up three spots, and no others moved more than two places up or down, MPLX notwithstanding.

In the entire list no other riser moved more than six spots.

There were several debuts in the table. Archrock, a compression services firm, broke onto the charts in grand style at No. 29. Archrock was formed in November 2015 when Exterran separated its global equipment business and non-U.S. compression businesses from its U.S. contract-compression operations. In something of a trend, USA Compression first appeared on the Midstream 50 at No. 39, while CSI Compressco LP made its initial showing at No. 42.

Cheniere joins in

There were two other debuts that were essentially technical. Cheniere is no spring chicken, but having reported no EBITDA for 2015, it had to be left out. The big gas company was back in the black last year and arrived on the Midstream 50 ranked at No. 40. Noble Midstream Partners—the midstream MLP carved out by major independent producer Noble Energy Inc.—was also new to the charts at No. 43, but hardly new to the sector.

Noble Midstream’s 2016 numbers were pro forma because its IPO for the midstream company as a discrete organization was in September of last year. There is still a close relationship. In its full-year statement the operator stated, “We refer to certain results as ‘attributable to the partnership,’ which excludes the non-controlling interests in the development companies retained by Noble Energy. We believe the results ‘attributable to the partnership provide the best representation of the ongoing operations from which our unit holders will benefit.’”

Zero sum

Unlike the midstream business itself— now replete with growing, win-win situations—the Midstream 50 is by defi-nition a zero-sum game. So for every company up and in, there has to be another down or out. Household names were not immune. SemGroup Corp. fell five spots to No. 32.

Global Partners LP skidded eight spots to No. 41. In the company’s full-year 2016 results, Eric Slifka, president and CEO, wrote, “Our plan included cutting expenses and selling non-strategic assets. We signed an agreement in December to voluntarily terminate a sublease for 1,610 [underused] rail cars from a third party, three years ahead of schedule, saving the partnership more than $10 million in cash … While year-over-year our 2016 financial results were negatively impacted by the challenging crude oil environment, the core elements of our business, terminals, marketing and retail are fundamentally strong.”

On the bubble

Two downstream-related MLPs were down five spots each, Western Refining Logistics to No. 44 and PBF Logistics to No. 45. Below them were four companies flirting with relegation. At 47th, Sprague tumbled nine spots, the biggest decline of the year. At No. 48, Delek Logistics was down seven; at No. 49, TransMontaigne was also down seven.

And just on the bubble at 50th place was Blueknight Energy Partners LP, down six.

Five companies fell out of the Top 50: World Point, USD Partners LP, Arc Logistics Partners LP and JP. Columbia Pipeline Partners LP, which had been a lofty 16th last year, was acquired by TransCanada.

There are three very different types of operators in the midstream sector represented on the Midstream 50. There are the large, traditional corporations that dominate the top of the table. Only eight of the Top 50 are C corps, but seven of them are in the Top 10. The rest are MLPs, but those are divided into stand-alone operators and those affiliated with a parent corporation that has done asset dropdowns to its MLP.

It might seem unfair to rank all three different types on the same table given that they operate on different terms in the midstream space. But the C corp giveth and the C corp taketh away. Affiliated MLPs benefit from having assets dropped into them, but also wither for lack of largesse.

MPLX dropdowns

MPLX dropdowns

That is reflected in the accompanying tables. MPLX also soared from its organic gains, and from Marathon Petroleum Corp. dropdowns, notably the inland marine assets that added $120 million of EBITDA. The MPLX/MarkWest combination closed in December 2015.

Several affiliated MLPs that were lower on last year’s table slipped close to relegation this year. No specific causes were evident from the operators’ activities, but the dog that did not bark in the night was a dearth of big dropdown announcements.

It is likely that MPLX will boom again for 2017’s Midstream 50 tables a year hence, given its activity already. In March, Marathon Petroleum dropped terminal, pipeline and storage assets to MPLX worth $2 billion. The assets include 62 light-product terminals with approximately 24 million barrels (MMbbl) of storage capacity; 11 pipeline systems consisting of 604 miles of pipeline; 73 tanks with approximately 7.8 MMbbl of storage capacity; a crude oil truck unloading facility at the parent’s refinery in Canton, Ohio; and eight NGL storage caverns in Woodhaven, Mich., with approximately 1.8 MMbbl of capacity.

On its own, MPLX in February closed on the previously announced transaction to acquire a partial, indirect equity interest in the Dakota Access Pipeline and the Energy Transfer Crude Oil Pipeline projects, collectively referred to as the Bakken Pipeline system, through a joint venture (JV) with Enbridge Energy Partners LP. The hotly disputed Dakota Access line is expected to enter service sometime in May.

Antero JV

Antero JV

The same month MPLX announced that its wholly owned subsidiary, MarkWest Energy Partners, and Antero Midstream Partners formed a JV to support the development of Antero Resources Corp.’s extensive Marcellus Shale acreage in the rich-gas corridor of West Virginia. Antero Midstream Partners will release to the JV its dedication from Antero Resources Corp. of approximately 195,000 gross operated acres located in Tyler, Wetzel and Ritchie counties of West Virginia.

The JV will support the development of incremental gas processing required by independent producer Antero Resources in the Marcellus Shale. The JV is investing in fractionation capacity at MarkWest’s Hopedale Complex in Ohio and has an option to invest in future fractionation expansions that support Antero Resources’ liquids production.

Looking further ahead, Marathon said it “plans to accelerate significantly its drop of assets with an estimated $1.4 billion of MLP-eligible annual earnings before EBITDA to MPLX, expected in 2017.”

Also, a special committee of the Marathon board will conduct a review of Speedway, the company-owned fuel and convenience store retail network, with the assistance of an independent financial advisor. The review will include a tax-free separation of Speedway to Marathon Petroleum shareholders and other strategic and financial alternatives. An update on the review is expected to be provided by mid-2017.

Tallgrass, Rice in high cotton

Tallgrass Energy Partners moved higher by five spots to 25th place. The MLP increased its guidance in 2016 as a result of its acquisition of a 25% interest in Rockies Express Pipeline (REX). Tallgrass’s management increased its quarterly distributions for the second and third quarters of 2016 by 9 cents per unit over its distribution of 7.05 cents per unit for the first quarter. The MLP said it expects a minimum average compounded annualized distribution growth rate of at least 20% for 2017 and 2018.

CONE Midstream Partners LP jumped six spots to 37th place. Highlights for 2016 were net income of $96.5 million as compared to $71.2 million; net cash provided by operating activities of $160.1 million as compared to $116.0 million; and adjusted EBITDA of $110.5 million as compared to $80.3 million.

CONE Midstream Partners LP jumped six spots to 37th place. Highlights for 2016 were net income of $96.5 million as compared to $71.2 million; net cash provided by operating activities of $160.1 million as compared to $116.0 million; and adjusted EBITDA of $110.5 million as compared to $80.3 million.

“Our fourth quarter capped another year of growth and strong financial and operating performance for CONE,” said John T. Lewis, CONE CEO, in the earnings release. “For the full-year 2016, we reported a 35% increase in net income, a 38% increase in net cash provided by operating activities, a 38% increase in adjusted EBITDA over 2015 results and distributable cash flow for the year grew by 36%.”

“Our fourth quarter capped another year of growth and strong financial and operating performance for CONE,” said John T. Lewis, CONE CEO, in the earnings release. “For the full-year 2016, we reported a 35% increase in net income, a 38% increase in net cash provided by operating activities, a 38% increase in adjusted EBITDA over 2015 results and distributable cash flow for the year grew by 36%.”

The quarter saw two significant events for CONE, Lewis noted.

“We completed the acquisition of the remaining interest in the Anchor Systems, which will provide additional support for distribution growth for the future. Also, our sponsors announced and closed a transaction to separate their upstream joint venture, allowing each sponsor to have more flexibility in the timing and pace of development,” he said.

Rice Midstream Partners LP also vaulted six spots, to No. 38. The company reported 2016 average daily throughput of 983,000 dekatherms per day, 3% above guidance. Adjusted EBITDA for 2016 was $158.4 million, 6% above the high end of guidance. Fourth-quarter distribution was raised to 25.05 cents per common unit, an increase of 27% over the prior year quarter and 6% relative to third-quarter 2016. Expansion capital of $104 million for 2016 was 23% below guidance. That resulted from a combination of projects under budget and shifted into 2017.

Rice acquired Vantage Energy’s midstream assets for $600 million, including an acreage dedication covering 85,000 core dry-gas Marcellus acres in Greene County, Pa.

Commenting on the results, CEO Daniel J. Rice IV said, “Our sponsor’s reliable production growth has allowed Rice to spend its capital effectively and grow distributions at top-tier rates while maintaining ample coverage. Additionally, the acquisition of Vantage Energy provides a longer, more visible runway for our team to execute and deliver top-tier distribution growth at healthy coverage levels.”

Recommended Reading

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

Chevron Technology Ventures Would Like to See the Manager

2025-03-13 - Chevron Corp.’s Chevron Technology Ventures, which turns 25 this year, pays close attention to leadership teams when making investment decisions in technology startups.

BP Cuts Over 5% of Workforce to Reduce Costs

2025-01-16 - BP will cut over 5% of its global workforce as part of efforts to reduce costs and rebuild investor confidence.

Shell Shakes Up Leadership with Upstream and Gas Director to Exit

2025-03-04 - Zoë Yujnovich, Shell’s Integrated Gas and Upstream director, will step down effective March 31.

Baker Hughes Appoints Ahmed Moghal to CFO

2025-02-24 - Ahmed Moghal is taking over as CFO of Baker Hughes following Nancy Buese’s departure from the position.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.