EOG Resources Corp. (EOG) is looking to dump a bulk of its noncore assets in Wyoming, Utah and Colorado, despite having about $3.4 billion in available liquidity.

Though the acreage for sale totals nearly 130,000 net acres, EOG’s ample liquidity suggests it may simply be adjusting its portfolio.

“It’s noncore acreage,” EOG spokeswoman K. Leonard told Hart Energy. “It’s just as simple as that. It’s outside of our core producing areas.”

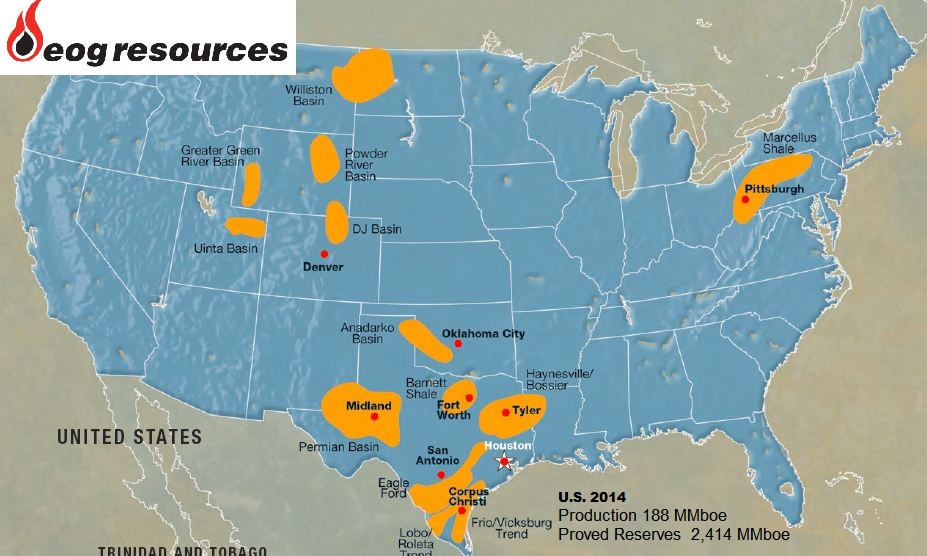

In February, EOG’s crude inventory showed that in the Denver-Julesburg and Powder River basins, the company has a combined 735 minimum drilling locations—a number dwarfed by the lucrative Eagle Ford’s 5,500 minimum locations.

EOG is offering acreage in the Powder River, Washakie, Piceance and Uinta basins. Additionally, the acreage is only 31% HBP. However, the land offers stability since the majority of acreage doesn’t expire until 2017 or beyond. The offer includes an 80% net revenue interest.

It’s likely the properties require significant capital commitment, which could be better used elsewhere, said Gabriele Sorbara, vice president of E&P/energy research for Topeka Capital Markets.

“We believe EOG will deploy proceeds to economic opportunities in today’s environment,” Sorbara told Hart Energy.

In early 2015, EOG said it intends to use its financial flexibility to grow inventory through “tactical acquisitions” of low-cost, high-quality acreage at less than $2,000 per acre.

The company’s dry powder is stacked by the tanker truck rather than the barrel. As of the second quarter of 2015, EOG reported liquidity of $1.4 billion in cash as of June and an undrawn $2 billion credit facility.

However, over the years EOG has been a muted played in the A&D market, instead priding itself on organic growth. Its last acquisition appears to have been in February 2011. Since then, it has sold a variety of assets, the largest a deal to sell its interest in the Kitimat LNG project in Canada.

“It comes down to greater opportunities elsewhere in its portfolio, with superior economics in the Eagle Ford, Bakken and Permian, where EOG has significantly greater running room,” he added.

EOG's stock took a plunge last week along with the drop in crude oil prices, closing at a 52-week low at $68.36 per share on Aug. 25. The company's stock has since rebounded closing at $79.70 per share on Sept. 2. Overall, though, EOG’s shares are trading down year-over-year by roughly 25%.

During the downturn, the company's goal is to remain "laser focused on improving returns," said William R. “Bill” Thomas, chairman and CEO, during a second-quarter conference call, according to a Seeking Alpha transcript.

In order to apply that focus, the company is choosing to refrain from growing oil production while the market is oversupplied.

The company has deliberately dialed back production, with Thomas saying “we’re not interested in growing oil in a low price environment.”

“We will be watching the supply/demand fundamentals in the second half of this year closely as we determine our plan for 2016,” he added.

Instead, EOG's focus in 2015 is on capital efficiency to improve returns and the company intends to keep spending within cash flow.

When the year began the company said it expected capex for 2015 to range from $4.9- to $5.1 billion, which is a 40% year-over-year decrease. The company has since lowered its 2015 capex by $200 million.

The company plans to direct 85% of its capex in 2015 to its top oil plays—the South Texas Eagle Ford, the Delaware Basin in New Mexico and Texas, and the Bakken in North Dakota.

"The bottom line is productivity improvements and reduced costs are allowing us to produce more oil with less capital," Thomas said.

Noncore Acreage

EOG has retained Meagher Energy Advisors to handle the sale of its noncore acreage.

In the Powder River Basin, the acreage is located in Campbell, Converse, Johnson, Natrona and Weston counties, Wyo. The company has about 63,000 net acres in the basin with 275 remaining locations, as of Jan. 1, 2015.

Nearby horizontal wells producing from the Frontier, Shannon, Turner and Parkman formations, have generated initial production of more than 1,000 barrels of oil equivalent per day (boe/d). Active offsetting operators include Devon Energy Corp. (DVN), Samson Resources Corp., SM Energy Co. (SM), among others.

In the Washakie Basin, the acreage is located in Sweetwater and Freemont counties, Wyo., near wells operated by Chevron Corp. (CVX), BP Plc (BP) and Anadarko Petroleum Corp. (APC). Operations target the Fort Union, Lewis, Mesaverde and Almond formations.

Acreage in the Uinta Basin is located in the Green River, Mesaverde and Wasatch formations in Duchesne and Carbon counties, Utah. The company holds about 94,000 net acres in the basin.

Acreage in the Piceance Basin is located in the Mancos, Dakota and Morrison formations in Garfield County, Colo.

Emily Moser can be reached at emoser@hartenergy.com, and Darren Barbee at dbarbee@hartenergy.com.

Recommended Reading

Trump Fires Off Energy Executive Orders on Alaska, LNG, EVs

2025-01-21 - President Donald Trump opened his term with a flurry of executive orders, many reversing the Biden administration’s policies on LNG permitting, the Paris Agreement and drilling in Alaska.

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

Trade War! Or Maybe Not

2025-03-06 - An energy industry that prefers stability gets hit with whiplash as it attempts to adjust to the Great Disruptor taking over the White House.

CEO: TotalEnergies to Expand US LNG Investment Over Next Decade

2025-02-06 - TotalEnergies' investments could include expansion projects at its Cameron LNG and Rio Grande LNG facilities on the Gulf of Mexico, CEO Patrick Pouyanne said.

E&P Execs Level Scathing Criticism at Trump's Drill Baby Drill 'Myth'

2025-03-26 - E&P executives pushed back at the Trump administration’s “drill, baby, drill” mantra in a new Dallas Fed survey: “’Drill, baby, drill,’ does not work with [$50/bbl] oil,” one executive said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.