Many investors use MLPs on an ad hoc basis in their search for income. However, energy infrastructure MLP distribution growth has contributed more to MLP total returns than the frequently cited MLP yield.

During the past 10 years, the Alerian MLP Infrastructure Index (AMZI) has generated 17% in total returns. Of this, 7% was attributable to yield, 8% to distribution growth and 2% to multiple expansions.

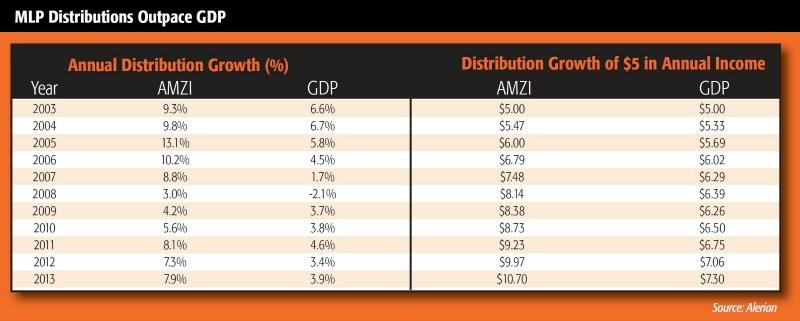

Successful MLPs are able to grow their distributions quarter after quarter regardless of the broader macro environment. Energy infrastructure MLP distributions have grown on average 8% over the past 10 years, almost twice as fast as the broader economy’s 4% growth.

During the 2005 to 2008 time period, average distribution growth rates of 9% to 13% were driven by the number of MLPs that completed their IPOs in that time frame. Smaller companies have a relatively easier time achieving above-average growth because they have a smaller asset base (and cash flow stream) off which to build. A $100 million acquisition for a $500 million MLP represents significant growth, whereas a $30 billion MLP making that same acquisition would not see much impact at all.

During the financial crisis, through conservative stewardship of capital, most MLPs were able to maintain or grow their distributions even when the U.S. economy, as measured by GDP, shrank considerably. Overall, a rising tide lifts all boats, and while MLPs are able to grow their distributions despite broader weakness in the economy, the greatest growth occurs when the country does well as a whole.

The table below shows annual AMZI distribution growth and annual GDP growth amounts. In addition, it provides an example of how $5 in income would have grown over the past 10 years, based on whether it grew at the same pace as AMZI distributions, or at the pace of GDP. Cumulatively, energy infrastructure MLP distributions have increased 114% in the past 10 years, vs. cumulative GDP growth of 46%.

Looking forward, industry analysts generally expect 4% to 6% baseline distribution growth for midstream MLPs, anchored by increasing inflation-adjusted tariffs and the backlog of organic construction projects coming online. Acquisitions, depending on magnitude and frequency, can enhance these distribution growth payouts.

Because MLPs offer both yield and growth, they appeal to a wide variety of investors and can nicely supplement a fixed income or equity growth portfolio.

Maria Halmo and Emily Hsieh, CPA, are directors for Alerian, an independent provider of MLP and energy infrastructure market intelligence. Over $19 billion is directly tied to the Alerian Index Series. For more information, please visit www.alerian.com.

Recommended Reading

DNO Makes Another Norwegian North Sea Discovery

2024-12-17 - DNO ASA estimated gross recoverable resources in the range of 2 million to 13 million barrels of oil equivalent at its discovery on the Ringand prospect in the North Sea.

Wildcatting is Back: The New Lower 48 Oil Plays

2024-12-15 - Operators wanting to grow oil inventory organically are finding promising potential as modern drilling and completion costs have dropped while adding inventory via M&A is increasingly costly.

DNO Discovers Oil in New Play Offshore Norway

2024-12-02 - DNO ASA estimated gross recoverable resources in the range of 27 MMboe to 57 MMboe.

Freshly Public New Era Touts Net-Zero NatGas Permian Data Centers

2024-12-11 - New Era Helium and Sharon AI have signed a letter of intent for a joint venture to develop and operate a 250-megawatt data center in the Permian Basin.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.