When Kinder Morgan Inc. first left the MLP space, it was an anomaly. Now that ONEOK Inc. and Targa Resources Corp. have both also bought in their MLPs, there is validity to the question of whether the MLP model is still relevant.

One of the original arguments made for the value and expansion of the MLP model was that large energy companies could spin off their midstream assets into an MLP, transforming an internal cost of doing business into a profit center. This is precisely what Hess Corp. did with the IPO of its midstream assets into Hess Midstream Partners LP. Just recently, BP Plc announced the same thing, potentially raising cash while maintaining access to the assets. Analysts are even speculating that Chevron Corp. might try the same thing.

A typical new MLP has an incentive distribution rights (IDR) burden so low that it essentially resembles that of an MLP with no IDR burden. However, as that MLP succeeds in creating value both for the unit holders and the general partner (GP) in the form of increased cash distributions, an increasing proportion of future cash flow is mandated to go to the GP.

IDRs incentivize success but after a certain point, the incrementally increasing cash flows to the GP can become an impediment to growth for the MLP.

Being relieved of the burden of IDRs lowers an MLP’s cost of capital, making it more competitive both in any further consolidation, and in pursuing growth opportunities. Several MLPs—including Enterprise Products Partners LP, Magellan Midstream Partners LP and Genesis Energy LP—removed their IDR burden in simplification transactions years ago. But other companies who built infrastructure empires have found that they only had a limited lifespan as an MLP with IDRs.

Kinder Morgan is, of course, the popular example of this. Given the limited set of new pipelines to be built in this commodity environment, cost of capital matters now more than ever.

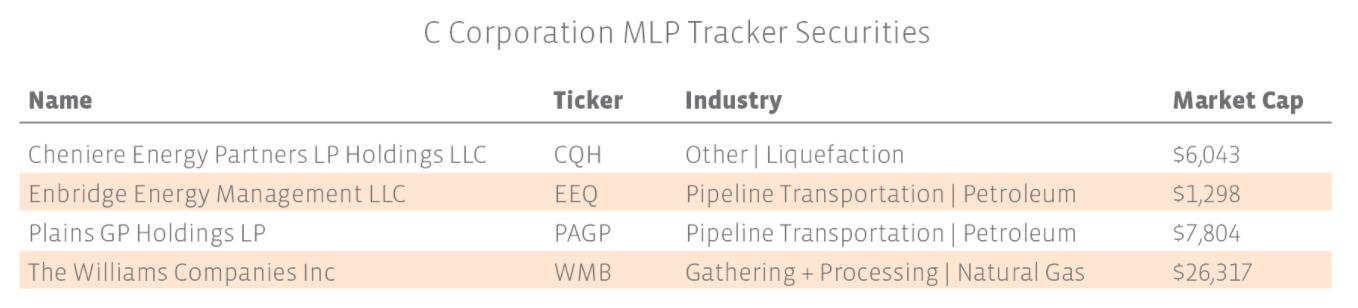

The other major drawback to the traditional MLP structure is a much smaller investor base. Filing Schedule K-1s for an income tax return is about as popular as getting a root canal. Adding insult to injury, MLPs are not permitting in the Standard & Poor’s 500 index or other total market stock indices, leading to the loss of associated tracking dollars. The best hope for maintaining the structure on this front might be those MLPs with tracking stocks, where one C corp share owns one MLP unit.

That way, investors can get exposure to the MLP without needing to deal with a K-1.

The continuation of IPOs and the recent announcement that other large energy companies are also considering using the MLP structure for their midstream assets prove that investor and stakeholder interest remains. However, recent struggles prove that the industry needs to remain cognizant that minimizing an MLP’s IDR burden—or lowering its cost of capital in other ways—and maximizing an MLP’s investor base may be needed to extend an MLP’s lifespan beyond 15-20 years.

Maria Halmo is the director of research at Alerian, an independent provider of MLP and energy infrastructure market intelligence. As of July 31, 2017, over $16 billion was directly tied to the Alerian Index Series. For additional commentary and research, please visit www.alerian.com/alerian-insights.

Recommended Reading

Plug Power CEO Sees Hydrogen as Part of US Energy Dominance

2025-01-29 - Plug Power CEO Andy Marsh says the U.S., with renewable energy resources, should be the world’s leading exporter of hydrogen as it competes globally, including with China.

Energy Transition in Motion (Week of Jan. 17, 2025)

2025-01-17 - Here is a look at some of this week’s renewable energy news, including more than $8 billion more in loans closed by the Department of Energy’s Loan Programs Office.

HIF Global Receives First US Approval for E-Fuels Design Pathway

2025-03-11 - Houston-based HIF Global, which develops projects focused on producing fuels with renewable energy, has won U.S. approval for an e-fuels pathway certification.

Tallgrass Secures Rights of Way for Green Plains’ Trailblazer CCS Project

2025-01-16 - Green Plains’ Trailblazer project will transport captured biogenic CO2 from a number of Nebraska ethanol facilities to sequestration wells in Wyoming.

USA BioEnergy Secures Texas Land for $2.8B Biorefinery

2025-01-13 - USA BioEnergy subsidiary Texas Renewable Fuels plans to annually convert 1 million tons of forest thinnings into 65 million gallons of net-zero transportation fuel, including SAF and renewable naphtha.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.