Regardless of whether an investor purchases a company’s debt or equity, it’s an investment in the same company, and prevailing wisdom says that an investment-grade company is a generally safer investment. If a bondholder is confident in repayment, an equity investor is considered to be relatively safe as well.

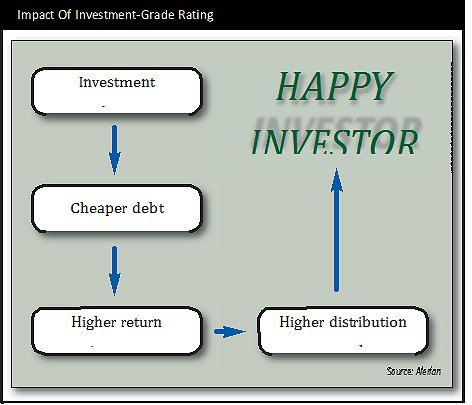

The more certain debt purchasers are of repayment, the lower the rate of return they require for taking on risk. An investment-grade rating—and therefore less expensive debt—lowers an MLP’s cost of capital, so more of the profits are available to be paid to equity holders in the form of distribution increases. The one thing that MLP equity investors like more than a stable distribution is a growing distribution.

In determining credit metrics, agencies tend to look at size and diversity, business risk, financial leverage and distributions. The last two metrics tend to be the most important to equity investors. If a management team sees an incredible opportunity that requires taking on additional debt, increased leverage can be quite useful in growing the business. A temporarily high leverage ratio may indicate that new assets have yet to begin generating revenue. However, when debt is constant despite falling EBITDA, or increasing despite no expected EBITDA gains, a high leverage ratio does represent increased risk.

Equity investors prefer high distribution coverage ratios, which are not always viewed positively by rating agencies. High coverage can provide a cash flow cushion, but an agency may worry that a company with a significant amount of cash may pursue projects it would otherwise consider to be too high risk. In the same way, distribution increases may be great for equity investors but are viewed skeptically by rating agencies because less available cash flow puts bond coupon payments at risk. Paradoxically, distribution cuts can be viewed positively by rating agencies. When Boardwalk Pipeline Partners LP cut its distribution in February 2014, Moody’s eventually downgraded the debt, but not below investment grade. As Boardwalk cut its distribution much further than necessary, it was able to maintain a very high coverage ratio as well as a solid leverage ratio. An investor relying on its investment-grade credit ratings to make an equity investment decision would have been quite surprised at the stock’s price performance.

If you are looking to make an investment decision based on a report from a rating agency, it’s probably best if that decision relates to your fixed-income portfolio. As always, do your homework, get comfortable with the risks—and good luck out there.

Maria Halmo is the director of research at Alerian, an independent provider of MLP and energy infrastructure market intelligence. Over $19 billion is directly tied to the Alerian Index Series. For additional commentary and research, visit www.alerian.com/alerian-insights.

Recommended Reading

Chevron Completes Farm-In Offshore Namibia

2025-02-11 - Chevron now has operatorship and 80% participating interest in Petroleum Exploration License 82 offshore Namibia.

Perission Petroleum Extends Colombian Assets Sale

2025-01-22 - The sale was delayed due to pending formal confirmation regarding the extension of Perission Petroleum’s E&P license in Colombia, specifically for Block VMM-17.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

US Oil, Gas Rig Count Unchanged This Week

2025-03-14 - The oil and gas rig count was steady at 592 in the week to March 14. Baker Hughes said that puts the total rig count down 37, or about 6% below this time last year.

E&P Highlights: March 17, 2025

2025-03-17 - Here’s a roundup of the latest E&P headlines, from Shell’s divestment to refocus its Nigeria strategy to a new sustainability designation for Exxon Mobil’s first FPSO off Guyana.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.