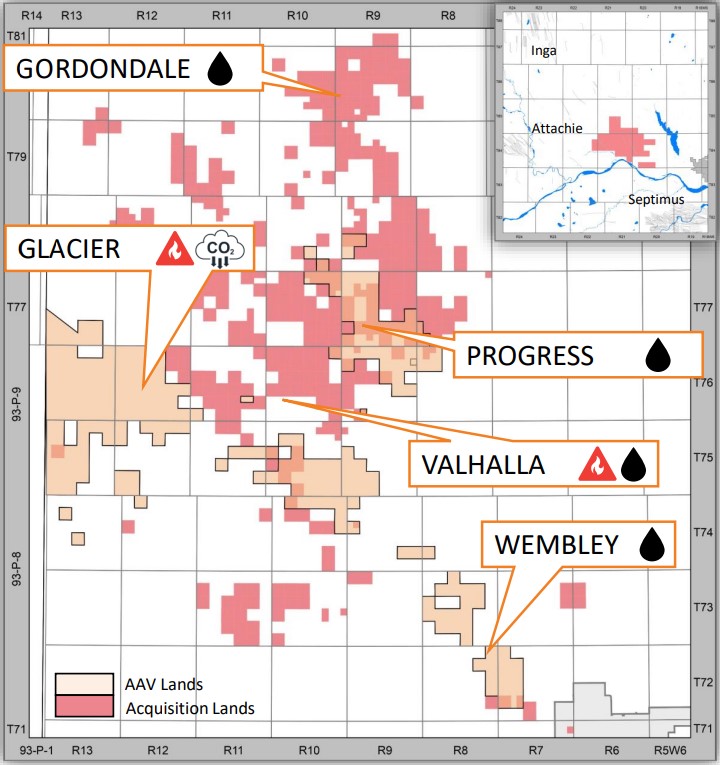

Advantage Energy is growing in Alberta (pictured) and northeast British Columbia through a CAD$450 million acquisition. (Source: Shutterstock, Advantage Energy logo)

Pure-play Montney producer Advantage Energy is growing its core footprint with a CAD$450 million (USD$326.77 million) acquisition, the company said on June 10.

The transaction, with a private seller, is expected to add around 14,100 boe/d of incremental production, including 6,685 bbl/d oil, 810 bbl/d NGL and 39.7 MMcf/d natural gas.

The acquired acreage features multiple benches of gas and liquids resource across stacked Montney and Charlie Lake rights, Advantage said.

The deal adds more than 100 Tier 1 Charlie Lake drilling locations, representing more than 10 years of incremental inventory.

The acquisition will be financed through a combination of common equity, convertible debt and an upsized credit facility.

Advantage is working with a syndicate of underwriters to raise gross proceeds of CA$65 million of subscription receipts and CA$125 million of convertible unsecured subordinated debentures; TD Securities Inc. and Scotiabank are serving as joint bookrunners.

The company also received commitments for an upsized CA$650 million revolving credit facility led by Scotiabank and jointly underwritten with National Bank of Canada and RBC Capital Markets.

Advantage expects the acquisition to be immediately accretive for most core metrics, including free cash flow, production per share and adjusted funds flow per share.

“Over the next 18 months, Advantage plans to maximize FCF by eliminating redundant infrastructure spending, integrating synergies, rerouting production, and reducing drilling capital,” the company said in a news release.

Advantage’s production averaged 66,020 boe/d (357.4 MMcf/d natural gas, 6,452 bbl/d liquids) during the first quarter, up 14% quarter-over-quarter.

Following the acquisition, the company anticipates annual production to grow by roughly 20% in 2024 and by 14% in 2025.

Advantage plans to keep production from the acquired Charlie Lake assets at current levels “for the foreseeable future” while prioritizing drilling projects for the highest return wells.

The acquisition is expected to close by the end of the month, pending closing conditions and the receipt of necessary regulatory approvals.

Liquids-rich shale inventory is being consolidated in oily basins across the U.S. Lower 48—particularly in the prolific Permian Basin.

As high-quality U.S. shale inventory becomes scarce and pricier, operators and experts are keeping a close eye on Canadian plays like the Montney and Duvernay shales.

The Montney and Duvernay are primarily natural gas and NGL plays with relatively small oil production.

Condensate production is also key to the value of Canadian shale production: Condensate is used as a diluent to blend Western Canadian Select, or WCS, one of North America’s largest heavy crude oil streams.

RELATED

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Chevron Technology Ventures Would Like to See the Manager

2025-03-13 - Chevron Corp.’s Chevron Technology Ventures, which turns 25 this year, pays close attention to leadership teams when making investment decisions in technology startups.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.