Months after President Barack Obama blocked TransCanada Corp.’s (NYSE: TRP) cross-border Keystone XL pipeline, the Canadian company is back with a deal giving it enough pipe to circle the Earth twice.

TransCanada said March 17 it entered an agreement to acquire U.S.-based Columbia Pipeline Group Inc. (NYSE: CPGX) for US$13 billion, which includes about US$2.8 billion of debt. As part of the agreement, Columbia shareholders will receive US$25.50 per common share, an 11% premium to its closing price on March 16.

The all-cash deal, approved by the boards of both companies, gives TransCanada gas pipelines and storage in the Marcellus and Utica shales and a possible path toward LNG exports.

“[Columbia’s] attractive and inimitable portfolio of FERC [Federal Energy Regulatory Commission]-regulated natural gas transmission assets, catering to one of North America’s most prolific supply basins, rendered it a natural acquisition target for any entity seeking entry into or scale within this market,” Christopher Sighinolfi, equity analyst with Jefferies LLC, said in a report.

The acquisition is set to create one of North America’s largest regulated natural gas transmission businesses with a combined portfolio of $23 billion worth of secured, near-term growth projects, the release said.

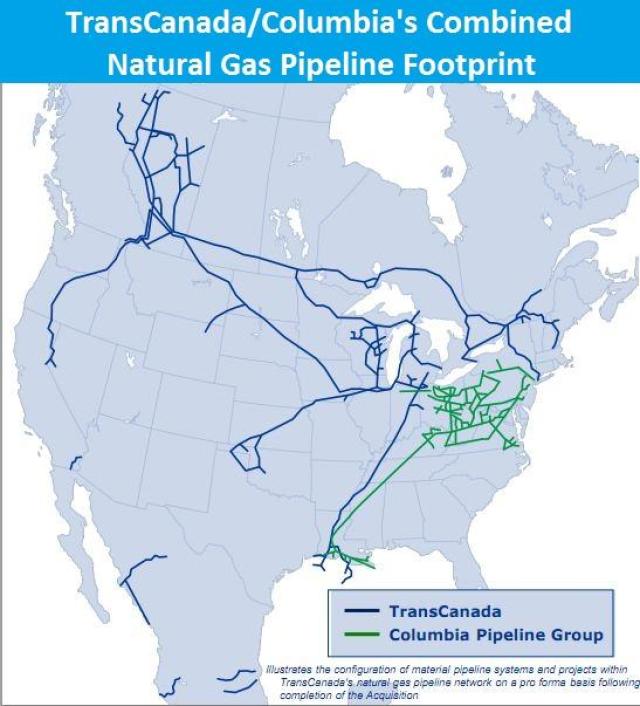

In total, the merged companies will create a 57,000-mile natural gas pipeline system in North America.

“At the same time, we will be well positioned to transport North America’s abundant natural gas supply to LNG terminals for export to international markets,” Russ Girling, TransCanada’s president and CEO, said in a statement.

The merger is expected to support and potentially supplement TransCanada’s anticipated 8-10% annual dividend growth through 2020, Girling said.

Columbia

Based in Houston, Columbia provides transportation, storage and related services in the U.S. Northeast, Midwest, Mid-Atlantic and Gulf Coast regions.

Owning one of the largest interstate natural gas pipeline systems in the U.S., the company operates a network of about 15,000-mile interstate natural gas pipelines extending from New York to the Gulf of Mexico. It also has a significant presence in the Appalachia production basin, the release said.

Columbia is currently advancing US$5.6 billion of commercially secured projects that are subject to normal course regulatory and permitting processes, according to the release.

The projects are underpinned by long-term contracts and expected to generate earnings growth as they enter service. Under agreements with customers, additional growth is also anticipated from about US$1.7 billion of modernization initiatives to be implemented through 2021.

Funding

Following its merger announcement, TransCanada also launched a bought deal offering to sell 92 million subscription receipts at $45.75 per unit. The offering includes a 4.6 million greenshoe option. RBC Capital Markets and TD Securities Inc. are lead underwriters.

Total expected proceeds of about $4.2 billion will be used to fund the Columbia acquisition along with the planned sale of U.S. Northeast merchant power assets and a minority interest in its Mexican natural gas pipeline business.

As an interim measure, TransCanada has bridge term loan credit facilities in place for up to US$10.3 billion with a syndicate of lenders, the release said.

The acquisition is expected to close in the second half of 2016 subject to receipt of Columbia shareholder approval, along with certain regulatory and government approvals. Upon closing, Columbia will become an indirect wholly owned subsidiary of TransCanada and will cease to be a publicly held corporation.

Wells Fargo Securities LLC was exclusive financial adviser to TransCanada. Mayer Brown LLP, Blake, Cassels & Graydon LLP and Osler, Hoskin & Harcourt LLP were its legal advisers.

Goldman Sachs & Co. was lead financial adviser and Lazard Frères & Co. LLC was financial adviser to Columbia. Sullivan & Cromwell LLP was its legal counsel.

Emily Moser can be reached at emoser@hartenergy.com.

Recommended Reading

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

EIA: NatGas Storage Withdrawal Eclipses 300 Bcf

2025-01-30 - The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.