For 2025, Morningstar DBRS expects natural gases to continue to rally, averaging $3.25/mcf for 2025. (Source: Shutterstock)

U.S. natural gas inventories are getting tighter, but will likely remain above normal levels in spite of a record-setting hot summer, according to a report released by credit-rating firm Morningstar DBRS on June 21.

“Since gas storage remains ample, further significant changes in market conditions will be required for the market to enter the 2024–‘25 winter with inventory at an average or below-average level,” said Andrew O’Conor, Morningstar DBRS vice president for corporate ratings, energy and natural resources.

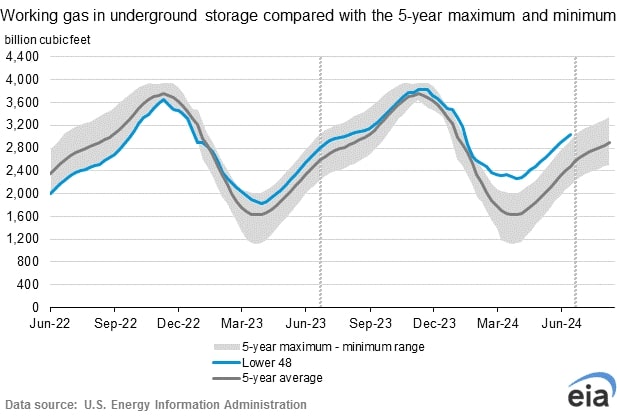

The U.S. Energy Information Administration's (EIA) weekly update of natural gas storage levels showed that overall inventory levels had risen by 71 Bcf from June 7 to June 14. The U.S. had a total of 3.05 Tcf in storage on June 14, 561 Bcf above the five-year average, according to the EIA.

U.S. natural gas storage levels have slightly moved back down towards normal levels after setting record highs in the spring nearly 700 Bcf above the five-year average.

O’Conor noted that gas storage levels in Europe are also well above average, dampening a quick turnaround for U.S. gas demand.

High levels of gas storage tend to hold back natural gas prices, according to Morningstar DBRS, which forecasts a NYMEX average price of $2.50/mcf for full-year 2024. For 2025, the firm expects natural gases to continue to rally, averaging $3.25/mcf for 2025.

Inventories will continue to tighten, but a significant event is needed to draw inventories back to normal levels prior to winter. O’Conor said the significant event could be a blazing summer.

“The brunt of electricity generation to satisfy summer AC demand is still ahead of us,” he said. “We've got another week of June, July and then the dog days of August. There's probably 10 more weeks of AC demand ahead of us.”

The National Oceanic and Atmospheric Administration has forecast a higher-than-average summer for most of the U.S., and the country has already dealt with hot days.

“The heat really took off this week, but even last week, cooling-degree days had been higher than normal,” O’Conor said. “If we have a repeat or two of this week within the next 10 weeks, storage inventories could come down pretty quickly.”

Natural gas producers are preparing for a sharp increase in demand, thanks to LNG export terminals currently under construction along the Gulf Coast and a predicted surge in demand to power an ever-expanding need for data centers.

O’Conor said he expected the projected demand to show up in 2025, though new LNG export project permits are currently under a ban from the Biden Administration, which could have an effect on growth in that sector.

Recommended Reading

MOGAS Wins Multimillion Contract for Aramco-backed S-Oil

2024-07-02 - MOGAS said the contract is part of S-Oil backer Aramco's largest investment in South Korea.

Oceaneering Awarded Multiple GoM Vessel Services Contracts

2024-07-02 - Oceaneering also secured two separate pricing agreements that include the use of new technologies from its integrated, customizable IMR service.

The OGInterview: BPX E-fracs Push ‘Values Up, Emissions Down,’ CEO Says

2024-07-02 - BPX Energy CEO Kyle Koontz discusses the company’s role as the “nimble entrepreneurial” arm of supermajor BP in the Permian Basin and Haynesville and Eagle Ford shales.

E&P Highlights: July 1, 2024

2024-07-01 - Here’s a roundup of the latest E&P headlines, including the Israeli government approving increased gas export at the Leviathan Field and Equinor winning a FEED contract for the all-electric Fram Sør Field.

Laredo Oil Subsidiary Hell Creek Begins Drilling in Montana’s Midfork

2024-06-28 - Laredo Oil expects the well to be production-ready by late July.