The achievement was recognized as oil and gas players, among others, are challenged to lower emissions in an effort to limit global warming. (Source: Shutterstock)

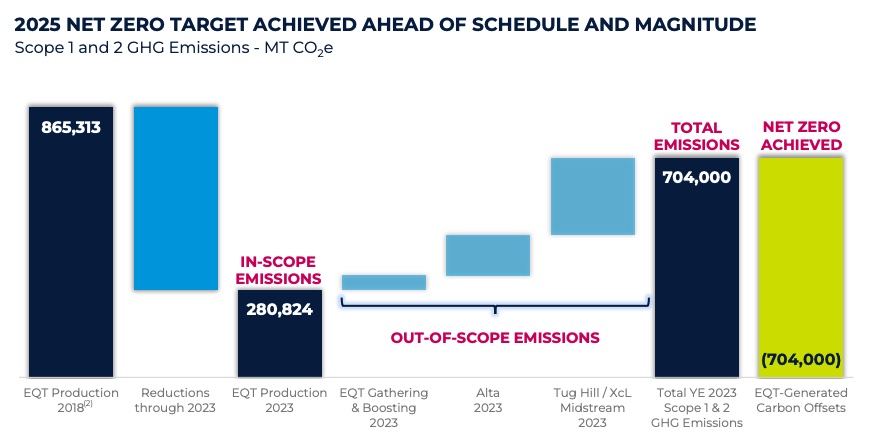

Natural gas producer EQT Corp. hit its net-zero target ahead of its 2025 goal for Scope 1 and 2 emissions from legacy upstream operations and recently acquired assets.

The company announced the accomplishment last week and highlighted the feat Oct. 30 on the company’s third-quarter earnings call, saying EQT is the world’s first traditional energy producer of scale to achieve the milestone. The company said it lowered Scope 1 and Scope 2 greenhouse gas emissions by more than 900,000 tons, which is equivalent to taking about 195,000 cars off the road annually.

“Not only did we accomplish this ahead of our 2025 goal, but we achieved this net-zero status across the entirety of our upstream operations, inclusive of the recently acquired Tug Hill/XCL Midstream and Alta [Resources] assets, which were not included in the target originally set in 2021,” EQT CEO Toby Rice said Oct. 30.

RELATED

Rice: EQT Walking the Walk on Natgas Emissions, Despite Politics

The achievement was recognized as oil and gas players, among others, are challenged to lower emissions in an effort to limit global warming. Though burning natural gas is cleaner than its coal and oil fossil fuel counterparts because it produces fewer CO2, natural gas’ methane content makes it a potential significant contributor to emissions if leaks occur.

Methane has a shorter atmospheric lifetime than CO2, but it is more than 28 times as potent as CO2 when it comes to trapping heat in the atmosphere, according to the U.S. Environmental Protection Agency (EPA).

The EPA and other regulators are getting tougher on methane emitters even as oil and gas companies have taken steps on their own to lower emissions and capture value from products. Under the EPA’s Methane Emissions Reduction Program, companies face fees into the hundreds of dollars for each metric ton of methane released into the atmosphere.

Federal laws also mandate companies regularly look for methane leaks at wells and compressor stations and fix them; eliminate routine flaring of natural gas produced by new oil wells; and stop the use of natural gas-powered pneumatic controllers, among other rules.

EQT’s emissions reductions efforts included replacing more than 9,000 pneumatic devices, which led to an annual emissions reduction of about 300,000 mt CO2e, and shifting its conventional diesel frac fleets to electric fleets powered by natural gas-fired turbines. The move, which utilized gas produced by EQT, lowered the company’s carbon footprint by an estimated 35,000 mt CO2e to 50,000 mt CO2e, EQT said.

Other steps taken included taking a combo-development approach using digital technologies and long-range well planning and installing advanced emissions control devices.

“For the remaining emissions that are not abatable with current technologies, EQT has generated carbon offsets through forest management projects as opposed to purchasing third-party carbon credits,” Rice said. “This was done via our partnership with the state of West Virginia and includes conservation management practices such as the removal of invasive species, wildfire risk monitoring and native tree and shrub placement, all of which have co-benefits for local stakeholders.”

EQT expects to generate 10 million tons of offsets for less than $3 per ton over the partnership’s lifetime, Rice said.

Recommended Reading

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

Mach Prices Common Units, Closes Flycatcher Deal

2025-02-06 - Mach Natural Resources priced a public offering of common units following the close of $29.8 million of assets near its current holdings in the Ardmore Basin on Jan. 31.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.