Natural gas storage drops on winter weather. (Source: Shutterstock)

U.S. natural gas storage levels decreased by 4 Bcf for the week ending Nov. 15, the U.S. Energy Information Administration (EIA) said in its weekly report.

The drop, announced by the EIA on Nov. 21, was the first since a blip in the summer and the first for the fall season, a week earlier than in a market survey conducted by The Desk.

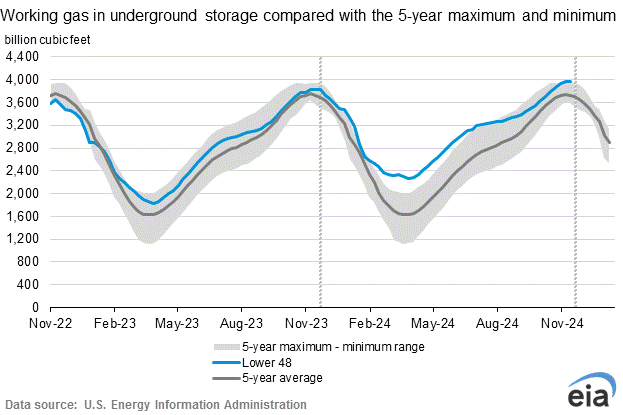

Gas in storage amounts to approximately 3.97 Tcf and remains outside of the EIA’s five-year high and low range. Last year’s storage level at this time was 3.83 Tcf.

Natural gas prices continued a rally that began at the end of October. On Nov. 19, the Henry Hub front month futures price surged past $3/MMBtu for the first time since May. Mid-day Henry Hub prices on Nov. 21 were trading at $3.44/MMBtu, a high for 2024.

RELATED

US NatGas Prices Jump 7% to 1-Yr High on Surprise Storage Draw, Colder Forecasts

Recommended Reading

Drones Proving to be More than Just a Toy in Chevron Operations

2025-04-22 - Chevron Corp. has partnered with drone maker and operator Percepto to get a better look at its operations in two U.S. basins.

Aris Takes on the Permian’s ‘Wall of Water’

2025-04-21 - Aris Water Solutions CEO Amanda Brock rings the alarm bell on the Permian’s water takeaway and recycling challenges and how they can be solved.

Halliburton, Nabors Collab to Deploy Drilling Automation in Oman

2025-04-15 - The companies integrated Halliburton’s Logix automation with Nabors Industries’ SmartROS rig operating system.

Exclusive: Halliburton's E-Fleets Lower Haynesville Completions Costs

2025-04-14 - Halliburton’s Neil Modeland, senior business technology development manager, shares insight into the company’s electrification services and efforts to minimize associated completions costs in the Haynesville Shale, in this Hart Energy Exclusive interview.

Nabors, Corva Expand Alliance to Boost AI-Driven Innovation at Rig Sites

2025-04-13 - Nabors Drilling Technologies and Corva AI will use the RigCloud platform to provide real-time insights to crews directly at drilling sites, the companies said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.