Despite a drop in gas in storage, prices took a hit from forecasts of warmer-than-expected weather. (Source: Shutterstock.com)

U.S. natural gas crossed a storage threshold, according to the U.S. Energy Information Administration’s weekly storage report on Jan. 3.

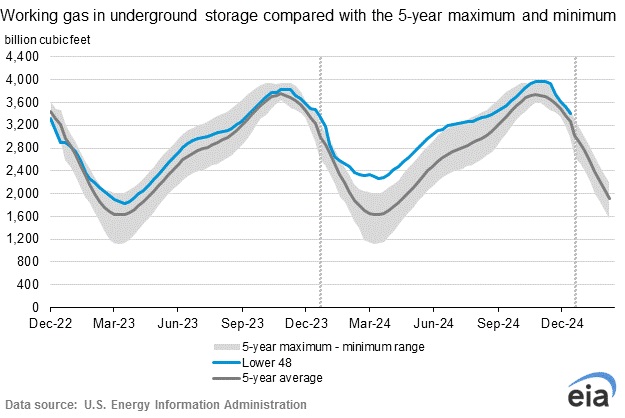

For the first time since December 2022, the amount of gas in storage decreased year-over-year, according to the EIA. The market was not bullish on the news, however, as the natural gas price fell following warm weather forecasts and reported production increases.

The U.S. withdrew 116 Bcf of natural gas from storage for the week ending Dec. 27, leaving the total amount of storage at 3.529 Tcf. During the same period in 2023, the U.S. held 3.480 Tcf of natural gas, or 67 Bcf more.

It was the first time in two years that overall storage levels fell from 12 months before, according to Mizuho Securities.

Stocks still remain higher than the five-year average of 3.259 Tcf, according to the EIA.

The news that overall gas in storage had shown a decrease did not reflect in the market price on Jan. 3.

After daily trading took the Henry Hub front-month futures price over $4/MMBtu just four days ago, the price continued a two-day retreat on Jan. 3, falling more than $0.25 to hit $3.38/MMBtu after the market opened.

Traders and analysts had expected a withdrawal between 125 and 140 Bcf, instead of 116 Bcf, according to East Daley Analytics and Bloomberg.

Several traders blamed the lower withdrawal on a warmer-than-average end to December and low activity during the holiday season.

While an Arctic cold front is still expected to hit most of the U.S. in January, forecasters in Europe and the U.S. predicted a weaker front than expected, meaning less days for heating. And an analysis from Wood Mackenzie estimated that U.S. natural gas production rose 7 Bcf/d from November to December, reaching 106 Bcf/d by the end of 2024, according to Natural Gas Intelligence.

At 106 Bcf/d, U.S. production would be at a year-high, after much of 2024 saw natural gas production drop or flatten at around 102 Bcf/d to adjust to low prices.

Recommended Reading

Pinnacle Midstream Execs Form Energy Spectrum-Backed Renegade

2025-02-03 - Renegade Infrastructure, led by Permian-centric Pinnacle Midstream developers Drew Ward and Jason Tanous, have received a capital commitment from Energy Spectrum Partners.

Argent LNG, Baker Hughes Sign Agreement for Louisiana Project

2025-02-03 - Baker Hughes will provide infrastructure for Argent LNG’s 24 mtpa Louisiana project, which is slated to start construction in 2026.

Velocity Management Invests in Pipeline Builder M Wright Services

2025-01-16 - Velocity Management Advisors has made a minority investment in M Wright Services and three of Velocity’s partners will join the construction firm’s board.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Venture Global LNG Pares IPO Hopes by 15% to $2.2B

2025-01-22 - LNG exporter Venture Global nearly halved the price per share, while increasing the number of shares it expects to offer.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.