Hydrogen is mostly used today for oil refining, production of ammonia and as an ingredient for fertilizer. However, it has the potential to decarbonize hard-to-abate sectors such as steel, maritime and aviation. (Source: Shutterstock)

The Appalachian region is known for its abundant natural gas resources, but CNX Resources Corp. and others aim to establish the area as one of the first hydrogen hubs in the U.S.

“Since this is a hockey town, as a company, we feel like we need to be where the puck is going to be rather than where the puck is,” Navneet Behl, COO for CNX Resources, said recently at Hart Energy’s DUG East conference in Pittsburgh. “And that’s why we are really bullish on the hydrogen economy that’s coming here.”

Serving as an anchor supplier of low-carbon intensity feedstock, natural gas producer CNX is among the 15 key project development partners involved in the Appalachian Regional Clean Hydrogen (ARCH2) project. The hub was one of seven selected by the U.S. Department of Energy in October to enter negotiations—currently underway—for a share of up to $7 billion to form regional hydrogen hubs to jumpstart the sector in the U.S.

ARCH2, with applied science and tech company Battelle as program manager, is in line to get up to $925 million in federal funds. Private investment required for the hub is about six times as much, Behl said, adding the hub could bring more than $6 billion in investment to the region.

RELATED

CNX Banking on Built-in Customer Base for Hydrogen [WATCH]

US Unveils Recipients of $7 Billion for Hydrogen Hubs

Biden Spotlights $7B for Hydrogen Hubs, But Hurdles Remain

Hydrogen is mostly used today for oil refining, production of ammonia and as an ingredient for fertilizer. However, it has the potential to decarbonize hard-to-abate sectors such as steel, maritime and aviation; power fuel cells; generate electricity; and serve as a transportation fuel, displacing carbon-emitting fossil fuels.

Combined, the hubs are targeting production of more than 3 million metric tons per year (mtpy) of hydrogen, including electrolytic hydrogen (green) and hydrogen that uses natural gas as a feedstock with carbon capture (blue). ARCH2, which will span several sites across Ohio, Pennsylvania and West Virginia, is among the blue hydrogen hubs.

“If you look at the hydrogen value chain, the Appalachian region has all the ingredients of the value chain,” Behl said, referring to the region’s abundant, low-cost source of natural gas from the Marcellus and Utica shales, an industrial presence and capable workforce and hydrogen consumers. Plus, “within one hour of where we are in Appalachia, you have access to 50% of the country’s population.”

Providing feedstock

CNX will be the feedstock provider for Adams Fork, a proposed multibillion-dollar ARCH2 anchor project expected to produce up to about 2.1 mtpy of ammonia in its first train. That’s equivalent to more than 300,000 metric tons of hydrogen annually, according to the project’s website. The joint development of Adams Fork Energy LLC and the Flandreau Santee Sioux Tribe is located in Mingo County, West Virginia.

“We really believe [in] the federal government’s vision of creating this hydrogen economy to diversify our energy sources,” Behl said, later speaking to the hydrogen business case for CNX. “There’s going to be a natural transition from our current energy sources into future energy sources, and we believe [the] hydrogen economy is one of the key future energy sources. So, we want to be involved with that. … This will be the next phase of development for us as well, so we can grow as energy transitions and different forms of energy are developed and serve the communities going forward.”

However, it will be a while before the ARCH2 hub—along with the six others—becomes a reality.

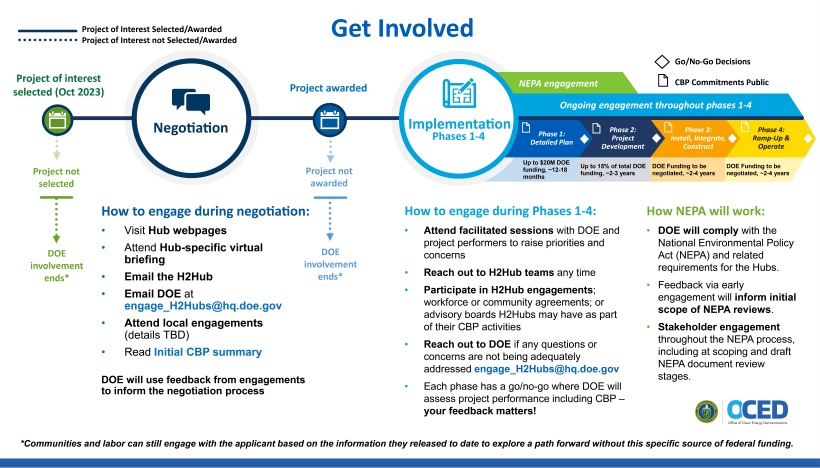

Based on the DOE’s timeline, the hubs won’t begin operations for at least another seven years. Following negotiations and award announcements, project implementation will begin. The process has four phases: detailed plan; project development; install, integrate and construct; and ramp-up and operate.

“I think they’ve got an aggressive timeline,” Baker Botts partner Travis Wofford told Hart in a separate interview. But the process might take longer than expected, given the number of stakeholders involved, it being an election year and yet-to-come guidance on regulations and tax credits, he added.

Awaiting guidance

With offtake and demand still of concern for the nascent hydrogen industry, many companies are counting on tax credits such as 45V, introduced in the Inflation Reduction Act, to strengthen the economics of hydrogen projects.

“Guidance on 45V will be one of the key things that will help everyone invest more,” Behl said.

The 45V hydrogen production tax credit offers up to $3 per kg of hydrogen, depending on greenhouse-gas emissions intensity. But the industry still awaits guidance from the U.S. Treasury Department on what electricity power sources qualifies for the credit.

Stricter rules could favor green hydrogen production, which utilizes renewables such as wind and solar, in an effort to lower emissions; while looser rules could allow the sector to scale more quickly with the use of natural gas combined with carbon capture.

“That [45V] is going to be a large part of what determines the economics of some of these projects,” Wofford said, adding government support will be needed at not just the federal level but the state and local levels, plus commitments from high credit quality offtakers.

“Some of the questions that people are raising are, ‘to what extent is it going to be just hydrogen [produced], or will we focus on hydrogen and ammonia?’ Some of those decisions still need to be made,” Wofford said. “Ammonia can really accelerate the bankability of facilities so that it’s no longer just a local hydrogen economy that you’re focused on, but something that can allow export-import as well.”

Located on a reclaimed coal mining site near Gilbert Creek, West Virginia, the Adams Fork project could become the largest clean ammonia facility in the U.S., according to CNX. Construction is expected to begin in 2024.

Recommended Reading

Segrist: American LNG Unaffected by Cut-Off of Russian Gas Supply

2025-02-24 - The last gas pipeline connecting Russia to Western Europe has shut down, but don’t expect a follow-on effect for U.S. LNG demand.

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

Charif Souki Plans Third US NatGas Venture, Including E&P Team

2025-03-25 - Charif Souki, co-founder of the Lower 48’s first and largest LNG exporter, has his sights set on a third natural gas venture after his exit from Tellurian Inc.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

US LNG Exports May See EU Demand Drop-Off, Asian Surge

2025-03-27 - Ukrainian peace talks could end with Russian gas back on the market, Poten & Partners analysts said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.