MEXICO CITY—An abundance of production from the Permian Basin has allowed Texas producers to find a welcoming natural gas export market in Mexico. That situation isn’t likely to change under Mexico’s next president, Claudia Sheinbaum Pardo, who takes office on Oct. 1. This bodes well for Texas producers and developers behind liquefaction plants on Mexico’s Pacific Coast that will continue to tap the Permian for LNG feed gas.

The market for U.S. piped-gas exports to Mexico has remained robust for years, owing to ongoing operational and financial woes at state-owned Petróleos Mexicanos (Pemex), which has struggled to revert declines in gas production. Pemex’s domestic production continues to fall short of Mexico’s demand for gas, necessitating imports.

“Importing gas, especially from Texas, makes tremendous economic sense—at least in the timeframe required to attract investment and develop Mexico’s gas deposits,” Mexico Business Forum President Roberto Salinas León told Oil and Gas Investor (OGI) from Mexico City.

“In my view, this should not merely continue, but in fact should be facilitated even further, especially if new nearshoring investments materialize. LNG processing and production represents a real opportunity for massive investment. That would also help diversify sources of gas and lessen dependance on spot market purchases,” Salinas said.

RELATED

Mexico’s Demand for Permian Pipe-gas Likely Here to Stay

Sheinbaum won Mexico’s June presidential election by an overwhelming majority. The former mayor of Mexico City received 60.7% of the votes, according to Mexico’s National Electoral Institute (INE). With her victory, the president-elect from the Morena Party will be the first woman president of Mexico and the first woman president of a North American country. Sheinbaum is a physicist of Jewish heritage and holds a doctorate in energy engineering from the National Autonomous University of Mexico (UNAM).

Sheinbaum has said that she doesn’t believe in the “absolute privatization model,” which she said hasn’t worked in Mexico. And Sheinbaum plans to continue with national and sovereign development plans for Pemex and the Federal Electricity Commission (CFE). Her stance aligns with Mexico’s outgoing President Andrés Manuel López Obrador (AMLO), who founded the Morena Party.

Mexico’s membership in the United States-Mexico-Canada Agreement (USMCA)—which entered into force on July 1, 2020 and which succeeded the North America Free Trade Agreement (NAFTA)—provides Mexican producers of goods and services direct access to the U.S. and Canadian markets.

Mexico’s cheap labor is facilitating a nearshoring boom able to compete with China. Tesla CEO Elon Musk has revealed plans for the U.S. electric vehicle maker to build a massive plant in Mexico’s northern Nuevo León state to take advantage of Mexico’s manufacturing capabilities. Mexico’s nearshoring boom is already helping to support an uptick in industrial, commercial and service building construction.

“Mexico’s policy makers need to consider not only a lack of continuous and available energy but also that sources of energy comply with their own corporate and buyer commitments,” Erick Sánchez Salas, Rystad Energy’s vice president of business development told OGI.

—Erick Sánchez Salas, vice president of business development, Rystad Energy

“Our expectations are that global gas and LNG demand will continue to grow and, [as] Mexico is successful in capturing more relocating investments and industries, this will grow more,” Sánchez said. “This again should be a call to action, not only for increasing gas production, but also [increasing] storage for strengthening energy security.”

Sánchez continued: “There are a lot of areas of national integrated gas transportation and storage system (SISTRANGAS) that will be in need of expanding capacity. And in line with strategic projects such as the Transistmico [infrastructure project to connect the Pacific Ocean and the Gulf of Mexico], the demand for gas on the development poles will increase the national average and force investments to bring gas to the soon-to-settle industries in such poles.”

Private sector involvement

Given the resource constraints Sheinbaum will inherit, she will likely be more open to the participation of the private sector across various sectors of Mexico’s economy.

“It’s true that there is continuity in the thinking that the state should play a much more significant role,” FTI Consulting Senior Managing Director Pablo Zárate told OGI. “But Sheinbaum has been much more vocal in the need for private investment—and when you look at the fiscal constraints that both Pemex and the administration face, it’s clear that there is no way in which she will be able to make progress on her broader economic objectives, such as advancing nearshoring, without it,” Zárate said.

“Given the objectives and Sheinbaum’s background, it’s reasonable to expect a much sharper focus on energy transition and the power sector than in E&P,” Zárate said. “But, depending on how those play out, the last CSIEE or incentivized integral service contracts awards from Pemex could build up some momentum to talk again about the role of private investment in E&P—hopefully through also some form of farmouts and JVs with Pemex. So far, there have not been any announcements about incentivizing gas investments.”

AMLO was elected with a campaign promise of a Fourth Transformation, which aimed to end corruption and reduce violence while boosting economic growth, expanding infrastructure and social programs designed to reduce poverty and inequality. The other three transformations include the Mexican Revolution, the reforms of Benito Juárez and Mexico’s independence, AMLO said in early July.

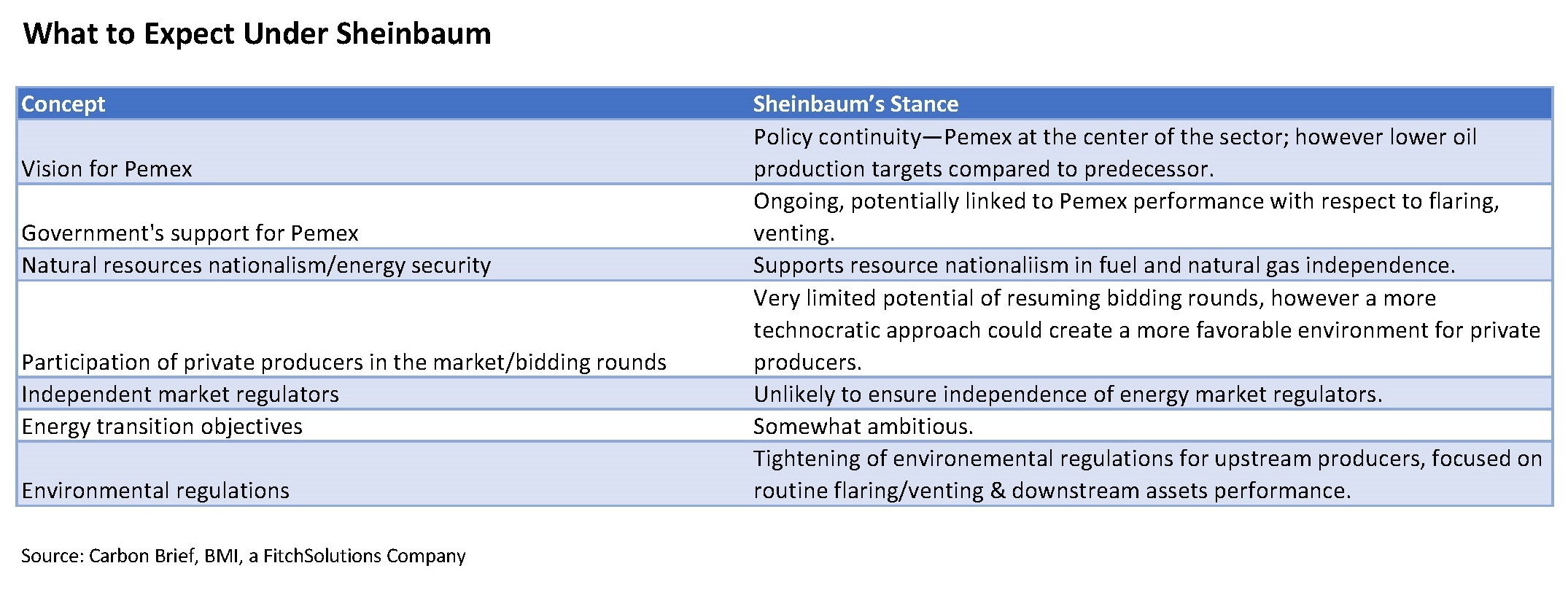

Sheinbaum’s election translates into continuity of the Fourth Transformation, Conor Beakey, associate director with BMI Consulting, said in May during a webinar.

“While Sheinbaum is an environmental scientist by training, she is also both a pragmatist and a leftist. The former means she recognizes that fossil fuels have a role to play for the foreseeable [future] and the latter [means] that she would rather domestically produce those fossil fuels rather than importing them from the U.S.,” Beakey said.

Outside of oil and gas, Beakey said Sheinbaum has reaffirmed her support for the government’s existing plans to double green energy production by 2030 with solar, in particular, likely to play a big role.

Sheinbaum’s initial foreign policy test will relate to the November presidential election in the U.S., which is of critical importance for Mexico.

“We are going to see in Mexico over the next weeks and months to come until September, namings on the rest of the president-elect’s cabinet,” Rystad’s Sánchez said. “This will be a first sign of the route [her] policies will take.”

Gas demand to keep rising

In 2020, Mexico had estimated gas reserves of 6.1 Tcf, according to data published in BP’s Statistical Review of World Energy. That’s just enough to last another 5.9 years. And gas-short Mexico imported an average 6.6 Bcf/d of gas from the U.S. during the week ended June 26, according to data from the U.S. Energy Information Administration (EIA).

Mexico’s internal gas demand will continue to grow through 2032, according to Mexico’s Energy Secretariat (Sener). In 2032, Mexico’s gas demand could reach 9.9 Bcf/d, according to the Sener, up from around 8.9 Bcf/d expected in 2024. The rise in gas demand will primarily be dominated by the electric sector, which will represent around 53.3% of total demand in 2032, followed by industrial (24.3%), petroleum (20.2%), residential (1.4%), services (0.7%) and transport vehicles (0.1%).

Mexico’s domestic production will be insufficient to cover domestic demand through 2032, according to Sener’s estimates, despite higher expected production from Pemex, which will force Mexico to continue to rely on gas imports from the U.S. or other destinations.

Sheinbaum has indicated she would facilitate higher domestic gas production to ensure Mexico’s gas independence. However, Mexico will continue to rely on U.S. piped-gas imports due to ongoing financial and operational headwinds that confront Pemex and are likely to hamper such efforts, BMI Consulting Senior Oil and Gas Analyst Dominika Rzechorzek said during the firm’s webinar in May.

“Sheinbaum will likely maintain Pemex’s dominant position in the upstream and downstream markets, although we could see her tightening regulations for Pemex, in particular, environmental standards for the upstream operations. We expect Sheinbaum to continue supporting Pemex as it is in-line with her resource nationalism stance,” Rzechorzek said.

In terms of private companies and their participation in the market, Sheinbaum is expected to be more technocratic than her predecessor, AMLO. This approach will likely improve the relationship between the Mexican government and international oil companies (IOCs), according to Rzechorzek. However, Sheinbaum is not expected to resume bidding rounds or facilitate higher participation of private producers in the market.

While Mexico will continue to lean on the U.S. for piped-gas to fulfill increasing domestic demand, it will also need additional volumes to support plans by a handful of developers looking to build liquefaction export capacity on Mexico’s west coast.

Mexico is making a big bet on LNG exports, especially from its Pacific Coast, which provides a direct route to Asian markets with their increasing appetite for LNG, especially from North America. Mexico’s LNG projects will source low-carbon feed-gas from the Permian and will avoid the need to send cargoes through the Panama Canal.

Five projects proposed by Sempra Infrastructure, Mexico Pacific and LNG Alliance Pte Ltd. Singapore have the potential to bring to market 59 million tonnes per annum (mtpa) of liquefaction capacity, or around 7.8 Bcf/d over the short-to-medium term, according to data compiled by OGI.

But getting there won’t be easy and Mexico’s LNG exporting success depends on the completion of liquefaction plants and crucial pipelines from the Permian.

BMI sees relatively limited risk to Mexico’s LNG forecast, and like Poten & Partners, expects Mexico to become a net exporter of LNG in 2024.

“In our view, Sheinbaum will most likely continue AMLO’s policies in facilitating investment in export infrastructure,” Rzechorzek said. “However, we highlight lingering challenges primarily [related to] lacking midstream and road infrastructure which could delay some of those projects in pre-FID stage.”

U.S.-Mexico bilateral relations

Mexico is the U.S.’ largest trading partner, surpassing even Canada and China, AMLO boasts almost daily during his “mañanera” or early morning press conference with the media.

U.S. bilateral trade in goods with Mexico reached $779.3 billion in 2022, the Section of Economic Affairs of the Embassy of Mexico to the U.S. said in a report in March 2023. Of that, Mexican imports totaled $454.9 billion with exports of $324.4 billion. The robust trade is a result, among other factors, of global supply chains specialized in the electric and industrial machinery sectors, as well as automotive, according to the embassy.

In fact, bilateral trade between southern U.S. states and Mexico is larger than the U.S.’ trade with all of South and Central America combined. Mexico’s largest partner is Texas, which boasted bilateral trade of $285.6 billion in 2022, according to the embassy.

Petroleum and coal products, as well as oil and gas exports from the U.S. to Mexico represented 18% of the north-south trade flows. However, U.S. oil and gas imports from Mexico represented just 5% of the south-north trade flows.

“AMLO managed to avoid conflict with [former U.S. President Donald] Trump and [President Joe] Biden, the former through appeasement and the latter through circumstance,” said BMI’s Beakey.

A Biden reelection would pave the way for a continuation of the status quo, while a second Trump presidency poses meaningful downside. Republicans view border issues as Mexico’s problem and have advocated imposing economic sanctions should this situation fall to improve, Beakey said.

A Trump reelection will not entirely undermine near-shoring since the USMCA was Trump’s deal, Mexico will retain significant cost advantages and Sheinbaum will adopt a conciliatory tone.

“Mexico buys more from the U.S. than any other country in the world and it sells more to the U.S. than any other country in the world,” Mexico Business Forum’s Salinas said. “The opportunity to take North American integration to the next level is reason enough to care deeply about what happens in Mexico, the U.S. and Canada.”

Recommended Reading

Valeura Boosts Production, Finds New Targets in Gulf of Thailand

2025-03-03 - Valeura Energy Inc. has boosted production after drilling three development wells and two appraisal wells in the Gulf of Thailand.

Murphy’s Vietnam Find May Change Investor Views, KeyBanc Analysts Say

2025-01-09 - The discovery by a subsidiary of Murphy Oil Corp. is a reminder of the company’s exploration prowess, KeyBanc Capital Markets analysts said.

Exxon Enlists Baker Hughes to Support Uaru, Whiptail Offshore Guyana

2025-02-03 - Baker Hughes’ will provide specialty chemicals and related services in support of the Uaru and Whiptail projects in the Stabroek Block.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.