There is a potential revenue stream that some natural gas producers should not overlook, experts say.

Depending on the production method, it has no CO2 emissions. It has two main value-adding products. It is produced from natural gas—an abundant, low-cost energy source in the U.S. And, technology breakthroughs could elevate its status on the so-called Swiss Army knife of energy and amplify its impact on the world’s decarbonization journey.

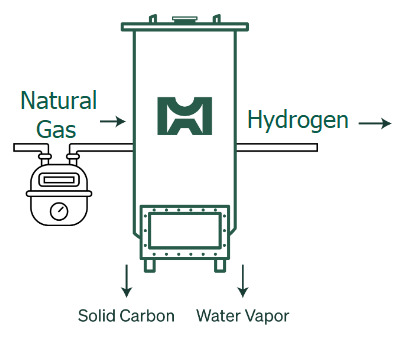

Pyrolytic hydrogen, or “turquoise hydrogen” for those familiar with the hydrogen color wheel, is produced via pyrolysis. The process involves heating natural gas, or methane (CH4), to temperatures of at least 900 C to break the molecule into hydrogen and carbon—both of which have established markets.

Methane pyrolysis is seen by some as a promising decarbonization tool that can leverage the existing hydrocarbon value chain. The technology is gaining attention amid persistent efforts to lower global greenhouse-gas emissions. Although it still has hurdles to overcome, pyrolytic hydrogen could become a viable alternative to hydrogen production methods requiring carbon capture and storage or methods that have little to no environmental advantages.

“Methane pyrolysis sits in this weird little space in between where it’s currently proven and really interesting at distributed scale, takes advantage of existing infrastructure and has scalability potential, but it still has some challenges to solve along the way,” said Lindsey Motlow, senior research associate of sustainability and energy transition for Darcy Partners.

Currently, about 95% of hydrogen is produced from steam reforming of natural gas, according to the U.S. Department of Energy. During the process, natural gas reacts with steam and a catalyst at high temperatures to create hydrogen—but the CO2 is released into the atmosphere. While this so-called “gray hydrogen” dominates production, green (electrolytic) hydrogen and blue hydrogen (essentially gray plus carbon capture and storage) dominate headlines.

Still, methane pyrolysis is on the radar of some large oil and gas operators. However, the scalability of some of the technologies involved is of concern. Plus, like blue hydrogen, it also faces challenges because of its hydrocarbon roots.

“There’s the sector of thought that kind of stands against any hydrocarbon-based hydrogen production process, especially on the West Coast in the U.S.,” Motlow said. “Certain areas have been pushing to develop policies and incentives surrounding which technology choice can be made most economically, with credits or incentives and things like that. And, some folks are really pushing against any type of technology that is from hydrocarbon sources.”

Getting natural gas

The natural gas community is uniquely placed to capitalize on pyrolytic hydrogen, according to Mothusi Pahl, vice president of business development for Modern Hydrogen.

—Mothusi Pahl, vice president of business development, Modern Hydrogen

“Rather than just thinking about natural gas equivalents and a Henry Hub value, now we can convert that natural gas into hydrogen that has significant value multiple,” Pahl said. “And you convert that natural gas into carbon, which we’re showing also has a significant value multiple.”

Modern uses a thermal non-catalytic process to produce hydrogen and solid carbon, starting with natural gas. The process involves heating natural gas to a point where it is hot enough to dissolve the carbon and hydrogen bonds—about 2,000 F or hotter.

The process occurs inside two chambers: one for combustion and another for pyrolysis. Natural gas is initially injected into the combustion chamber, resulting in a CO2 footprint; however, as the system gets up to operating temperatures, some of the hydrogen produced is used to provide ongoing heat. After the hydrogen and carbon are separated and floating freely, the two are separated. The carbon atoms join each other to form a solid.

“The hydrogen is used as a fuel for transportation or industrial operations or chemicals or power generation. And what makes it really, really unique is that the heat that we use to drive our process comes from combusting a subset of the hydrogen that we produce,” Pahl said.

The process takes place inside Modern Hydrogen’s MH500, which can be bolted onto existing infrastructure to remove carbon from natural gas, LNG or RNG. The technology can be deployed where needed, reducing transportation and storage needs.

“Wherever you have a natural gas connection today, you can quite literally remove the carbon from that natural gas and deliver a clean fuel for any commercial, industrial or transportation operation,” Pahl said.

Modern takes a modular approach to decarbonizing natural gas, depending on the challenge its customers are trying to solve.

“The more natural gas you’re consuming and the more carbon that you want to remove, the more filters you would put in place,” he said. “So, each one of our boxes is really optimized to output about half a ton of hydrogen per day. But we don’t really think about our application spaces with that as the scale. Really, the question ultimately comes down to the end user and how much decarbonization are they looking for.… We deploy the number of boxes required to get to that decarbonization threshold.”

Modern, which is not yet manufacturing the MH500, has deployed pilot projects and is working toward its first scheduled deliveries of full-sized projects, expected in late 2025/early 2026. The company has orders under contract that are now pushing its next phase of deliveries out through late 2026 and early 2027, Pahl said.

Following positive field operation results in Miami, Washington State and Oregon over the last eight to nine months, the company is moving into early stage manufacturing mode.

Another company focused on methane pyrolysis is currently the only commercial-scale producer: Monolith.

Getting bigger

Nebraska-based Monolith uses a thermal plasma process to produce carbon black and carbon-free hydrogen from natural gas.

—Kelsey Roste, vice president of decarbonized solutions, Monolith. (Source: Monolith)

“Unlike other pyrolysis companies, our advantage is that we turn solid carbon into a high-quality carbon black.… That carbon black is used for tires,” Kelsey Roste, vice president of decarbonized solutions, told Oil and Gas Investor. “This is one of the toughest industries to enter into since the tire is the No. 1 safety element of a vehicle. Our process utilizes less electricity, and we’re extremely efficient with the natural gas. We turn over 98% of the CH4 molecule into to the two high-value products.”

Roste said the company’s process is able to create a significantly more decarbonized hydrogen product today, without the need for carbon capture and sequestration requirements, at a price that’s competitive with traditional ways of producing hydrogen such as steam methane reforming (SMR).

Although SMR is considered affordable, the process releases 11 tons of CO2 into the atmosphere for every 1 ton of hydrogen produced, the company said. Electrolysis, which uses renewable energy-powered electrolyzers to split water molecules, is more expensive and requires seven times the electricity than methane pyrolysis. Instead of combustion, heat is used with methane pyrolysis, eliminating the release of CO2.

Monolith’s Olive Creek 1 facility in Lancaster County, Neb., became the U.S.’ first commercial-scale methane pyrolysis facility in 2020. It has the capacity to produce up to 15,000 tons per annum of carbon black and about 5,000 tons of hydrogen. Looking to replicate the success, Monolith is expanding with Olive Creek 2. The facility will have up to 12 reactors and be capable of producing 180,000 tons of carbon black and about 60,000 tons of hydrogen per year.

After the expansion, Monolith plans to build production facilities of similar sizes in the U.S. and eventually around the world, she said.

“The hydrogen we plan to turn into ammonia/fertilizer,” Roste said. “Carbon black is an essential material that’s most notably known for making up one-third of the tires worldwide. The process currently uses fossil natural gas as well as clean electricity. But we do have the opportunity to use other hydrocarbons as our feedstock such as renewable natural gas.”

On the East Coast, Empire Diversified Energy is also planning to use pyrolysis to transform RNG into hydrogen as one of the projects selected for the Appalachian Regional Clean Hydrogen Hub (ARCH2). Working with Heartland Water Technology, Empire plans to produce hydrogen from anaerobically digested food waste at a facility in Follansbee, West Virginia.

“From a sustainability standpoint, we knew that we could capture methane coming from food waste and sludge byproducts or waste products,” said Bernard Brown, COO for Empire Diversified. “And … looking at thermal conversion technologies, it was not hard to bring two existing known processes together, meaning capture the food waste and generate a biogas.”

He added that thermally separating carbon can be accomplished with either pyrolysis or gasification technology.

The company plans to produce about 2 million kilograms of hydrogen per year, but that depends on how much waste material comes in, he said. “Now, could you scale up? Absolutely. But we’re not looking to do that. We found a very good point of equilibrium in the design process to make it financially profitable.”

Getting credit

Like other hydrogen players, companies that use pyrolysis are positioning themselves to take advantage of hydrogen production tax credits if final guidance from U.S. regulators is favorable.

However, Pahl pointed out that the current hydrogen production pathway for the 45V hydrogen production tax credit is heavily weighted toward hydrogen generated from renewable sources.

Hydrogen producers meeting certain prevailing wage and registered apprenticeship requirements could qualify for a credit ranging from $0.60 per kilogram (kg) of hydrogen produced to $3/kg, depending on the life-cycle greenhouse-gas (GHG) emissions from hydrogen production, including its power source. The fewer emissions, the higher the credit.

“But if you’re generating hydrogen from natural gas, even if you deliver the same CO2 impact as the renewable originated hydrogen, you’re not eligible for the same benefits,” Pahl said. “And that, I think, fundamentally is a problem that we as the energy community need to work together to resolve.”

Similar sentiments were shared for solid carbon and the 45Q for carbon capture.

“If I can capture and sequester an equivalent amount of carbon in the form of Modern’s solid carbon that are avoiding CO2 emissions, they should be eligible for the same carbon capture and sequestration incentives under 45Q as all of the oilfield-captured CO2 is eligible for it,” Pahl said. “We think the upstream community should really see this as a bolt-on benefit for natural gas in creating long-term demand and long-term understanding of natural gas as a feedstock for decarbonization. That whether you’re capturing the carbon after you’ve burned the fuel or you’re capturing the carbon before you burn the fuel. If the outcome is the same, the incentives should be the same.”

Modern’s produced carbon has a unique binding quality makes it ideal for use in asphalt materials with asphaltene. When mixed with materials that asphalt producers use to make asphalt for roads, the carbon makes the road stronger, he said.

Modern has NextEra Energy and National Grid among its backers, and NW Natural is among its customers. The company currently does not have any strategic partners in the E&P or midstream space.

Getting onboard

Pyrolysis, which has been around for a long time, has been traditionally used for the production of solid carbon, Motlow said. It wasn’t until the early 2000s that hydrogen—then a byproduct of the process—was considered for hydrogen production amid decarbonization goals. But the molar ratio of solid carbon is significantly larger than the hydrogen output, she said.

“Methane pyrolysis due to, I guess, the demonstrated scale of some of those reactors and inherent R&D related to the scaling of those technologies has been a concern for a lot of oil and gas operators,” she added.

Oil and gas companies are looking to move forward with projects with technologies that can be deployed at a large scale. “These technologies need a little bit more time to get to that point in scaling.”

Still, some of the oil and gas industry’s biggest players are involved in methane pyrolysis projects or backing companies developing such technologies.

Chevron Technology Ventures, Shell and Williams Cos., for example, are among Aurora Hydrogen’s investors. The Canadian startup is developing microwave pyrolysis technology that converts natural gas into hydrogen and solid carbon without consuming water or generating carbon emissions.

Pyrolysis is something that perhaps more companies, specifically those in natural gas, could find value, Pahl said. He said he thinks the upstream natural gas community has been segmented in its thinking of the gas ecosystem historically but that could change.

“Whether or not you agree with the politics of decarbonization, the market pull for decarbonization is significant … a lot of our gas production and gas utilization is going to be influenced by big industrial and commercial end-users that are trying to solve decarbonization challenges,” Pahl said.

There is marketplace potential outside the traditional natural gas value chain.

“It is a strategic imperative for the upstream gas community to really understand the marketplace that we’re creating for decarbonized natural gas,” he said. “There’s a significant opportunity in creating value to deliver decarbonized natural gas. The real question is: who’s going to capture that value creation?”

Recommended Reading

E&Ps’ Subsurface Wizardry Transforming Geothermal, Lithium, Hydrogen

2025-02-12 - Exploration, drilling and other synergies have brought together the worlds of subsurface oil drilling and renewable energies.

GA Drilling Moves Deep Geothermal Tech Closer to Commercialization

2025-02-19 - The U.S. Department of Energy estimates the next generation of geothermal projects could provide some 90 gigawatts in the U.S. by 2050.

Superhot Rock Drillers Advance Technology to Rival Oil and Gas

2025-03-23 - Building on synergies with the oil and gas sector, geothermal companies seek to go hotter and deeper to unleash energy.

Oil & Gas, Geothermal Technology Transfer Not a One-Way Street

2025-03-19 - Technologies commonly used in oil and gas are making it cheaper to drill deep into hot reservoirs to generate geothermal power, but the oil sector could also learn from geothermal, panelists say.

Geothermal Player Ormat Adds Capacity as Power Demand Rises

2025-02-28 - Ormat aims to grow its installed capacity to between 2.6 and 2.8 gigawatts by the end of 2028, CEO says.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.