Whiting Petroleum Corp., Denver, (NYSE: WLL) plans to buy Equity Oil Co., Salt Lake City, (Nasdaq: EQTY) in a stock-for-stock deal worth about $76 million, including the assumption of about $29 million of debt. Equity shareholders will receive a 0.185 share of Whiting per Equity share. Assuming Equity has 13.27 million outstanding shares, the exchange ratio values the company at about $3.56 a share based on Whiting's closing price of $19.24 on Jan. 30. Whiting shareholders will own approximately 88.4% of the combined company, and Whiting management will run the company after the merger. Whiting's share price rose 61 cents on the news, to close at $19.85 on Feb. 2. Equity's share price fell 89 cents, closing at $3.61. The merger is expected to be accretive to Whiting's 2004 earnings, cash flows and reserves. Merrill Lynch & Co. provided a fairness opinion to Whiting. Wayne Andrews, an analyst with Raymond James & Associates, says the deal is a "clear strategic positive" for Whiting. At year-end 2003, Equity had estimated proved reserves of 85- to 90 billion cu. ft. of gas equivalent, implying a low purchase price of $0.87 per thousand cu. ft. of gas equivalent, Andrews said. Whiting's reserve life should rise from its current level of 11.7 years. And, Equity has properties in California and Canada, which will broaden the scope of Whiting's asset base. Andrews has a price target of $23 on Whiting, with an Outperform rating. When he initiated coverage on Whiting in January, Andrews noted that the company is "highly adept at carefully selecting potential acquisitions of proved properties with exploitation and development upside." During 2000-02, as a private company, Whiting completed 41 separate acquisitions, adding 369.6 billion cu. ft. equivalent at an "extremely attractive" average price of $0.90 per thousand cu. ft. equivalent, he said. He added that in January, Whiting was trading at about 4.2 times its projected 2004 enterprise value/EBITDA, a "substantial discount" to Andrews' small-cap E&P coverage universe, which trades at a median of 4.8 times. "...The shares do not adequately reflect the company's impressive growth in production volumes, efficient capital structure, vast undeveloped acreage and excellent long-term prospects." The Equity merger is subject to the approval of shareholders owning two-thirds of the outstanding Equity shares. Equity intends to call a special shareholders meeting during the second quarter to vote on the deal. Equity began exploring strategic alternatives for the company in the second quarter of 2003, with the help of Petrie Parkman & Co. as financial advisor. Equity contacted 73 companies and disseminated material to 58 prospective buyers. This resulted in 21 meetings with prospective buyers, 16 data-room visits and eight offers for the company or its assets. Whiting operates primarily in the Gulf Coast, Permian Basin, Rocky Mountains, Michigan and Midcontinent regions. Production for the nine months ended Sept. 30, 2003, was 1.9 million bbl. of oil and 16.1 billion cu. ft. of gas. The company went public in November, selling 15 million common shares at $15.50 each, at the high end of its announced range of $14 to $16. Equity operates in California, Colorado, North Dakota and Wyoming. Production for the nine months ended Sept. 30 was 427,000 bbl. of oil and 2.5 billion cu. ft. of gas.

Recommended Reading

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Investor Returns Keep Aethon IPO-ready

2024-10-08 - Haynesville producer Aethon Energy is focused on investor returns, additional bolt-on acquisitions and mainly staying “IPO ready,” the company’s Senior Vice President of Finance said Oct. 3 at Hart Energy’s Energy Capital Conference (ECC) in Dallas.

The ABCs of ABS: Financing Technique Shows Flexibility and Promise

2024-07-29 - As the number of ABS deals has grown, so have investors’ confidence with the asset and the types of deals they are willing to underwrite.

Aethon, Murphy Refinance Debt as Fed Slashes Interest Rates

2024-09-20 - The E&Ps expect to issue new notes toward redeeming a combined $1.6 billion of existing debt, while the debt-pricing guide—the Fed funds rate—was cut on Sept. 18 from 5.5% to 5%.

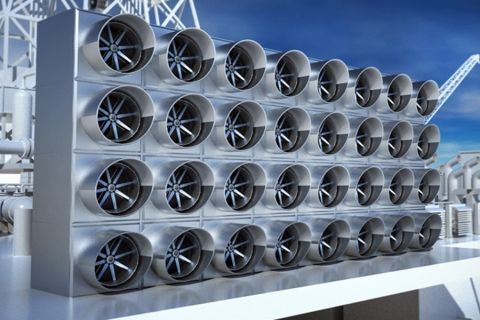

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.