The company’s technology customers have been consistent demand drivers, comprising about 3 GW of the operating portfolio and more than 3 GW of the project backlog, NextEra CFO Kirk Crews said. (Source: Shutterstock/ NextEra Energy)

The electrification of oil and gas fields, Big Tech’s data centers and the rebirth of America’s domestic manufacturing sector are fueling demand for more power in the U.S., executives of a renewable energy powerhouse said April 23.

NextEra Energy CEO John Ketchum said the company is meeting the demand with renewable energy and is positioned to capitalize on future growth given its scale and technology alongside a strong project backlog.

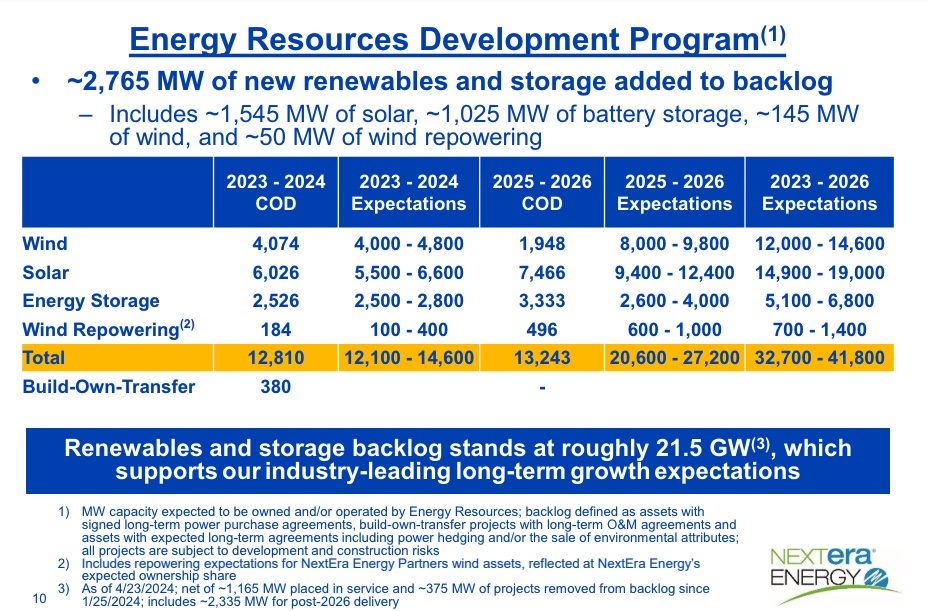

The Florida-based company’s renewable energy arm, NextEra Energy Resources, added about 2,765 megawatts (MW) to its backlog in first-quarter 2024, marking its second-best quarter for new renewables and storage origination.

For solar and storage origination, it was the company’s best quarter. The company added about 1,545 MW of solar and 1,025 MW of storage to its backlog — along with 145 MW of wind and 50 MW of wind repowering.

The additions boost Energy Resources’ backlog to about 21.5 gigawatts (GW).

Growth is being delivered amid efforts to load up grids with lower-carbon energy and storage to reduce emissions. The Biden administration has set a goal to deliver 100% clean electricity by 2035, offering federal incentives to encourage renewable energy development.

Though the expected load growth will take time to materialize, Ketchum said customers looking to expand are concerned about power availability. That means opportunity for renewables.

“We believe renewables and storage are a key enabler to help meet this increased demand,” Ketchum said on the company’s April 23 earnings webcast.

Over the next seven years, the U.S. renewables and storage market has the potential to triple compared to the previous seven years, “growing from roughly 140 gigawatts [GW] of additions to approximately 375 to 450 GW,” Ketchum said.

Driving growth

The U.S. Energy Information Administration (EIA) forecasts power consumption will jump to 4.096 billion kilowatt-hours (kWh) this year, up from 4 billion kWh in 2023. Power demand could reach 4.125 billion kWh in 2025. For non-residential electricity consumption, the EIA reported areas with large new computing customers, such as data centers, have the fastest forecast growth.

Ketchum called opportunities around data centers significant for NextEra.

“We understand how they work, how they operate. … We see about a 15% CAGR through the end of the decade for data center demand,” Ketchum said. Data center developers, he added, are focused more on three elements: low-cost energy; low-cost energy, decarbonization targets and location; and the right location to speed to market.

The company’s technology customers have been consistent demand drivers, comprising about 3 GW of the operating portfolio and more than 3 GW of the project backlog, NextEra CFO Kirk Crews said.

“Origination activity across our power and commercial and industrial customers are beginning to reflect the rising power demand,” said Crews. “We are seeing it manifest with our power customers in their state RFP processes and bilateral discussions where we deliver cost-effective renewables and storage to their grid. We are also observing it through interactions with our oil and gas and manufacturing customers, where we utilize our data and technology to help them make better siting decisions.”

Returns

How quickly renewable energy companies like NextEra will be able to meet power demand growth remains to be seen, given grid connection times.

Connecting to electrical infrastructure may take a couple of years in the ERCOT market or it may take between five to seven years in markets in the Midwest, NextEra Energy Resources CEO Rebecca Kujawa said.

The company said NextEra Energy Transmission was recently selected by the California ISO to develop a new 82-milie, 500-kv transmission line in southern California with a more than $250 million capital investment. The project could unlock more than 3 GW of new renewable generation capacity, according to Crews.

“I think we’re the least behind of anybody with our 300-GW portfolio but some of this will take some time to materialize,” Kujawa said.

While solar energy tops Energy Resources’ development portfolio — with wind significantly trailing in backlog additions — different regions in the U.S. call for different technologies.

Wind is economic in some areas, while solar and storage is better suited for others, Kujawa said.

“And from a returns’ perspective, I think we continue to realize very attractive returns for all the technologies, and of course, adjusted for the types of risks that we think we take. Mid-teens for solar and above 20% full levered returns for wind and storage technologies,” she said. “So, I think from an investor standpoint, that’s a very attractive proposition.”

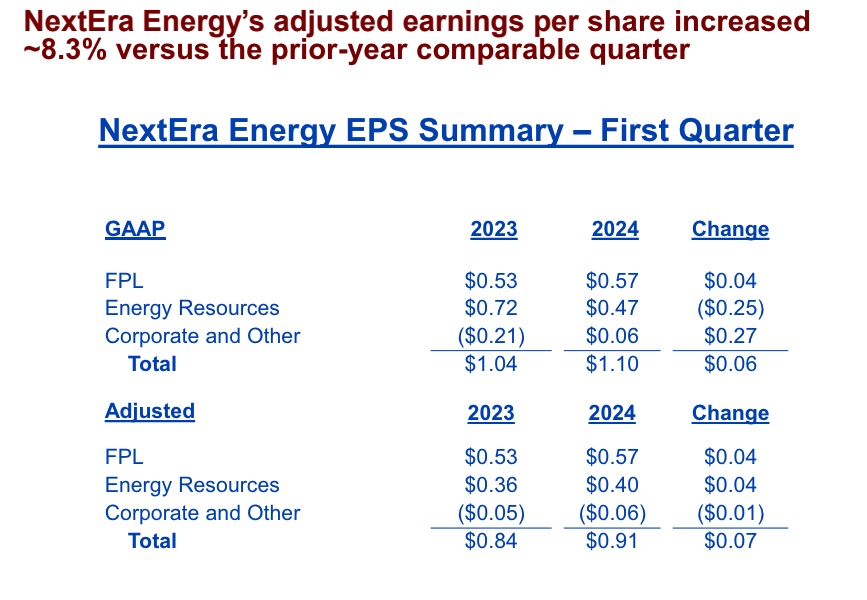

NextEra Energy reported first-quarter 2024 earnings of $1.873 billion, up from $1.678 billion a year earlier. The renewables division’s earnings were $828 million, up from $732 million. The company reiterated expectations to grow its dividends per share at a roughly 10% rate per year through at least 2026 off a 2024 base.

Recommended Reading

Obsidian to Sell Cardium Assets to InPlay Oil for US$225MM

2025-02-19 - Calgary, Alberta-based Obsidian Energy is divesting operated assets in the Cardium to InPlay Oil for CA$320 million in cash, equity and asset interests. The company will retain its non-operated holdings in the Pembina Cardium Unit #11.

Bowman Consulting Acquires Texas Firm UP Engineering

2025-02-19 - The acquisition of UP Engineering strengthens Bowman Consulting Group’s position in the oil and gas market, Chairman and CEO Gary Bowman says.

TotalEnergies, Air Liquide Form Hydrogen Joint Venture

2025-02-18 - TotalEnergies says it will work with Air Liquide on two projects in Europe, producing about 45,000 tons per year of green hydrogen.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

Type One Energy, Private Equity Firm Partner to Advance Fusion Energy

2025-02-14 - The partnership between Pine Island New Energy Partners and Type One Energy focuses on identifying and evaluating fusion industry supplier chain companies to grow the sector.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.