NextEra Energy’s CEO is considering restarting the Duane Arnold nuclear plant as electricity needs, particularly from data centers, are growing. (Source: Shutterstock.com)

NextEra Energy (NEE) is evaluating the restart of Iowa’s Duane Arnold nuclear plant as it looks to meet an expected surge in electricity demand.

Speaking during the company’s third-quarter earnings call Oct. 23, NextEra Energy CEO John Ketchum said there is strong interest from data center customers in the site. The approximately 600-megawatt (MW) Duane Arnold nuclear plant was shuttered in 2020 after its last customer, Alliant Energy, accepted a buyout, turning to wind, and a derecho damaged the plant’s cooling towers.

The plant in Palo, Iowa, had operated for 45 years.

“We’re doing all the things right now that you would expect us to do. We’re doing all the assessments, which include engineering assessments,” Ketchum told analysts. “It includes working with the NRC [Nuclear Regulatory Commission]. It includes working with local stakeholders. … It goes without saying there is very strong interest from customers, really data center customers in particular.”

NextEra’s conversations on a possible restart take place as the nuclear industry experiences a rebirth driven by a need to lock in reliable sources of clean energy. The expected surge in electricity demand comes from data centers and their energy-intensive artificial intelligence applications; the reshoring of manufacturing; and the electrification of essentially everything with a plug.

Ongoing net-zero emissions initiatives are leading some companies to nuclear and renewable energy, with natural gas and energy storage systems adding to grid stability.

Potential, limitations

Constellation Energy announced plans in September to launch the Crane Clean Energy Center and restart the Three Mile Island Unit 1 in 2028, which shut down about five years ago. The news came after Constellation signed its largest ever power purchase agreement with Microsoft.

RELATED

EQT’s Rice: Three Mile Island Restart Not ‘Needle-Mover’ vs. Natgas

Holtec International is also on track to restart operations at the Palisades nuclear plant in Michigan in October 2025.

Many investors had anticipated news of a Duane Arnold nuclear restart, according to analysts at Jefferies.

“We have written that this [restart] was a remote possibility, and we believe a Duane Arnold restart is challenging, given the plant damage and robust regional wind generation,” Jefferies analyst said in an Oct. 23 note. “Using the Constellation Energy Three Mile Island’s likely more robust economics, we estimate ~$3Bn [net present value] which would represent 1-2% of NEE’s market cap.”

Despite nuclear energy’s potential to provide abundant around-the-clock, low-emission, baseload dispatchable power, it has limitations.

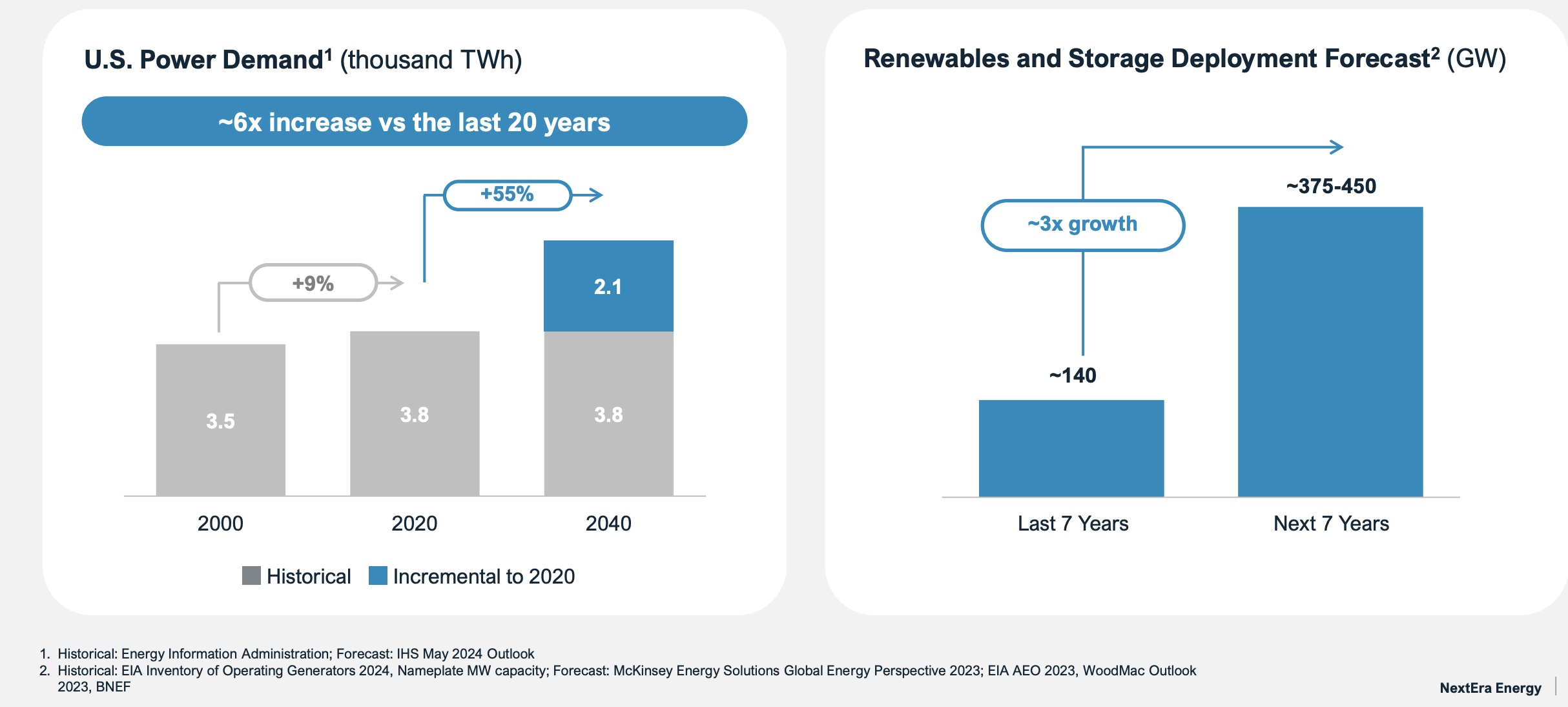

“Today there are forecasts for an approximate 6x increase in power demand growth in the next 20 years versus the prior 20. That significant projected shift in fundamental demand is across industries,” Ketchum said.

U.S. data centers are expected to demand approximately 460 terawatt hours of additional electricity, compounded annually at a rate of 22% from 2023 to 2030, Ketchum said. Data center power demand “could potentially enable 150 gigawatts [GW] of new renewables and storage demand over the same period.”

Across the U.S., NextEra expects the grid will need to add 900 GW of new generation by 2040.

“There are only a few nuclear plants that can be recommissioned in an economic way,” Ketchum said. “We are currently evaluating the recommissioning of our Duane Arnold nuclear plant in Iowa as one example. But, even with a 100% success rate on those recommissionings, we would still only meet less than 1% of that demand.”

Existing merchant nuclear generation is also limited, with only 20 merchant nuclear plants in the U.S., Ketchum said. Only two such plants are operating west of the Mississippi River.

“Nuclear plants across the country are already serving an existing demand. So even if they are contracted by specific customers, new resources need to be built to meet new demand and alternatives such as new utility scale nuclear,” he said, turning to small modular reactors (SMRs). “SMRs are unproven, expensive and again not expected to be commercially viable at scale until the latter part of the next decade.”

Meeting demand

Renewables backed by energy storage and natural gas generation are expected to meet rising demand. Most of the conversations NextEra has involving data center customers are focused on renewables, he said, noting the company’s nuclear fleet is part of its data center strategy.

“When it comes to economics, renewables and storage are the lowest cost generation and capacity resource for customers in many parts of the U.S. We believe new wind is up to 60% cheaper and new solar up to 40% cheaper than new gas power generation,” Ketchum said. “And that’s on a nearly firm basis when paired with a four-hour battery.”

NextEra on Oct. 23 said it entered new framework agreements with two Fortune 50 companies. The companies were not named. Rebecca Kujawa, CEO of the company’s renewables unit NextEra Energy Resources, said they are not technology companies.

“They are folks that are building facilities that they need to get power to,” Kujawa said. “They are folks that are concerned and care about ensuring that they are low cost, ready to deploy and ideally low carbon forms of energy and capacity. So, I think this is, again, a robust sign of significant broad-based demand.”

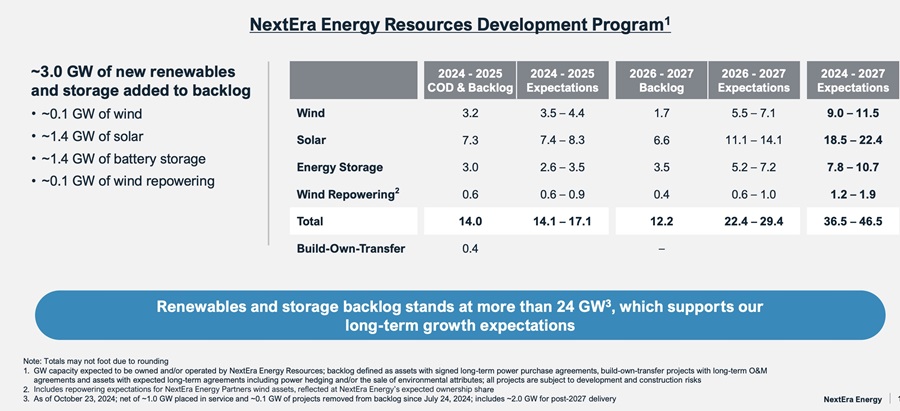

Ketchum said the framework agreements total more than 10.5 GW for renewable energy and storage. The agreements were announced as the company continued to grow its backlog.

NextEra said it added about 3 GW to its backlog, pushing it past 24 GW (excluding the most recent framework agreements).

The company reported third-quarter 2024 adjusted earnings of $2.127 billion, compared to $1.920 billion in third-quarter 2023. NextEra Energy Resources’ adjusted net income was $979 million in the quarter, up from $882 million during the same period in 2023.

Recommended Reading

Saudi Aramco Discovers 14 Minor Oil, Gas Reservoirs

2025-04-10 - Saudi Aramco’s discoveries in the eastern region and Empty Quarter totaled about 8,200 bbl/d.

Analysts’ Oilfield Services Forecast: Muddling Through 2025

2025-01-21 - Industry analysts see flat spending and production affecting key OFS players in the year ahead.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Winter Storm Snarls Gulf Coast LNG Traffic, Boosts NatGas Use

2025-01-22 - A winter storm along the Gulf Coast had ERCOT under strain and ports waiting out freezing temperatures before reopening.

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.