NEW YORK—With warm weather returning to the northeastern U.S., midstream and utility companies are assessing what actions to take in the wake of the short but nasty price spike during a long, hard midwinter freeze.

Nationally, producers and midstream companies have been vocal about how the country got through the first cold winter in several years with no supply crunch, despite significant new industrial and export consumption, and with little price volatility. Regionally however, there was a shock.

Henry Hub prices for Jan. 2 and Jan. 3 were $6.24 per million Btu (MMBtu), dropping to $4.65 on Jan. 4. That same day the price at the Dawn Hub in Ontario that supplies significant quantities of gas to the Northeast was about twice as high at $8.20/MMBtu.

The New York spot price at New York on Jan. 4 was not twice or three times Henry Hub, but an order of greater magnitude: $159.60/MMBtu.

To be sure, the spike was as short as it was sharp. Ratepayers in New York and New England may not have even noticed. But midstream operators, gas marketers and power generators certainly did. There was a lively discussion about the role of natural gas in power efficiency, reliability and economy at the recent 13th annual Northeast Power and Gas Markets Conference, hosted by SD&P Global Platts.

Lurking behind the shocking price for spot buyers last winter was an unpleasant realization for the gas industry: “As the gas price spiked, gas became uneconomical and was thus unavailable,” said Sherman Knight, president and chief commercial officer of Competitive Power Ventures. “The cold spike was picked up by coal and oil.”

An official from the regional wholesaler NYISO in attendance noted that dual-fuel capability—natural gas and fuel oil—is a requirement for generation in New York City and some surrounding suburban areas.

An official from the regional wholesaler NYISO in attendance noted that dual-fuel capability—natural gas and fuel oil—is a requirement for generation in New York City and some surrounding suburban areas.

“We fell back on oil-fired generation, despite the reliance on gas for the base,” said Manan Ahuja, senior director of North American electric power for PIRA Energy, part of S&P Global. “ISO New England has become dependent on gas as a result of retiring coal-fired plants and building new gas-fired ones.”

But now the region finds it tough to get more gas.

“In New England the gas risk is now stark,” Ahuja said. “There are supply issues in New England already, and when New York retires Indian Point [Energy Center with three nuclear power units] it will be even harder to get gas into New England.”

The multiple ironies of this were reiterated by several speakers:

- The Northeast is already at or close to the limits of current gas pipelines into the region;

- It pays some of the highest prices in the country for natural gas; and

- State governments, especially the administration of Gov. Andrew Cuomo in New York, have repeatedly blocked, delayed, or litigated multiple efforts to build new lines into the region.

It has been noted that it is cheaper and easier to get Marcellus ethane 3,000 miles by ship to petrochemical companies in Europe than it is to get Marcellus methane 300 miles by pipe to New York City.

Knight added a further frustration for midstream operators and gas sellers. “The Northeast is not resource-rich in renewable energy. It is not exactly the Riviera of America. You don’t look for cases of rickets in southern California, but in Boston at the end of a long winter. Renewables will be built over time, but they do not have the same potential in the Northeast as elsewhere in the country.”

The inherent demand in the region means that midstream has an obligation to keep trying, said Knight. “Some lines are being built despite the litigation and permit delays. It is not entirely responsible for our industry to give up just because New York is being difficult.”

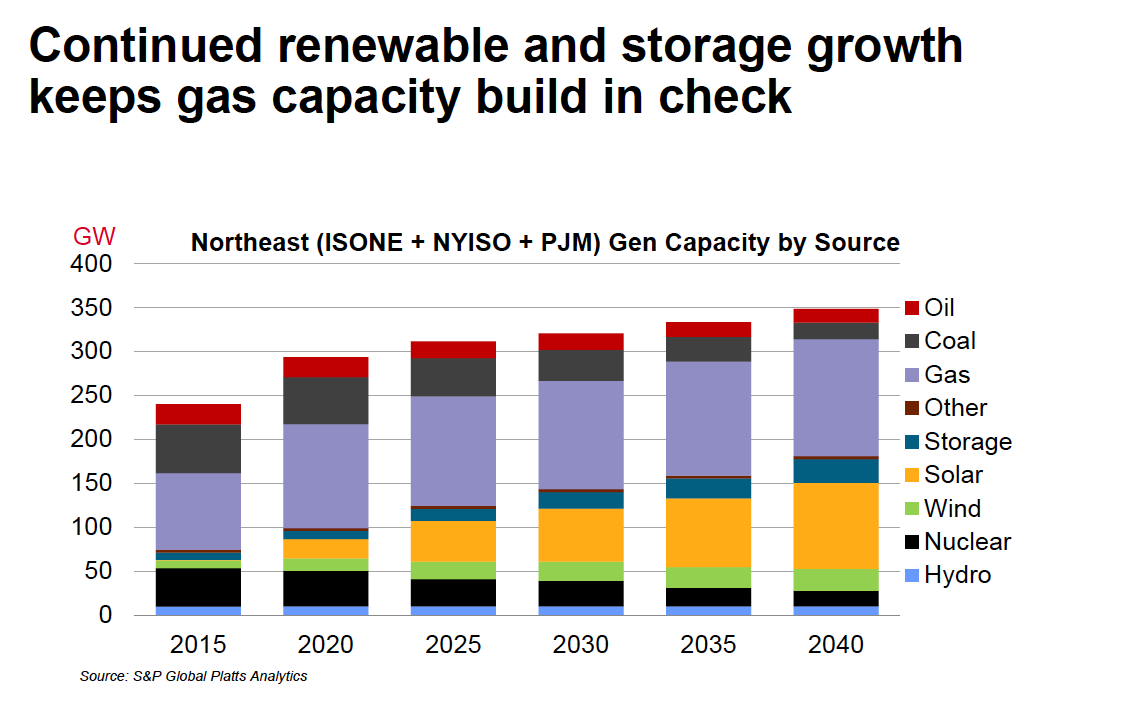

Ahuja jestingly suggested that New England may have to go back to more oil-fired power but said seriously, “New England will have to get gas, or will have to depend on LNG.” He offered a slide showing projected fuel mix in the Northeast out to 2040 (see charts).

By LNG he meant imports, because there are no gas ships that comply with the cabotage laws of the U.S. Jones Act to take LNG from the Gulf Coast or even Cove Point, Md., coastwise to New York or New England.

“These [supply and cost] concerns are actually avoidable,” said keynote speaker Sara Graziano, senior vice president of corporate development at Vistra Energy Corp. (NYSE: VST). “Rather than permitting U.S. companies to move U.S. gas through U.S.-owned pipelines built by U.S. labor, the law forces the generating industry to rely on foreign gas.” Vistra Energy is the parent company of TXU Energy and Luminant. On April 9, it completed the acquisition of Dynegy.

Technically gas from Canada is foreign, but Chris Shorts, director of storage, transportation, marketing and utilization at Union Gas, offered a North American perspective. Union Gas, part of Spectra Energy and thus now part of Enbridge Inc. (NYSE: ENB), operates the Dawn Hub.

“We have the capacity to get about half a B[illion cubic feet a day] to the Northeast over the next few years. We are getting more gas down Iroquois and Portland, which is being expanded. It all comes down to the ability to build south of the border. On the Canadian side we can add compression or pipe. We can add another corridor. TransCanada has the capacity.”

Recommended Reading

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

US Drillers Cut Oil, Gas Rigs for Second Week in a Row

2024-11-22 - The oil and gas rig count fell by one to 583 in the week to Nov. 22, the lowest since early September. Baker Hughes said that puts the total rig count down 39, or 6% below this time last year.

Water Management Called ‘Massive Headwind’ for Permian Operators

2024-11-21 - Amanda Brock, CEO of Aris Water Solutions, says multiple answers will be needed to solve the growing amounts of produced water generated by fracking.

Coterra Takes Harkey Sand ‘Row’ Show on the Road

2024-11-20 - With success to date in Harkey sandstone overlying the Wolfcamp, the company aims to make mega-DSUs in New Mexico with the 49,000-net-acre bolt-on of adjacent sections.

Suriname's Staatsolie Says Exxon has Withdrawn from Offshore Block

2024-11-20 - Suriname's state-run oil company Staatsolie said on Nov. 20 that U.S. oil giant Exxon Mobil has withdrawn from its offshore block 52, and block operator Petronas Suriname E&P will take over its 50% stake.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.