Northern agreed to acquire nonop Williston Basin assets from Tailwater Capital-backed Pivotal Petroleum at an attractive valuation, according to Seaport Global analysts. (Source: Hart Energy and Shutterstock.com)

Northern Oil and Gas Inc. (AMEX: NOG) added “significant production” to its nonop Williston Basin position with an acquisition worth roughly $151.8 million in cash and stock, the company said July 18.

The acquisition, consisting of wells in the core of the Williston in North Dakota currently producing over 4,100 boe/d, is expected to make the Minneapolis-based E&P cash flow positive immediately upon closing.

The company agreed to acquire the assets from Pivotal Petroleum Partners for $68.4 million cash and 25.75 million shares of Northern stock. Analysts with Seaport Global Securities pegged the assets’ price tag at roughly $151.8 million, or about $37,000 per boe/d, assuming the closing price of Northern stock on July 17 of $3.42.

Overall, Northern’s acquisition was inked at an attractive valuation “significantly below PDP value” at PV-15 or better at Strip prices, Seaport analysts said in a July 19 research note.

Following close of the transaction, Pivotal, which was formed in 2013 to acquire nonop oil and gas assets across North America, will own a roughly 9.1% stake in Northern. The company is backed by private-equity firm Tailwater Capital.

Northern’s founder and president, Mike Reger, welcomed Pivotal as a new, significant shareholder in the company. Reger also added that the strong free cash flow and high rate of return from the acquired assets are “transformative” for Northern.

“The combination of this asset, along with our significant and growing core inventory of future drilling locations and the outstanding well results we have seen so far in 2018, will achieve our goal to be cash flow positive upon closing, with below-peer debt metrics in 2019,” he said in a statement.

Northern expects the acquired assets to generate roughly $56 million of cash flow from operations over the next 12 months. The company also plans to enter into commensurate hedge agreements for a significant portion of the acquired volumes.

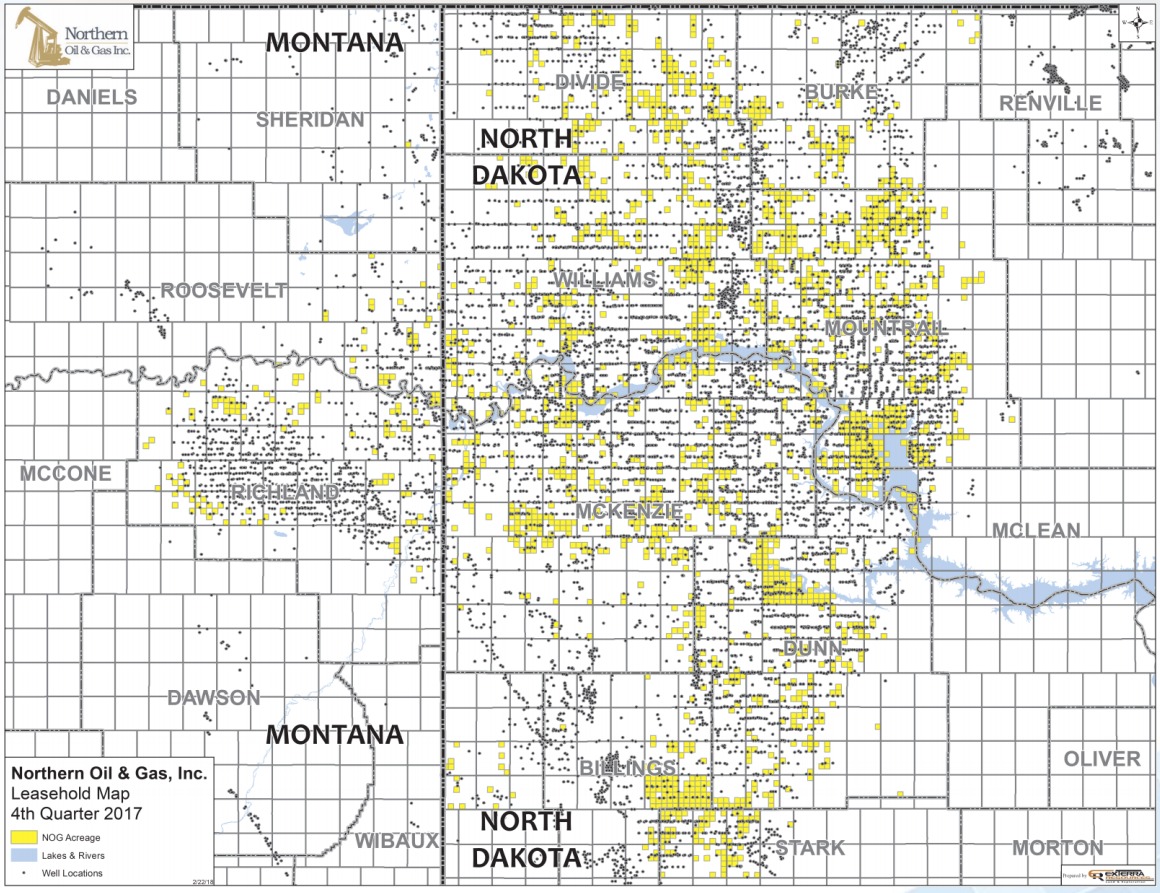

Northern is an E&P with a nonoperator strategy focused in the Williston Basin’s Bakken and Three Forks play in North Dakota and Montana, where A&D activity has remained steady so far in 2018.

RELATED: Bakken A&D Remains Steady Despite Overall Slowdown

“The good news for us is there are a lot of stranded and smaller size assets that don’t matter to larger funds and operators. And the prices are not outrageous, but quite economically reasonable,” Northern CFO Nicholas O’Grady recently told Hart Energy’s Oil and Gas Investor.

So far this year, Northern has been an active acquirer in the Williston. Including the Pivotal deal, the company has spent roughly $280 million on acquisitions in the basin.

Still, Northern has a backlog of nonop assets either possibly for sale or actively marketed, with a value “in the multiple billions of dollars,” O’Grady said. The company holds about 143,000 net acres of nonop assets in the Williston Basin, according to a February investor presentation.

O’Grady spoke to Oil and Gas Investor in early July following the announcement that Northern’s CEO, Reger, would switch titles with President Brandon Elliott.

“I was surprised that [Elliott] agreed to be the CEO in the first place,” he said. “Investor communications and day-to-day operations take too much time away from his main focus, which is to grow the company through land and asset acquisitions.

Northern’s agreement with Pivotal contains a mechanism for potential additional consideration to be paid during the 13-month lock-up period if Northern’s common stock trades below certain price targets. The acquisition is expected to close in roughly 60 days, with an effective date of June 1.

Additionally, Northern separately announced July 18 a debt exchange to swap $9.9 million of 2020 notes for roughly 3.1 million in common stock. Combined with three separate debt exchanges announced over the past month, Northern has retired about $63.7 million worth of notes due 2020, Seaport analysts said.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

Sintana Reports Two Discoveries Offshore Namibia

2025-01-06 - Sintana Energy Inc. said the Mopane-2A well found gas condensate in one reservoir and light oil in a smaller one.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Chevron Completes Farm-In Offshore Namibia

2025-02-11 - Chevron now has operatorship and 80% participating interest in Petroleum Exploration License 82 offshore Namibia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.