Nick O’Grady, Northern Oil and Gas CEO, at Hart Energy’s A&D Strategies and Opportunities conference in Dallas.

Oil producers are running out of fairway with just the economic new-well prospects they have now, according to a non-op interest owner in 10,000 Lower 48 wells.

In a heated M&A run during the past two years, “what you'll find out is that the best stuff, in many cases, especially for the operators, has already been bought.

“That's why now they're all resorting to buying each other,” Nick O’Grady, Northern Oil and Gas CEO, told deal-makers, financiers and investors at Hart Energy’s A&D Strategies and Opportunities conference in Dallas.

He suggested producers “buckle up for the next few years and hold onto the assets you have—and get more if you can—because longer term I think scarcity is coming.”

“And it's going to require a new pivot from the industry—whether that's exploration or other creative measures,” he said.

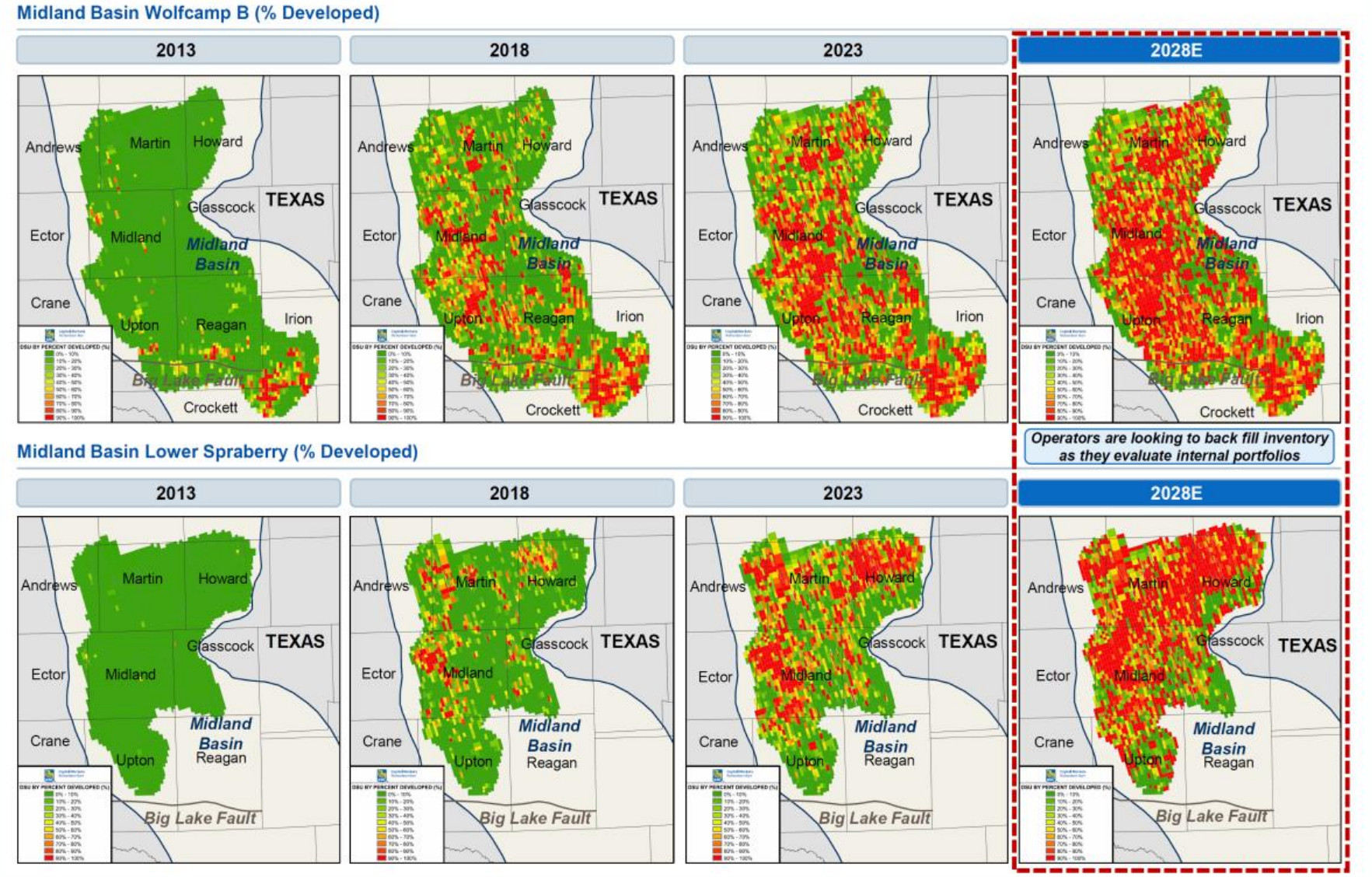

In the Midland Basin, for example, today’s primary targets—Lower Spraberry and Wolfcamp B—will be mostly drilled up in the core by 2028, he expects.

“In my opinion, public investors vastly overestimate public companies’ inventories or, at least, their current [inventory at] economic levels,” he said.

“Shale is really in the later innings of its life and its ability to keep growing in the short term may not be effective.”

“…It's going to become increasingly challenging and certainly more expensive to extract that oil.”

But oil demand in the long term “is fine. It keeps growing,” he said. “Maybe it hasn't been what we've hoped for. But it continues to grow.”

Global demand is 103.9 MMbbl/d, he said, up some 1 MMbbl/d from year-end 2023.

Initially, future prospects may not seem as attractive currently as the hot spots—Wolfcamp, Bone Spring, Spraberry, Bakken, Eagle Ford, Woodford, Niobrara and others.

But “you don't have to look too far out to get a lot more assured over [oil demand’s] ability to sustain and grow,” he said.

“…It’s setting up a much rosier long-term picture.”

‘Thrilled’ in the Uinta

Northern did find a long fairway on the oily western side of Utah’s Uinta Basin this summer, picking up 20% interest in XCL Resources and Altamont Energy for $530 million in an SM Energy-led deal that brought SM an 80% interest for $2 billion.

The nonop’s biggest acquisition to date, it gained 15,800 net acres with 116 net PUDs—plus prospects for additional well locations.

“We're thrilled,” O’Grady said at the A&D conference. “We have decades of work to do here, and I think we're just scratching the surface of what's possible technically.”

The Uinta has recently been unleashed by Fort Worth, Texas-based operator Finley Resources, which built, with Energy Transfer, a rail-transfer facility on the basin’s southside, sending the prized waxy crude to markets south and east.

Prior, basin production was capped at just under 100,000 bbl/d when market access was economically stranded to only Salt Lake City’s refineries.

Output in June was 176,000 bbl/d, according to the Utah Department of Natural Resources.

The XCL and Altamont property on the basin’s northwestern side “sits in the core of the Uinta Basin and has a significant runway of opportunities,” O’Grady said.

Payzones are stacked, numbering up to 17 layers that can be tapped with laterals.

“It's productive like the Delaware,” he added. “But it has the cost structure of the Midland.”

The takeaway costs—by insulated tanker that prevents the warmed crude's wax from solidifying on the way to Salt Lake City west or to the rail terminal south—is “the only real downside,” O’Grady said.

This is “something [Uinta operators are] continuing to find ways to improve.” Still, “today the economics are just as good” as other oil plays.

“That explains in part why it's been the fastest-growing basin in the U.S. over the past few years, with some of the biggest oil EUR seen in the Lower 48.”

Not all operators are alike

Northern holds, on average, a 10% interest in roughly 10,000 wells operated by more than 100 E&Ps in the Williston, Permian, Appalachian and Uinta basins—giving it a broad, inside look at well cost and performance.

Net leasehold is 292,000 acres. Its share of production is 75,000 bbl/d and, on a two-stream basis, 125,000 boe/d.

The company formed in 2006, buying small interests in prospective leasehold for stimulated, horizontal Middle Bakken production as legacy producers were beginning to try the technique in the oil-saturated, but dense, rock that had historically been a bail-out zone.

Now, “we're in over half of every well ever drilled” there, O’Grady said.

With that comes all the well data—including what isn’t in public records. The data show rock quality can’t overcome poor E&P operations, he said.

“Even to this day, there are two major operators in North Dakota who abut each other, and there's nearly a 40% difference in their returns.”

O’Grady did not identify the two operators.

Public records alone aren’t useful when deciding what non-op interests to buy. Just “looking at a well queue is not ‘full’ data,” he said.

“I can show you a lot of … wells that are really uneconomic because they cost a lot of money to drill or they took two years to go online or they have terrible midstream contracts.

“The data doesn't tell you everything.”

Operators themselves typically hold non-op interests in peers’ wells, getting a look over the fence at neighbors’ costs and results.

At Northern, though, “we just have it covered across the entirety [of the Bakken].”

With that information, Northern will try to show partners “where the netbacks are from one operator to another.”

“We really do try to share that data where we see material discrepancies.”

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Elliott Nominates 7 Directors for Phillips 66 Board in Big Push for Restructuring

2025-03-04 - Elliott Investment Management, which has taken a $2.5 billion stake in Phillips 66, said the nominated directors will bolster accountability and improve oversight of Phillips’ management initiatives.

Activist Elliott Builds Stake in Oil Major BP, Source Says

2025-02-10 - U.S.-based Elliott is seeking to boost shareholder value by urging BP to consider transformative measures, Bloomberg News reported Feb. 8.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.