Ethane’s status as the most preferred ethylene feedstock has been challenged by propane and butane in different parts of the country. This should change as crude prices improve and, in turn, help raise heavier NGL prices. In the meantime, butane remains the most preferred in much of the U.S.

This represents another in a series of challenges over the past few years for ethane, which first had to contend with the economic downturn in 2008, followed by a tremendous storage overhang saturating the market and then a shortage of cracking capacity due to turnarounds and expansions.

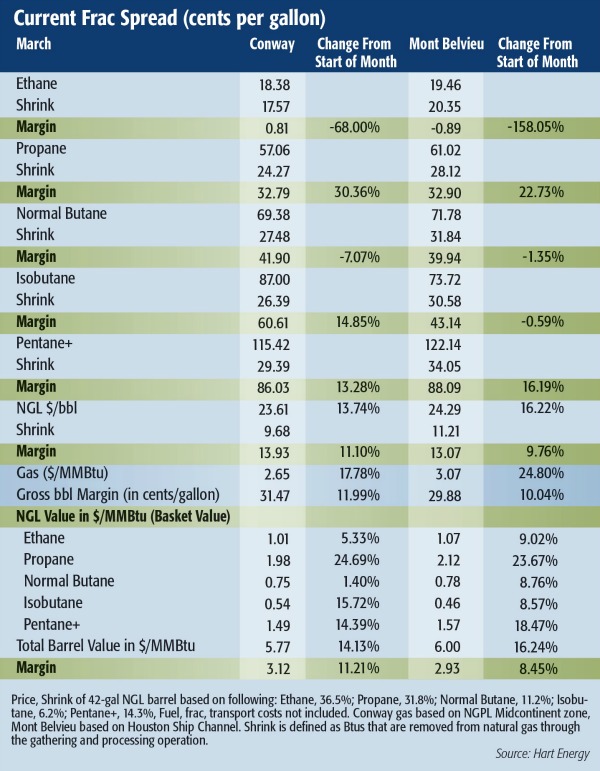

While there is still a great deal of supply to work off, cracking capacity has returned and grown. Prices have at least stabilized in recent months despite the downturn in crude prices, with frac spread margins reaching a flat state. It is likely that ethane will continue to slowly improve because it is not dependent on crude prices.

The ethane market is the lone feedstock without any relationship to crude prices. Normally this isn’t a positive considering how strong crude prices have been the last five years, but in the case of the current downturn, it benefits ethane.

That said, lower butane and propane prizes are incentivizing crackers to switch from ethane to secure the higher values those products represent compared to ethane.

Heavy NGLs also experienced gains as winter temperatures receded. West Texas Intermediate crude oil prices saw another uptick the first week of March, rising slightly above $50 per barrel (bbl). There are concerns that U.S. storage levels might reach capacity this year since the U.S. Energy Information Administration reported in March that storage increased by more than 10 million bbl (MMbbl).

Barclays Capital stated in a recent research note that increased storage levels will pull WTI prices further down in the first half, with the contango widening due to the use of more expensive storage solutions.

However, En*Vantage Inc. stated these concerns may be overblown as Cushing, Okla., hub storage levels have increased. “Cushing stock levels are just 2 MMbbl below its all-time high level reached on Jan. 11, 2013, but Cushing working storage capacity has increased [more than] 6.5 MMbbl since that peak level was reached. At 70.8 MMbbl of working capacity there is still 21.6 MMbbl of spare capacity at Cushing,” the company said in a March Weekly Energy Report.

Though commodity prices may have hit their floor earlier this year, there are still challenges in the months ahead.

Frank Nieto can be reached at fnieto@hartenergy.com or 703-891-4807.

Recommended Reading

J. Douglas Schick Succeeds PEDEVCO Majority Owner Simon Kukes as CEO

2024-12-12 - Simon G. Kukes, who took over PEDEVCO in 2018, said the company has since worked toward entering joint development agreements in the Permian and Denver-Julesburg basins.

Pinnacle Midstream Execs Form Energy Spectrum-Backed Renegade

2025-02-03 - Renegade Infrastructure, led by Permian-centric Pinnacle Midstream developers Drew Ward and Jason Tanous, have received a capital commitment from Energy Spectrum Partners.

Former IPAA Chair Steven Hinchman Dies at 66

2025-01-03 - During his time with IPAA, Steven Hinchman founded Scala Energy and became its president and CEO.

Viper to Buy Diamondback Mineral, Royalty Interests in $4.45B Drop-Down

2025-01-30 - Working to reduce debt after a $26 billion acquisition of Endeavor Energy Resources, Diamondback will drop down $4.45 billion in mineral and royalty interests to its subsidiary Viper Energy.

Natron Energy Appoints New CEO

2024-12-17 - Sodium ion battery technology company Natron Energy has appointed Wendell Brooks as the company’s new CEO to lead growth initiatives in 2025.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.