After selling oil and gas assets in New Mexico and West Texas last year, Novo Oil & Gas is reloading with EnCap backing to pursue Delaware Basin acquisitions. (Source: Shutterstock)

Novo Oil & Gas II is taking off and targeting Permian Basin acquisitions after making a $1.5 billion exit last year.

Novo Oil & Gas Holdings II LLC is launching with an equity capital commitment from private equity firm EnCap Investments, Novo announced April 23. Financial terms of EnCap’s investment in Novo II were not disclosed.

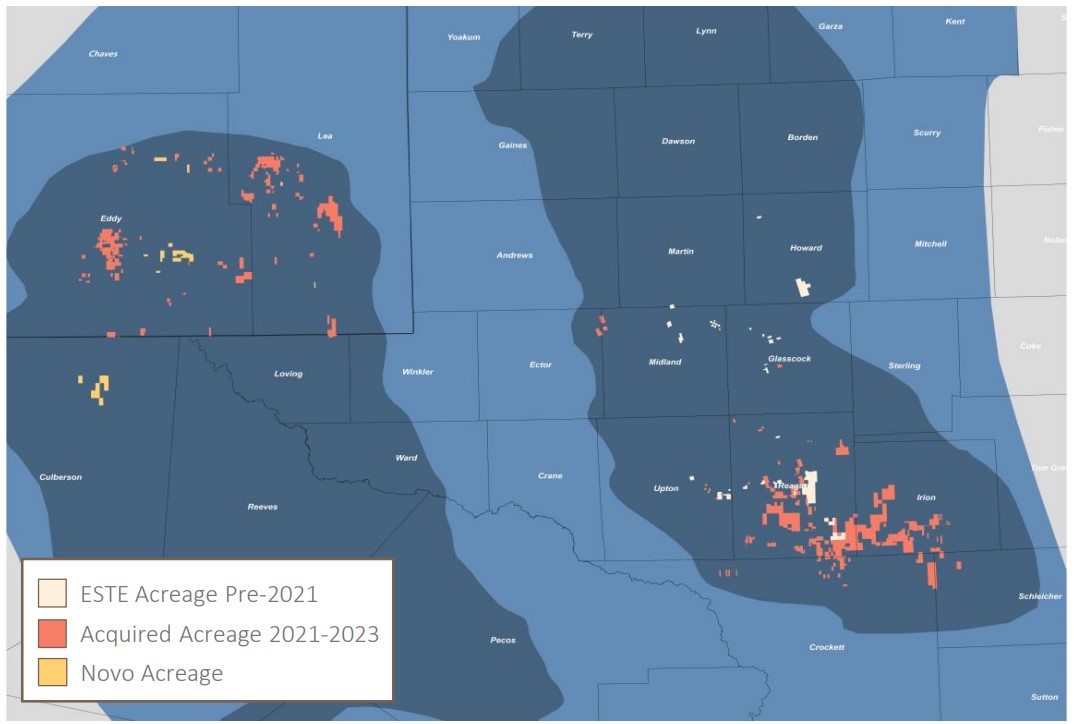

The second Novo aims to build on the strategy employed by its predecessor, Novo I, which built up a sizeable Delaware Basin position.

Novo II also plans to pursue unconventional asset acquisitions with a particular focus on the Delaware side of the basin. The company will acquire both operated and non-operated mineral positions.

The company is led by CEO and Co-Founder John Zimmerman, who served as CFO for Novo I.

“We are excited to once again focus on the acquisition and development of high-quality upstream assets throughout the Delaware Basin, one of the most prolific oil and gas regions in North America,” Zimmerman said in a release.

“EnCap has been a trusted partner for more than a decade, and we are grateful for their continued support as we leverage our existing relationships and expertise to drive value through innovative exploration, drilling and completion techniques,” he said.

The Novo II team also includes President and Chief Commercial Officer Brandon Patrick, CFO David Avery and COO Kurt Shipley. All in-house Novo II employees previously held roles within Novo I.

Formed in 2016, Novo I exited in a $1.5 billion sale to Earthstone Energy and Northern Oil & Gas last year.

Earthstone acquired two-thirds of the company for $1 billion; Northern Oil & Gas acquired a 33.33% undivided stake in the Novo assets for $500 million.

Novo’s assets included around 11,300 net acres across Eddy County, New Mexico, and Culberson County, Texas.

“Our tenured partnership with John Zimmerman and Novo has led to multiple successful exits across different basins,” said EnCap Managing Director Jason DeLorenzo. “They have a proven track record of value creation, and we look forward to continuing our successful partnership with them.”

Just days after Earthstone and NOG closed the Novo acquisition, Earthstone itself was acquired by growing Delaware Basin producer Permian Resources for $4.5 billion.

RELATED

Recommended Reading

Talos Selects Longtime Shell Exec Paul Goodfellow as President, CEO

2025-02-03 - Shell veteran Paul Goodfellow’s selection as president, CEO and board member of Talos Energy comes after several months of tumult in the company’s C-suite.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Are Shale Producers Getting Credit for Reining in Spending Frenzy?

2024-12-10 - An unusual reduction in producer hedging found in a Haynes and Boone survey suggests banks are newly open to negotiating credit terms, a signal of market rewards for E&P thrift.

E&P Consolidation Ripples Through Energy Finance Providers

2024-11-29 - Panel: The pool of financial companies catering to oil and gas companies has shrunk along with the number of E&Ps.

US Energy Secretary Nominee Chris Wright Champions Energy at DUG GAS

2024-11-19 - President-elect Donald Trump's energy secretary nominee Chris Wright championed energy's role in bettering human lives earlier this year on stage at Hart Energy’s DUG GAS Conference and Expo.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.