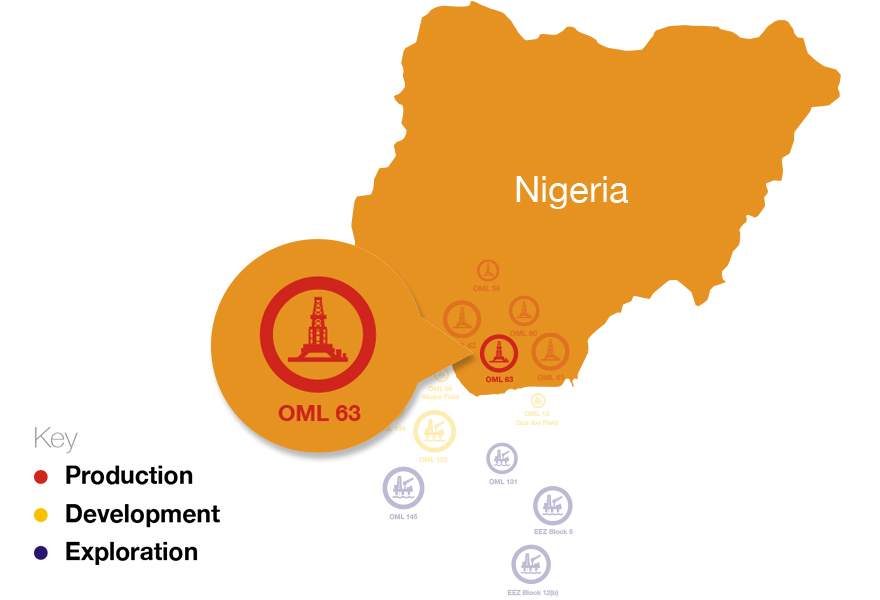

Oando’s acquisition of NAOC brings Oando’s participating interests in OMLs 60, 61, 62 and 63 from 20% to 40%. (Source: Shutterstock)

Nigeria’s Oando Plc completed the acquisition of 100% of the shareholding interest of Eni subsidiary Nigerian Agip Oil Co. (NAOC) for a total consideration of US$783 million, the company announced in an Aug. 22 announcement.

The deal is comprised of consideration for the asset and reimbursement, the company said in the press release.

Oando’s acquisition of NAOC brings Oando’s participating interests in OMLs 60, 61, 62 and 63 from 20% to 40% and increases its ownership stake of all NNPC E&P Ltd. (NEPL)/NAOC/OOL joint venture assets and infrastructure.

Oando now has increased ownership in 40 oil and gas fields, of which 24 are currently producing, as well as 40 identified prospects. The acquisition also expanded its stake in 12 production stations, approximately 1,490 km of pipelines, three gas processing plants, the Brass River Oil Terminal, the Kwale-Okpai Phases 1 and 2 power plants and associated infrastructure, Oando said.

“With our assumption of the role of operator, our immediate focus is on optimizing the assets' immense potential, advancing production and contributing to our strategic objectives,” Oando Group CEO Wale Tinubu said.

The transaction delivers a 98% increase of 4993.6 MMboe to its reserves, bringing its total reserves to 1 Bboe.

Immediately cash generative, the deal will add significantly to Oando’s cashflows.

"Today's announcement is the culmination of ten years of toil, resilience, and an unwavering belief in the realization of our ambition since the 2014 entry into the joint venture via the acquisition of Conoco-Philips’ Nigerian portfolio,” Tinubu said. “It is a win for Oando, and every indigenous energy player, as we take our destiny in our hands, and play a pivotal role in this next phase of the nation’s upstream evolution.”

Recommended Reading

Gas & Midstream Weekly: Cushing Crude Storage Levels Near All-Time Lows

2025-01-16 - Low levels of crude in storage could cause problems across the U.S. supply chain; a "gas super-cycle" may be coming; and Liberty Energy's Chris Wright testifies to the Senate.

Permian Resources Divests Delaware Basin Midstream Assets to Kinetik

2024-12-10 - The deal includes approximately 60,000 gross operated acres dedicated by Permian Resources under long-term, fixed-fee agreements for natural gas gathering, compression and processing and crude oil gathering services, Kinetik said.

Uinta’s Scout Energy Likely Not for Sale as Takeaway to Gulf Rises

2024-12-11 - Despite the Uinta Basin’s recent flurry of M&A activity, Scout Energy Partners isn’t looking to sell anytime soon, said the company’s executive vice president, Juan Nevarez, at Hart Energy’s Executive Oil Conference.

Shale Outlook: Power Demand Drives Lower 48 Midstream Expansions

2025-01-10 - Rising electrical demand may finally push natural gas demand to catch up with production.

Polar LNG Express: North American NatGas Dynamics to Change with LNG Canada

2025-02-21 - The next major natural gas export project in North America has a location advantage with Asian markets. LNG Canada opens up a new pathway that will change the price dynamics for producers.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.