Calgary, Alberta-based Obsidian Energy is divesting operated Pembina assets to InPlay Oil Corp. for CA$320 million (US$224.7 million) in cash, equity and asset interests, according to a Feb. 19 press release. (Source: Shutterstock)

Calgary, Alberta-based Obsidian Energy is divesting operated Cardium Pembina assets to InPlay Oil Corp. for CA$320 million (US$224.7 million) in cash, equity and asset interests, according to a Feb. 19 press release.

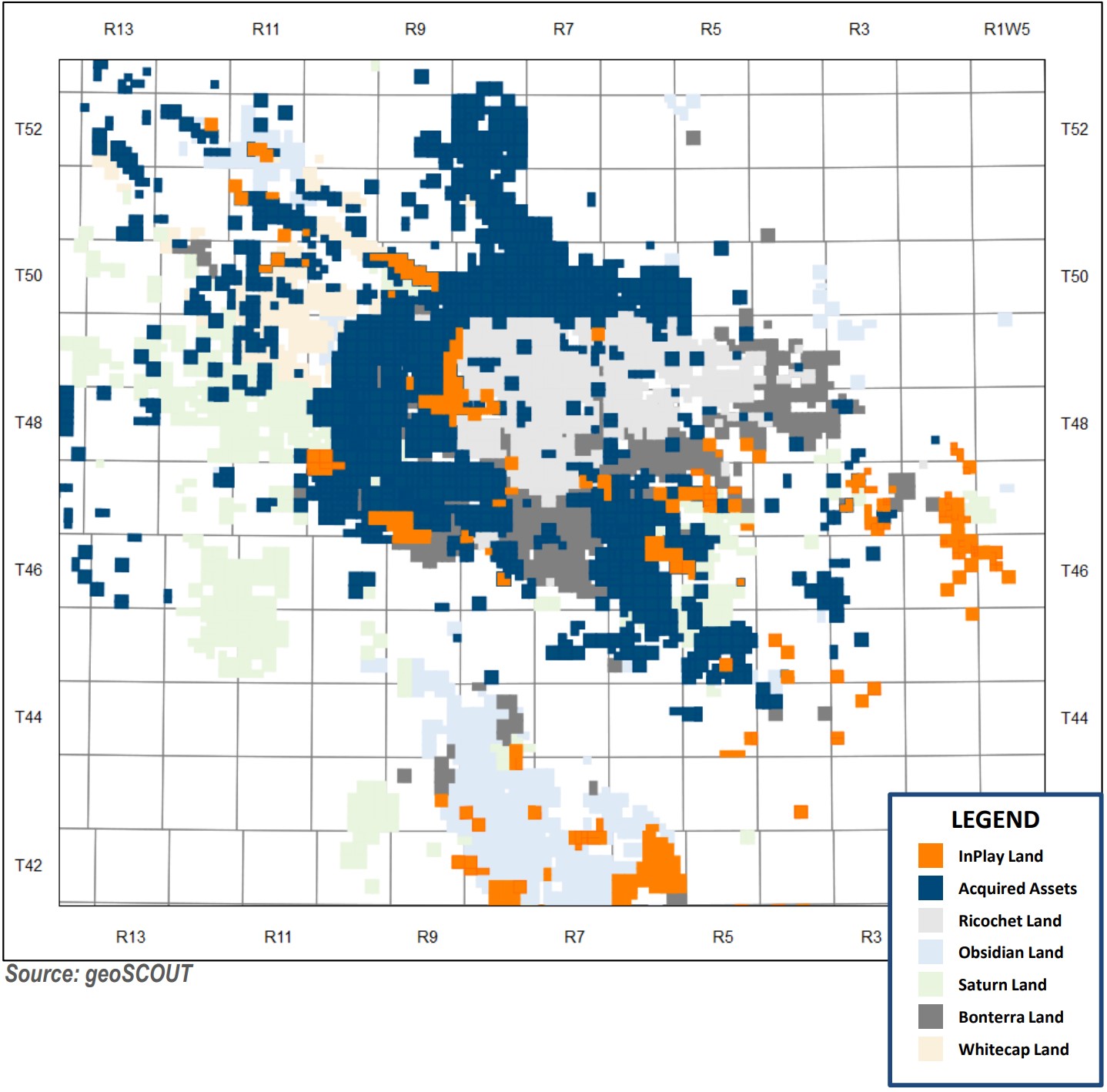

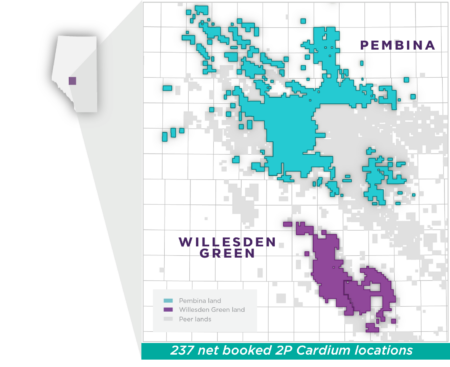

The Pembina assets include 498 net sections of lands in the Pembina area of Central Alberta, including associated facilities and gathering systems.

Obsidian said it will retain its non-operated holdings in the Pembina Cardium Unit #11, which was estimated to have an average fourth-quarter production of approximately 2,500 net boe/d.

Calgary-based InPlay will pay Obsidian CA$220 million in cash, CA$85 million of common shares and InPlay’s 34.6% working interest, valued at CA$15 million, in the Willesden Green Cardium Unit #2 oilfield.

Following the transaction, Obsidian’s ownership of Willesden will increase to 99.8% and is expected to boost its production in the field by approximately 150 net boe/d, the company said.

Pro forma, Obsidian Energy will have an estimated production base of over 29,000 boe/d, President and CEO Stephen Loukas said. Obsidian's average production in the fourth quarter was approximately 40,000 boe/d, the company said in January.

Obsidian said the sale will allow the company to focus on its now largest asset, the Peace River play. The asset will account for 42% of Obsidian’s total production and 33% of its total proved plus probable reserves, based on fourth-quarter 2024 estimates.

Cash proceeds from the sale are expected to reduce Obsidian’s debt to CA$192 million (US$134.85 million), the company said.

“The successful execution of our growth plan to date has put us in a position to rationalize our asset portfolio at a value that we believe to be accretive to our shareholders, while securing increased financial flexibility and meaningfully reducing asset retirement obligations,” Loukas said.

Obsidian will also be entitled to two nominees on InPlay’s board of directors at transaction close, which is expected for early second-quarter 2025.

RBC Capital Markets is acting as exclusive financial adviser and Burnet, Duckworth & Palmer LLP and Stikeman Elliott LLP are acting as legal counsel to Obsidian Energy on the Transaction.

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

Equinor’s Norwegian Troll Gas Field Breaks Production Record

2025-01-06 - Equinor says its 2024 North Sea production hit a new high thanks to equipment upgrades and little downtime.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.