Backed by federal and state incentives, companies such as Occidental’s 1PointFive, are pushing forward with DAC projects in an effort to lower emissions and slow global warming. (Source: Shutterstock)

The first phase of Occidental Petroleum’s direct air capture (DAC) project Stratos is about 90% complete and on track to begin operations mid-2025 with a new design, company executives say.

And despite fears by many that clean and lower-carbon energy setbacks are inevitable with President-elect Donald Trump returning to the White House, Occidental CEO Vicki Hollub said the next president will be positive for the U.S. energy industry, especially DAC.

“I believe he understands better than anybody our need for energy independence here in the United States. He understands the industry. He understands how it plays in geopolitical politics,” she said Nov. 14 on the company’s third-quarter 2024 earnings call. “He knows what we’re trying to accomplish and what we’re doing. And he also understands the part that our direct air capture will play in helping with that energy independence and security.”

Backed by federal and state incentives, companies such as Occidental’s 1PointFive, are pushing forward with DAC projects in an effort to lower emissions and slow global warming.

Unlike more traditional carbon capture projects that, for example, target CO2 emissions form flue gas streams with post-combustion technology, DAC pulls CO2 directly from the air with the help of giant vacuums, heat, chemicals and filters. The process is energy intensive, which drives its higher cost compared to other methods of capturing CO2.

Maintaining support

Developers of DAC projects are counting on continued support to help make projects economic.

Enacted under the Biden administration, the Inflation Reduction Act of 2022 increased the 45Q tax credit for DAC to $180 per ton of CO2 permanently stored and $130 per ton for used CO2. The Infrastructure Investment and Jobs Act, also signed into law by President Joe Biden, has also paved a path to DAC project funding, including for the South Texas Direct Air Capture facility that Oxy’s 1PointFive is developing in Kleberg County.

The U.S. Department of Energy announced in September that 1PointFive secured funding for the South Texas hub. The facility will initially be capable of removing and storing 500,000 metric tons of CO2 per year. But that could increase to more than 1 million tons per year in the future.

“We do expect to get the $500 million with the potential for $650 million,” Hollub said. “We also believe that 45Q will continue to have bipartisan support.”

The tax credit not only incentivizes companies to decarbonize, the captured CO2 can also be used to recover more U.S. oil reserves, she said. “President Trump clearly supports that as well.”

Occidental is already getting DAC costs down with Stratos. It intends to carry those learnings on to other DAC projects.

Staying on track

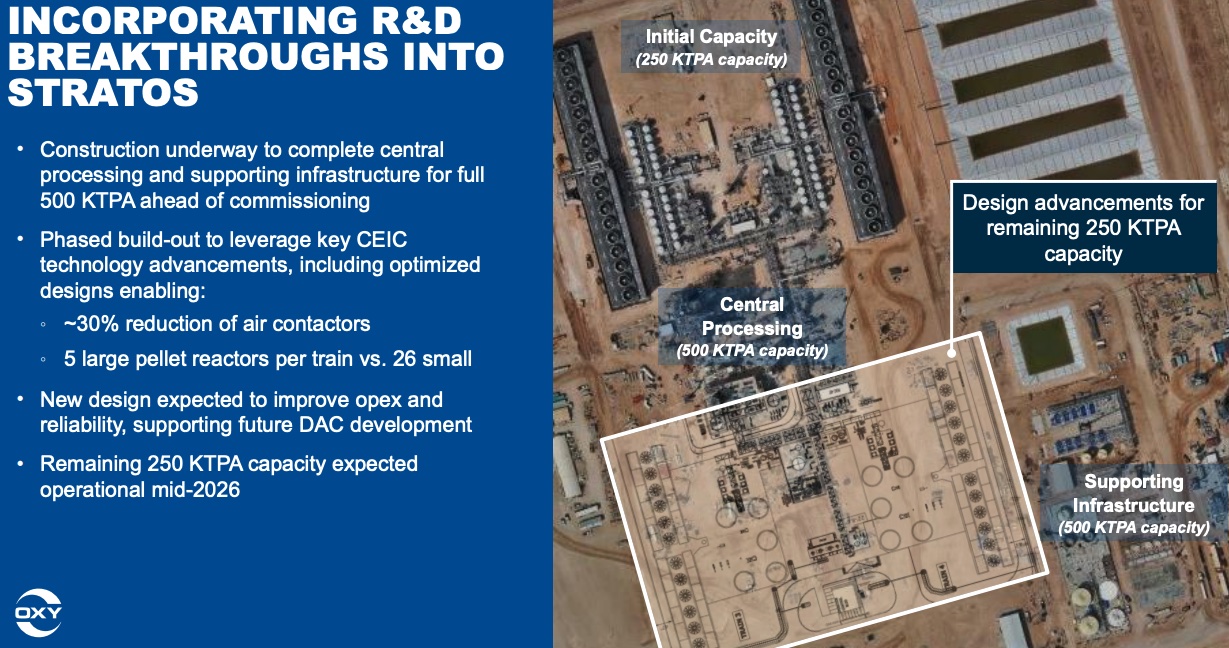

Expected to be the world’s largest DAC facility, Stratos is designed to capture up to 500,000 metric tons of CO2 annually when it becomes fully operational. Overall, the project—being developed in phases on a 65-acre site in Ector County, Texas— is about 70% complete. The first phase includes two capture trains and central processing. Currently, construction is underway to finish central processing and supporting infrastructure.

“The new design will feature fewer air contactors and fewer pellet reactors, which should reduce operating expenses and increase reliability,” Hollub said. “We expect to bring the initial 250,000 tons per annum of capacity online in mid-2025, with the additional 250,000 tons to phase in during the next year incorporating those improvements.”

Occidental expects to see savings between 10% and 15% from project modifications resulting from an improved air contactor construction method. The optimized design enables about a 30% reduction of air contactors and five large pellet reactors per train vs. 26 small ones, the company said.

Hollub envisions Oxy’s DAC business fitting into the same category as its chemicals business or gas business in the Middle East.

“I think DAC is going to be a value creator and a cash flow generator for us for a long time. We have work to do in the near-term,” Hollub said, later pointing out support for the technology.

She added, “We’re already working down on the cost curve. We’re already looking at opportunities for improvements in DAC 2. So, we do believe that the commerciality is still there for these units, and the market is getting stronger all the time.”

Recommended Reading

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.