Occidental Petroleum started its pursuit of Anadarko Petroleum back in 2017 when Anadarko CEO Al Walker and Occidental CEO Vicki A. Hollub had their first meeting.

DENVER—At turns feeling like “suckers” or simply confused, Occidental Petroleum Inc.’s two-year saga to buy Anadarko Petroleum turned from finesse to hardball as the company negotiated a deal valued at $55 billion.

In May 2017, on his first day at Occidental, CFO Cedric Burgher was told the company had set its sight on acquiring Anadarko.

“I was like, ‘Woah, wait a minute, can we slow the bus down a little bit,’” Burgher said at a keynote luncheon address on Aug. 12 at EnerCom’s The Oil & Gas Conference.

Burgher defended the deal as well as a recent joint venture (JV) with a Colombian company in the Midland Basin that Pioneer Resources Inc. CEO Scott Sheffield said was largely noncore acreage.

“We acknowledge this is a bold move for Occidental,” Burgher said. But, by 2022, the company’s acquisition stands to double free cash flow, after dividends, compared to its previous plans.

RELATED:

Pioneer Takes Aim At High-Grading Prized Permian Basin Position

Occidental Completes Anadarko Petroleum Acquisition

The company is also touting 10% lowering costs and more than 10 billion barrels of oil equivalent acquired at $2 per barrel. Burgher also said the company sees potential upside, including in Anadarko’s Gulf of Mexico (GoM) assets that it hasn’t publicized.

Nevertheless, Occidental’s initial plan has been to build a company that could keep its dividend intact, generate cash flow organically and keep production flat at WTI prices of $40 per barrel.

Burgher noted that Occidental stuck with dividends through the downturn and returned $3.6 billion to shareholders in 2018, including $1.3 billion in share repurchases. However, the company’s business development team had also “scoured the universe for a way to accelerate or do something in M&A that would accelerate the breakeven plan.”

Anadarko’s assets, it discovered, were the ideal counterpart, he said.

“This was the deal,” he said. “It’s the only corporate deal we’ve considered or pursued since this leadership’s been in place.”

Rejections

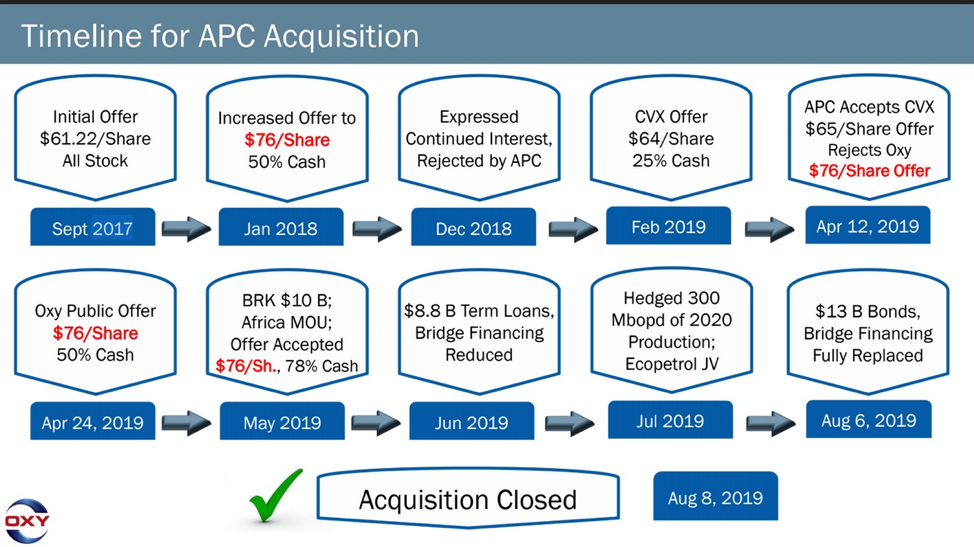

The business development team brought it to management in early 2017 and, in July of that year, it was taken to the board. In August 2017, Occidental CEO Vicki A. Hollub and Anadarko CEO Al Walker had their first meeting. Hollub formerly offered $61.22 per share on Oct. 13, 2017. Anadarko’s closing stock price that day was $47.79 per share.

Anadarko rejected the offer.

“They said they were undervalued,” Burgher said. “We were offering a big premium. They just weren’t ready to sell.”

On several occasions, Occidental’s advisers urged the company to go public with the offer or make a hostile takeover attempt.

Burgher said the company decided “we were only going to consider it on a friendly basis.”

In January 2018, the company made another offer: $76 per share, including 50% cash. Burgher met with his CFO counterpart at Anadarko for a day.

“That was rejected,” Burgher said, adding that Anadarko “told us to go away for a year and forget about them.”

Occidental waited roughly 11 months and asked again about its offer.

“The answer was no interest. We pounded sand,” Burgher said.

Then, in February 2019, Chevron Corp. “comes into the party. We didn’t know that.”

Chevron’s offer was $64 per share and 25% cash.

“A few weeks later, they’re negotiating that deal. We were called to come back in [and told] ‘if you’re still interested, somebody else has come in.’”

Occidental offered $76 per share but Burgher said Anadarko advised them they “didn’t need to come back in with 50% cash. You don’t need that much debt. Come in 25% cash, that’ll be enough.”

“So, we did that, suckers that we were. It was rejected. Not enough cash,” Burgher said, eliciting laughs from the luncheon crowd.

Burgher said he was just as surprised as other onlookers when Anadarko announced a deal with Chevron in April 2019.

“We didn’t understand why the seller would accept an offer that much lower, $11 a share lower than ours,” he said.

Shortly after Chevron’s deal was announced, word leaked that “we had made an offer substantially higher than Chevron’s. And our new best friends were the Anadarko shareholders,” who Burgher said preferred Occidental’s offer.

Occidental went public April 24 with its offer—essentially the same as it had made in January 2018—to buy Anadarko for $76 per share and 50% cash.

Occidental’s subsequent decision to up the cash portion to 78% was based on “information that led us to believe if we didn’t move quickly we would lose the deal, the [$1 billion] breakup fee would go up or they would get their proxy filed and the hurdle to close the deal gets higher,” Burgher said.

Once the deal was accepted as superior, and Chevron declined to bid higher, the deal was set. However, Occidental was already moving to put together the money it needed for the deal.

Burgher noted that Berkshire Hathaway chairman and CEO Warren Buffett offered $20 billion to help Occidental close the deal, but “$10 billion was all we needed,” he said.

In July, the company also put together “what may be one of the largest hedge positions ever done in this business.” The company hedged 300,000 barrels of oil per day to protect 2020 cash flows.

“We did it very stealthily,” he said.

Occidental also sold $13 billion in bonds to finance its deal, which Burgher called the “largest bond deal ever done.”

Cleaning Up

The company is now the top producer and acreage holder in the Permian Basin, as well as the top producer in the Denver-Julesburg Basin and Uinta Basin and the fourth largest producer in the GoM.

Burgher said the company has targeted up to $15 billion in divestitures, including the sale of its African assets to Total SA for $8.8 billion.

Burgher hinted that some of its newly acquired GoM assets may be up for sale, though he said the assets’ free cash flow makes them “a keeper.”

Occidental is “trying to be pretty coy about what we’re willing to sell because you don’t want to front-run a sale process,” he said.

Occidental also announced a $1.5 billion JV with Colombia’s Ecopetrol SA on July 31. The JV will target 97,000 net acres held in the Midland by Occidental. Ecopetrol will pay $750 million at closing for purchase 49% of the acreage position and 75% of Occidental’s capex up to $750 million.

On an Aug. 7 earnings call, Sheffield said the deal, which works out to about $31,500 per acre, gave a rich value to leasehold he considers mostly noncore.

“In our treasure maps in the Midland Basin where [we’re] the experts, only 15% of that acreage was in core [areas], 85% was noncore. So, it seems like a very, very high price for noncore acreage,” Sheffield said. “We would sell noncore acreage all day long at $31,500 per acre,” he said.

Asked by Hart Energy about Sheffield’s comments, Burgher weighed Sheffield’s assessment before answering, “Do I agree with it? No,” Burgher said.

Burgher said investors should look at well performance. Without mentioning Pioneer by name, he added, “If you aren’t making many good wells, you’ve got to be questioning how good are they? Look at the scorecards on by-well performance and how many great wells they can produce.

“Then look at the cost. Look at the proppant loading,” he said. “If it takes a lot of proppant to load it up, you may be destroying value at the NPV.”

The JV and the asset unite quality assets and Occidental’s operational prowess, Burgher added.

“We think it’s a good asset and we think we’ll make some good wells,” he said. “Also, there’s good enhanced oil recovery potential for that—something that we have good experience in already and we think we can take some of that to the Midland Basin.”

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

EIA Reports Big NatGas Withdrawal, as Expected

2025-02-27 - According to the EIA’s weekly storage report, natural gas levels are 238 Bcf below the five-year average and 561 Bcf below the level from the same time last year.

NatGas Prices Jump on Forecast of Widespread Freeze

2024-12-30 - The National Weather Service predicts a mid-month, lingering cold snap for much of the U.S., prompting natural gas prices to increase by roughly $0.50 per MMBtu.

Natural Gas Prices Shoot Past $4

2025-02-19 - The market has responded to an oncoming cold snap, sending natural gas prices at the Henry Hub over $4/MMBtu.

EIA Reports Larger-Than-Expected NatGas Withdrawal, Again

2025-02-20 - The storage drop failed to offset warmer forecasts, as natural gas prices dipped following a three-week rally.

EIA: NatGas Storage Withdrawal Misses Forecasts by 20 Nearly Bcf

2025-01-23 - Natural gas prices fell following the release of the U.S. Energy Information Administration’s weekly storage report showing a near-20 Bcf miss on analysts’ expectations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.