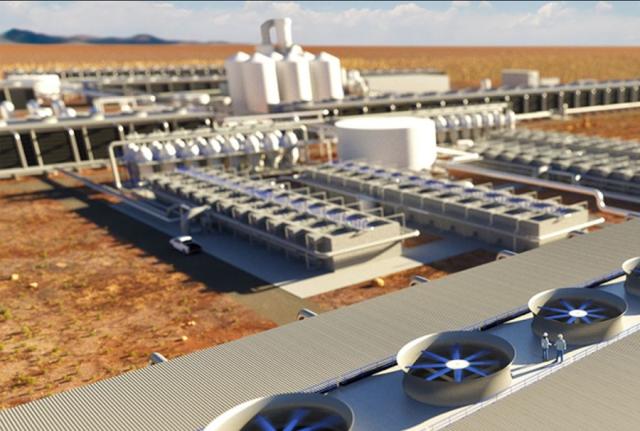

An artist's rendering of a direct air capture facility. (Source: Carbon Engineering Ltd.)

Occidental Petroleum and Abu Dhabi National Energy Co. (ADNOC) are assessing a potential investment partnership centered around direct air capture (DAC) of CO2 in the U.S. and the United Arab Emirates (UAE).

The companies are considering investment opportunities in DAC facilities and carbon sequestration hubs.

Under the terms of a memorandum of understanding (MOU), ADNOC may evaluate participation in DAC plants and CO2 sequestration hubs under development in the U.S. by Occidental subsidiary, 1PointFive.

1PointFive is currently constructing what is expected to be the world’s largest DAC plant, named STRATOS, in Texas. The facility, which will use technology provided by Canada-based Carbon Engineering Ltd., is designed to capture up to 500,000 tonnes of CO2 from the atmosphere each year when fully operational. The DAC plant being evaluated by the companies in the UAE, if built, would use the same technology and could be the first megaton-scale facility of its kind outside of the United States.

Occidental and ADNOC and may also evaluate jointly developing one or more UAE-located CO2 sequestration hubs and consider commencing feasibility and pre-FEED studies for a 1 million tonne-per-year DAC plant, which together would provide emissions reduction solutions for carbon-intensive industrial emitters and other hard-to-abate sectors within the UAE, including aviation and maritime operations.

Through the collaboration, ADNOC will also explore technologies in which Occidental has made investments, such as emissions-free power and sustainable fuels.

“We look forward to building on our longstanding partnership with ADNOC as we advance our plans to globally deploy DAC technology and engage partners who are committed to developing carbon solutions at climate-relevant scale,” said Vicki Hollub, Occidental president and CEO. “Partnerships like this one are essential to helping the world reach its climate goals and ensure it has the resources it needs to thrive through the energy transition. We look forward to working with ADNOC on our shared vision of establishing a global net-zero ecosystem.”

The agreement is enabled by the UAE-U.S. Partnership for Accelerating Clean Energy (PACE), which was launched in November 2022 and is expected to mobilize $100 billion in clean energy and carbon management projects, including carbon capture and storage and DAC by 2035.

White House Senior Advisor to the President for Energy and Investment Amos Hochstein said the world is going to “need a host of technologies, including DAC and CCUS, to meet our global climate objectives. This important announcement is a great example of what the U.S.- UAE Partnership for Accelerating Clean Energy (PACE) can help enable. I look forward to what this agreement yields.”

Musabbeh Al Kaabi, ADNOC’s executive director of low carbon solutions and international growth said the agreement highlights how the UAE-U.S. PACE is driving innovative climate technologies to decarbonize the energy sector.

“The need to significantly reduce carbon emissions to address climate change is clear and urgent and carbon capture is an important technology that can be scaled up to decarbonize across all industries,” he said.

As ADNOC accelerates its net zero ambition to 2045 and decarbonizes operations, partnerships such as the one with Occidental, offer the potential to transform the systems that will be vital to provide the lower-carbon energy the world needs for the energy transition, he said.

“ADNOC’s is a pioneer in carbon management, exemplified by our industry leading low-carbon intensity and our operation of Al Reyadah, the region’s first commercial scale carbon capture facility.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.