In recent years, the offshore wind energy market has been ablaze and all indications are that it will only continue to grow.

According to report by Global Market Insights Inc., the offshore energy market—windfarms constructed on bodies of water—will surpass $60 billion by 2024. The reason for the expected growth is the worldwide quest for more sustainable and cleaner energy sources.

Currently, the largest offshore wind energy farms are in Northern Europe and Germany, but the market is gaining steam with the U.S. and China also investing heavily in the offshore wind energy market, according to Global Market Insights

“In the current scenario, wind energy is considered among the mature energy sources, since its first deployment in Denmark,” said Ankit Gupta, who is the research manager for energy and power with Global Market Insights. “The Global Wind Energy Council in 2016 claimed that the unconventional energy system will be led by wind. Subject to the fact, offshore wind industry has been gaining momentum, as to contribute majorly in achieving renewable energy targets across the globe.”

At the end of 2017, the total worldwide offshore wind energy market had a capacity of 18,814 megawatts (MW). The largest sources are in the U.K. and Germany where two-thirds of the worldwide offshore wind energy farms have been installed.

But the U.K. and Germany are now facing some strong competition.

After the first offshore wind farm in North America was completed, the continent has been identified as one of the more lucrative markets. The Block Island Wind Farm offshore Rhode Island is projected to produce enough electricity to power over 17,000 homes.

Still, China is marked to be the next potentially favorable nation, according to the Global Market Insight report. China has evolved from being just a mere player in offshore wind energy in 2001 to now being a market leader because of strong governmental support.

In 2016, China had an offshore wind energy capacity of more than 1.6 gigawatts (GW). Now as part of a five-year plan China will have a 5 GW grid online by 2020.

In fact, China is on target to install 13 GW between 2017 and 2026, which would increase that nation’s 2017 capacity by 10 times what it is currently.

“Over time China has considerably added wind energy to [its] renewable energy capacity and the nation is expected to emerge as offshore wind industry leader over the coming years,” Gupta said. “Europe has witnessed huge offshore wind expansion in the past few years, including the sites currently under construction and in the planning stages, there are more than 84 offshore wind power projects across 11 European countries. However, it has been recorded that offshore wind power still contributes to just 1% of Europe’s total energy mix which provides considerable expansion potential.”

Accounting for over one-third of the total European offshore wind potential, the U.K. offshore wind energy market is another potential hotspot for wind developments. The region has the world’s largest offshore wind farm—London Array—producing 630 MW of clean electricity that is enough to power more than half a million of homes a year. The 500 MW Greater Gabbard offshore wind farm, touted as the second largest offshore wind farm in terms of installed capacity, is also located in the U.K.

Rested, a Denmark based energy firm, has recently announced that the construction has begun on an even bigger wind farm, Hornsea Project One, which is slated to be operational by 2020. Upon completion, this plant will be capable of supplying clean energy to more than 1 million homes.

Offshore wind energy market is also gaining traction from tech giants showing their interests in harnessing clean energy. Microsoft, for instance, has recently signed an agreement with GE to purchase electricity from its wind farm and power its cloud data centers in Ireland. The Silicon Valley bigshots Apple and Facebook are already in this league harnessing clean power and pledging its operations to be 100% from the renewable energy sources. Then Google. in the year 2010. has also thrown its financial clout behind new wind farms off the U.S East Coast.

This changing competitive scenario is further likely to enrich the growth dynamics of global offshore wind energy market in the coming years. [LV1]If there is a drawback it is the current expense of offshore wind power projects. Currently, offshore wind investment costs are around two times higher than that of onshore wind, which is mostly attributable to the huge structures and logistics of deploying the towers in water bodies. In fact, the upfront costs value up to over 70% of the overall lifetime cost.

The financial aspect is seen as a major hindrance in the expansion of offshore wind industry size.

“Bringing the costs down to a point to compete with coal, oil, and nuclear power is a major challenge that the offshore wind industry players face in the current industrial regime,” Gupta said. “Industry participants, alongside offshore wind industry giants have been constantly experimenting and developing over project design life, turbine performance, and improving the operational efficiency to curb the overall investments.

“This in turn is set to infuse huge opportunities across the offshore wind market which has been encroaching towards cheaper energy.”

Recommended Reading

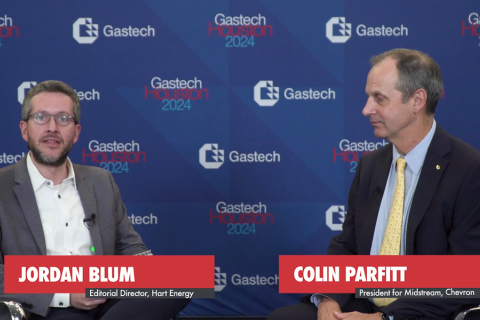

Exclusive: Chevron’s Big Worry for the Permian Basin? Infrastructure

2024-10-07 - Colin Parfitt, the president of midstream for Chevron, said U.S. permitting can be slow and the LNG has only exacerbated concerns about moving Permian gas to Gulf Coast export terminals.

Hart Energy Announces 2024 ‘Forty Under 40’ Honorees

2024-10-21 - ‘Forty Under 40’ honorees represent top young rising stars rising up from across the energy spectrum.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.