TWMA, a portfolio company of Buckthorn Partners, developed the TCC RotoMill, a technology that separates drill cuttings for recycling and reuse. (Photo Courtesy: Buckthorn Partners)

[Editor's note: A version of this story appears in the September 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Unlike venture capital, private equity is chasing companies with positive balance sheets and getting them to the next level. But some have found ways to get start-ups that aren’t making money into their portfolio through less direct means.

Most of the investments are for acquiring cutting-edge technology that will improve the operations and efficiency of existing oilfield service companies or investing alongside venture capital arms of major firms such as Saudi Aramco and Schlumberger Ltd., said Brittany Sakowitz, a partner at Vinson & Elkins’ M&A and private-equity practice.

It has been especially true in the past five years that venture capital has been actively investing in technology companies in oilfield services or with applications for that industry, particularly because they do not require a large amount of start-up capital, and even relatively small seed investments can reap sizeable returns, she said. Private equity’s interest in those same companies once they have a track record also can lead to a quicker payout for the venture investors.

There are a few exceptions such as RigUp, an Austin-based company that received early-stage venture capital in 2014. Later that year, the energy-industry online marketplace for independent contractors and labor received a renewal of investment from that fund alongside a rare private-equity buy-in from Quantum Energy Partners LP. In January, the private-equity firm, along with several others, invested again as part of a $60 million round of funding.

Sakowitz said there has been a spike in the number of private-equity funds buying into oilfield service companies in the U.S., particularly from international private-equity firms with a thirst for those providing services in the Permian Basin.

“Oilfield service investment and industry consolidation has been pretty steady the last few years,” Sakowitz said. However, without stability in the oil and gas sector, private-equity firms and service companies are experiencing “a period of uncertainty on how to value companies, and that makes it hard to get deals done,” she said.

That has sent much of venture capital and private equity into technology firms that can help oilfield service assets operate more efficiently or give a leg up on the competition.

Oil and Gas Investor talked to top executives about the role of private equity in the oilfield service sector, taking companies to the next level, and how the teams are working together to help meet their ultimate goals.

A Matter Of Resources

There’s nothing flashy about the phrase “lower middle market,” but that’s where Houston-based Hastings Equity Partners finds energy service companies that meet that definition of being a lucrative investment opportunity.

“These companies deliver consistent growth, often overlooked because of their perceived lack of scale or management capability, but the lower middle market is dominated by unique companies that have significant upside, material opportunities for scale and experienced leadership that is looking for a partner,” according to Hastings’ official explanation of its strategy. “The constraints holding these companies back are often a matter of resources rather than capability, market or vision.”

Since its founding in 2004, Hastings has made 60 acquisitions and has routinely made advantageous sales, often within three years.

“We come in and help grow a business and take it to the proverbial next level,” said Tanner Moran, a managing director at Hastings, overseeing business development. “We partner with owners and companies in niches and verticals that help them grow their bandwidth. We’re not a buyout shop that buys 100% of the business, sticks in a new CEO and we’re off and running. We want to help existing businesses find efficiencies.”

Finding the right deal isn’t as easy as announcing there is a pot of money ready to invest in energy and industrial service firms. Moran attends trade shows, energy industry and investment conferences and anywhere owners of target companies will be.

“It takes years to develop a relationship with a target company that is strong enough to become an investment partnership. It’s a constant series of follow up,” Moran said. “Rarely when we call on a company are they ready to take on a partner or sell.” When a company seeking an investment partner has hired representation to make the match, the deal can happen more quickly, but it is often still a 12-month process from start to finish, he said.

Like most private-equity companies, Hastings is looking for energy service and equipment companies with three to five years of profitability under their belts, solid management that will stay onboard and an EBITDA of $4- to $20 million. “It’s important to us to acquire companies that have an established earnings history. If a business has several years of profitable operations, it allows us to become more comfortable that the company is battle tested. The majority of our investments are in companies that performed well through downcycles, because we can’t have a concentrated investment portfolio of cycle-exposed businesses. We wouldn’t have much of a future if we did” Moran said.

The company has made investments in some new companies, but Hastings’ start-up investments in companies that have yet to turn a profit are usually done using a different strategy.

“Sometimes the concept of a start-up could join a portfolio we already have,” Moran said. “The way we’ve approached start-ups and newer companies is to acquire them and immediately roll it into an established business in our portfolio to differentiate our investments.”

In 2017, Hastings invested in Reach Wireline. Reach was formed by an experienced management team with a strategy to put the latest wireline technology into the field. The coated electric wireline gave operators the capabilities required to service longer laterals.

“Reach was a start-up, with a unique technology partner, and built the business from the ground up,” Moran said. At the time “there were no coated cable platforms to buy. We purchased units, acquired the cable and built systems, but combined two existing wireline companies that had several years of operating history, equipment and personnel to rapidly expand the Reach platform.”

Although much capital has been raised in the past five years, instability in the oil and gas market has made some of those funds hard to come by. “There is an incredible amount of capital raised and deployed in the sector, but there hasn’t been much liquidity, so the investment community is slow to invest more capital. A priority for all is to create liquidity events for our investors,” Moran said.

However, he thinks now is a great time for investing across the oil and gas service industry spectrum. With oil at $106 a barrel there was a lot of “poor market discipline” that led to paying too much for companies. Stability has improved, apart from a six-week downturn of 40% in the fourth quarter of 2018, he said.

Hastings’ investments take advantage of efficiencies emerging in the service sector, but it still keeps an eye on what oil prices might mean for companies.

“There is an upside and downside if oil hits those highs again,” Moran said. Lower prices have driven efficiency through discipline and improvements in technology. “There is just as much profitability for operators and service companies with $60-a-barrel oil today as there was when it was $100 in some cases.”

On one hand, if prices of the commodity go up, it “could create cost inflation across a lot of sectors.” On the other hand, higher prices could help with liquidity by drawing institutional investors and others back in, a positive for private-equity and venture capital funds ready to exit.

Moran’s advice for service companies looking for capital to expand is to “have an open dialogue. Talk to a friend who has done it with their company or contact a firm directly. Bringing on a partner is a wonderful way to reach a new level. It’s an intense process, so learn all you can before starting.”

Technologically Different

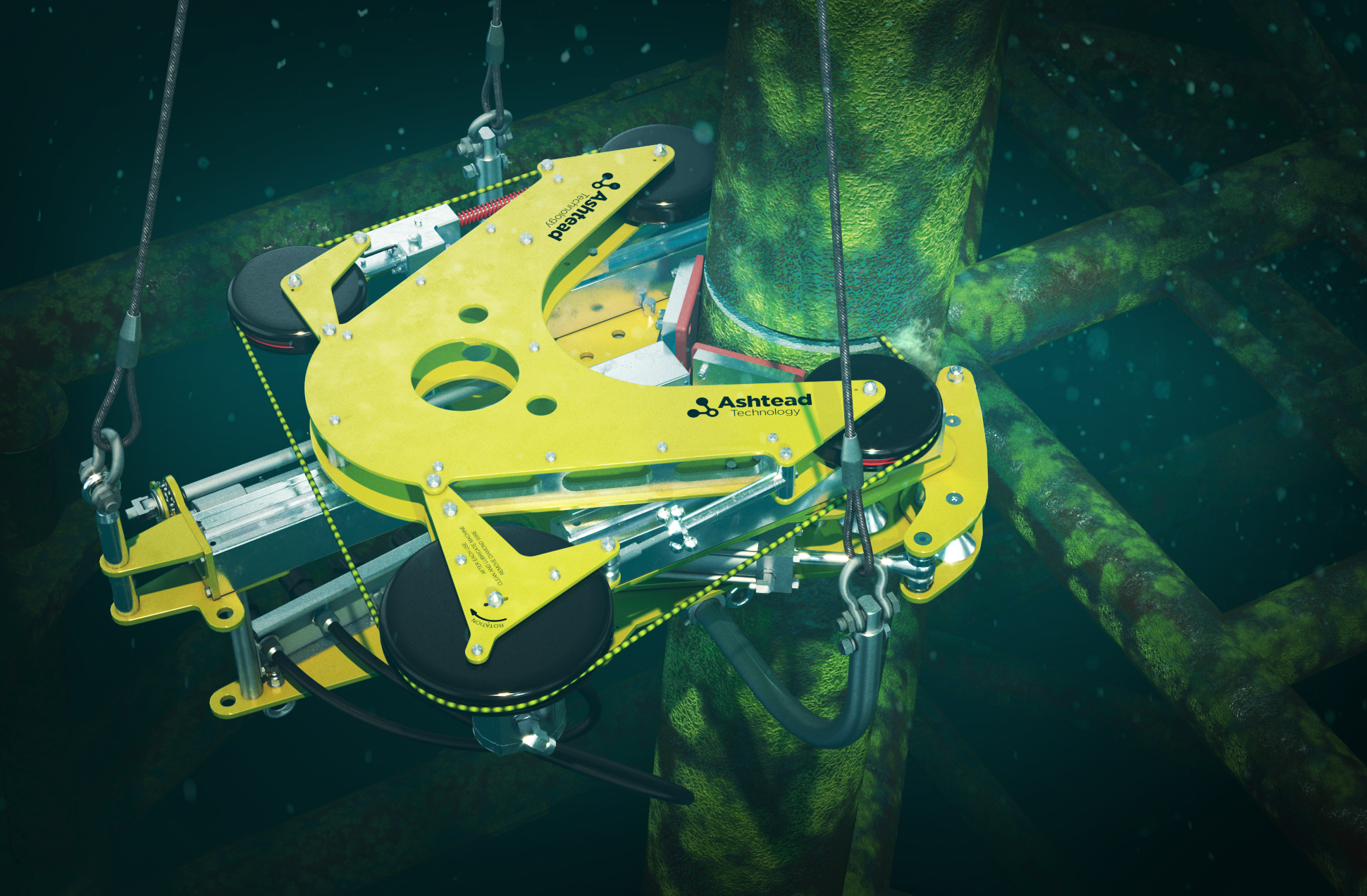

Buckthorn Partners, based in London, views the oilfield service M&A market with an international eye. There are plenty of offshore and subsea service businesses in its portfolio, which occasionally buy start-ups or U.S.-based assets to help achieve their goals.

“We don’t start at start-ups, but once we have a portfolio company established, then certainly we would give that company the opportunity to look at something and to invest in something small, and that was perhaps pre-profit that we thought we could commercialize within the portfolio business,” said Nicholas Gee, partner at Buckthorn.

“I think the reality though is that we believe that technological differentiation is important to businesses, in a world where you’ve got essentially flat oil and gas prices, which are a proxy for the oilfield service flat activity,” Gee said. “Post the crash in 2014 and 2015, activity, which is the major driver for oilfield services, has been definitely muted and slow to recover in almost all segments. Part of that muted recovery has naturally to do with oil and gas operating company activity. Also, it’s because there is an awful lot of oilfield service capital chasing a reduced amount of business. A lot of that speaks to an overpopulated market, and the commodity end of that is competing very, very hard for what remaining revenues there are.”

Because of that, technological differentiation is the key to survival in the service industry, especially in U.S. land-based oil and gas, “if you really want to play hard in that market. Otherwise it’s really about whose capital can last longest,” he said.

Gee said he has seen few private-equity investors in oilfield service-related technology internationally, “but over the past decade there has been a rise of corporate venturing from inside large companies such as Saudi Aramco and Chevron [Corp.], investing in businesses that they think could be important to their business.”

Other than new technologies, there are companies in Buckthorn’s portfolio that differentiate themselves with other ways to remove cost from a process. For example, Buckthorn invested in Coretrax, a company that specializes in well-bore cleanup and well abandonment, in which there is an active market in the North Sea.

“Coretrax works very closely with its clients to see how it can reduce the cost and improve the effectiveness of the well-plugging process. That is a more customized approach. How can I maintain or improve the quality of the job while taking structural cost out of the operation? It’s not about price,” said Gee. The technology isn’t new but improves functionality by saving time and improving effectiveness.

What does Buckthorn bring to the table besides money to the companies in its portfolio? A wealth of expertise in how to deploy that money in the best way is one example.

“We’re not management, and that’s an important distinction. For us, we work very closely with the management team, and we do play an active role at times in certain tasks.

“I think the first thing is that nobody knows the business like the management team,” Gee said. The team at Buckthorn brings “the ability to have a conversation around what could be or what you want to do as a team. We act as a sounding board on an occasional basis and certainly at the outset in the period when we’re looking to buy the business and get it set on its path.

“One of the things we bring is money. That’s not particularly differentiating; a lot of people bring money. But if we want to invest to grow the business, then we need to be able to help the management team be explicit about where they want to go and how they can deploy capital effectively,” Gee said.

The Buckthorn team also can help the company move into new geographies, especially when it or its personal network have contacts that can provide introductions or inside market knowledge, he said.

Another expertise Buckthorn brings to bear is M&A experience. “If the company hasn’t done acquisitions before, but thinks there’s a target that is a strategic fit with where they want to take the business, then we can absolutely roll our sleeves up and guide them through the detail of the M&A process, because it’s not something that’s done all the time,” Gee said.

[SIDEBAR]

Capital With Experience

The story of Houston-based LiquidFrameworks’ growth is told in the carpet and paint at the company’s offices in Southwest Houston. As walls were removed with each growth spurt in the past decade, floor and wall colors tell the tale like tree rings.

As the tech start-up, assisting oilfield, industrial and environmental service companies, tops 100 employees, they are ready to move up to modern space on the 10th floor of the high rise, a move befitting a company that received nearly $100 million in private-equity funding from San Francisco’s Luminate Capital at the end of 2018.

Its product, FieldFX, runs on tablets and laptops to enable the “quote to cash” process for efficiency and improved cash flow. “We have streamlined the day-to-day operations for field service professionals and have increased transparency across organizations by transforming previously paper- or Excel-based workflows,” said LiquidFrameworks founder and CEO Travis Parigi.

FieldFX also works offline in the field and automatically uploads all data such as field tickets and workflow schedules when a connection is in range.

“I’ve been working in the oil and gas space for a while, and I saw the same problem with field ticketing over and over again,” Parigi said.

He founded the company in 2005 with his own capital and pumped any money made back into the company and product development. “For seven years, we didn’t make a dime. There were zeros across the board,” Parigi said. He didn’t pay himself for five years and funded development mostly from money that came from his consulting practice. “It was stressful to make payroll.”

That all changed in 2012, when Houston Ventures came through for the start-up. Ultimately, the 15-year-old venture capital firm put $6 million into the company before it sold six years later to technology private-equity company Luminate Capital Partners.

LiquidFrameworks is currently hiring people to do implementation, software, development and sales with plans to be at more than 100 employees by 2020. The catalyst for the venture capital in 2012 was the need to move existing customers off a legacy process developed in Microsoft.net and to grow across all areas of the business.

In April 2018, the process of finding a new private-equity partner to scale everything up began. “I know a lot of people in oilfield service private equity in Houston, but we’re really a software company that plays in the [oilfield service] space,” Parigi said. That led them to investors in California that specialize in companies with subscription-based software.

“It’s way more than the money. You’re looking for capital that has some expertise attached to it,” Parigi said. In this case, they gained a team with a deep expertise in enterprise software after fielding offers from several private-equity funds.

Parigi said he knows Luminate will eventually exercise its exit strategy and that his company will have a new financial partner. For now, he is taking advantage of the team’s knowledge to fill any holes more quickly for customers and to possibly do acquisitions. “This private-equity round will facilitate much more growth,” he said.

Recommended Reading

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Analysts’ Oilfield Services Forecast: Muddling Through 2025

2025-01-21 - Industry analysts see flat spending and production affecting key OFS players in the year ahead.

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.