Oil and gas company stocks, particularly those of E&Ps and oilfield services, enjoyed a boost immediately following the presidential election of Donald Trump. (Source: Shutterstock)

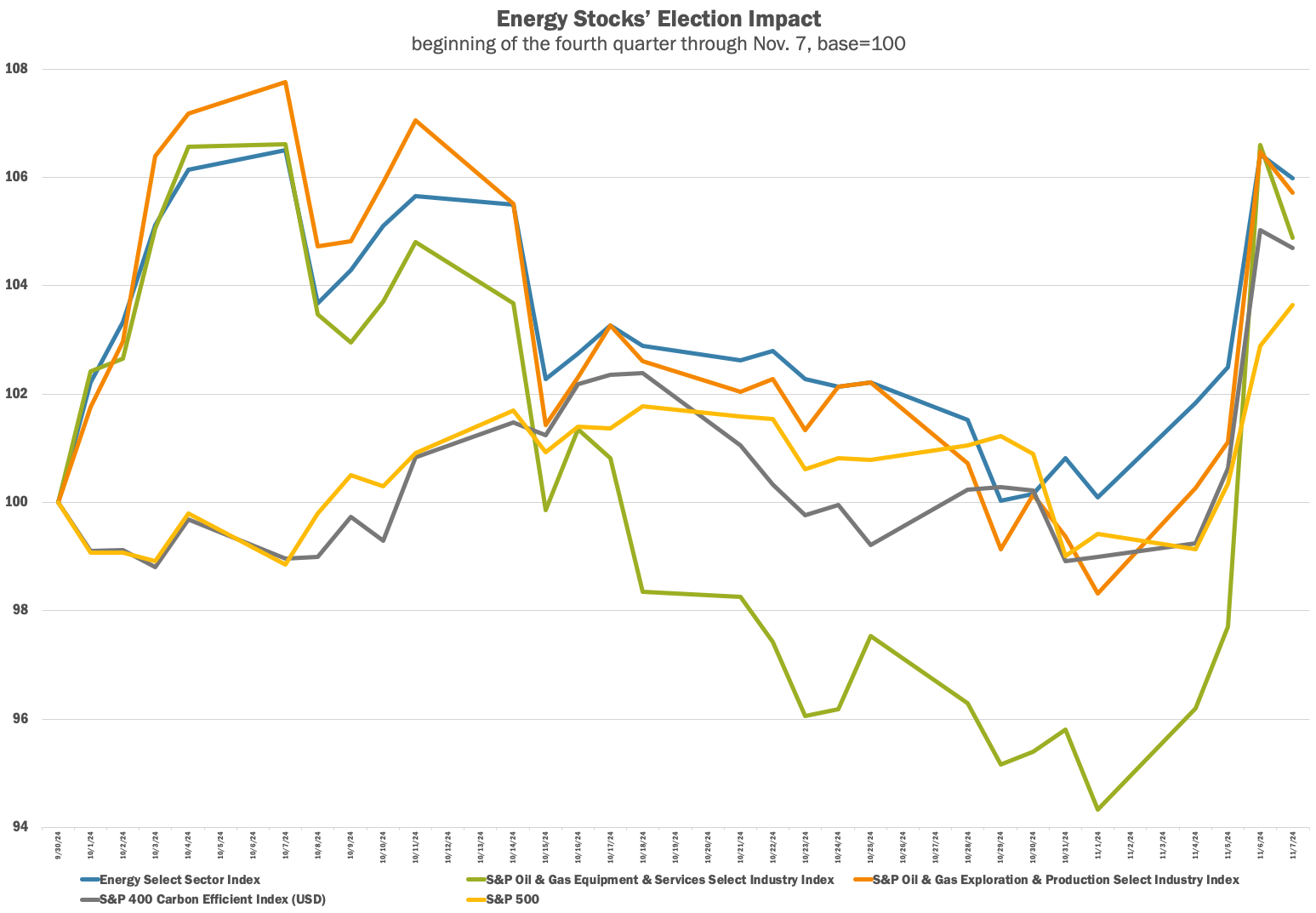

Oil and gas stocks, particularly those in the oilfield services sector, enjoyed a boost following election day, with several indexes boasting superior performance to the benchmark S&P 500.

The S&P Oil & Gas Equipment & Services Select Industry Index, which had struggled since the start of the fourth quarter, experienced a 9% jolt on Nov. 6 after major news outlets called the presidential election for Donald Trump. S&P’s E&P sector index recorded a 5.3% increase.

The market’s positive reaction can be attributed to several factors.

Trump has made no secret of his desire to see U.S. oil and gas companies increase production and made promises to streamline the federal permitting process. E&Ps are hoping for more access to Alaskan oil following the Biden administration’s offer of the minimum 400,000 acres for auction on the coast plain of the Arctic National Wildlife Refuge.

There is also the possibility of renewed sanctions on OPEC members Iran and Venezuela, which could remove a significant amount of crude from the market, UBS analyst Giovanni Staunovo told Reuters.

Iran produces about 3.2 MMbbl/d, or about 3% of global production. It announced Nov. 4 plans to increase production by 250,000 bbl/d.

Venezuela’s oil exports reached a four-year high of almost 950,000 bbl/d in October, according to a Reuters analysis of shipping data and documents from state-owned oil company PDVSA. That figure represents a 21% increase over September’s averages. Venezuelan crude shipments to the U.S. from Chevron averaged 280,000 bbl/d during the month, and Spanish producer Repsol also exported crude to the U.S., as well as Spain.

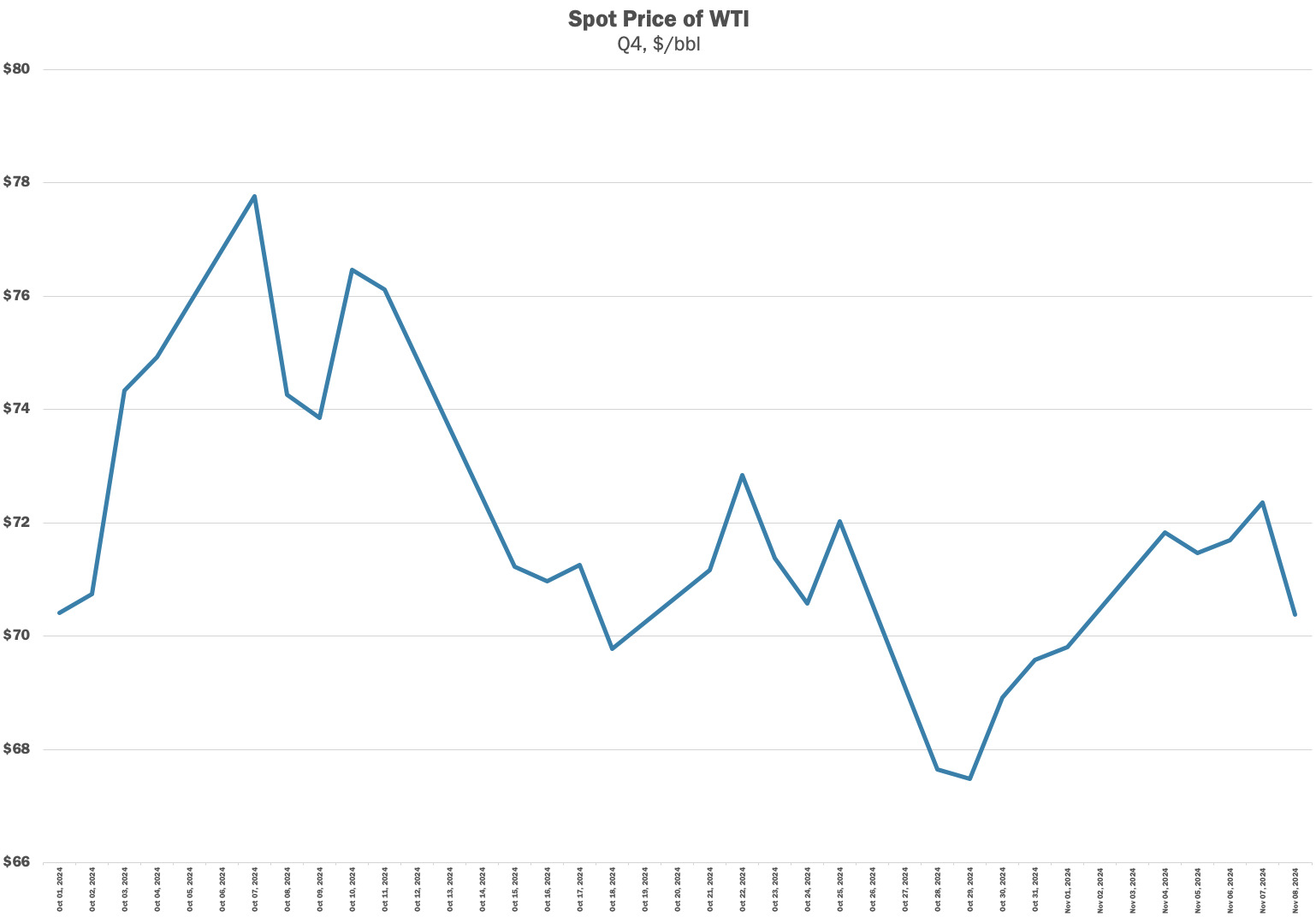

Oil prices, on the other hand, remained stagnant, with WTI continuing to trade in a narrow range of about $70/bbl to $72/bbl this week. This, despite the election and Hurricane Rafael shutting down 400,000 bbl/d of production in the Gulf of Mexico.

Recommended Reading

Commercial Operations at Calcasieu Pass LNG to Begin in April

2025-02-18 - Venture Global started selling LNG at the plant in 2022, angering its long-term customers.

Baker Hughes Wins LNG Technology Orders for Venture Global

2025-01-30 - Baker Hughes Co. also signed a multiyear services agreement to support the first two phases of Venture Global’s Plaquemines LNG project in Louisiana.

DOE Approves Venture Global’s CP2 LNG to Export to Non-FTA Countries

2025-03-20 - The U.S. Department of Energy approved Venture Global’s Calcasieu Pass 2 LNG project in Cameron Parish, Louisiana, to export LNG to non-FTA countries.

Venture Global Gets Final Approval to Fully Open Calcasieu Pass LNG

2025-04-03 - Venture Global has FERC permission to put the remaining facilities at its Calcasieu Pass LNG plant into service, placing an unknown status on arbitration hearings with its long-term customers.

NextDecade, Aramco Agree to 20-Yr LNG Offtake Deal for Rio Grande Train 4

2025-04-08 - Aramco will buy 1.2 mtpa from NextDecade Corp. upon completion of its Rio Grande Train 4 at a price indexed to Henry Hub.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.