Survey results indicate investors had a higher level of comfort for investing in renewable electricity and battery storage, compared to hydrogen and carbon capture, utilization and storage. (Source: Shutterstock.com)

Amid pressure to go green, institutional investors say having energy transition plans is not enough for oil and gas companies: clarity is needed, targets must be hit and low-carbon ventures must create value, according to analysis of results of Boston Consulting Group’s (BCG) latest survey of oil and gas investors.

Near-term optimism was abundant, however, when it came to expectations for robust oil prices. About 70% of the respondents believe Brent will stay above $60/bbl through 2024, up from projections between $40 and $60/bbl in BCG’s 2020 survey.

Though companies have no control on the oil or gas price, higher prices help pave the way toward profitability and payout—two things that appease investors, said Rebecca Fitz, senior director for BCG’s Center for Energy Impact. A third leg exists, she added, that’s aggressiveness in terms of the environment and transparency on long-term strategies.

“The takeaway is profitability and payout are essential, but they’re not sufficient if the environmental side or the emissions side of the strategy is not effectively laid out,” Fitz told Hart Energy. “There will be skepticism if that third pillar is not effectively addressed in the strategy.”

The insight, gleaned from 250 oil and gas institutional investors in October, was shared Jan. 6 as companies continue missions to fight climate change by injecting CO2 underground, producing and using lower-carbon fuels, eliminating routine flaring or producing renewable energy among other tactics. Many companies, including in the U.S. onshore, are near the beginning of what is expected to be long environmental journeys as the world tries to decarbonize.

About 60% of investors surveyed believe peak oil demand will occur by 2030, driven by climate change concerns and the energy transition. The survey also showed that investors are upbeat on natural gas, with 85% saying it will play a critical role as a bridge fuel between traditional hydrocarbons and renewable energy sources.

In addition, about 70% say they want oil and gas companies to pursue growth in natural gas. That’s up from nearly 60% in 2020.

BCG noted the response gives a “clear signal” for continued investment in natural gas.

“We already see the bigger integrated companies leaning heavily into natural gas as an investment driver for the next decade,” Fitz said. “I think the low-price environment in 2020-2021 obviously made large investment decisions quite hard to make but strategically, there’s already a commitment to really investing along the gas value chain as part of their energy transition approach.”

The narrative is different in the U.S., where companies for the most part are either oil-focused or gas-focused, according to Fitz, who doesn’t foresee that changing.

“It’s more fit for purpose. Either you’re an oil pure-play or a gas pure-play,” she said.

That consistency perhaps shows focus and helps maintain capital discipline, a plus in the eyes of investors.

There were some results from the survey that Fitz found interesting or surprising:

Emissions Targets: Investors showed strong support for not only Scope 1 and Scope 2 emissions targets but also addressing Scope 3 emissions. Results revealed 81% found Scope 1 targets important; 57%, Scope 2; and 59%, Scope 3.

“That can be a challenge for some; it could be an opportunity also,” Fitz said of the latter.

As defined by the U.S. EPA, Scope 3 greenhouse-gas (GHG) emissions result from activities from assets that the reporting company doesn’t own or control but indirectly impacts its value chain. Scope 2 emissions are indirect emissions from sources owned or controlled by the company, while Scope 1 emissions are direct emissions from sources owned or controlled by the company.

Low-carbon Investments: There was a higher level of comfort for investing in renewable electricity and battery storage, which are technologically scaled up industries, Fitz said, noting that makes the investment proposition clearer.

Results showed 80% of investors found renewable electricity value accretive with short- or long-term payouts. The percentage was 72% for battery storage. Less confidence in value add was evident for technologies such as hydrogen, 49%; advanced mobility, 49%; and carbon capture, utilization and storage, 37%.

Technological maturity appeared to be the determining factor.

“Renewable power generation, it’s scaled. It’s understood. You know what you’re getting,” Fitz said. “CCUS: it’s immature. It’s been around for a long time, but it’s certainly not commercially scaled.”

Climate Risk and Valuations: Of the investors surveyed, only 12% factor climate risk as a critical focus into their valuations of oil and gas companies. This compares to 40% who are beginning to consider factoring climate risk and 27% who factor climate risk but not yet as a critical focus.

“I would imagine when we do it next year, that number grows,” Fitz said.

And, of the companies that factor climate risks into their models, 70% said they don’t believe they impact valuations.

Many oil and gas companies are in early environmental stewardship conversations with their investors on setting targets. Fitz called that a good start, an essential first step that signals these issues are taken seriously.

BCG works with many E&Ps on setting targets.

“We need to get it to a point where you can benchmark targets across companies and measure progress toward targets, and have total transparency about what target means what,” Fitz said. “We do this benchmarking, and it’s very difficult to actually compare Company A, Company B, Company C. … This is going to be an ongoing discussion where targets get clearer and get more transparent. They get more benchmarkable and investors are going to be part of saying ‘yes, I agree’ or ‘no, I don’t agree with that.’”

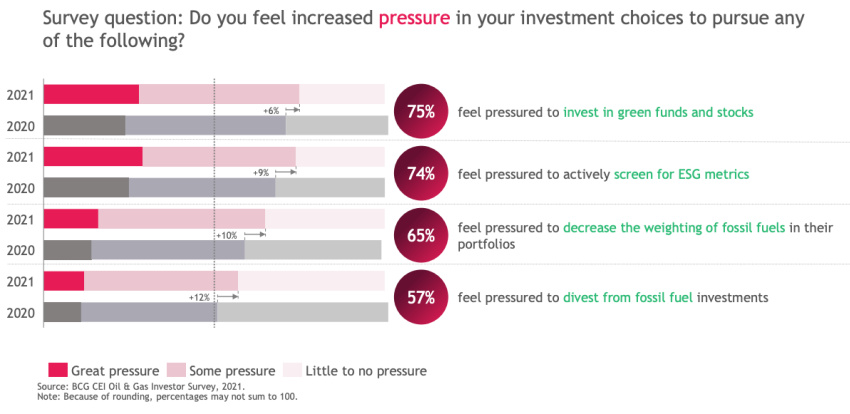

Survey results showed that about three-quarters of the investors feel pressured to invest in green funds and stocks as well as to actively screen for ESG metrics, while 65% said they feel pressured to decrease the weighting of fossil fuels in the portfolios and 57% pressured to divest from fossil fuel investments.

BCG said most investors acknowledge that oil and gas companies have taken some initial steps to improve their environmental performance, but they want to see results “hitting emissions reduction targets and showing EBITDA growth from companies.”

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 24, 2025)

2025-02-24 - Net long positions of WTI have decreased by 59% since Jan. 21 and are 61% below the level seen on July 16, 2024, when the price of WTI was $80.76.

Paisie: Trump’s Impact on All Things Energy

2024-12-11 - President-elect Donald Trump’s policies are expected to benefit the U.S. oil and gas sector, but also bring economic and geopolitical risks.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

Paisie: With Oil Prices, It’s All About the Economy

2024-12-20 - One of the keys to pricing is whether global conflicts curtail the flow of oil. They have not.

LNG, Crude Markets and Tariffs Muddy Analysts’ 2025 Outlooks

2024-12-12 - Energy demand is forecast to grow as data centers gobble up more electricity and LNG liquefaction capacity comes online in North America, but gasoline demand may peak by 2025, analysts say.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.