(Source: Shutterstock.com)

[Editor's note: A version of this story appears in the August 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

After months of falling back, the oil and gas industry has settled for a stalemate with the COVID-19 pandemic. But the losses have mounted.

In the U.S., wells have been shut in, rigs idled and oil filled storage faster than it drained out. The pandemic and OPEC+ price war, like a nationwide blackout, have knocked offline nearly 2 MMbbl/d of U.S. oil production.

In the estimation of the International Energy Agency (IEA), the global energy system is facing its greatest shock since World War II with a resulting drop in energy demand that will dwarf the 2008 financial crisis. Globally, world demand is expected to fall 6%, “the equivalent of losing the entire demand of India,” the world’s third largest energy consumer, David M. Turk, acting deputy executive director with the IEA, told Congress in July.

In the U.S., WTI spent most of June and early July struggling in the mid $40s following an abrupt plunge of oil prices that forced the industry to choke back activity and cut tens of thousands of jobs.

Reid Morrison, PwC’s leader of the Global Energy and U.S. Energy & Chemicals Advisory practices, said the industry, designed for growth, is now expected to generate free cash flow and dividends, which means shifting resources and capabilities, including staff.

“What you’re seeing is a submission of the industry to two forces that they can’t change,” he said. “One is investors want returns, and growth is a secondary focus. ... And there’s a level of activities that are smaller than what has happened historically. Therefore, you need fewer resources, and just doing the math, it means fewer and fewer people are needed.

“And that’s the unfortunate side of where we are right now.”

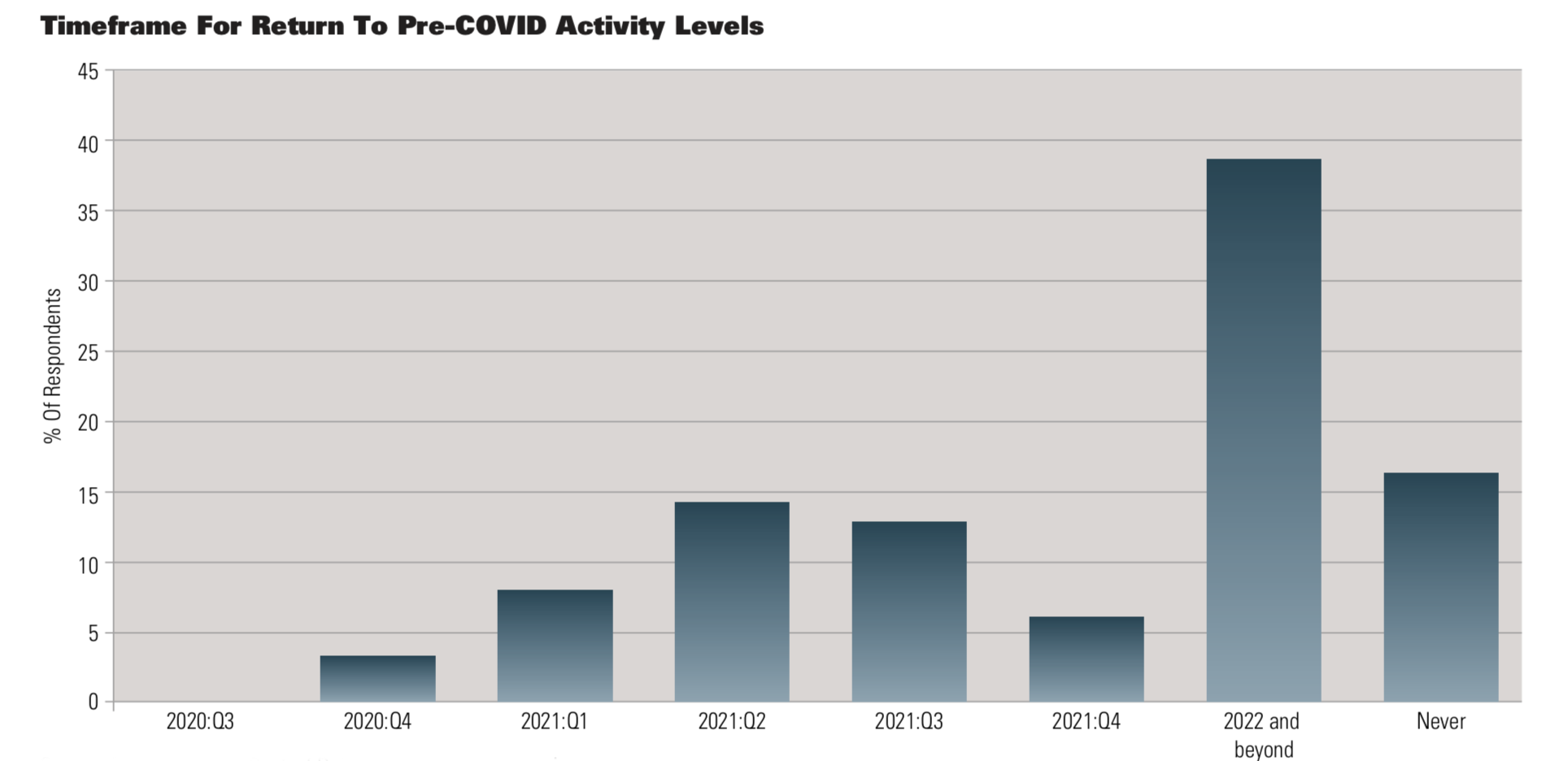

Most industry executives expect to be solvent next year—though not all. A Dallas Fed survey of oil and gas executives shows little optimism for a quick turnaround to pre-pandemic activity levels. The survey, conducted in June, found that 41% of respondents expected drilling and completion activity to return in 2021, with nearly as many expecting drilling to reset by 2022 or later. But one out of six executives don’t foresee a return to previous activity levels, ever.

That’s if prices return to normal. As one executive told the Dallas Fed, without a recovery in commodity prices, “All bets are off.”

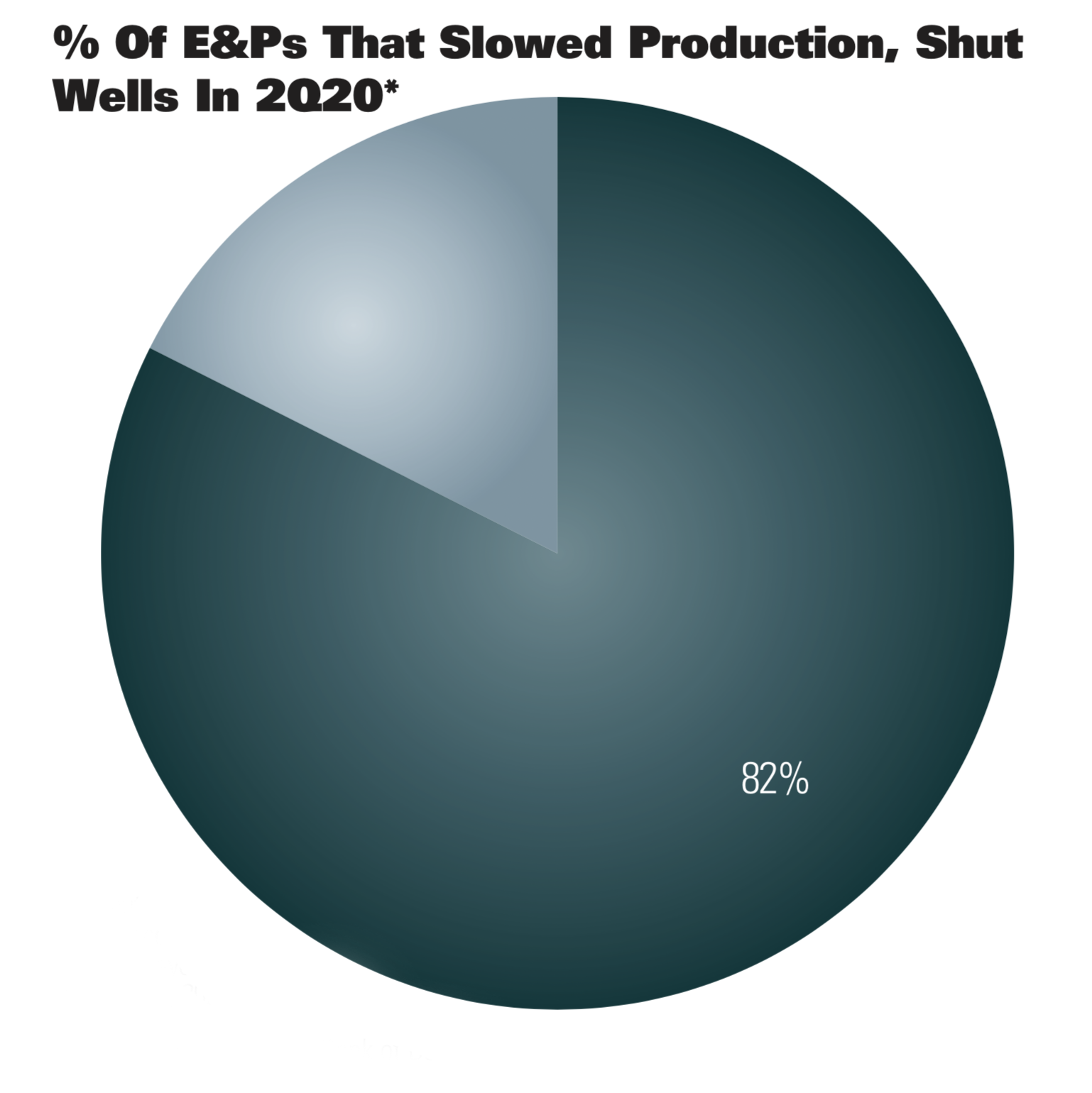

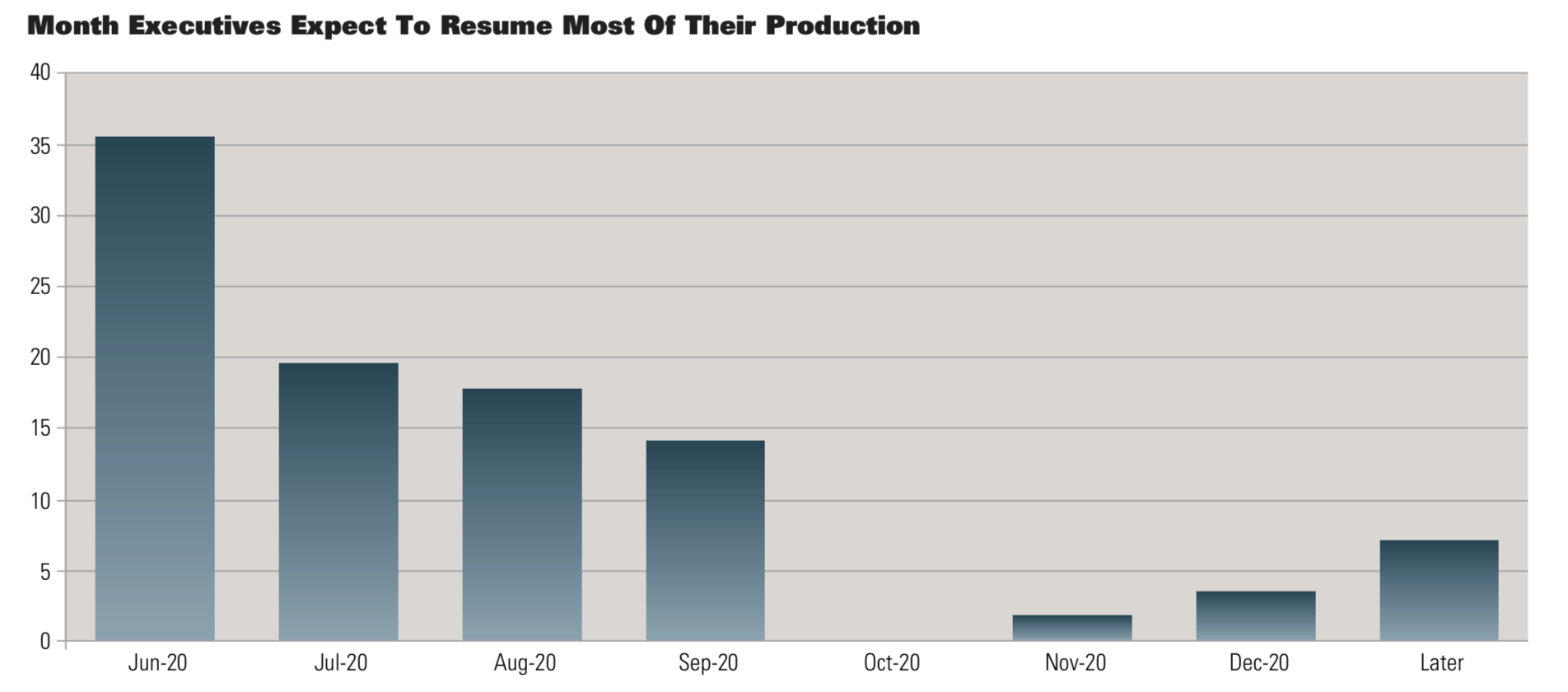

* Executives from 147 oil and gas firms were surveyed between June 10-18, 2020.

In candid responses, executives largely see 2020 as a lost summer stretching into a forgettable fall. Of the survey’s respondents, most were confident in their ability to remain viable, with just 5% saying they expect to be insolvent next year.

One E&P executive gave a desultory timetable for recovery beginning with the “dismal” lockdown, a “miserable” transition from June through December and a “somber” new normal in 2021.

“The oil industry went into a deep hole in first-quarter 2020,” the executive told the Dallas Fed. “We reached the bottom, and now we are trying to climb up. It will be quite a while (2022+) to get back up the hole to the pre-COVID-19 level of activity and service pricing.”

In just two months—March and April—all sectors of the energy industry slashed 1.3 million jobs, or 13% of the workforce, erasing five years of job growth, former U.S. Energy Secretary Ernest J. Moniz told Congress in June.

Moniz said the oil and gas industry faces a period of uncertainty as oil demand recalibrates. “We don’t know the recovery from COVID. We don’t know how the secular change in the energy industry is going to affect demand,”

he said.

Through June, oilfield service (OFS) and equipment employment is down by 116,000 compared to June 2019, bringing employment to its lowest point since March 2017, according to a report by the Petroleum Equipment and Services Association (PESA).

The job losses already surpass $11.4 billion in lost annual wages, and more are expected in coming months, said Tim Tarpley, PESA’s vice president of government affairs.

After withstanding the initial blast of the pandemic, companies will need the expertise they’re currently shedding as oil prices keep wells shut in and new wells undrilled.

“Our biggest fear is that when you start seeing a lot of these employees that have 20 and 30 years of experience leaving the industry, they may go work in another sector,” Tarpley said.

‘We may lose them’

NexTier Oilfield Solutions Inc.—the company created by the 2019 combination of C&J Energy Services and Keane Group—is well positioned to survive the downturn, said president and CEO Robert Drummond. The company has established liquidity through various synergies associated with its merger.

NexTier has positions in all U.S. basins, with the largest in the Permian. The company has 45 hydraulic fracturing fleets, which Drummond said is likely the second largest in the U.S.

Still, with oil inventories brimming over and gas prices similarly depressed, NexTier and other service companies have had to make painful decisions to remain financially viable.

“Unfortunately, like everyone in this sector, we’ve had to shrink our organization in response to these activity declines,” he said. “As a result, we’ve got a workforce with more talent, concentrated expertise, drive [and] motivation. I have no doubt we can rebuild around a team of people like that.”

Watch the complete video interview with

NexTier CEO Robert Drummond

Drummond is not concerned about a brain drain among his ranks. NexTier has protected its talent as much as possible through measures such as warm stacking equipment and keeping on supervisors in low-run positions until a full restart is called for.

“Being a very versatile workforce, for example, you have supervisors in the field who take temporary demotions to become an equipment operator to allow us to concentrate the skill set,” Drummond said. “Then when activity returns, you re-dilute it and put the guys in the jobs they had before.”

As of July, activity remains slow in most basins, including the Permian, Tarpley said. Texas, which is home to a large portion of the Permian as well as the Eagle Ford Shale, has lost 57,000 jobs since 2020—more than the next six states combined, according to PESA. Many OFS companies have 25% to 50% of their workforce on furlough.

With oil prices in the low $40s, Tarpley said prices are close to breakeven only in the most profitable areas within basins, causing activity to sputter. There are also concerns that furloughs may ultimately lead to more layoffs.

“It’s been very slow and, quite frankly, from a service perspective they’re going to need some significant activity really to start” again, he said.

PESA also is thinking about the future in terms of workforce members lured away by jobs in other industries.

“We may lose them,” Tarpley said. “Our principal desire, in all of our companies, is to try to keep as many of those folks in the industry as we can.”

Carbon capture technology, for instance, will likely be in demand as a recovery gets underway.

“So a big concern is that we see significant institutional knowledge basically leave not only the sector but the area perhaps where a lot of hardware companies are operating,” he said.

Upstream E&P companies are similarly concerned about the marketplace for workers. One executive surveyed by the Dallas Fed said COVID-19 will only exacerbate the “Great Crew Change” retirement of baby boomers.

“The industry is depopulating itself of knowledgeable and experienced personnel,” the executive said. “That collective knowledge drain is not being effectively replaced by ‘newbies.’ The newer, younger employees don’t know much, and while they can stare at computers and run applications, they are making critical land, legal, financial and business errors at an astonishing rate.”

Morrison said the oil and gas industry will face increased competition for workers after the pandemic.

“I think the overall sentiment of the industry is not attractive to the younger generation,” he said. “I think there is actually sufficient talent that’s out there, and it’s not going to be where the problem is. The biggest concern that I personally have is attracting the next generation that may look at this industry as something that either has too much volatility or just a reputation of the industry they don’t want to be part of.”

The industry should tell its story in a way that emphasizes it is on the leading edge of science and technology.

“For those STEM students that really want to cut their teeth on leading-edge technology and innovation, the industry is the vanguard, but they’ve let the headlines be written by others, not around the real science and innovation that happens.”

Drummond said the industry has always been able to bounce back.

“Should the industry be concerned? I think yes. But I also know that we will collectively respond,” he said. “We’ve done it so many times before. After all, who doesn’t want to be involved in a winning system? I think we can handle it.”

A long convalescence

The picture for industry recovery remains murky, largely because it is dependent on the broader economic recovery globally. In the U.S., which is leading in reported cases of COVID-19, fears of a prolonged pandemic appear to justify outlook of E&P executives.

Asked when global oil consumption will return to levels seen before the pandemic, roughly 55% of executives said they expected oil to recover in 2021, while more than one-third expected a full recovery in 2022 or beyond.

The IEA projected that global oil demand this year will fall by 8.1 MMbbl/d compared with 2019, the largest drop in history, according to the June IEA Oil Market Report. IEA said containment measures in 187 countries and territories had “almost brought global mobility to a halt.”

Improvement in WTI prices close to $40/bbl is not enough to allow a significant increase in U.S. output, “which in June is estimated to have fallen to 10.5 MMbbl/d, down by 2.4 MMbbl/d from a record high seen in November,” IEA reported.

At a U.S. Senate hearing in July, Turk told Congress the IEA expected advanced economies to see the largest demand declines, including 9% in the U.S. and 11% in the EU.

The COVID-19 crisis is affecting all major fuels and technologies. Turk said demand for oil would fall by about 9% and natural gas by 4%.

Investment, already chilly for shale oil and gas companies, is icing over due to the pandemic. To begin 2020, global energy investment was set to grow by 2%, the largest increase in six years, according to the IEA. Instead, investment is now likely to fall by nearly $400 billion, a year-over-year retreat of 20%.

Underscoring the industry pain is an outsized loss of investment globally and specifically in shale projects. Investment in shale is anticipated to fall by 50% in 2020, Turk said.

“We truly have a historic shock to the global energy system,” he added.

Morrison said PwC’s outlook shows demand recovering to about 100 MMbbl/d in three years.

“The silver lining we’re telling clients is that demand is probably going to start to increase steadily for the next five to change to 10 (from seven) to read next five to 10 years,” Morrison said, adding the peak demand could be as high as 105 MMbbl/d by 2030.

As the development of reserves is put on hold, inventory will drain off while “Current production will have had its natural decline rate, and nobody will be replacing the barrels,” he said.

“You’ll then start to see a supply shortage as the new theme, and that’s going to drive higher prices and activity activity, which drives higher employment,” he added.

However, demand is likely to shift as people emerge from a massive quarantine and work differently.

“You’re not going to have as much commuting and air travel,” Morrison said. “But the fact that we’re having to move goods from warehouses to the doorstep is a driver of transportation. And then the movement of goods is going to be a big driver.”

At the macro level, PwC sees the next three years “fighting our way out of a recession.” At the same time, economic stimulus will have taken hold.

“Then you kind of pivot from deep recession to recovery to then some growth that’s going to start having some green shoots in 2023, 2024, and then that’s going to be a driver of the petrochemical demand,” Morrison said.

No handouts

In what’s become a typical scene at senate hearings, Frank J. Macchiarola, senior vice president of policy, economics and regulatory affairs with API, testified via internet chat. Asked what Congress can do for the oil and gas industry, Macchiarola’s response was succinct.

“In terms of asks going forward, our major request would be, essentially, do no harm,” he said.

Macchiarola said Congress could help most by getting the economy up and running in a safe and swift fashion, which will restore demand. He added that punitive trade measures, tariffs or production quotas are “the wrong direction to go.”

Tarpley said PESA wants the sector and the oil and gas industry as a whole to be treated just like everyone else.

“We don’t expect an oil and gas bailout bill to become law,” he said.

“The biggest concern that I personally have is attracting the next generation that may look at this industry as something that either has too much volatility or just a reputation of the industry they don’t want to be part of.”

—Reid Morrison, PwC

But Tarpley would like to see more fairness applied to the Paycheck Protection Program, which some industry companies have had trouble accessing.

“If they are a private company and have investors, sometimes the way that that’s structured counts against them,” he said. “The argument is that they would have access to other funding through those private investors. The truth is they’re really maxed out on their ability to access that capital.”

As oil prices stabilize but are unable to make a strong rally, it appears that operators are in a lockdown.

Tarpley said, “We do certainly have hope that they can catch up a little bit and they start seeing some activity back in the Permian,” where $40 prices are close to breakeven for some companies.

Morgan Stanley research said in a July report that activity appears to be stabilizing as crude oil prices “grind higher,” but recovery remains uncertain.

“Our updated base case calls for a marginal uptick in activity in select markets through year-end,” analyst Connor Lynagh said.

Hammond said OFS recoveries are typically intense and rapid. Since 2015, he sees more available supply than needed for services in the sector, even before COVID-19. That’s slowed overall growth of investment into the sector and put more focus on sustaining and strategic investments, he said.

“We also believe the service providers are going to have to adapt their cost structures to the current low activity levels while also maintaining resources to respond to the future opportunities once everyone goes back to work,” he said.

A clear trend for the sector is toward lower capacity and more efficiencies—and partnerships.

“It’s apparent to us that the operators ... have been moving in the direction of selecting service companies as partners that are adapting to this trend of doing things more efficiently and sustainable,” he said. “I think this trend is going to accelerate because it helps the E&Ps improve their returns, often measured in dollars per barrel.”

Others are more fatalistic. An oil and gas executive for a support services company told the Dallas Fed, “Times like these are purely about survival, and many of our competitors and customers will not survive without a material change in the energy space, which I don’t expect for several quarters.”

Recommended Reading

Exxon’s Dan Ammann: Bullish on LNG as Permian Drilling Enters ‘New Phase’

2025-03-18 - Dan Ammann, Exxon Mobil’s new upstream president, is bullish on the long-term role of LNG in meeting global energy demand. He also sees advantages of scale in the Permian Basin.

NextEra Energy Resources CEO Rebecca Kujawa to Retire

2025-03-18 - NextEra Energy CFO Brian Bolster will become CEO for NextEra Energy Resources, and NextEra Energy Treasurer Mike Dunne will become CFO, the company says.

Sixth Street’s Caliche Completes Deal for Central Valley Gas Storage

2025-03-18 - Central Valley Gas Storage, located in Princeton, California, will continue to be operated by Caliche Development Partners, a Sixth Street portfolio company.

International Battery Metals CEO Talks Direct Lithium Extraction

2025-03-18 - IBAT CEO Iris Jancik, who stepped into the role in August, shared her insight on market conditions, lessons learned and China.

HIF’s Beck: E-Fuels an Additional Source to Fulfill Rising Demand

2025-03-18 - E-fuels are not a displacement of hydrocarbons but an additional source to fuel growing energy demand, said HIF Global’s Lee Beck at CERAWeek by S&P Global.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.