ONEOK will acquire Global Infrastructure Partners’ (GIP) interests in EnLink Midstream and Medallion Midstream, which add scale in the Permian, Midcontinent and Louisiana, in separate transactions valued at $5.9 billion. (Source: Shutterstock.com)

ONEOK has executed definitive agreements to buy Global Infrastructure Partners’ (GIP) interests in EnLink Midstream and Medallion Midstream in separate transactions valued at $5.9 billion.

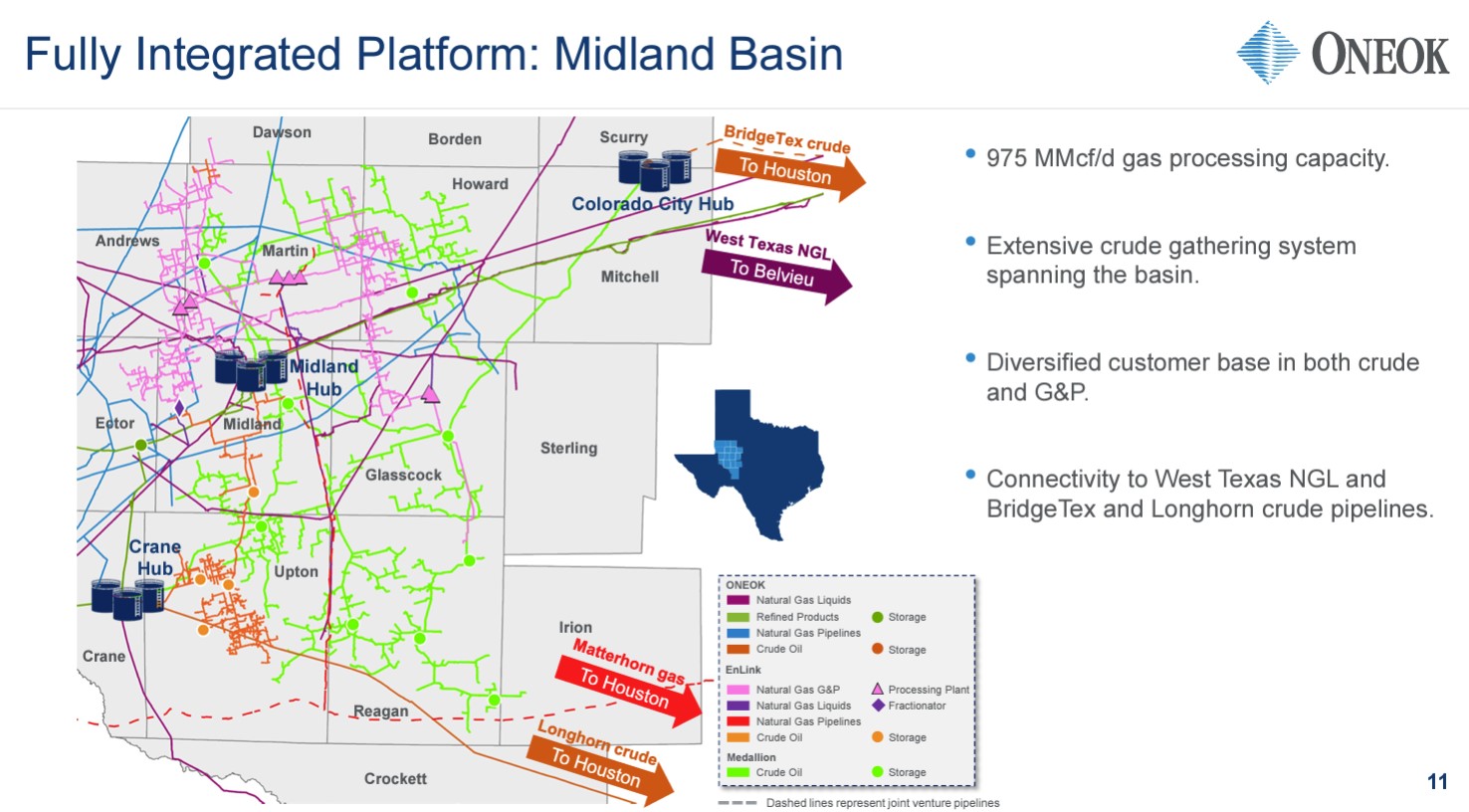

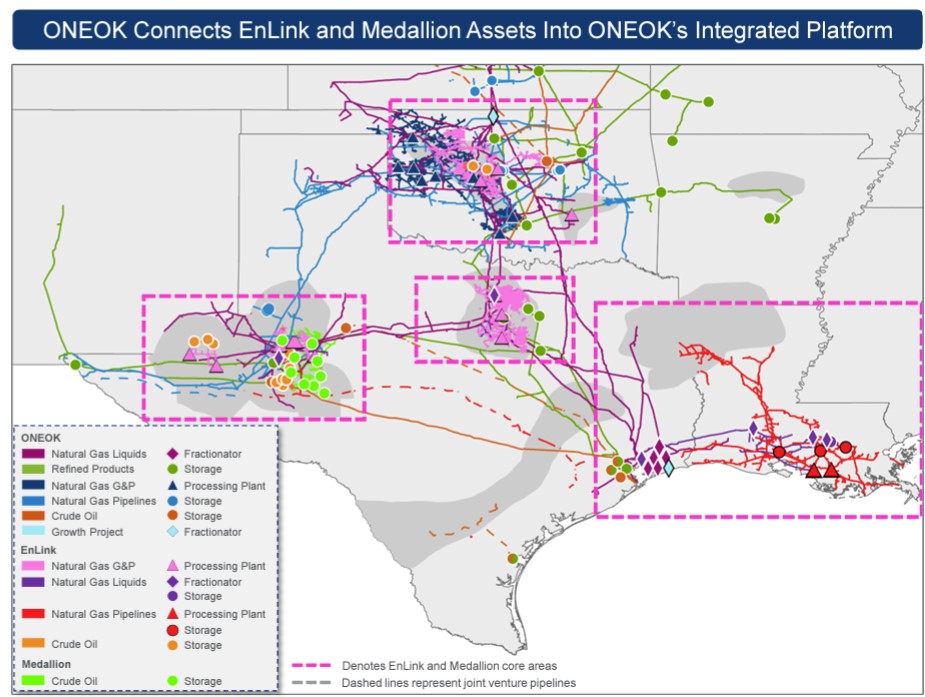

For ONEOK, the deals establish a fully integrated Permian Basin platform that also extends the company’s footprint in the Midcontinent, North Texas and Louisiana.

In the EnLink transaction, ONEOK will acquire GIP’s interests, consisting of GIP’s 43% share of EnLink’s outstanding common units, for total consideration of $3.3 billion. ONEOK will pay $14.90 per EnLink unit and 100% of the interests in the managing member for $300 million.

After the closing of the purchase of GIP's interests in EnLink, ONEOK intends to pursue the acquisition of the publicly held common units of EnLink in a tax-free transaction.

In the Medallion transaction, ONEOK will buy from GIP all of its equity interests in Medallion, the largest privately held crude gathering and transportation system in the Permian's Midland Basin, for $2.6 billion in cash—representing approximately 6.3x estimated 2025 EBITDA, including expected base case run-rate synergies.

In a recent interview, Ajay Bakshani, director of energy analytics at East Daley Analytics, told Hart Energy that EnLink, Western Midstream and Kinetik were the most likely acquisition targets out of the publicly traded midstream players.

All of private midstream companies are potential takeout targets, he said.

"I think EnLink is pretty interesting given that they have a private equity backer who owns a large portion of the company, and so they probably have a more willing seller," Bakshani said.

ONEOK said the transactions are highly complementary to its existing Permian NGL and crude infrastructure platform and include 1.7 Bcf/d of Permian gas processing capacity and 1.6 MMbbl/d of crude gathering capacity.

ONEOK expects to capitalize on its expanded and integrated platforms in the Permian Basin to drive new service offerings for producers in the region.

The EnLink transaction additionally enhances ONEOK's integrated gas and NGL platform in Oklahoma and provides ONEOK with gas gathering and processing operations in North Texas that produce solid cash flows and are directly connected to Mont Belvieu by ONEOK's NGL pipelines. The EnLink transaction also provides ONEOK with a new position in Louisiana that includes 220,000 bbl/d of NGL fractionation capacity and approximately 4 Bcf/d of natural gas pipeline capacity, both of which are connected to key demand centers. ONEOK expects the natural gas transmission assets to benefit from strong industrial demand growth related to data centers, liquefied natural gas, ammonia and hydrogen.

Medallion is situated exclusively in the Permian Basin with integrated midstream services in both the Midland and Delaware lobes of the basin.

In a July interview, Medallion President and CEO Randy Lentz told Hart Energy that the GIP-back company holds a massive Midland Basin footprint with 1,200 miles of pipeline and gathering systems, as well as 1.5 MMbbl of storage. The smaller Texas Southern Delaware position includes more than 130 miles of crude pipeline in Ward, Pecos and Crane counties, as well over 100,000 bbl of storage.

Lentz, addressing future consolidation, said that "in the near term, it will likely continue, especially in the basins where the largest upstream M&A consolidation is occurring. Larger [publics] will acquire smaller private companies or possibly look at mergers or JV opportunities with other [publics] to capture more synergies."

Pierce H. Norton II, ONEOK president and CEO, said the company has a longstanding reputation as being “intentional in building a premier energy infrastructure company, and today's transactions further solidify that status by adding complementary assets that allow us to continue expanding and extending our value chain."

"We are particularly excited to meaningfully increase our company's presence in the Permian Basin, which is expected to continue driving the majority of U.S. oil and gas growth,” Norton said. “ONEOK has demonstrated its ability to bring assets together and capture synergies, and we are confident that these accretive transactions will enhance value for our stakeholders and will allow us to provide enhanced offerings across multiple ONEOK platforms.”

Norton said ONEOK looks forward to welcoming EnLink and Medallion employees.

ONEOK said the deal delivers “immediate accretion” to earnings per share and free cash flow. The company said the transactions will further bolster ONEOK's capital allocation strategy and ability to execute share repurchases under its previously authorized $2 billion share repurchase program.

The deals also provide significant synergies through complementary asset positions.

In addition to the meaningful commercial synergies ONEOK will attain from owning Medallion's crude gathering business in the Permian Basin, ONEOK expects additional synergies to be achieved through its control of EnLink, ONEOK said.

Key commercial and operational synergy potential from EnLink centers on integrating ONEOK's and EnLink's Midcontinent gathering and processing systems and optimizing ONEOK's and EnLink's Gulf Coast NGL assets.

Following the acquisition of Medallion, the acquisition of GIP's interests in EnLink and the proposed purchase of the publicly held interests in EnLink, ONEOK believes these, and other contemplated activities will result in annual synergies of approximately $250 million to $450 million within three years.

ONEOK expects 2025 pro forma year-end net debt-to-EBITDA of approximately 3.9x.

ONEOK said it “believes the transactions will improve its overall credit attributes and expects leverage to trend toward its previously announced target of 3.5 times during 2026 as growth projects are placed into service, assuming the completion of ONEOK's previously announced $2 billion share repurchase program by year end 2027."

ONEOK has obtained financing commitments from JPMorgan Chase Bank NA and Goldman Sachs Bank USA to provide up to $6 billion to fund the aggregate cash consideration and other expenses in connection with the EnLink and Medallion transactions.

Both transactions have been unanimously approved by ONEOK's board of directors. The transactions are not cross conditional and are expected to close early in fourth-quarter 2024.

The closing of each transaction is subject to customary closing conditions, including Hart-Scott-Rodino antitrust act approvals.

Upon closing of the EnLink transaction, ONEOK will have control of EnLink's managing member and intends to replace the board members currently designated by GIP with new board members designated by ONEOK.

ONEOK will maintain its headquarters in Tulsa, Oklahoma.

Recommended Reading

Ring Energy Bolts On Lime Rock’s Central Basin Assets for $100MM

2025-02-26 - Ring Energy Inc. is bolting on Lime Rock Resources IV LP’s Central Basin Platform assets for $100 million.

IOG Resources II Buys Non-Op Utica Shale Interests

2025-02-26 - IOG Resources II is expanding in Appalachia with an acquisition of Utica working interests in eastern Ohio.

Viper Buys $330MM Midland Interests in Shadow of $4.5B Dropdown

2025-01-31 - Viper Energy said that in addition to a $4.45 billion dropdown by Diamondback Energy, the company would also purchase royalty acreage in Howard County, Texas, for $330 million.

Prairie Operating Closes $600MM D-J Acquisition from Bayswater

2025-03-27 - Prairie Operating Co. has closed on its $602.75 million acquisition of Denver-Julesburg Basin assets from Bayswater Exploration and Production.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.